America Needs Jobs. The Economy Isn’t Delivering Them.

No End To America's Jobs Recession

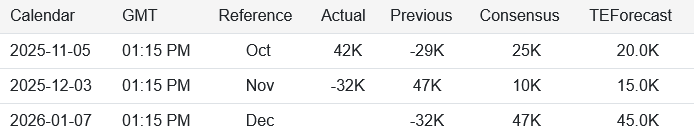

In an unusual convergence of data points, two key jobs reports came out today, neither of which was particularly encouraging.

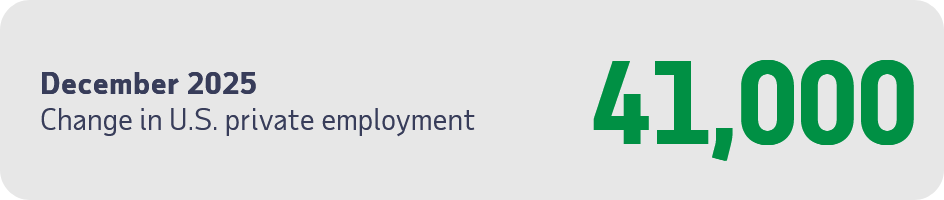

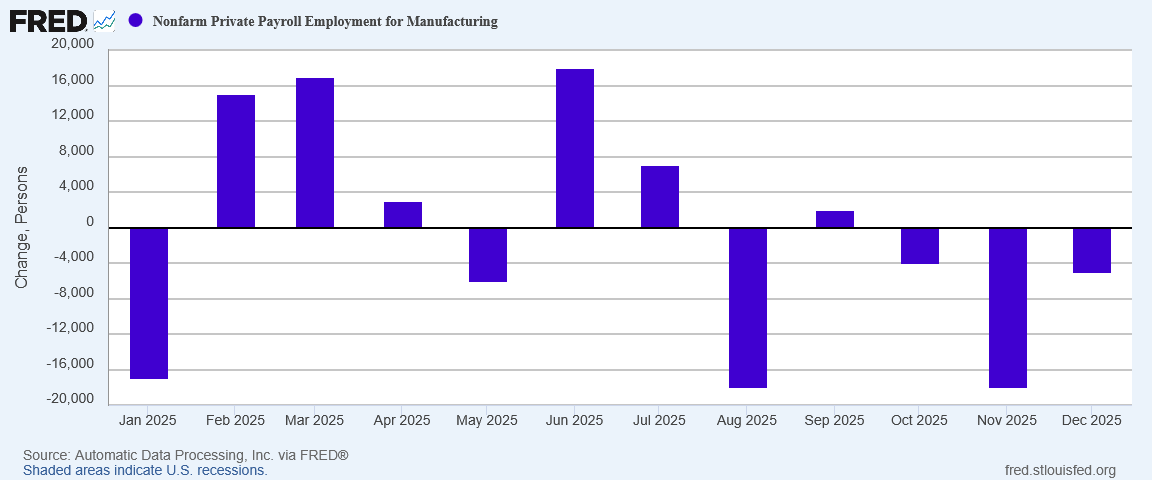

The first was ADP’s December National Employment Report, which printed a positive but anemic 41,000 jobs for the month.

While 41,000 private-sector jobs is an improvement over November’s job losses, the ADP report still was significantly below the Wall Street consensus of 47,000 jobs, as well as the Trading Economics estimate of 45,000 jobs.

