Corporate Media Stuck On "Muh Tariffs"

As Always, The Data Paints A More Complex Picture

Once again, corporate media is clutching its pearls over “inflation because tariffs” after last week’s release of the December Producer Price Index Summary.

Once again, the data challenges that narrative. Even the Bureau of Labor Statistics press release makes that assessment problematic (emphasis mine).

The Producer Price Index for final demand increased 0.5 percent in December, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices advanced 0.2 percent in November and 0.1 percent in October. (See table A.) On an unadjusted basis, the index for final demand rose 3.0 percent in 2025 after moving up 3.5 percent in 2024.

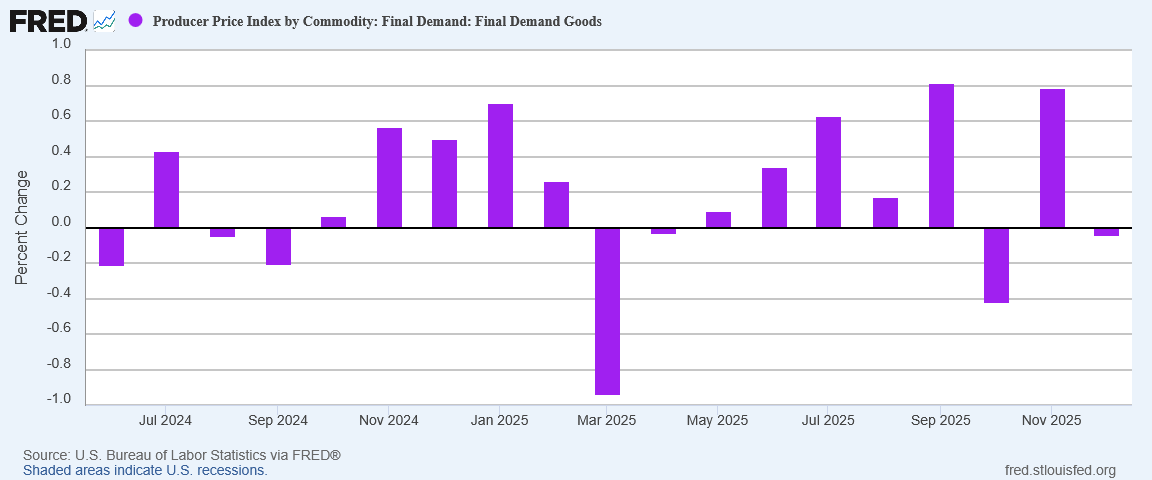

The December increase in prices for final demand can be traced to a 0.7-percent advance in the index for final demand services. Prices for final demand goods were unchanged.

Follow the corporate media rationale: factory gate inflation rose less in 2025 than in 2024, but tariffs were the cause of that reduced inflation in 2025. Also, tariffs cause prices for final demand goods to remain unchanged in December.

Structurally, tariffs are always going to represent an inflationary pressure on prices. Every additional cost incorporated into the resale of goods will push the price of those goods up, all else being equal. That is Economics 101.

However, as I have discussed innumerable times, all else is never equal. There are a myriad of inflationary and deflationary forces at work on prices all the time, and whether there is or is not inflation depends entirely on how those diverse forces resolve themselves.

That is a nuance that perpetually escapes corporate media.

Once again, we dive into the details to see what is really happening with factory gate inflation.

Corporate Media’s Perpetual Narrative: “Muh Tariffs”

The irony of the corporate media narrative is that they gloss over some foundational realities of tariffs to reach their perpetually extravagant and erroneous conclusions about the impact of President Trump’s Liberation Day tariffs.

Even their headlines broadcast their error.

But it is not merely the media pushing the wrong narrative. When we delve into the CNBC reporting, Wall Street analysts are equally off-base.

Producer prices were led higher by a 0.7% jump in the cost of services from the month before. Overall, service prices have jumped 3.2% from this time last year. Friday’s data “suggests businesses have been able to pass along some of the costs from tariffs as higher prices,” JPMorgan said in an analyst note.

Prices for goods were unchanged in December, primarily due to declines in food and energy prices, with a 14.6% decrease in diesel fuel prices. When those sectors were removed, prices for goods rose 0.4% for the final month of last year.

We should not forget that Jerome “Too Late” Powell also clings to the "tariffs are driving inflation" narrative to justify rejecting President Trump’s (rational and reasonable) calls for a lower federal funds rate.

