This past Monday, the Federal Reserve published the results of their quarterly Senior Loan Officer Opinion Survey On Bank Lending Practices.

The reported figures for loan demand are not at all encouraging.

Demand for commercial and industrial loans peaked in the third quarter of this year, and has fallen precipitously since then. While loan demand has not crashed (yet) to the degree it did in 2020 after the lunatic lockdowns, the trend is heading that way.

Regarding demand for C&I loans over the third quarter, a modest net share of banks reported weaker demand for loans from large and middle-market firms, and a significant net share of banks reported weaker demand from small firms. In addition, a moderate net share of banks reported a decrease in the number of inquiries from potential borrowers regarding the availability and terms of new credit lines or increases in existing lines. Similarly, a significant net share of foreign banks reported weaker demand for C&I loans over the third quarter.

Of the banks reporting weaker demand for C&I loans, major net shares cited decreased customer needs to finance inventory, decreased customer investment in plants or equipment, and decreased customer needs to finance mergers or acquisitions and accounts receivable as reasons for the weaker demand.

Decreased inventory financing needs, decreased capital investment, decreased merger and acquisition activity are not the signs of a robustly growing economy, but one that is slowing and perhaps even stopping. These are signs of diminishing business activity—which means a contracting economy by definition.

Similarly, mortgage loan demand is collapsing to its lowest level since 2017.

…major net shares of banks reported weaker demand for all RRE loans over the third quarter, except for HELOCs, for which a moderate net share of banks reported stronger demand.

No mortgage demand is tantamount to no home sales—not a bright prospect for the housing sectors.

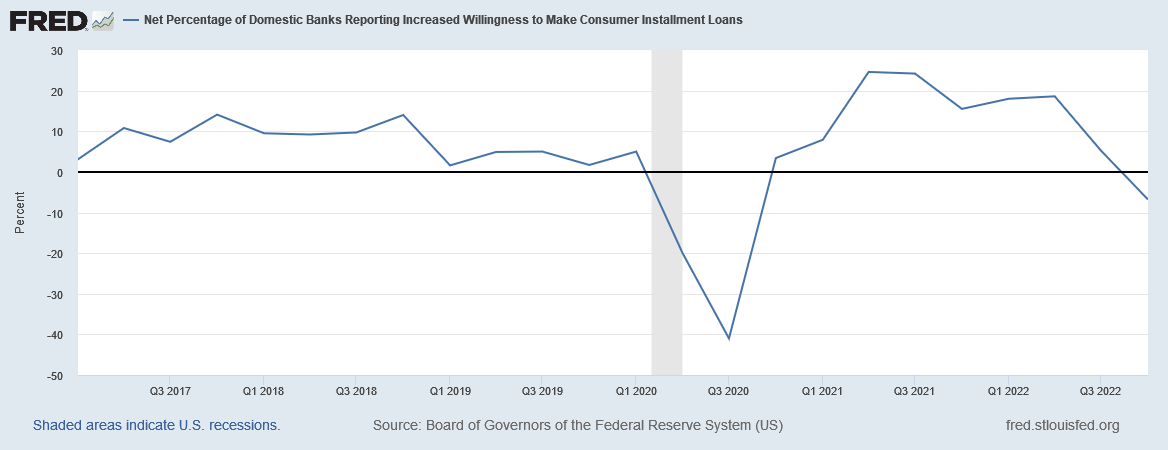

Nor are banks seeing much interest in consumer installment loans such as auto loans.

Regarding demand for consumer loans, a moderate net share of banks reported stronger demand for credit card loans, while a significant net share of banks reported weaker demand for auto loans.

As with housing, no loan demand for auto loans means no sales of automobiles.