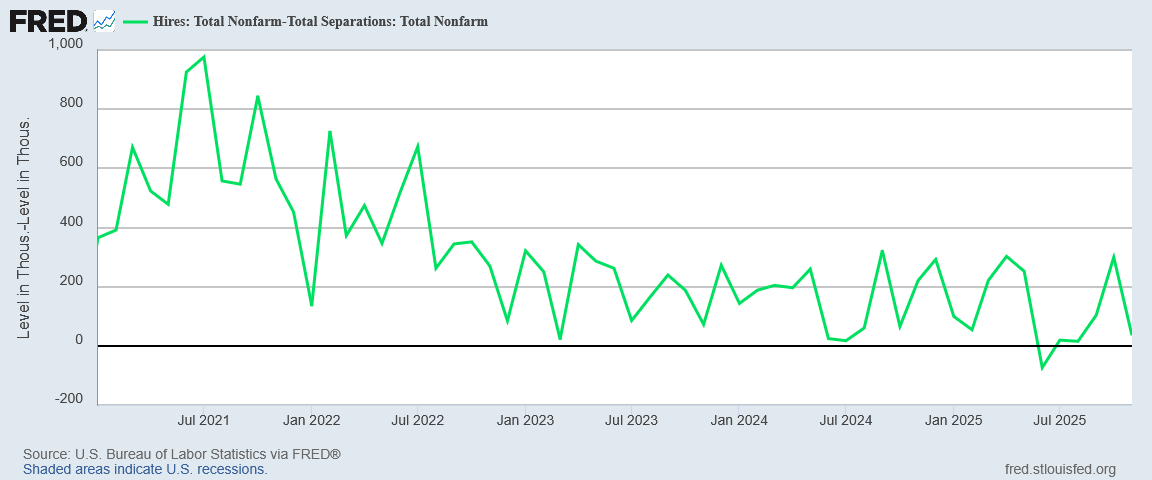

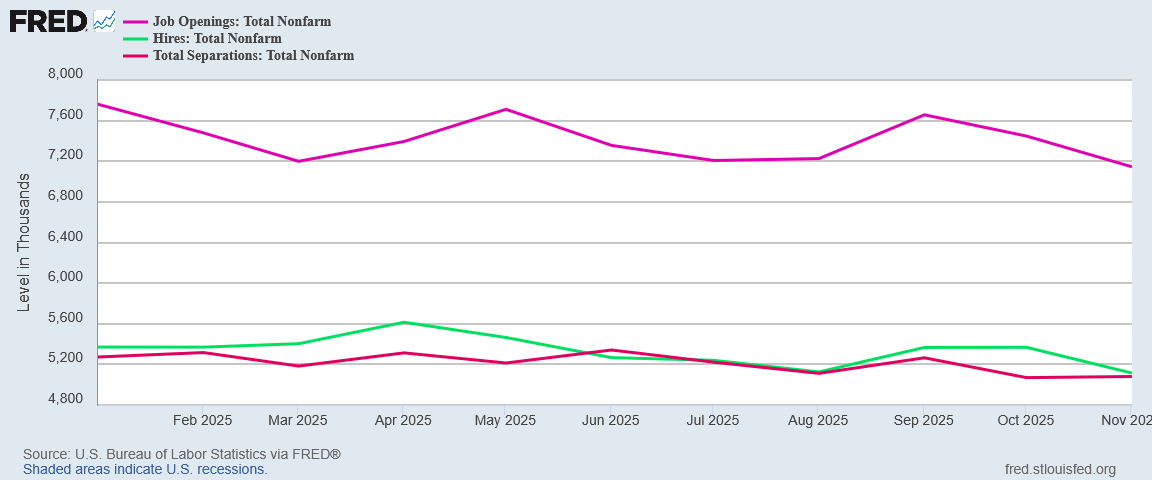

The second jobs report was the Bureau of Labor Statistics November Job Openings and Labor Turnover Summary, which charted a significant plunge in net hiring for the month—all the while hewing to the BLS’ standard JOLTS refrain of “little changed.”

The number of job openings was little changed at 7.1 million in November, the U.S. Bureau of Labor Statistics reported today. Over the month, hires were little changed and total separations were unchanged at 5.1 million each. Within separations, both quits (3.2 million) and layoffs and discharges (1.7 million) were little changed.

Both reports confirmed that the jobs recession in the United States shows little sign of easing, with job loss in key sectors such as manufacturing continuing unabated.

As a prelude to Friday’s Employment Situation Summary, the combination of reports gives little reason for any optimism. No jobs means no prosperity, and certainly no economic “Golden Age.” No jobs means there is still no end yet to America’s jobs recession.

