BLS Tries To Goldilocks September JOLTS Report

Jobs Data Not Too Hot, And Not Too Cold. Is It Just Right For The Fed?

One would have to be deeply cynical to ever think that the Bureau of Labor Statistics would manipulate fudge “revise” its data to fit a political narrative.

Therefore we must acknowledge that it is purely coincidental that, on the eve of an Election, the BLS produced a Job Opening and Labor Turnover Summary report that manages to be not too hot and not too cool.

Did it manage to be “just right” for the Fed? Possibly—but they still left several warning signs of a worsening jobs situation.

One of the BLS’ favorite phrases when making up compiling the data for these reports is “little changed”. It appears throughout the JOLTS news release.

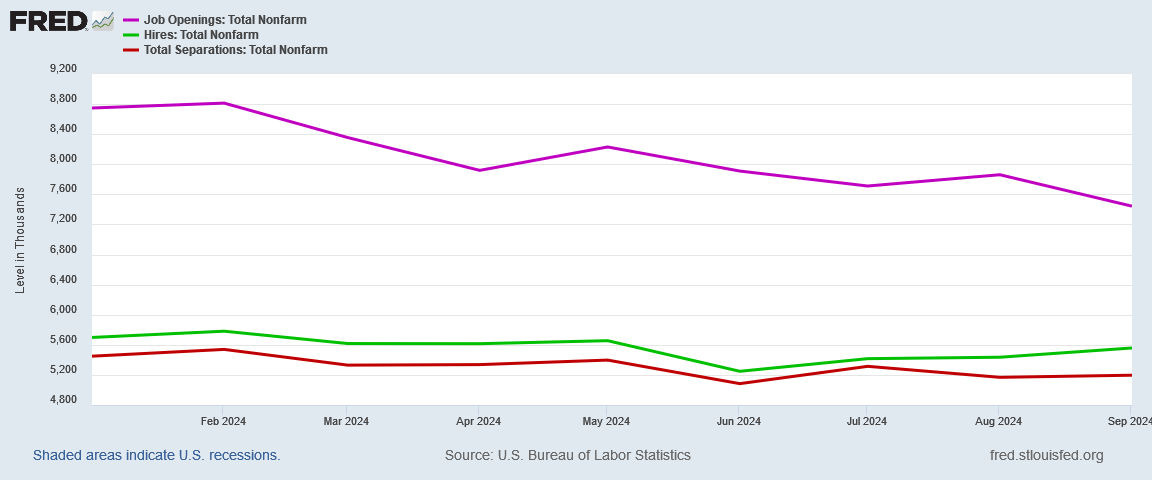

The number of job openings was little changed at 7.4 million on the last business day of September, the U.S. Bureau of Labor Statistics reported today. Over the month, hires changed little at 5.6 million. The number of total separations was unchanged at 5.2 million. Within separations, quits (3.1 million) and layoffs and discharges (1.8 million) changed little. This release includes estimates of the number and rate of job openings, hires, and separations for the total nonfarm sector, by industry, and by establishment size class.

However, while the September data was “changed little” from the August data, that is in large part because the August data had some significant corrections made to it.

The number of job openings for August was revised down by 179,000 to 7.9 million, the number of hires was revised up by 118,000 to 5.4 million, and the number of total separations was revised up by 171,000 to 5.2 million. Within separations, the number of quits was revised up by 94,000 to 3.2 million, and the number of layoffs and discharges was revised up by 60,000 to 1.7 million. (Monthly revisions result from additional reports received from businesses and government agencies since the last published estimates and from the recalculation of seasonal factors.)

In other words, the JOLTS report backloaded a reduction of 179,000 job “openings” (does anyone believe these jobs actually exist?), an increase in the number of hires, and an increase in the number of separations into August. Apparently that attracts less attention than capturing them this month?

Quits and layoffs also rose in September, with the net hiring effect of the revisions a reduction of 53,000 jobs in August. Note the report does not ever tell you that specifically, it merely spreads the numbers around in August.

Of course, those could really be corrections to the August data. Only someone deeply cynical and suspicious would think the BLS was fudging the data to game the September data.

