Ignorance must truly be bliss.

How else to explain Wall Street’s persistently deluded reactions to the demonstrably dysfunctional Employment Situation Summary from the Bureau of Labor Statistics?

Total nonfarm payroll employment increased by 150,000 in October, and the unemployment rate changed little at 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, government, and social assistance. Employment declined in manufacturing due to strike activity.

150,000 jobs is quite the come-down from September’s 336,000, only the September data was not so rosy either.

The change in total nonfarm payroll employment for August was revised down by 62,000, from +227,000 to +165,000, and the change for September was revised down by 39,000, from +336,000 to +297,000. With these revisions, employment in August and September combined is 101,000 lower than previously reported.

150,000 possible jobs in October less 101,000 fake jobs from August and September adds up to not a lot of jobs for anyone.

Naturally Wall Street sees this as good news. Nobody’s working on Main Street but that’s good for the economy…or…something.

Naturally, Dementia Joe’s handlers felt compelled to give him yet another unearned victory lap for all the jobs that were not really created.

Just as naturally, Wall Street agreed with them, with the Dow and other stock indices rising.

Treasury yields echoed the positive sentiment, dropping in early morning trading.

Wall Street is choosing to believe that the jobs report means there will be no more federal funds rate hikes.

US stocks soared higher again on Thursday as investors bet that the Federal Reserve’s current round of economically painful rate hikes might be over.

The Dow rose 565 points, or 1.7%. The S&P 500 was 1.9% higher and the Nasdaq Composite was up 1.8%.

Both the S&P 500 and Dow are on track to notch their largest weekly gains this year and the Dow closed its best day since June.

Treasury yields, which topped 5% just last month, have also come down precipitously. The 10-year Treasury yield dropped by about 0.12% on Thursday to 4.66%.

Even if that is true, of course, the Fed is still shrinking its balance sheet, shrinking demand for Treasuries, shrinking the money supply, which means regardless of what the federal funds rate does, market interest rates are headed higher in the near term.

Just don’t tell Wall Street that.

In another demonstration of Wall Street perversity, the jobs report showed a decline in manufacturing jobs due to the UAW strike, and the markets responded favorably.

In its report, the BLS noted employment in manufacturing fell by 35,000 in October largely due to strike activity, with labor actions from the United Auto Workers (UAW) at plants for three major auto manufacturers weighing on hiring. Earlier this week, the UAW reached a tentative deal with the automakers to end the strikes.

Let this part sink in: the UAW is costing American workers manufacturing employment and Wall Street thinks this is good news.

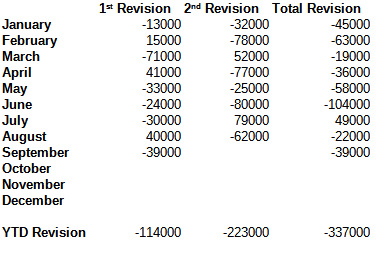

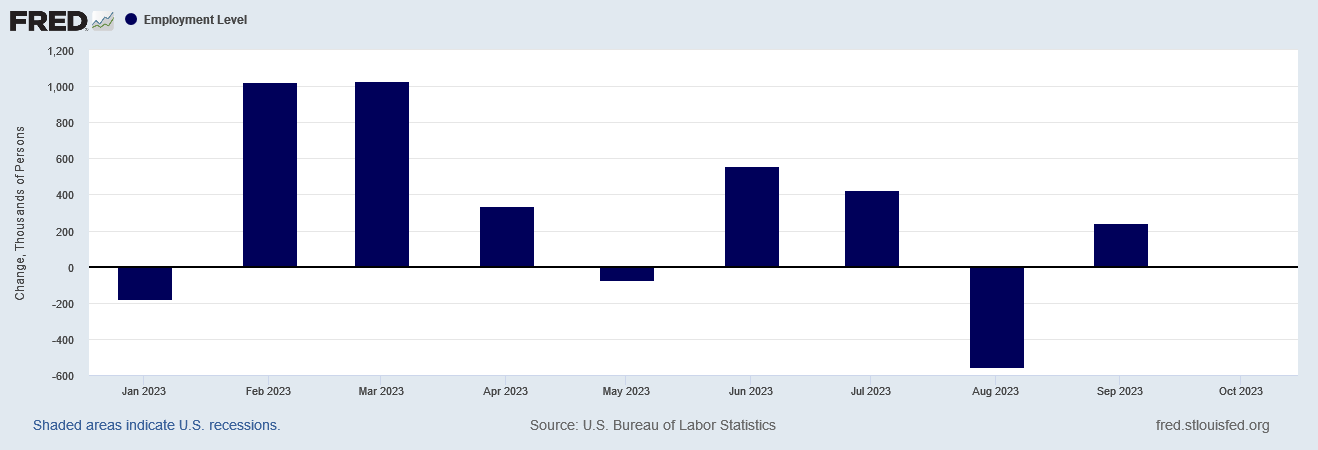

Of course, Wall Street is overlooking that the Employment Situation Summary headline number is sure to be revised significantly in November and December, as that has been the norm all year long. Thus far, the BLS has revised its monthly jobs numbers downward by a total of 337,00 jobs.

