About That 2.4% GDP Growth....

There Is The Narrative And There Is The Data. You Have To Choose One.

The way to weaponize narratives is to use them to confuse people. Media outlet A says the economy is growing, while media outlet B says the economy is in a “rolling recession.” The government press releases are unhelpful because they present data in isolation, with nothing intersecting to confirm their conclusions.

We must keep this reality in the back of the brain when evaluating the latest GDP guesstimates from the Bureau of Economic Analysis, which projected the US economy grew at an annual rate of 2.4% during the second quarter.

Real gross domestic product (GDP) increased at an annual rate of 2.4 percent in the second quarter of 2023 (table 1), according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 2.0 percent.

Naturally, Dementia Joe’s handlers thought this was supremely good news, and proceeded to tweet him yet another undeserved victory lap.

Equally naturally, the chronically self-unaware manager of Dementia Joe’s Twitter handle gives us the perfect framing for the divergent narratives the corporate media sees fit to put forth regarding the presumed “health” of the US economy.

Last week we were presented with the counter-narrative of the US economy being mired in a “rolling recession”, with manufacturing in contraction but services in expansion.

The recession Wall Street predicted to death is hitting the economy sector by sector rather than all at once – and that's slashed the risk of a sudden hard landing, according to Bank of America executive Keith Banks.

"We've got a $26 trillion economy that is basically made up of different sectors, operating at different speeds. So what we saw over the first half was a rolling recession in manufacturing, in energy, and in housing," Banks said in an interview with CNBC on Friday, pointing to economic weakness that stayed contained in those areas.

As I discussed yesterday, the recession is not so much “rolling” but “spreading”, with manufacturing mired in contraction while services are steadily sliding down to join it.

If manufacturing weakness continues and is joined by services weakness, the US economy will have spiraled into a deep and potentially long-lasting recession—deeper and longer if the current disinflation flips into outright deflation for more than just energy prices.

However, prior to the release of the BEA GDP guesstimates, the Wall Street Journal presented a more optimistic narrative of “solid” growth.

The economy likely grew at a solid pace in the second quarter, suggesting the U.S. is steering clear of a recession many forecasters had expected to take hold this year.

Also prior to the BEA data release, the Financial Times forecast a “slowing” economy.

Economic growth in the US is expected to have slowed to a steady pace in the second quarter of 2023, as activity proved resilient in the face of the Federal Reserve’s campaign of aggressive interest rate rises.

The world’s largest economy is forecast to have grown 1.8 per cent on an annualised basis between April and June, according to economists surveyed by Bloomberg. That would mark the second consecutive quarter of slowing growth, following a 2 per cent growth rate in the first quarter.

If we take all the corporate media narratives at face value (do not try this at home!), we have an economy mired in a rolling recession which in the second quarter slowed substantially to “solid” growth.

And we have economists and corporate media types who can say this with a straight face (this latter point is by far the more impressive).

Thus we come to my favorite and almost reflexive question: What does the data say?

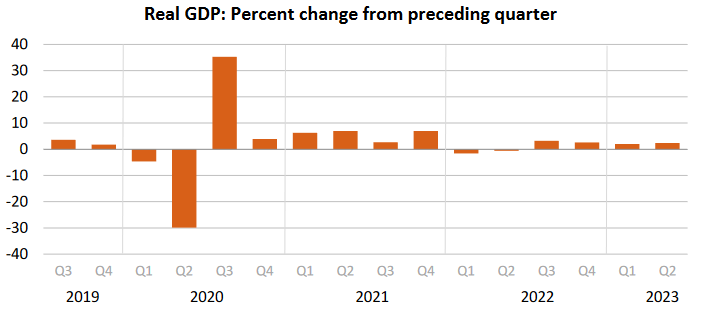

Let’s begin with the GDP numbers themselves, to put the data in some sort of context.

According to the BEA, nominal GDP in the second quarter of 2023 stood at $26,834.953 Billion. Real GDP, stated in 2012 dollars, stood at $20,404.088 Billion.

Those are big numbers. However, the trends are somewhat less so, particularly for the Real GDP data:

As you can see, the Real GDP graph is almost flat from the 4th Quarter of 2021 onward. This represents 2.4% annual growth?

Well, it does…sort of.

The 2.4% annual growth rate for GDP is the result compounding the guesstimated quarterly GDP growth percentage of 0.59818%. In other words, if the US economy grew for four successive quarters at the calculated pace of 0.59818%, the aggregate growth would be 2.41429%.

However, if we index GDP to the end of the Pandemic Panic Recession, we see a far more dismal picture of GDP growth.

Again, we see the Real GDP graph flattening out after the 4th Quarter of 2021—aggregate Real GDP growth from then onward has been from 115.1% of Q2, 2020, GDP 117.4% of Q2, 2020, GDP, or 2.3%. Applying the compound rate calculation across 6 periods rather than 4 gives a per-quarter GDP growth of just .379%—more than 0.2% less than the reported quarterly GDP growth.

Setting the base index for GDP to Q4 of 2021 yields a percent GDP growth since that period of 2.4%—approximately the same amount as in the previous calculation and leading to the same result: the 2.4% growth figure should really be for six quarters, not four.