Businesses had been absorbing some of President Donald Trump’s sweeping import tariffs, preventing a sharp increase in inflation. The Federal Reserve on Wednesday left its benchmark overnight interest rate in the 3.50%-3.75% range. Fed Chair Jerome Powell attributed the overshoot in inflation to tariffs, adding “but there’s an expectation that sometime in the middle quarters of the year we’ll see tariff inflation topping out.”

Wait, comes the rebuttal, if prices are going up, how is that not due to tariffs?

Comes the reply: the primary component of factory gate inflation in December was services. Tariffs are applied to goods—physical products.

But, comes the riposte, prices for goods other than food and energy rose 0.4% on the month—how is that not due to tariffs?

Remember what I said above: inflation occurs when all inflationary and deflationary forces on prices resolve. With the primary source of factory gate inflation for December being service price inflation, we have to look elsewhere besides tariffs for a primary cause.

Somewhat belatedly, even JPMorgan concedes this.

“Aside from food and energy prices, the final demand core goods PPI rose 0.4% in December, which is on the firm side of readings over the past few years and points to some continued pass-through of tariffs into goods prices,” JPMorgan said in a note. “On an over-year-ago basis, core final demand PPI goods rose 3.7%, which points to ongoing pipeline pressures for consumer inflation that appears to be bolstered in part by tariffs.”

With factory gate inflation lower in 2025 than in 2024, and with services driving factory gate inflation more even than core goods less food and energy, the obsession with the Liberation Day tariffs is simply not supportable by even a cursory view of the data.

When we peel back the layers of the detail onion, that obsession becomes even more unsustainable.