With the bulk of those revisions coming in the 2nd month after a particular jobs report, September’s unbelievable jobs numbers—which are already reduced by 10%—are highly likely to come crashing down to Earth.

Wall Street does not like to think about that.

Wall Street also does not like to acknowledge the annual “correction” the BLS introduces into the All Employees count within the Establishment Survey each January, which is fast approaching, where the BLS takes back a lot of the “unadjusted” job gains during the year.

Regular as clockwork, each January there is a massive drop in the job count.

All this year’s seeming overage between the unadjusted and seasonally adjusted employment numbers will disappear, and then some.

Between annual corrections, seasonal adjustments, and monthly “revisions”, the one thing of which we may be sure is that 150,000 jobs were not created during the month of October.

We get further confirmation of this from the ADP National Employment Report, which came out earlier this week, and only showed 113,000 jobs being created.

ADP undershot the BLS but nearly a third, which is a pretty wide variance.

An even more ominous warning sign comes from the BLS data itself, where the seasonally adjusted Household Survey data showed a drop in the employment level of 348,000 workers.

Even the JOLTS data suggests a pattern of softening employment, all of which are strong indicators that the BLS figure of 150,000 seasonally adjusted jobs created in October will soon be revised downward, perhaps even below 100,000.

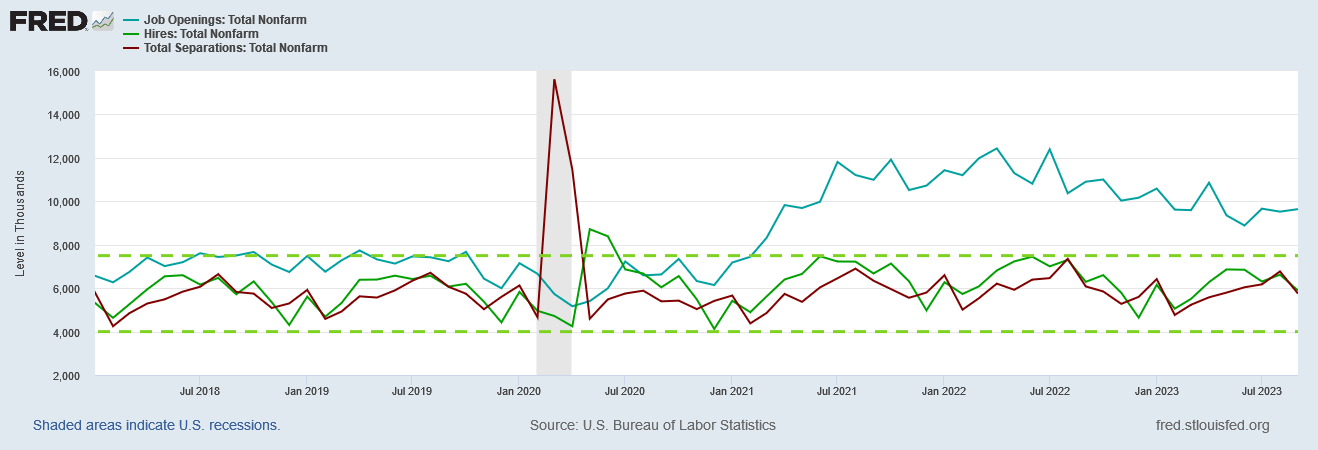

For its part, the JOLTS data continues to show the delusion of “job openings”, as both hiring and separations for September declined, even as the number of openings ticked up slightly on an unadjusted basis.

Note that the JOLTS report continues to show the same bizarre tendency of job openings being completely unhinged from the actual hiring and separation trends. Oodles of job openings are being reported, only the hiring data is not reflecting increased hiring.