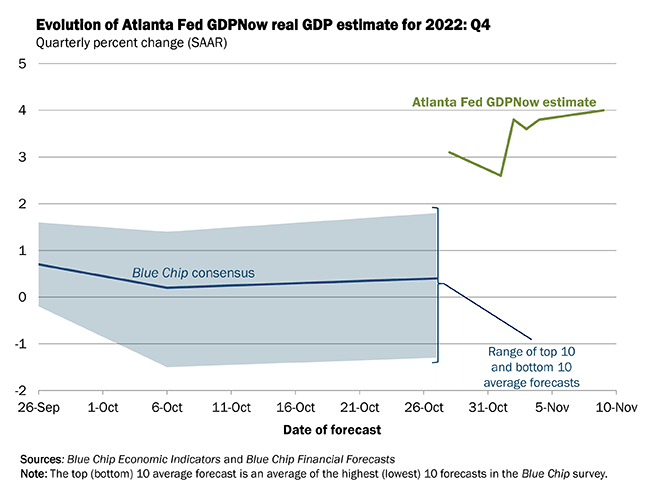

Yet despite the collapse in loan demand, the Atlanta Federal Reserve’s GDPNow nowcast is projecting 4% GDP growth for the fourth quarter.

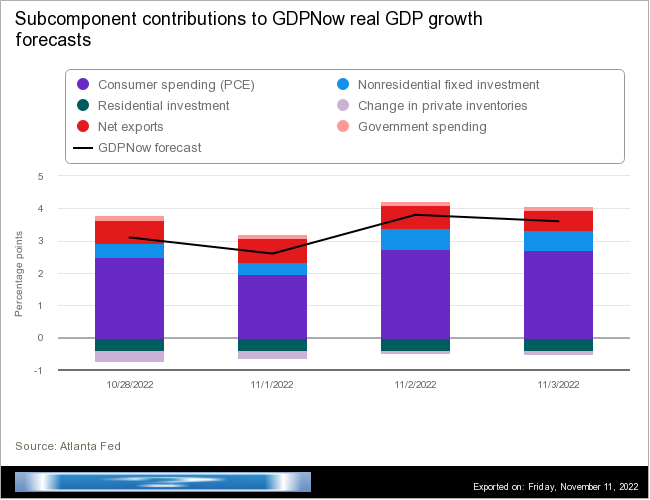

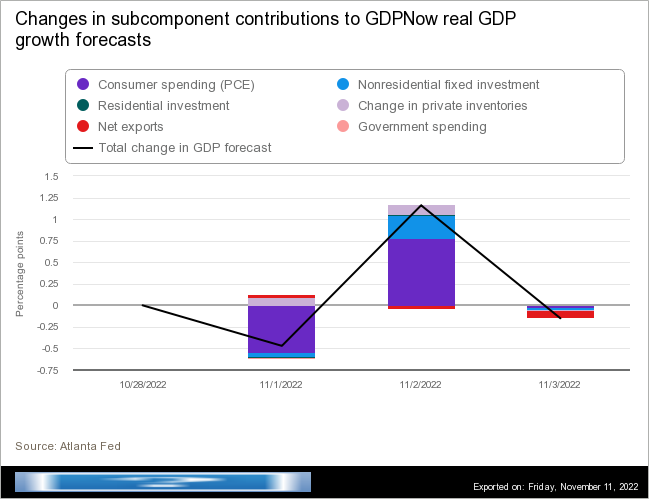

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2022 is 4.0 percent on November 9, up from 3.6 percent on November 3. After last week's employment situation report from the US Bureau of Labor Statistics and this morning's wholesale trade report from the US Census Bureau, the nowcasts of fourth-quarter real personal consumption expenditures growth and fourth-quarter real gross private domestic investment growth increased from 4.0 percent and 0.7 percent, respectively, to 4.2 percent and 2.1 percent, respectively.

The GDPNow nowcast acknowledges the decline in residential investment.

It even acknowledges a decline in business investment and even exports.

Yet despite all this the economy is supposed to grow 4% in this fourth quarter alone?

Something is decidedly wrong with this data.

The signs are pointing to an economy that is contracting, not one that is expanding at a robust 4% per year.

Inflation.

We know the CDC is corrupt and lying for the government. Why would we still think the Fed and other govt agencies are any different? It’s all a big propaganda campaign. ... until it all collapse...