Good crop yields require adequate applications of fertilizers, to ensure the growing wheat, rice, et cetera, has adequate nutrition to yield a bountiful harvest.

For much of 2022, the concern has been that rising fertilizer prices and even fertilizer shortages would result in severely diminished crop yields in 2023, resulting in food price inflation, food insecurity, and potentially even famine.

While the fertilizer price situation is far from resolved, we must acknowledge that recent price trends are at the very least improving. Fertilizer prices are dropping or stabilizing, which augurs well for future food price inflation trends.

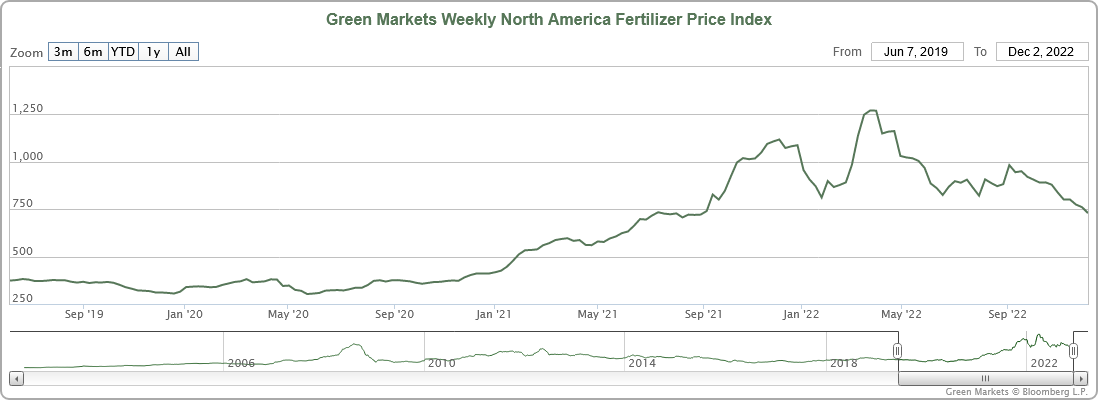

In North America, fertilizer prices are lower now then they were in August of 2021.

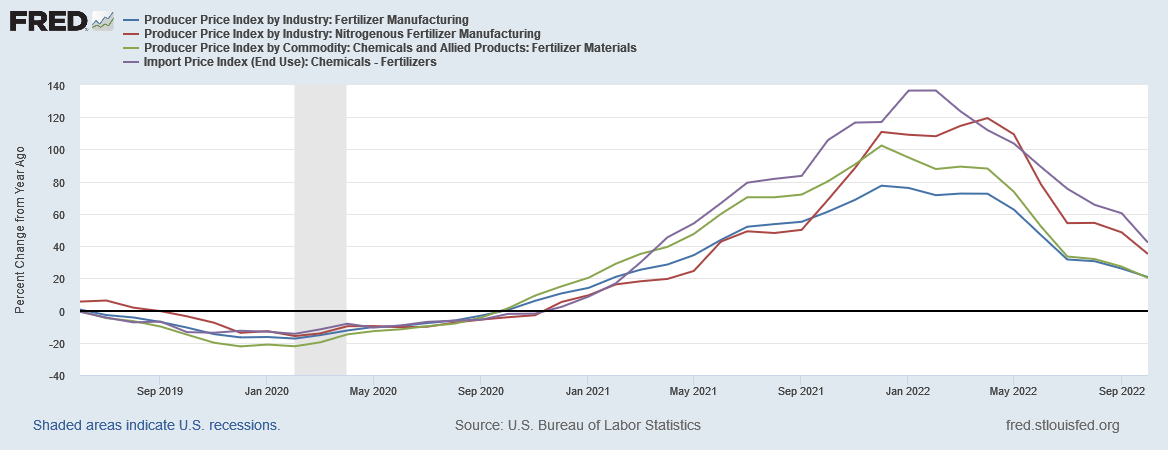

This is also reflected both in the decline of the producer price inflation metrics for fertilizers and their components, as well as the decline in the import price inflation for fertilizer.