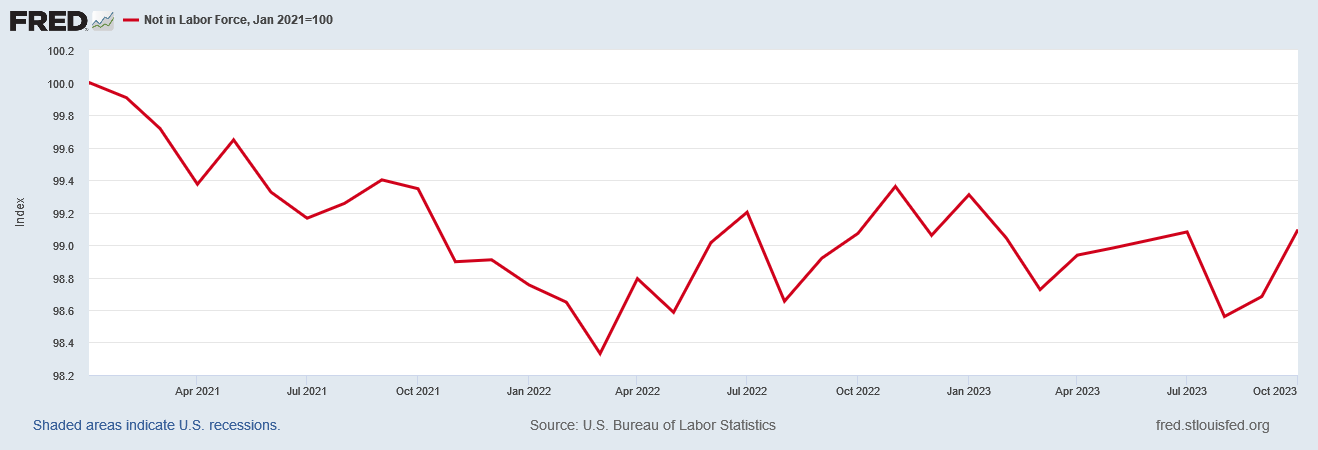

Wall Street also overlooked that the number of people not in the labor force increased for the second month in a row on a seasonally adjusted basis. We are coming up on four years since the Pandemic Panic Recession and fully one half of the people forcibly ejected from the labor force by that bit of government lunacy are still stuck on the sidelines.

The amount of people not in the labor force has only declined 0.9% on Dementia Joe’s watch, after increasing by nearly 10% during and after the Pandemic Panic Recession

People have actually been exiting the labor force since March 2022 (right around the time the Fed began looking for job losses as a sign that its federal funds rate hike was doing the appropriate level of damage to the economy).

We have a good idea that there has been significant damage to the economy, as from the Household Survey portion of the Employment Situation Summary report, total employment growth in October on an unadjusted basis was a whopping 7,000 people

That’s not a lot of actual job growth, and far worse than anything projected by either the BLS Establishment Survey or the ADP National Employment Report.

In fact, the unadjusted data indicates that the total number of people working in the US has actually decreased since July.

In other words, regardless of how many jobs the BLS says have been created, fewer people are working now than before.

The level of economic damage is further underscored by the fact that for the second straight month, the number of people working multiple jobs increased.

Since Dementia Joe took office, the number of people working multiple jobs has increased by more than 25% on a seasonally adjusted basis.

This is what Dementia Joe considers to be an example of Bidenomics “working”—people working harder and harder.