Factory Gate Inflation Has Been Rising Since 2024

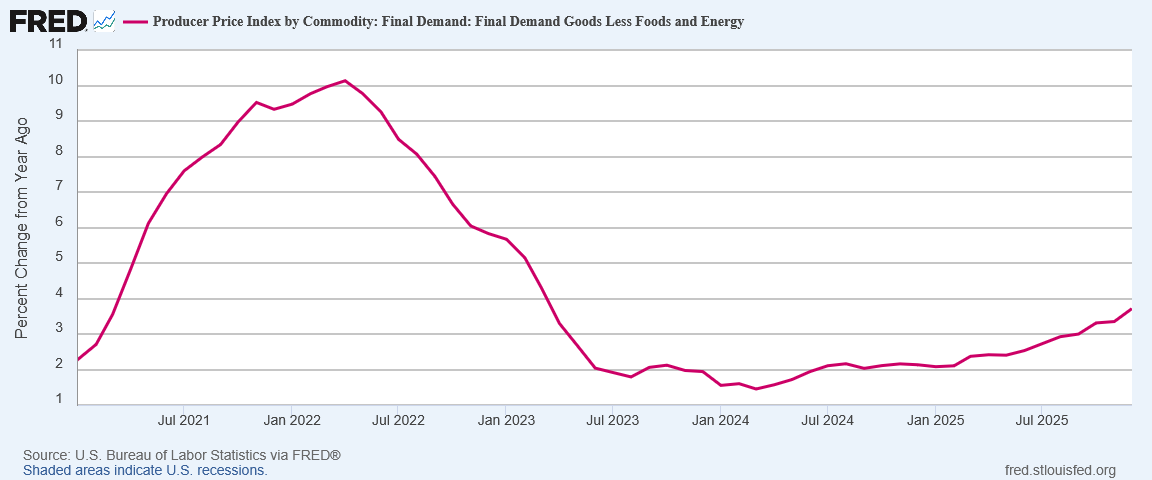

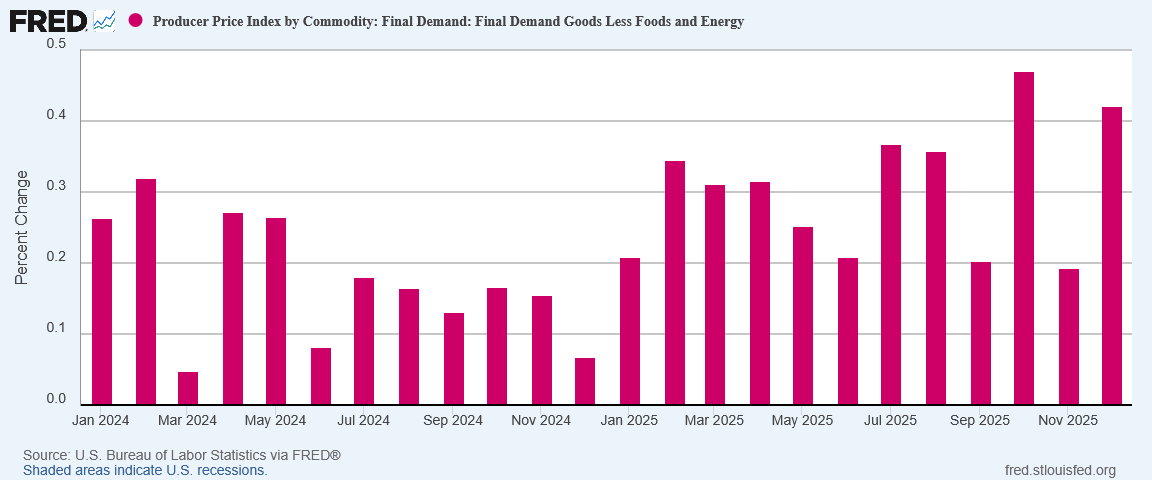

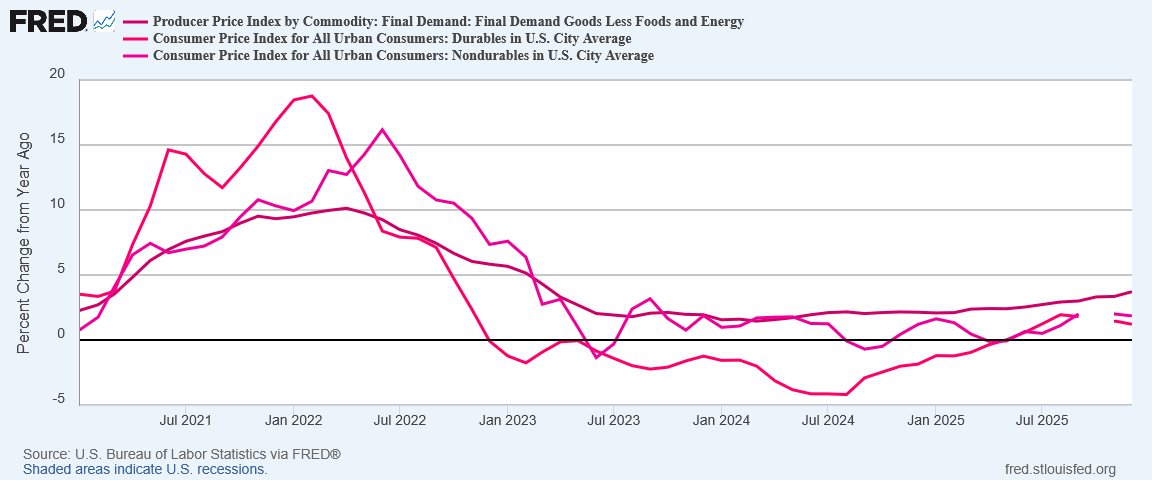

The biggest challenge to the corporate media narrative on tariffs is the reality that year on year producer price inflation for final demand goods less food and energy has been rising since early 2024.

There is no denying that other forces are at work, since President Trump’s Liberation day tariffs do not arrive until mid-2025 at the earliest.