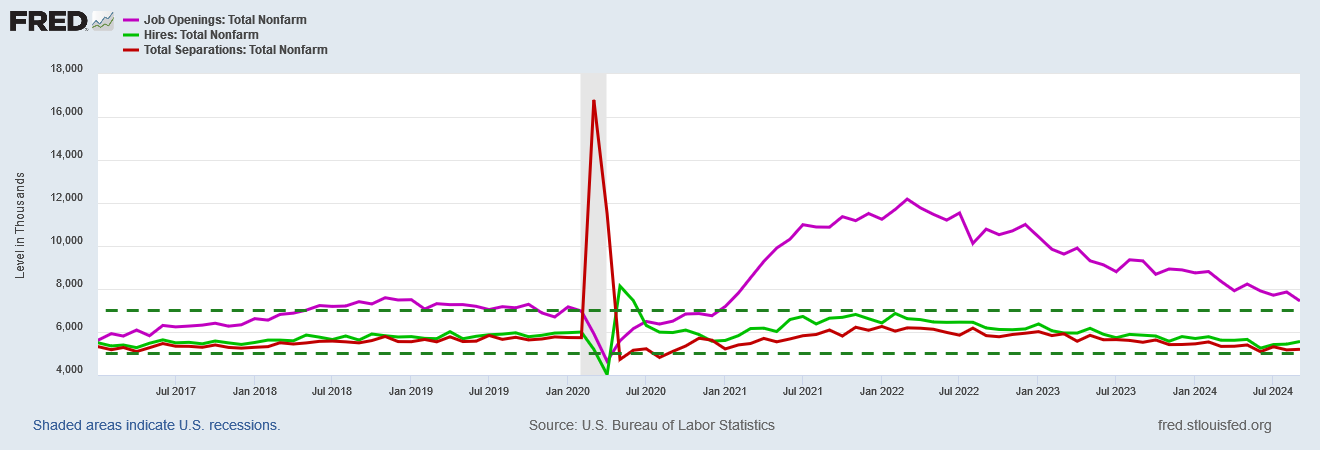

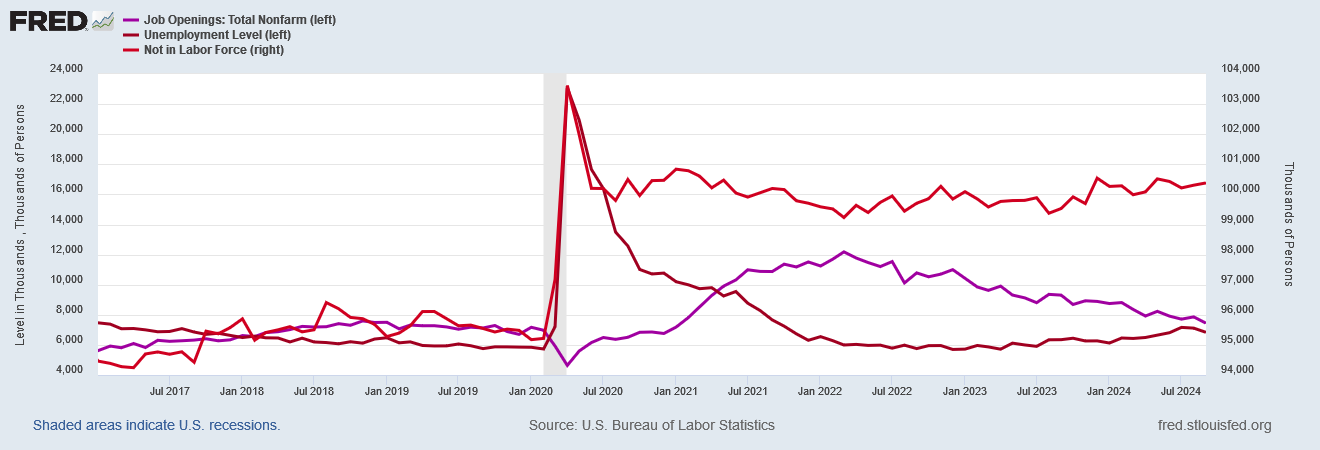

Overall, the hiring and separations numbers came in at the low end of the band they have been within since the start of Donald Trump’s first term of office (5 million to 7 million).

The fictional job openings likewise skirted closer and closer crossing below the 7 million ceiling established by the other data.

The Federal Reserve will no doubt be pleased to see yet another decline in the Job Openings number, which has been trending down all year.

Wall Street was pleased to see hiring inch upward, with equity markets largely moving up on the day.

Superficially, then, this would appear to be a “good” jobs report.

What about when we peel back the top layers and look underneath?