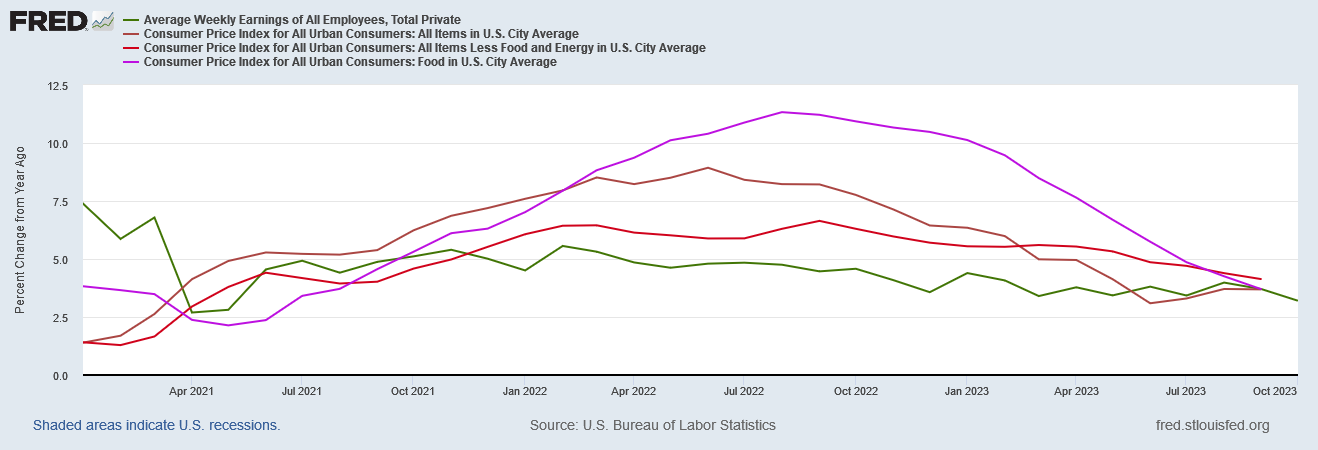

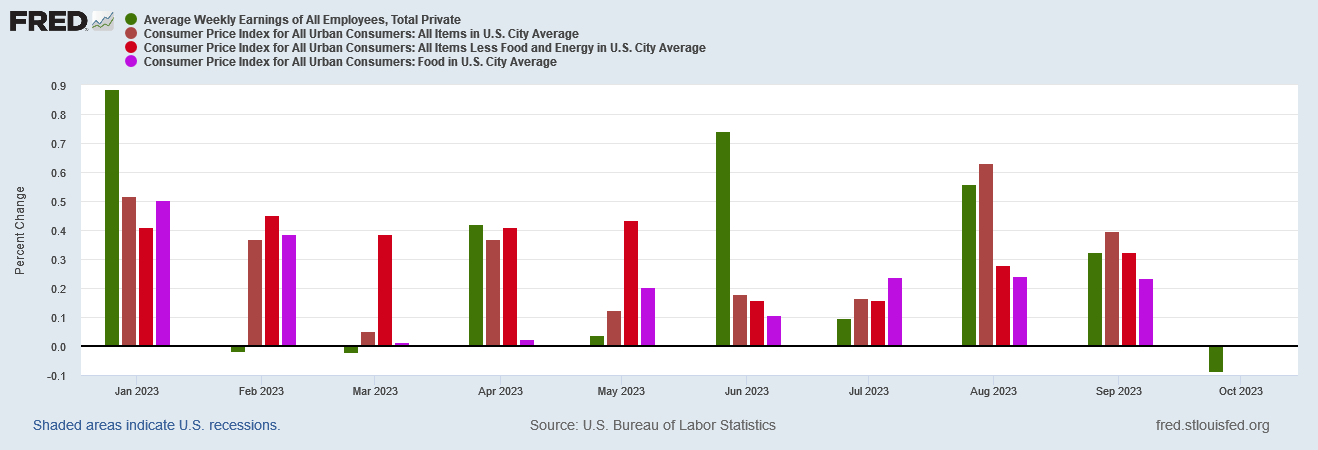

People are working harder, according to the BLS data, but, also according to the BLS data, people are not earning more. In fact, they are earning less.

With core inflation stuck above 4% and headline inflation inching up again, while growth in nominal pay decreasing, the brief respite workers have had from declining real paychecks has very likely ended, and inflation is once again set to take bigger and bigger bites out of worker’s paychecks.

Workers’ paychecks actually shrank month on month during October, further cementing the probability that real wages are declining once more.

By any metric, workers wages have not at all kept up with prices during Dementia Joe’s Reign of Error.

When nominal wages only increase 11% and food price increase 20%, workers are losing money. When nominal wages increase 11% and “core” consumer prices increase 14%, workers are losing money. When nominal wages increase 11% and consumer prices increase 17%, workers are losing money.

This is what Dementia Joe considers an example of Bidenomics “working”. This is what Wall Street is celebrating—workers working harder harder and harder but getting paid less and less.

Much as with the Fed’s FOMC announcement on Wednesday, Wall Street is simply not looking at the totality of the data.

Instead, Wall Street is cherry-picking the data it wants to see—this time enabled and empowered by the BLS rather than the Federal Reserve—and reaching all the wrong conclusions.

Wall Street may have properly concluded that the Federal Reserve will not raise the federal funds rate any more, but the jobs data and the inflation data simply do not matter any more: the Federal Reserve is shrinking its balance sheet and shrinking the money supply, and that’s going to push interest rates up regardless of what the federal funds rate does.

Even if the Federal Reserve does nothing else but continue to allow their balance sheet to shrink, interest rates are going to go up, increasing the cost of capital across the board, and further constraining actual job growth and actual employment.

Given the unadjusted decrease in the employment level in this country, we may already be seeing that effect on the economy.

Regardless of reported job openings and reported jobs created, with employment levels down and hiring down, crowing about any number of “jobs created” simply sounds delusional. If fewer people are working there no jobs being created, but there are jobs being lost.

If inflation is remaining high and wage growth is declining, workers are losing money on every paycheck. That’s not increase, but decrease.

Yet Wall Street does not care. The Federal Reserve does not care. Dementia Joe and his handlers do not care. The headline numbers are comforting even if completely bogus, and that is all that matters to them. Reality…that’s someone else’s problem.

When the reality check bounces, it is going to hurt.

"Bidenomics" sucks.

As long as it works, they'll keep up this charade. Linking again @https://nothingnewunderthesun2016.com/