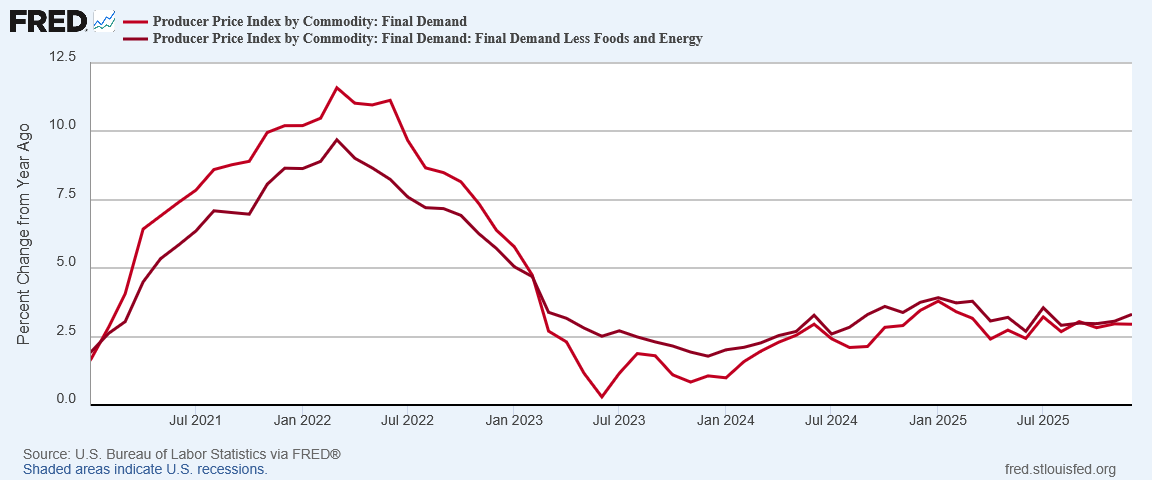

Despite the upward trend in goods prices, overall factory gate inflation shows the same leveling out trend that consumer price inflation has demonstrated.

Producer prices are showing greater volatility than consumer prices, but the macro trend is still predominantly a horizontal one.

This tracks with the report that factory gate inflation overall was less in 2025 than in 2024. If tariffs were a primary factor in pushing up producer prices, the overall inflation rate for 2025 would be greater than in 2024.

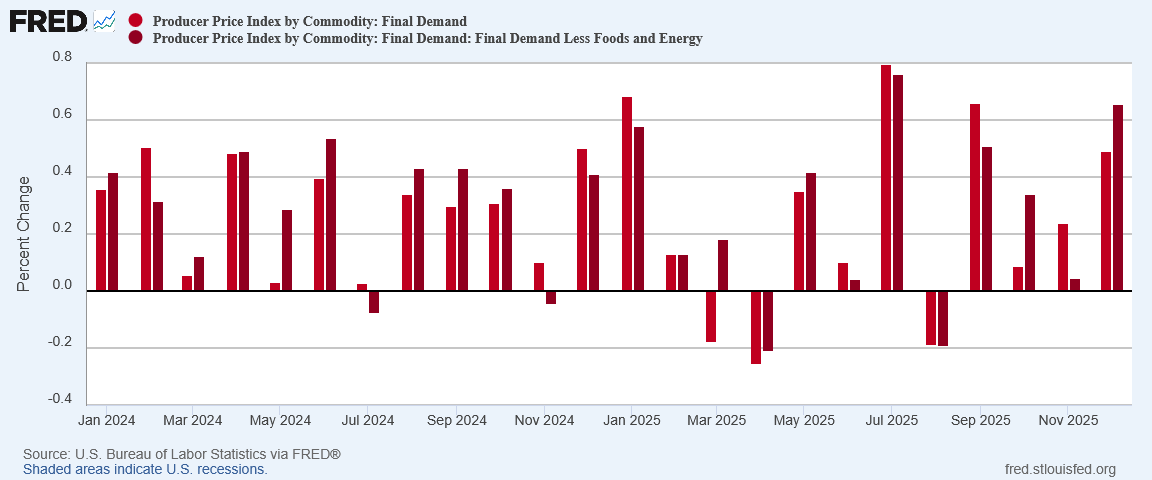

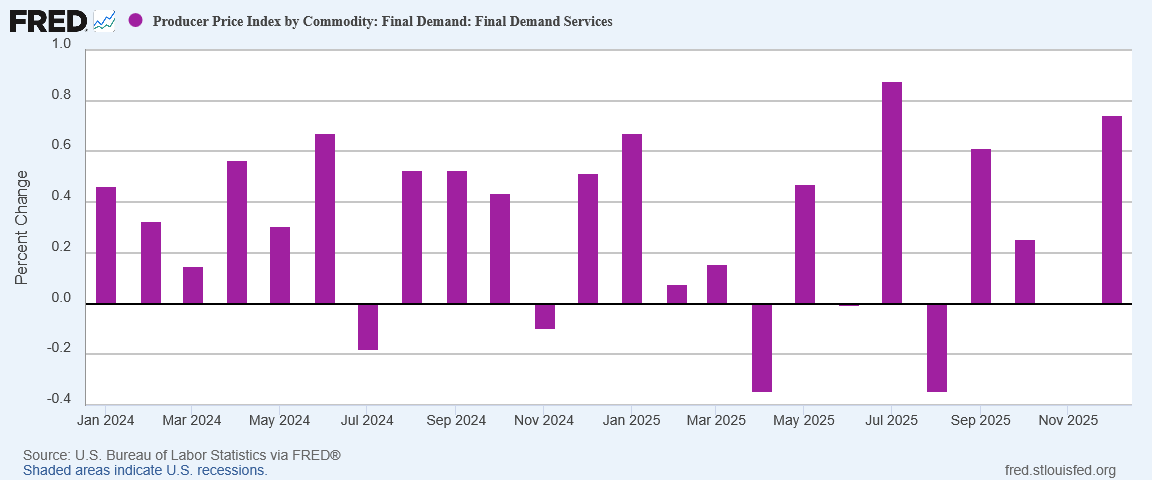

It is also important to note that December’s month on month inflation numbers were not the highest for 2025.