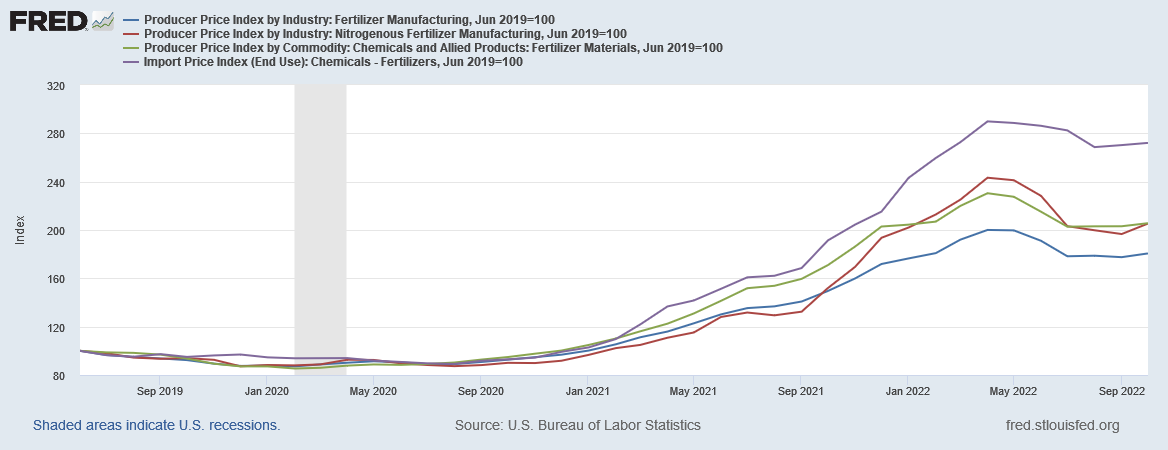

The producer price inflation for fertilizer and its components is still elevated, but it down significantly from the summer peaks, and the growth trend across the board is currently one of stabilization, as a baseline comparison graph shows.

Fertilizer prices are higher than they have been historically, but the price increases and most of the price inflation appears to have abated, at least for the near term.

Nor is this a trend that is isolated to North America. Benchmark prices for fertilizer components such as urea are also showing signs of stabilization, with urea now at the same spot price as in September of last year.

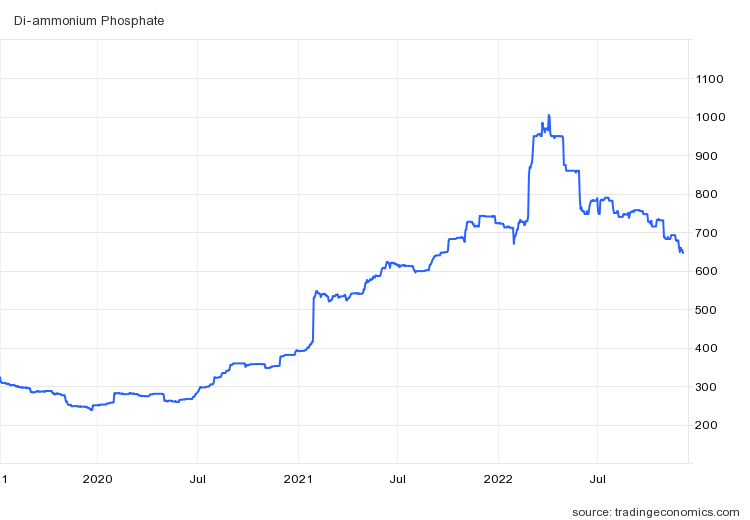

Di-ammonium phosphate is showing a similar price retreat.

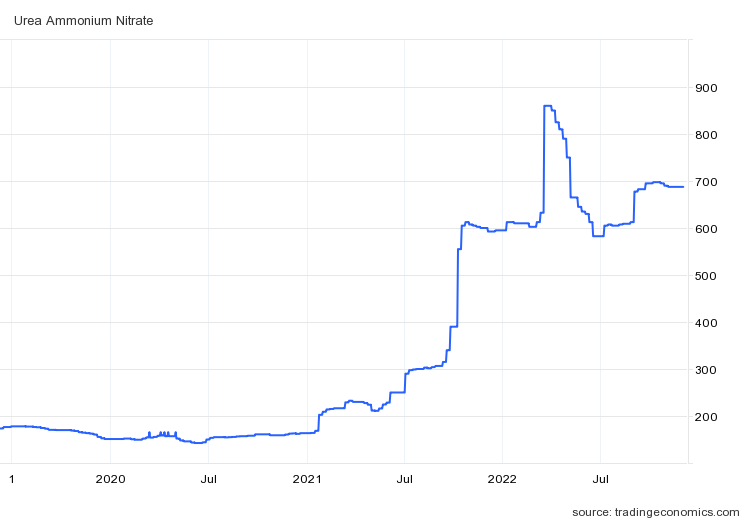

Only Urea Ammonium Nitrate is showing any ability to sustain an elevated price, and even that is showing signs of stabilization.

All of these are favorable fertilizer price trends that augur well for the availability of fertilizers for 2023 crops.

This is not to suggest that fertilizer price inflation is resolved and no longer a concern. Fertilizers themselves remain heavily dependent on the energy industry for feedstocks, and while energy prices have been in decline recently, throughout 2022 energy prices overall have shown marked volatility. Prices could easily ratchet up in the near future, and roil even fertilizer markets as a consequence.

Still, for now energy prices are not ratcheting up, and they are not roiling fertilizer markets. Fertilizer markets are at present showing downward price trends across the board. All of this makes the fertilizer situation for 2023 still not great, but considerably improved over what the situation appeared to be back in the summer of this year.

We are not yet to the point of “famine averted” for 2023. We are, however, at least to the point of “famine delayed”, which is a significant and somewhat optimistic milestone to achieve.

As an investor I'm trying to learn more about fertilizer pricing cycles. I'm thinking a cycle is two years, or crop seasons. Year one gives growers a price for a crop. Then, year two, they will buy more fertilizer for the crops that were most profitable for them. Meanwhile the worldwide "war" on fossil fuels has to force the price of fertilizers--especially the kind made from natural gas--higher.

Good and a relief to see those statistics Peter. Around our local rural area crops are very abundant and the growing and harvesting season was just about perfect. Northern Illinois.