Update 4:30PM CDT 12 May 2025

One of the interesting asides in President Trump’s press briefing earlier today over prescription drug prices was his commentary on the “trade reset” arranged in Geneva over the weekend. In particular, he claimed there is an assurance (yet another assurance?) that China will do more to open up its markets to American companies.

“China will also suspend and remove all of its non-monetary barriers, “ Trump said. “They've agreed to do that.”

If China does agree to remove even some of its non-tariff trade barriers, that will be quite huge. That would be transformative for the Chinese economy—and for Chinese society.

The transformative nature of such an agreement for China is, perversely, the reason to be the most skeptical about the agreement. The more China opens up its economy and society, the less control over the economy and the society the CCP has. The CCP has historically never put the benefits of a liberalized economy to the Chinese people ahead of the benefits of totalitarian rule to the Chinese Communist Party.

It would be a wonderful thing and a great benefit to all sides if China did open up its economy in this way.

I will believe it when it happens.

Update 8:30AM CDT 12 May 2025

The Trump Administration has released the details of the trade deal. In a nutshell, the US and China are hitting “pause” on the trade war.

The United States will (i) modify the application of the additional ad valorem rate of duty on articles of China (including articles of the Hong Kong Special Administrative Region and the Macau Special Administrative Region) set forth in Executive Order 14257 of April 2, 2025, by suspending 24 percentage points of that rate for an initial period of 90 days, while retaining the remaining ad valorem rate of 10 percent on those articles pursuant to the terms of said Order; and (ii) removing the modified additional ad valorem rates of duty on those articles imposed by Executive Order 14259 of April 8, 2025 and Executive Order 14266 of April 9, 2025.

China will (i) modify accordingly the application of the additional ad valorem rate of duty on articles of the United States set forth in Announcement of the Customs Tariff Commission of the State Council No. 4 of 2025, by suspending 24 percentage points of that rate for an initial period of 90 days, while retaining the remaining additional ad valorem rate of 10 percent on those articles, and removing the modified additional ad valorem rates of duty on those articles imposed by Announcement of the Customs Tariff Commission of the State Council No. 5 of 2025 and Announcement of the Customs Tariff Commission of the State Council No. 6 of 2025; and (ii) adopt all necessary administrative measures to suspend or remove the non-tariff countermeasures taken against the United States since April 2, 2025.

The most important element of the “pause” is that the punitive tariff rates are being dialed back for 90 days.