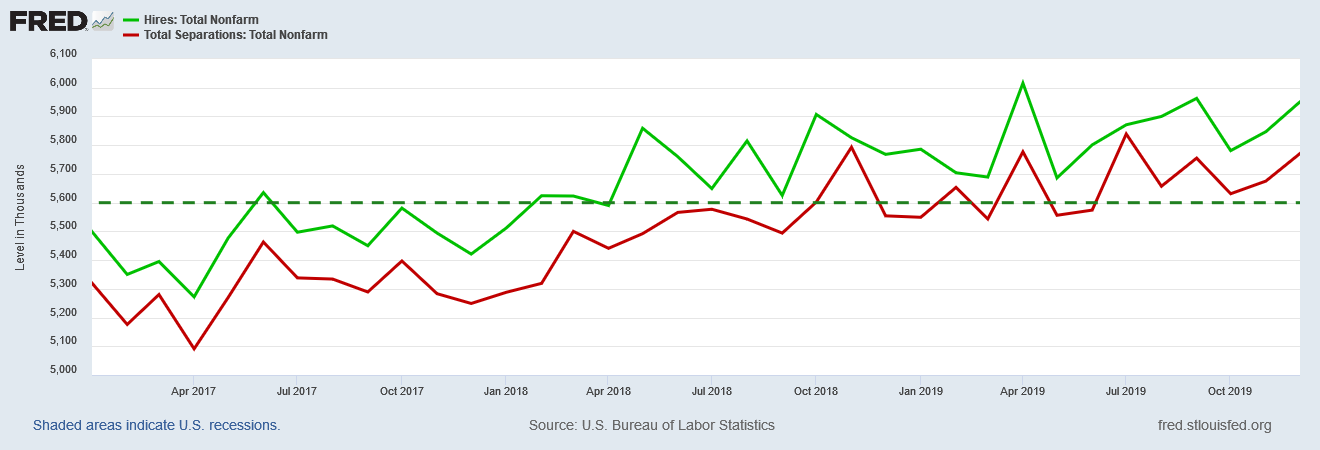

While hiring has picked up in the past few months, for most of the year hiring has been at or below 5.6 million each month.

The significant of the 5.6 million threshold is that, pre-COVID, under President Trump hiring was above that threshold from April of 2018 onward.

For most of 2024 hiring has in fact been significantly cooler. We can expect some downturn from the 2021-2022 hiring peak—a lot of elevated hiring pace would have been the result of job recovery, as the market struggled to get back to where things were before the Pandemic Panic Recession.

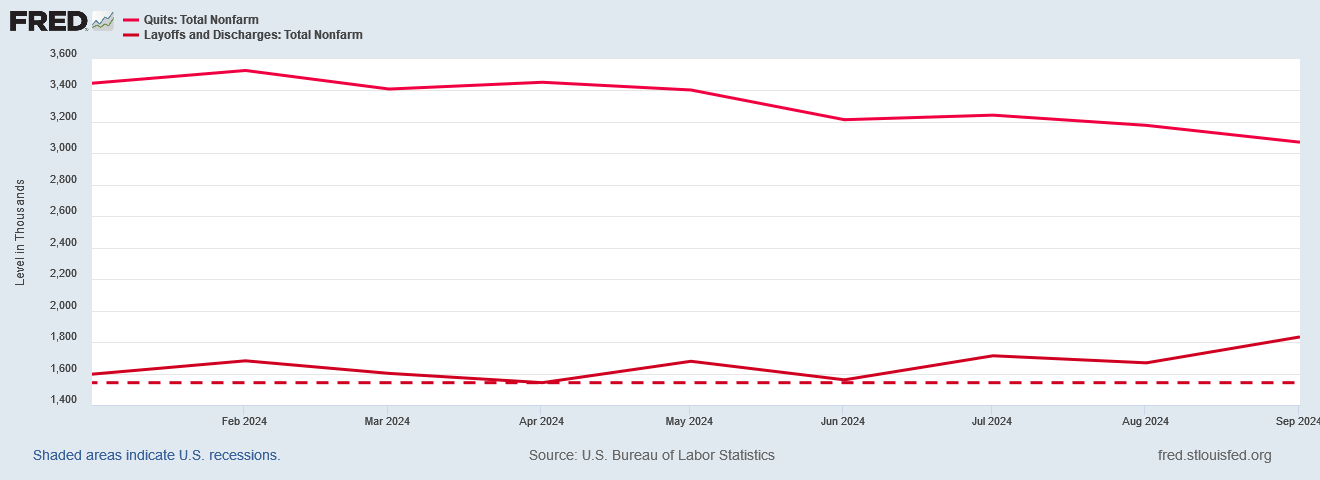

But if hiring has been cooling down of late, layoffs especially have been heating up.

Layoffs have been coming off of a local bottom (1.5 million in April 2024), and have been rising ever since June.

At the same time, quits peaked in February of this year, and have been moving down ever since.

Rising layoffs are, of course, not a good sign for the state of the economy. They signify companies are not growing their operations but are retrenching and preparing for difficult environs in the near future.

Falling quits are also a distant early warning signal of rising weakness in the jobs market. Falling quits signify workers are less confident about their prospects in the job market.

Total separations have been trending up despite the falling quits, which indicates that layoffs are starting to have more impact in employment than quits.

None of these are positive economic signals.

There are positive economic signals in the JOLTS report. For the second month in a row net hiring has been positive.

This broadly conforms to the shifts we see in the change in total employment.