No Job Growth

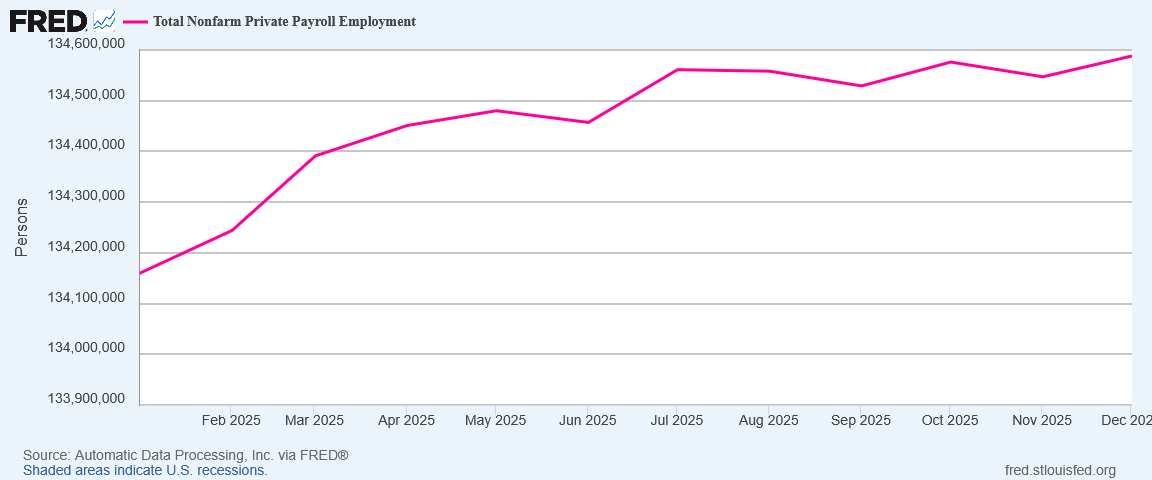

A look at total employment per the ADP report alone highlights the problem: no job growth since July.

The stagnation in employment is confirmed by the JOLTS data, which has not shown any sustained trend either up or down in two years.

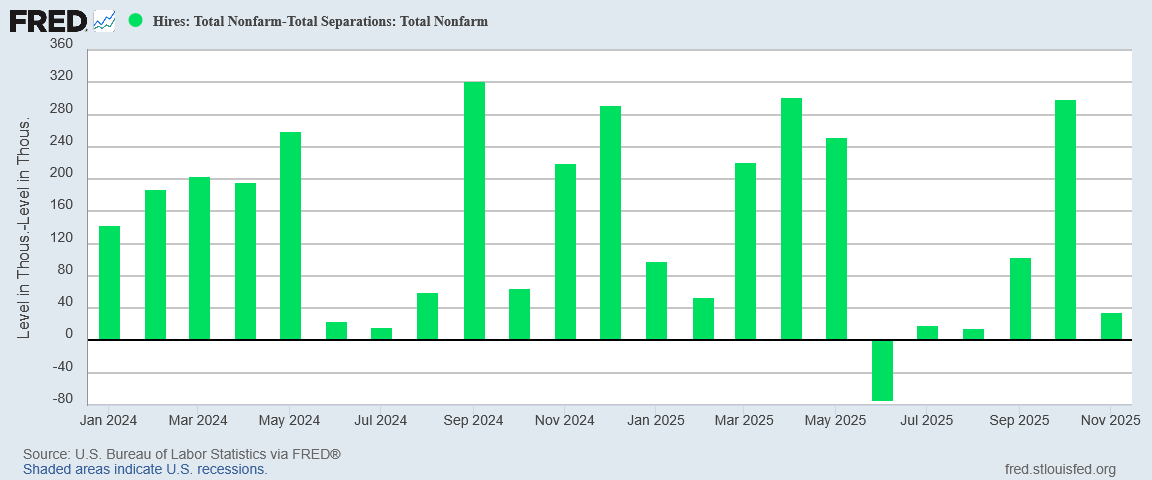

Zeroing in on the data from 2024 onward, November’s net hiring figure was a major drop-off from October’s.

While the November JOLTS data showed some growth, it was only a fraction of what was charted for October.

Even job openings dropped in November. Although the number of job openings remains freakishly large relative to actual hires, it is perhaps telling that the numbers mirror the overall downward trend in hiring.