Once again, note the volatility in the numbers. When data is that volatile the probability that one factor is solely responsible is approximately nil—not that corporate media will ever admit the need for that much context or nuance in their reporting. Orange Man must be Bad, after all.

Goods, Foods, And Energy Declined In December

When we unpack the numbers further, we encounter some data points which are decidedly contrary to the “muh tariffs” narrative.

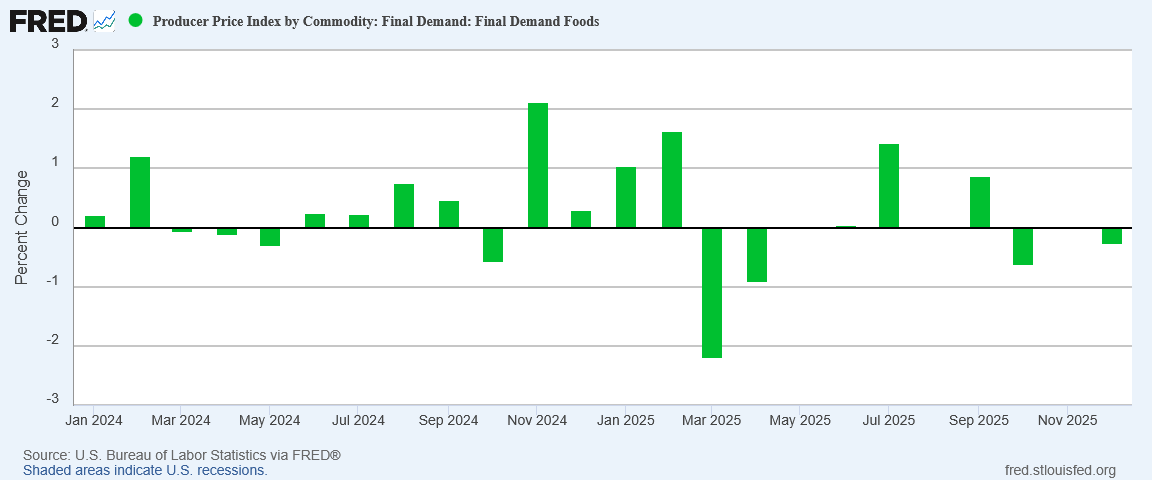

The first data point: Food price inflation was negative 0.26% in December.

While food prices have been their usual volatile self overall, for most of 2025 the factory gate inflation trend has been either disinflation or outright deflation.

Clearly tariffs are not having an inflationary impact on food prices!

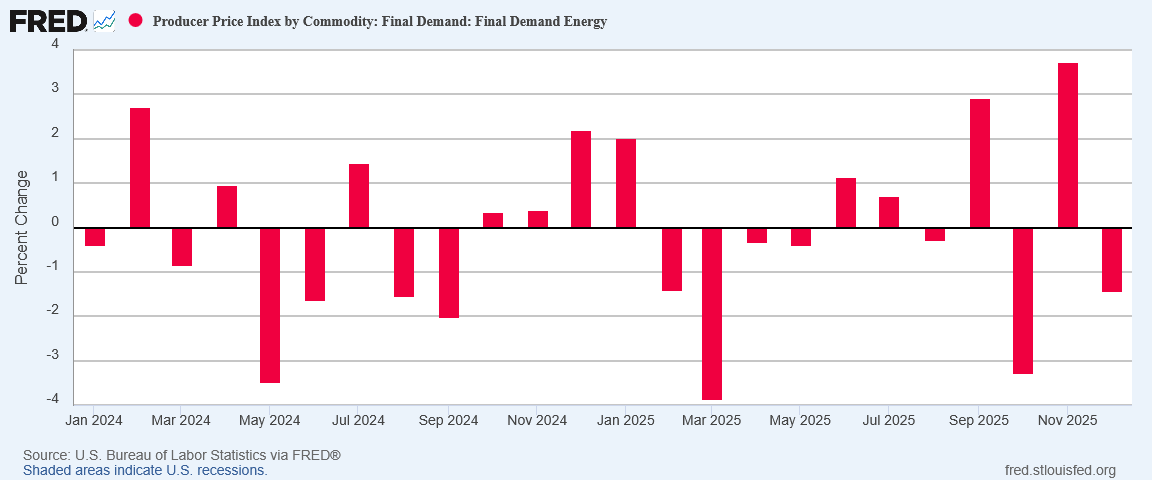

The next data point is the other volatile category—energy price inflation, which also printed deflation on the month.