Whatever else is happening in the economy, net hiring at least is moving in the right direction. For now.

What is far less certain is whether the positive hiring trend will continue. Employment has yet to break above the second plateau it has experienced during the (Biden-)Harris Administration.

The first plateau occurred as employment was finally returning to where it had been just prior to the COVID Pandemic Panic (red dotted line in the graph)—we should remember that during the first year or so of the (Biden-)Harris Administration, the economy was not creating new jobs but recovering existing ones which had been disrupted by the Pandemic Panic. From March through November of 2022, there was little if any significant job growth, and since November of 2023 employment in this country has actually fallen.

As a caveat on White House propaganda about jobs, the post-recovery period of significant job growth was, of course, the data between the two plateaus, or from November 2022 through November 2023, or 3.2 million jobs. That’s the total number of jobs the White House can plausibly claim to have created, and that one year span is the only post-recovery expansion of employment during the Biden-)Harris Administration.

That less than-reported jobs creation number is a major reason why the hiring trends post-COVID have failed to bring back into the workforce very nearly half of those workers forcibly ejected from the labor force during COVID.

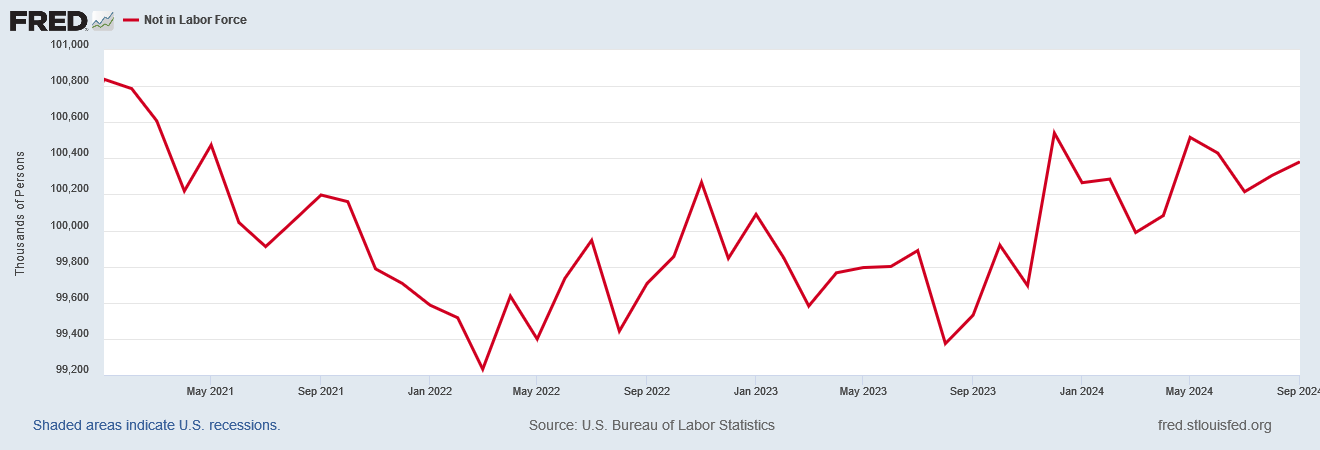

That less than-reported jobs creation number is a major reason why the number of workers who have left the labor force has crept back up since February of 2022.

Still, the JOLTS data shows just enough cooling to make the Fed happy that its rate hike strategy for dealing with inflation might actually be working (it’s not, but the Fed never looks too closely at the data for fear it will be confronted by reality). That expectation is enough to make Wall Street happy, as it means the Fed will feel good about another 25bps rate reduction to the federal funds rate—which is the amount Wall Street has currently priced out.

Layoffs are steadily increasing. That’s not good.

Workers are still exiting the labor force in increasing numbers. That’s not good.

Nearly forty percent of workers forcibly sidelined because of the Pandemic Panic still have not returned to the labor force and that’s not good.

Hiring is slipped below the pace set during the Trump administration, and that ‘s not good.

Employment has yet to break out of its most recent plateau, and that’s not good.

On the surface, the JOLTS data gives Wall Street and the Federal Reserve just enough hopium to encourage the Fed to follow through on another 25bps rate cut.

Underneath, however, the JOLTS data shows that real job growth still is not occuring within the US economy. The BLS has done its best to dress the numbers up to make that not quite so obvious, and Wall Street is doing its best not to notice the charade, but a charade it is.

This report confirms we’re still in a jobs recession, and have yet to break out of it.

Peter, your witty personality that exudes through your smart writing makes me smile every time. You’re a delight

Deception everywhere. Just voted and the parking lot filled with people handing out “Sample Ballots - here, it’s critical you take this with you into the voting booth” and it’s a Democratic Ticket/ballot and everyone took one as they looked like county officials handing out helpful information…grrr