There has been quite simply less and less employment as we have moved through 2025.

For both the JOLTS and ADP data sets, the latter half of 2025 has been a horrible period for job growth. Neither data set indicated there has been any sort of employment turn-around.

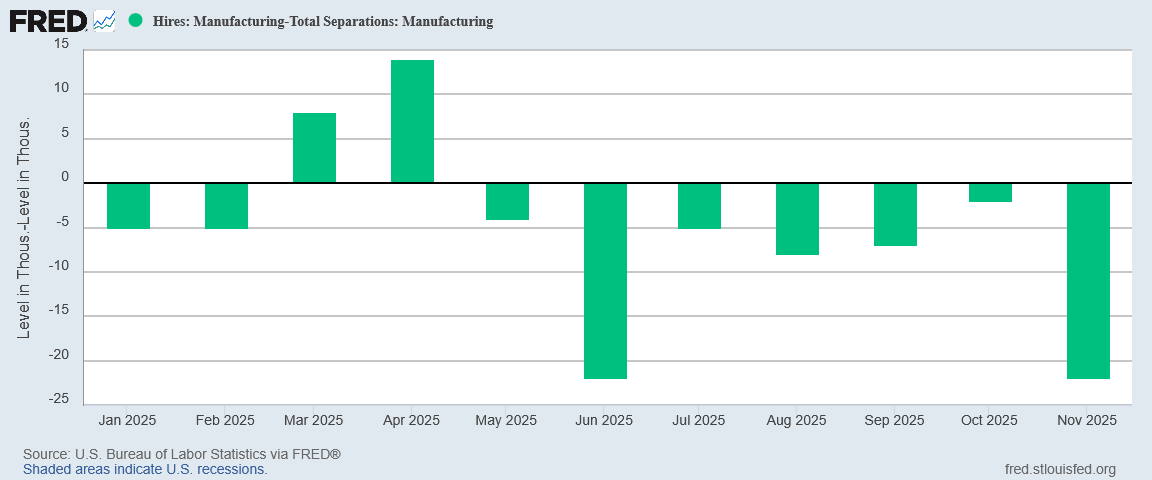

Manufacturing Job Losses Continue

By far the biggest concern is the continued job losses within the manufacturing sector. Within the JOLTS data, there were only two months in all of 2025 where manufacturing actually gained jobs.

Not only did the November job losses in Manufacturing increase, they matched June for the worse month all year for Manufacturing.

The ADP data set has been little better.

While the manufacturing job loss was less in December than it had been in November, it is still a long way from the sustained positive growth trend this country needs if it is to ever achieve Donald Trump’s Agenda 47 goal of becoming a manufacturing superpower.