As the United States is largely self-sufficient in energy, we would not expect tariff regimes to have any real impact on energy prices. However, it is worth noting that energy prices are trending down globally, as the benchmark crude prices demonstrate. That represents a global deflationary pressure on prices.

As a result of food and energy price deflation on the month, factory gate prices for goods overall also printed deflation for December.

Only when we strip food and energy products out of the goods category itself do we see price inflation on the month.

Even then, December was not the largest month on month rise.

That being said, we are seeing month on month rises in prices. However, as noted above, factory gate inflation for goods less food and energy has been rising for two years, meaning there are other significant factors at work besides tariffs.

Thus, even before we consider the impact of services on the producer price index, we already have reasons to discount the primacy of tariffs as a driving force behind factory gate inflation.

Services, remember, rose 0.74% month on month in December.

As even the BLS noted, by far the largest contributor to December’s increase in core PPI was the services category—and the Liberation Day tariffs were not levied on services (remember, tariffs are levied against goods).

Even if we could ascribe all factory gate inflation for goods less food and energy to tariffs, tariffs would still not be the primary driving force behind rising factory gate inflation for December. The major impact of services precludes that possibility.

Why Are Prices Rising?

If tariffs are not driving factory gate inflation, what is?

First we should clarify that we cannot and should not rule out tariffs entirely. We simply should also not focus on tariffs to the exclusion of all else.