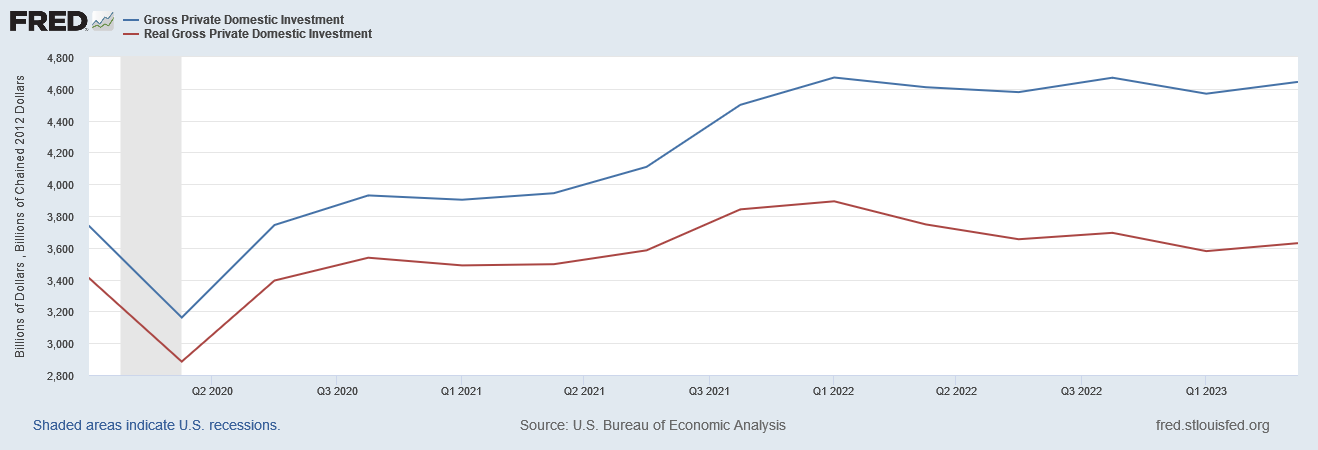

However, the most egregious sin goes to whomever manages Dementia Joe’s Twitter account. It is a touch of extreme irony to be boasting of “strong private business investment” when said investment has declined both in nominal and real terms since January 2022.

In Q1 of 2022, nominal Gross Private Domestic Investment was measured at $4,671.027 Billion. During Q2 of 2023, nominal Gross Private Domestic Investment was measured at $4,643.501 Billion—$27.5 Billion less.

In real terms, Gross Private Domestic investment declined even more, from $3,892.48 Billion to $3,629.237 Billion. A decline of over $200 Billion in real terms would more appropriately be characterized as “weakening” private business investment. In Bidenomics that is "strong” private investment.

In relative terms, Gross Private Domestic Investment in the US declined nominally by 0.6% over the past 6 quarters, and in real terms by 6.8%.

Private business investment is essential to a strong economy, but the US is seeing less of it, not more. Dementia Joe would have you believe that the declining private business investment that is “Bidenomics” is producing solid economic growth—taking the trope of “less is more” to truly delusional heights.

On the personal income front, the economic picture looks even more bleak, with inflation eliminating all of the nominal gains in personal income and then some when restating in real terms.

Bear in mind that even nominal personal income peaked in March of 2021 before dropping precipitously, and still has not fully recovered. In real terms personal incomes dropped after March, 2021, and just kept on dropping.

Gauging personal income growth during the presumed economic “expansion” since the end of the Pandemic Panic Recession, personal incomes grew in nominal terms an aggregate of 8.1%, but declined in real terms an aggregate of 6.2%.

This is the “success” Dementia Joe’s handlers tout as “Bidenomics.” It is what the Wall Street Journal characterizes as “solid” economic growth.

Somehow, Bidenomics just doesn’t seem all that impressive to me.

For regular readers, this is already a known situation, as I have previously documented how real incomes have declined dramatically in this country under Bidenomics. Whatever seeming wage gains have been achieved in nominal terms inflation has consumed and then some.

Even worse, since the Pandemic Panic Recession real disposable incomes have declined by approximately $1.6 Billion.

In relative terms, workers have lost nearly 10% of their real disposable wages to Bidenomics and inflation.

This is the sort of economic growth Reuters terms as “moderate”, and how Reuters defines “keeping a much feared recession at bay.” Workers lose one-tenth of their paychecks in a growing economy. That is exactly what the narratives are telling you.

The US has seen private business investment decline.

The US has seen nominal personal incomes decline.

The US has seen real personal incomes decline.

The US has seen real disposable personal incomes decline.

The data is unambiguous in each of these.

Yet the BEA and the corporate media would have you believe that these economic reductions amount to economic “growth” of 2.4% annually in the second quarter of 2023.

Less is more. Poverty is wealth. Disinvestment is the pathway to riches.

That all sounds quite believable and sensible….doesn’t it?

Oh yes, yes, yes.

"And we have economists and corporate media types who can say this with a straight face (this latter point is by far the more impressive)."

-Peter Nayland Kust

Thank you for the TRUTH! Damn the truth is hard to find!!