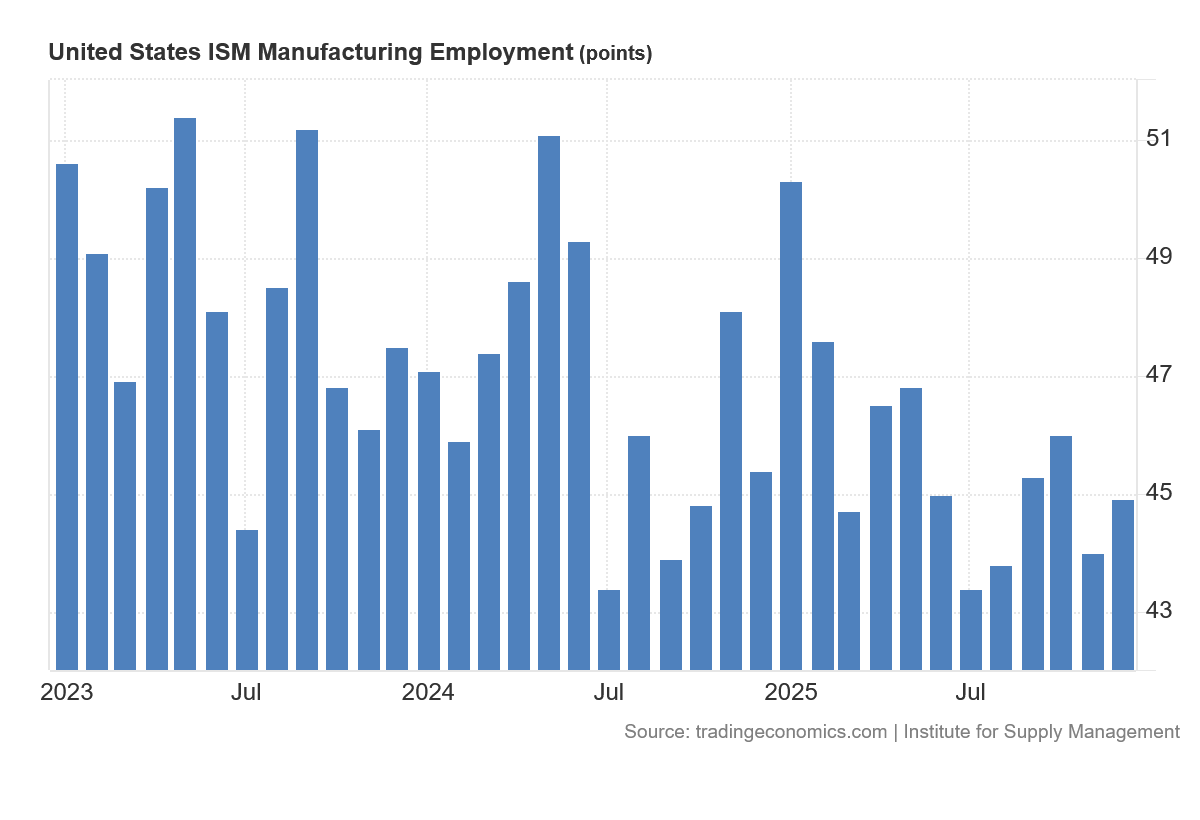

These negative figures are echoed by the Institute for Supply Management Manufacturing Purchasing Manager’s Employment Index.