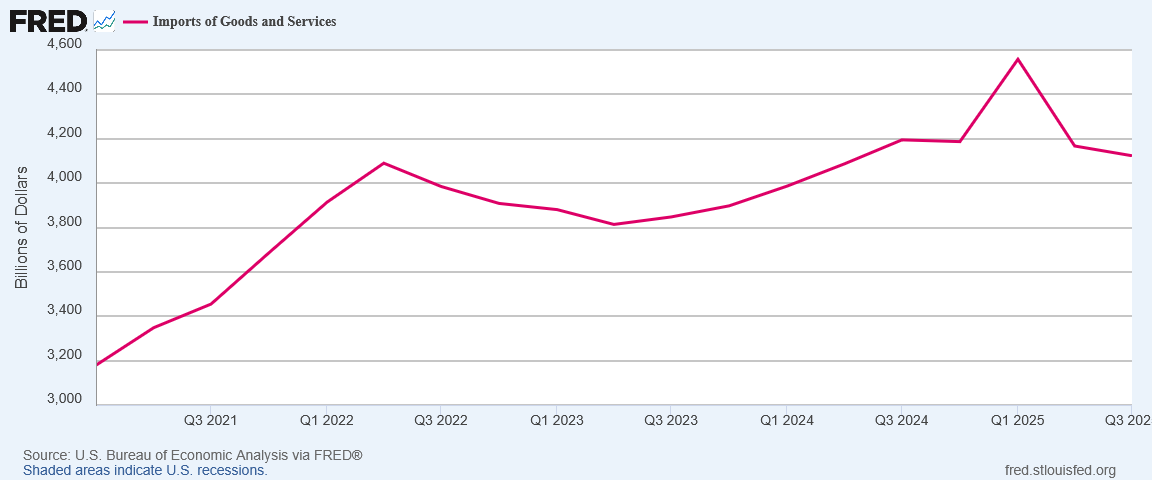

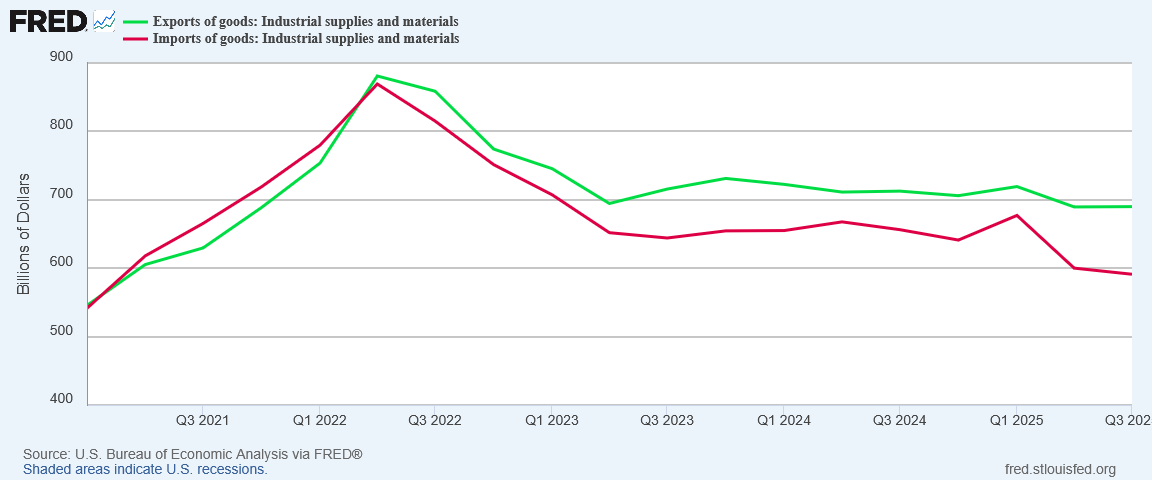

One factor we should consider is reduced imports. Aside from the first quarter of 2025, when there was demonstrable front loading of imports in anticipation of the Liberation day tariffs, imports had actually been starting to decline starting in 2024.

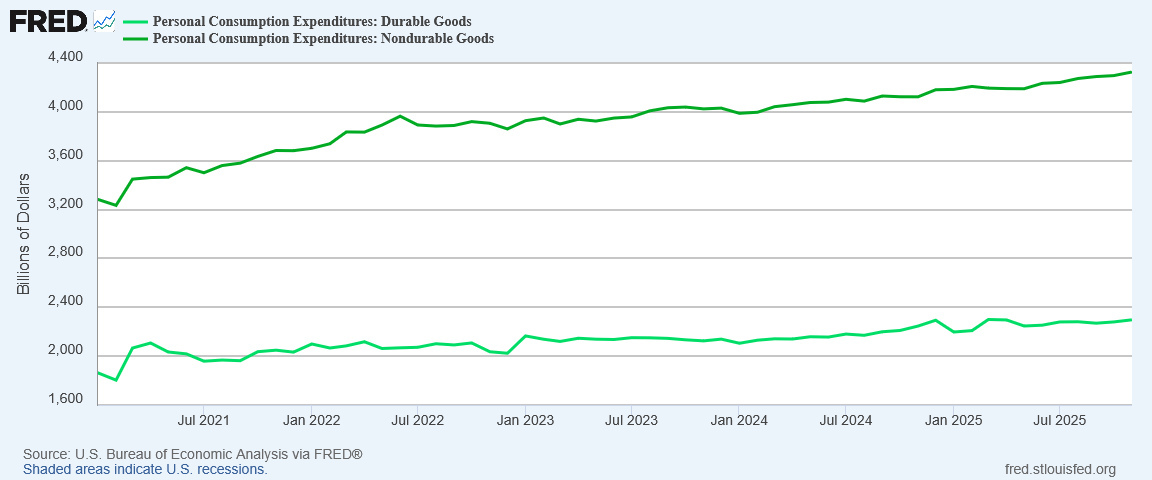

This is notable because consumption expenditures for both durable and nondurable goods have been rising at a steady pace since 2021.