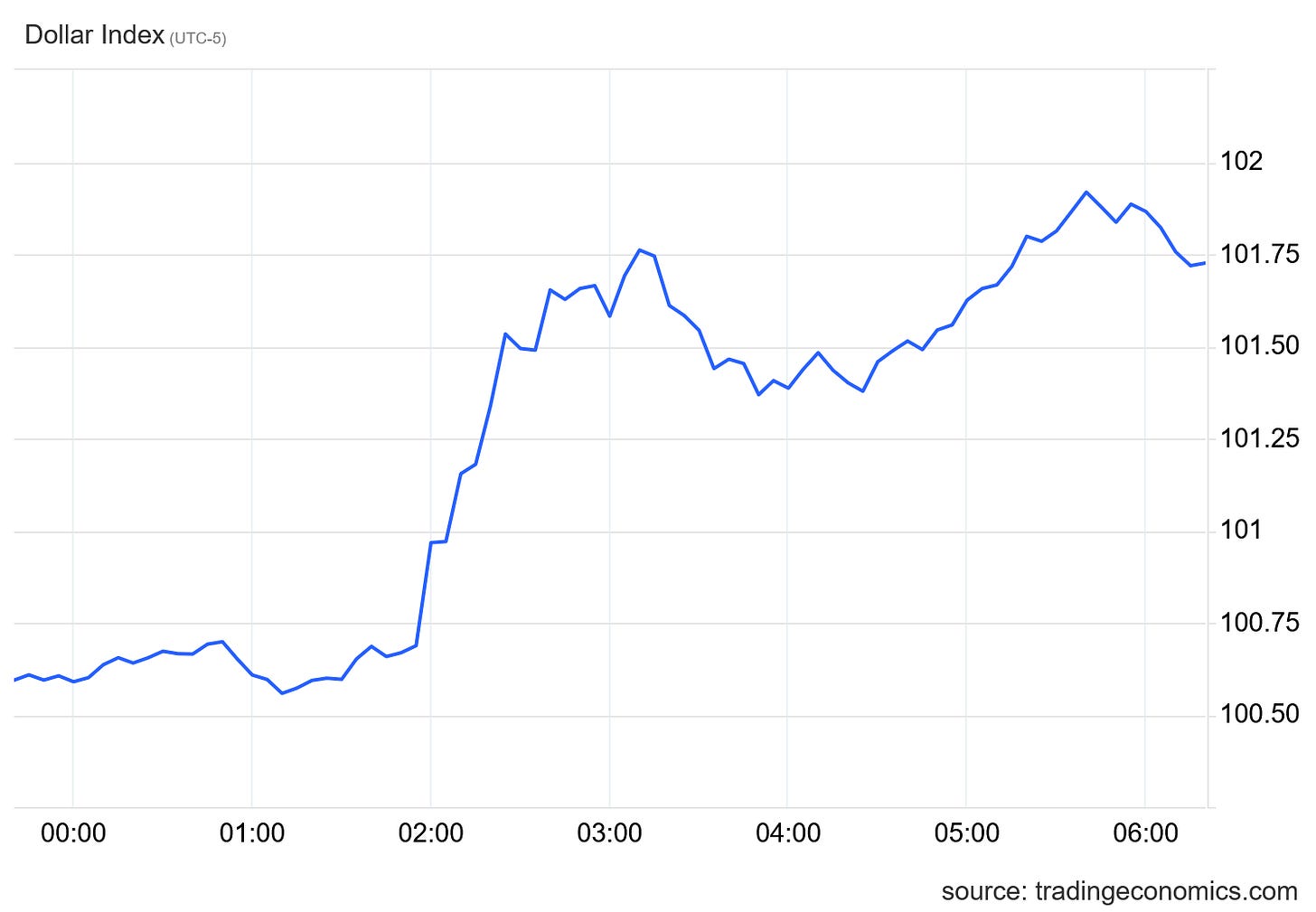

Not only is Wall Street pleased, retaining most of its overnight optimism about the trade deal, but currency markets are responding favorably as well, with the dollar index climbing sharply this morning.

It is worth noting that corporate media’s alarmist headlines from last week are appearing somewhat “exaggerated” this morning.

Those stories are not aging at all well, and are now yet another reminder that the real world effects of tariffs are not nearly as simplistic as corporate media has been presenting.

Update 8:00AM CDT 12 May 2025

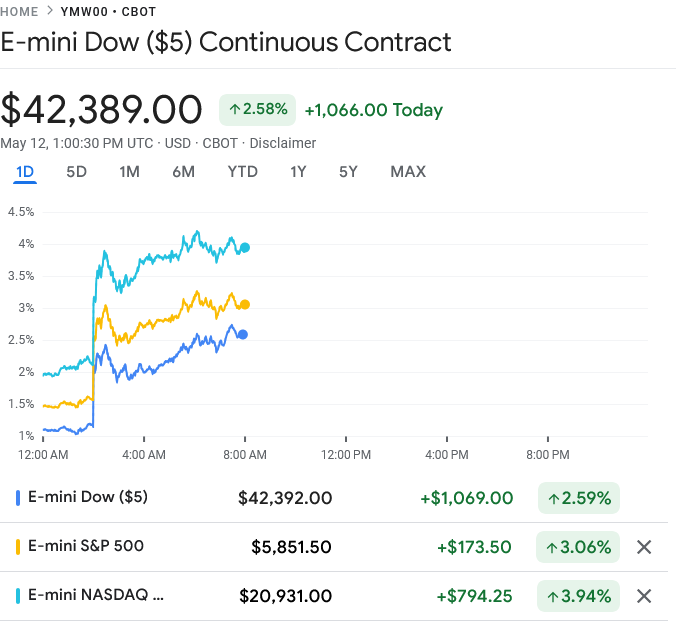

Wall Street is looking forward to the details of the Trump Administration’s “trade deal” with China. The Dow is anticipating a boost of over a thousand points when the trading day begins.

With no word on the actual details—or even if there is an actual deal or merely an agreement to make a trade deal—Wall Street is choosing an optimistic view of the Trump Administration’s announcement yesterday.

Will Wall Street be disappointed when the details are made public later this morning? That will the question of the morning.

Starting Point

Has Donald Trump scored another diplomatic win, forging a trade deal with China?

That is certainly what the Trump Administration is suggesting.

“I’m happy to report that we’ve made substantial progress between the United States and China in the very important trade talks,” Treasury Secretary Scott Bessent said in a brief statement Sunday in Switzerland, where the talks were held, calling the talks “productive.”

US Trade Representative Jaimeson Greer was even more optimistic.

Greer described the Geneva meetings' conclusion as "a deal we struck with our Chinese partners" that will help reduce the $1.2 trillion U.S. global goods trade deficit.

"And this was, as the secretary pointed out, a very constructive two days," Greer said. "It's important to understand how quickly we were able to come to agreement, which reflects that perhaps the differences were not so large as maybe thought," Greer said.

Exact details are to be released on Monday, May 12.

Even the usually effusive Commerce Secretary Howard Lutnick was unwilling to divulge those details in an appearance on “State Of The Union” with Dana Bash.

Is there a trade deal?

If I were to hazard a guess, I suspect the actual answer is “yes and no.”

“Yes,” the US and China most likely have reached an agreement in principle to cut the US trade deficit with China, and in particular to improve imports to China of a number of US-made goods. That agreement in principle most likely includes commitments to lower tariffs on both sides to some degree.

“No,” the two negotiating teams have almost certainly not finalized all the fine details over intellectual property protection, Chinese dumping of products on the export market, and countless other non-tariff trade barriers China erects with the outside world.

Donald Trump has never been shy about hyping his Administration’s policy wins, big or small, and Cabinet officials like Howard Lutnick share that tendency. We should not be surprised if this turns out to be the case here.

The Trump Administration has almost certainly made significant progress—perhaps even enough progress to downshift the more onerous reciprocal tariffs in place currently—but I have a strong suspicion that when the details are released corporate media will spend most of its energy trying to undermine the Trump Administration’s claims about a major trade deal having been concluded.

How successful they will be in that effort will depend on the details which actually get released.