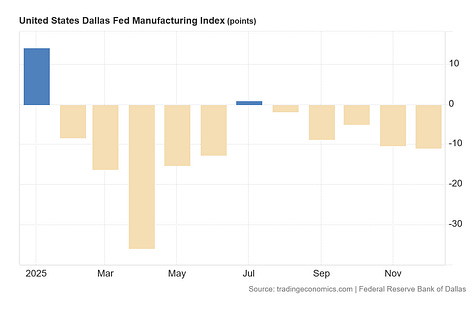

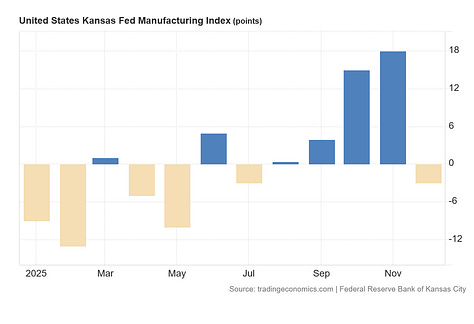

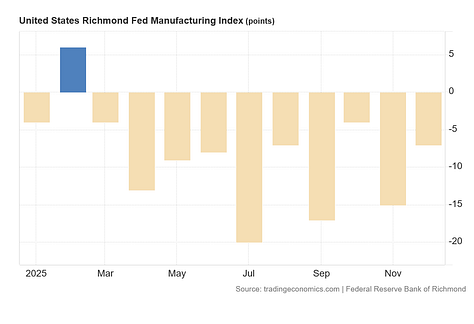

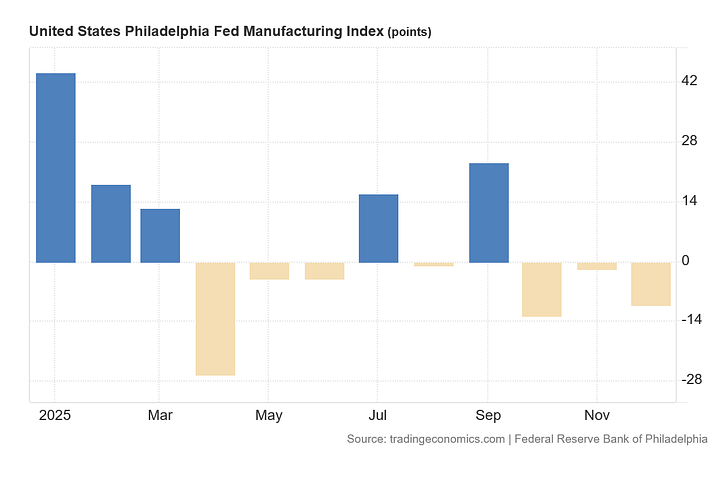

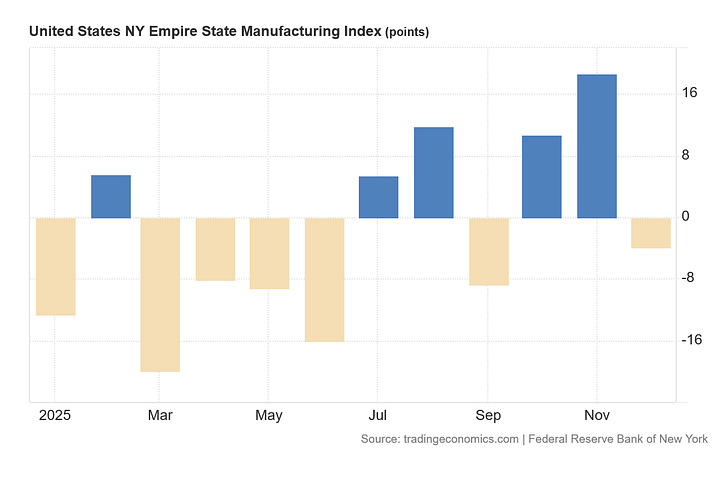

Even the Federal Reserve regional manufacturing indices show manufacturing is not doing well. Dallas, Kansas City, Richmond, Philadelphia, and New York all show declines.

One thing is clear: there has been no reversal from the steady decline in American manufacturing, and there is no sign a reversal is imminent.

Service Jobs Not Much Better

Manufacturing employment is in bad shape, but service sectors are not doing much better.

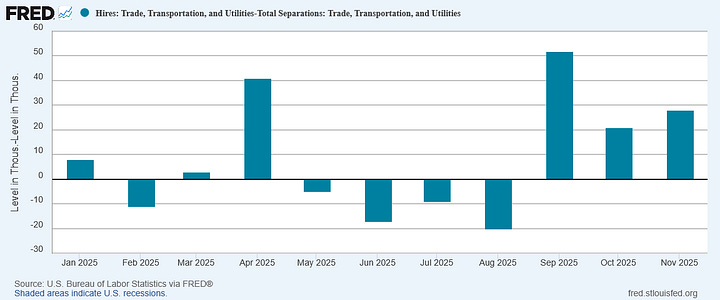

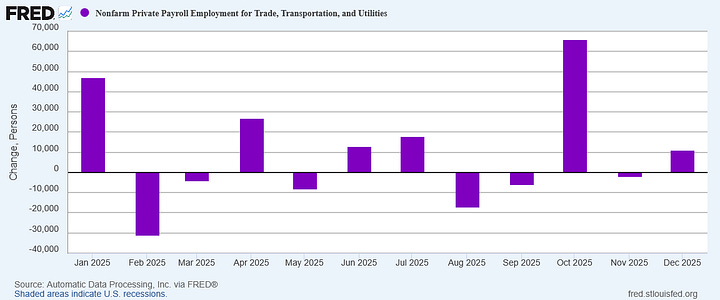

We should note that Trade, Transportation, and Utilities, a major services employment category, did manage a small rebound, both in net hiring for November and in the ADP data for December.