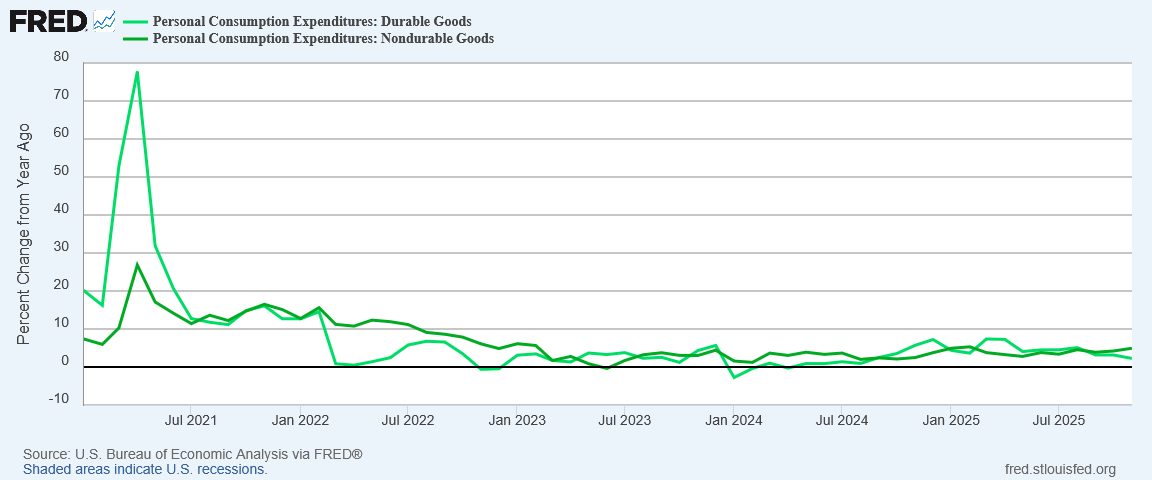

While there was a rebound effect immediately after the 2020 COVID Pandemic Panic, by 2022 the year on year percent change in consumption was already starting to flatten out.

With fewer goods imported, and consumption overall not declining, that itself will push prices up.

Are imports declining because of tariffs? While that is possible, it seems difficult to see a decline in imports due to other countries not wanting to trade with the US when exports of goods are rising.

Tariffs are certainly not dissuading countries from buying US products. Given the trade war dimensions of the “muh tariffs” narrative, if tariffs were having dramatic impact on trade overall we certainly should not be seeing rising export receipts—yet we are.

One aspect of trade that is declining is industrial supplies and materials. While exports are holding up better than imports, both have been declining since the peak of the 2022 hyperinflation cycle.

Is this an indication the US is heading into a “lost decade” or a deflationary episode? Certainly it gives rise to concerns of an over slowdown in industrial production—and I have written repeatedly about manufacturing languishing in this country (the jobs numbers alone tell the tale).

One final point we should also consider when assessing producer prices: while a long-standing presumption is that factory gate inflation is a leading indicator for consumer price inflation, in recent months and years that correlation is increasingly problematic.

While there was a correlation between year on year consumer price inflation and factory gate inflation for goods immediately after the COVID Pandemic Panic and during the 2022 hyperinflation cycle, after 2022 there has been more divergence, with consumer prices dipping into deflation year on year while producer prices stabilizing and then trending up.

With durable goods especially the correlation between consumer price and factory gate inflation has weakened significantly since 2022.

While a rise in the Producer Price Index does likely signify a rise in future consumer price inflation, the amount by which the PPI contributes to the CPI is diluted.

Even if tariffs are driving some factory gate inflation, the degree that translates into overall consumer price inflation is at best problematic. While the tariffs’ contribution to consumer price inflation is likely not zero, focusing on tariffs as if they are the primary or even sole contributing factor is simply not supported by the data.

“It’s Complicated”

Ultimately, the TLDR on what is driving factory gate inflation is almost always going to be “it’s complicated”.

Tariffs certainly can be a factor in pushing up prices, and are always an inflationary pressure on prices. Geopolitical tensions over Greenland, Venezuela, China, Ukraine and Iran can also be inflationary pressures. Political and non-tariff trade disputes can likewise be inflationary pressures.

There are simply too many forces pushing prices both up and down to say “inflation is due to this” or “inflation is due to that.”

The complexity of forces is undoubtedly one reason there has been a weakening of the correlation between factory gate inflation and consumer price inflation in recent years. In short strokes, we are seeing diverse forces assert themselves on both factory gate and consumer price inflation, and that diversity is having variable impact on each.

Needless to say, a narrative of “it’s complicated” does not serve the interests of either corporate media or Wall Street, or even the non-MAGA portions of the DC Swamp. Acknowledging the need for nuance and context on inflation would muddle the pristine purity of their “muh tariffs” propaganda against the Big Bad Orange Man himself.

On balance, there is not a lot of good evidence the Liberation Day tariffs have contributed much to consumer price inflation at all, and only slightly more evidence they have impacted factory gate inflation. At present at least, there are stronger forces that are negating much if not all of their influence and holding prices down as a consequence.

That much is evident by the amount of hyperinflation we have not seen since Trump’s tariffs were announced.

Are wage increases a part of the Producer Price? I know I saw a lot of headlines with “new hourly wage increases begin January 1” although this data is prior, but wages have been increasing, and unionization is also dramatically increasing which I would think impacts Producers and Transport etc

You really are the best at analyzing hard data, Peter. I”ll bet you’ve never lost a debate in your life!