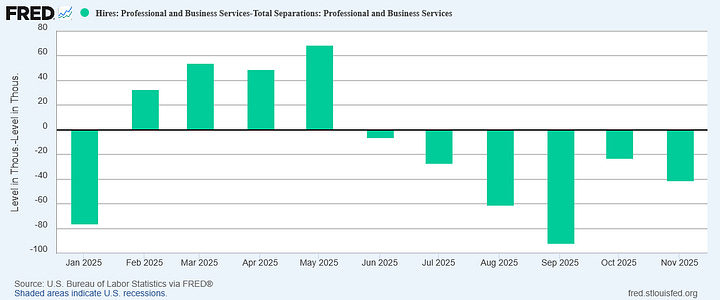

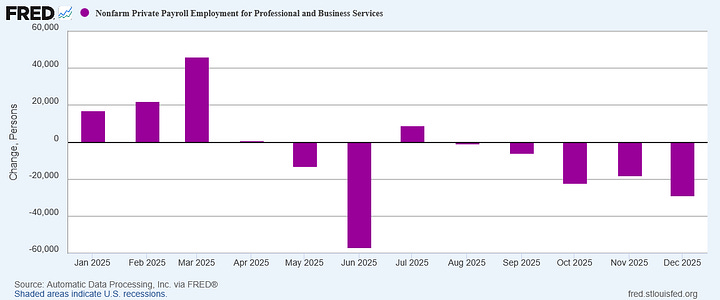

However, Professional and Business Services continued to shed jobs in both the JOLTS and ADP data sets.

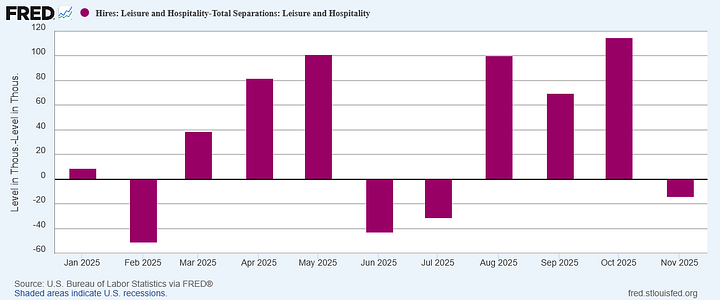

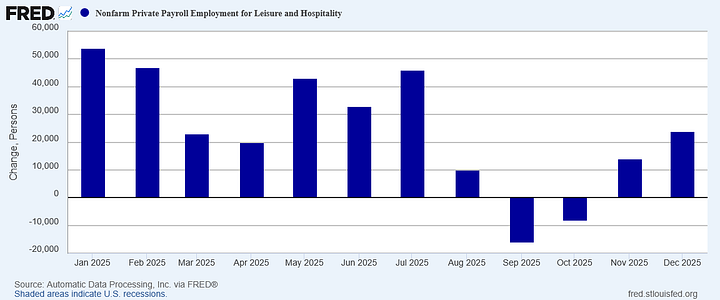

Leisure and Hospitality turned in a mix performance, with net hiring for November printing job losses while ADP showed continued job gains.

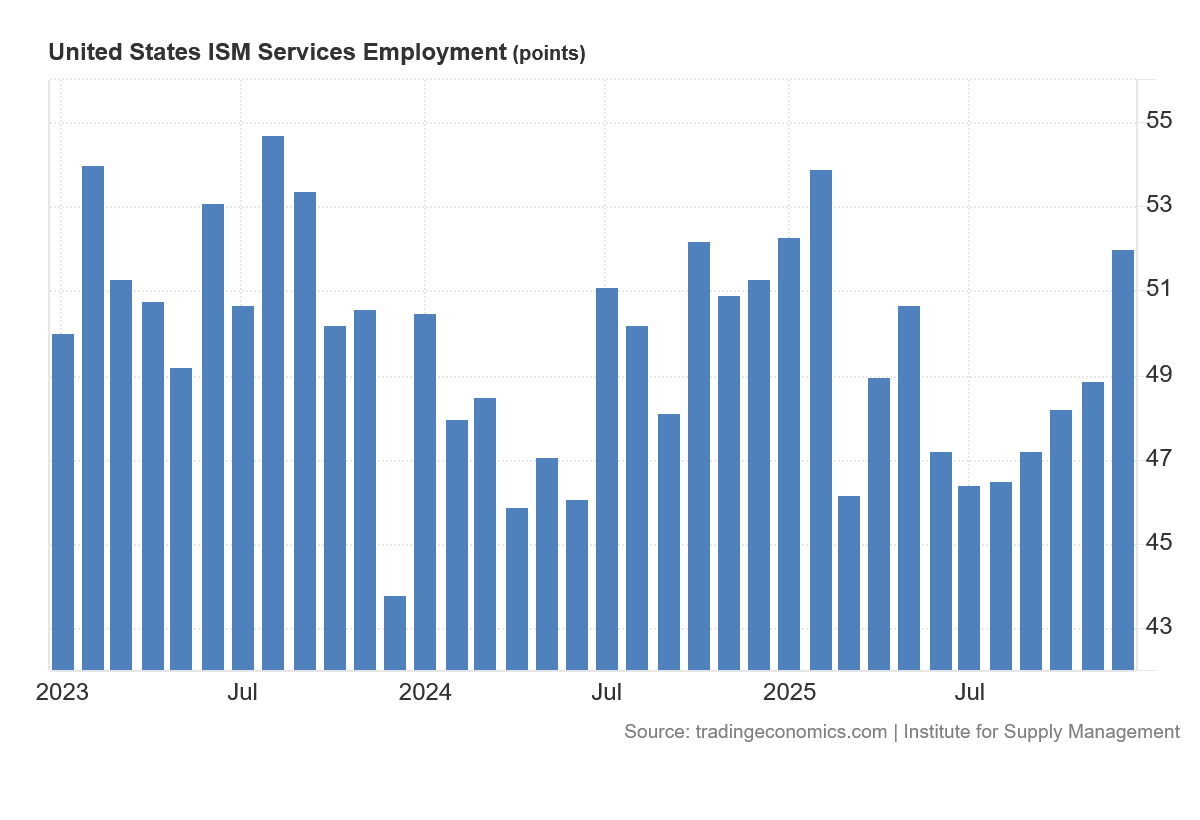

These weaknesses are largely reflected in the ISM Non-Manufacturing Employment PMI, which has been charting contraction for most of 2025, returning to expansion only in December.

Given the anemic nature of the services jobs data, we should not be surprised if the ISM indices show services employment returning to contraction in coming months. Certainly there is no basis to anticipate sustained services employment growth.

America Needs Jobs

No matter what else happens within the US economy, there can be no increase in prosperity if there is not first an increase in employment.

Before there can be a true “Golden Age” in the United States, America needs jobs.

Both the ADP and the JOLTS jobs numbers do not show America getting many jobs. The reports certainly do not show America getting the number of jobs it needs.

What both data sets show instead is labor stagnation. According to the ADP data, there has not been appreciable increase in employment in the US throughout the last half of 2025. According to the JOLTS data, net hiring has been slowing since 2021, and slowed significantly in November.

Neither trend is a good trend.

Nor do these numbers exist in isolation. Both the ADP and JOLTS data largely confirm each other, and other metrics such as the ISM PMI data are consistent with the negative job outlooks.

Jobs are the foundation for all economic prosperity in every country. That has been a foundational understanding of market economies since Adam Smith wrote Wealth of Nations, and that has not changed. Without jobs, prosperity does not happen.

Right now, jobs are simply not happening in the United States. They certainly are not happening at the levels of job creation America needs, given the size of its labor force.

Without jobs, and without far more job growth than we are seeing, sustainable economic prosperity cannot happen in this country.

Without a reversal of manufacturing job loss, America can never become a manufacturing superpower.

There is no silver lining here. Neither the ADP nor the JOLTS data is showing the employment growth trends necessary to deliver sustained broad-based prosperity within the American economy. The jobs are simply not there, and the job growth is simply not happening.

America needs jobs. America is not getting the jobs it needs. America is certainly not getting the jobs it needs to put an end to the jobs recession we have endured since 2023.

That is the takeaway from both the ADP and the JOLTS jobs reports this month.

The Trump administration has a theory of what needs to be done to make America a manufacturing superpower again. So far, not a success. Peter, is there enough data now for any analyst to make a call on the plan’s ultimate success? Is it a case of, “not successful theory” or “not successful yet”?

Or maybe there has not been enough data or time for anyone to make this call, and those who do are fools?

And the markets are at All Time Highs, cognitive dissonance? I thought markets were reflective of jobs and economy. Our trade deficit is at a 16y low - maybe good but probably bad?