To hear the economists at S&P Global tell the tale, the US economy is not doing too badly at the moment. Unlike the global economy, the US economy is actually growing, according to them.

“The overall rate of expansion of business activity in the US remained robust in June, consistent with GDP rising at a rate of 1.7% to put second quarter growth in the region of 2%,” said Chris Williamson, chief business economist at S&P Global.

Much like recent central bank activity, however, US economic growth would be very much an outlier against the backdrop of the global economy, which is flashing cooling signs most everywhere at the moment.

However, surveys of purchasing managers released Friday by data firm S&P Global pointed to sharper-than-expected slowdowns in the eurozone, Japan and Australia. In particular, activity in the previously strong services sector grew more slowly than in previous months, while manufacturing activity remained weak.

Indeed, when we look at the latest round of PMI data, contraction and softening growth are the dominant themes.

If we go by the Atlanta Fed’s GDPNow Nowcast, the US economy is presumably growing—not by a lot, but it is growing.

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2023 is 1.9 percent on June 20, up from 1.8 percent on June 15. After this morning's housing starts report from the US Census Bureau, the nowcast of second-quarter real residential investment growth increased from -2.1 percent to 2.2 percent.

However, one has to wonder where this growth is taking place.

It certainly is not taking place in manufacturing. The S&P Global US Manufacturing PMI is showing contraction for the second month in a row, falling to 46.3 when it was supposed to be improving to 48.5—still in contraction, but less steeply so.

Even the Services PMI is showing some softness, easing to 54.1 from 54.9 in May—still showing growth, just less of it. However, this was above the expected June figure of 54 even.

Taken together, manufacturing and services produced a Composite PMI figure of 53, down from 54.3.

Still, the Composite PMI is well below its 2021 peak values, when it was near or above 60 for most of the summer.

Technically, the services sector in the US is still growing—it’s just growing considerably more slowly than it has before, and getting slower.

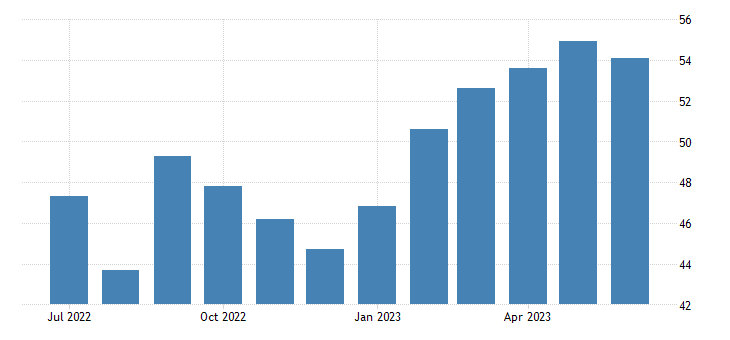

While the US manufacturing sector may be in modest contraction, and the services sector is softening, the eurozone’s manufacturing PMI has been under water for the past year.

Europe’s manufacturing sector has been contracting since last July, with June 2022 as the last month of manufacturing growth, according to the PMI data.

Even the Services PMI data is showing month on month softening, having eased now for the second month in a row, to 52.4.

A contracting manufacturing sector and a softening services sector resulted in a Composite PMI that, at 50.3, was just above the contraction threshold.

With the eurozone’s overall economy having contracted in the fourth quarter of last year and first quarter of this year, Europe began the year officially in recession. The PMI data suggests it is still there.

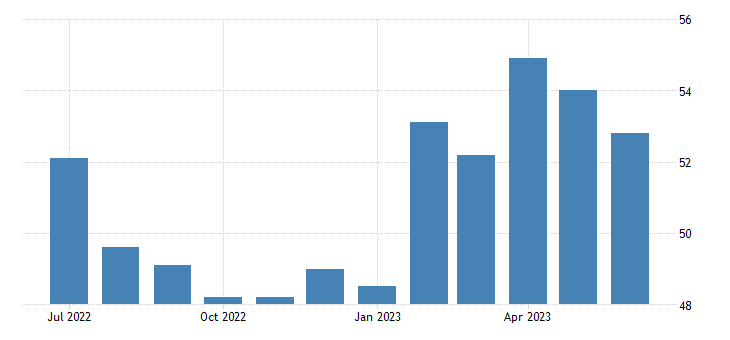

Nor is it merely the eurozone that is in the economic doldrums in Europe. Great Britain is having its share of woes as well.

Unlike the eurozone, Britain has not had a full year of contraction on the Manufacturing PMI. Rather, it has only had 11 months.

Still, a 0.9 drop to 46.2 in June, down from 47.1, is grim news.

The Services PMI also fared better than in the eurozone, with the UK falling to 53.7 (missing the market estimate of 54.8).

Manufacturing decline and softening services growth produced a June Composite PMI figure for the UK of 52.8

These are not the data points of robust global economic growth, or even really of soft global economic growth. These are the data points of economic deflation, or even stagflation.

Meanwhile, on the other side of the world, Australia is in its fourth month of manufacturing decline, according to the Manufacturing PMI data.

For its part, Japan’s Manufacturing PMI also fell, and fell more sharply than anticiapted.

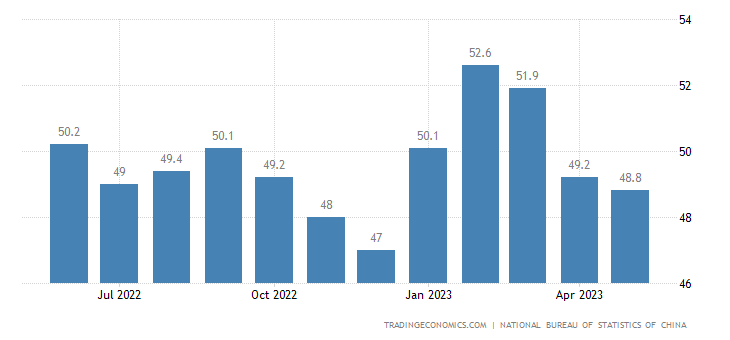

While it is hoped that China’s manufacturing PMI for June will show some expansion when it comes out, as of May the official PMI data showed Chinese manufacturing contracting for the second month in a row, and there certainly has not been an abundance of data to suggest a reversal of that trend.

With manufacturing in a contraction phase literally around the world, it is simply ludicrous to speak of a global economy that is growing. Global declines in manufacturing mean global demand for “stuff” is down literally everywhere—and that’s a recipe for deflation and a global “lost decade”.

As if to confirm the grim outlook, the price of Brent crude continues to move largely downward, as it has for the past six months, despite production cuts by Russia, OPEC, and Saudi Arabia.

Natural gas is at the bottom of a six month price low itself.

While the spot price for copper has been rising during the past month, it also has been in a longer term decline.

The same has been true for the spot price for steel.

Lithium has been moving mostly sideways for that same month—after also having been in a longer term decline.

Commodities such as these are the inputs for manufacturing and construction everywhere. Falling prices for such manufacturing inputs—as well as for the energy sources that power factories—means there is not a lot of demand for them, thus confirming the contraction trends shown by manufacturing PMI stats globally.

While services continues to show some growth, it is an open question as to how long such growth can continue without some contribution from the manufacturing side of the global economy. In order for consumption to power overall economic growth over the long term, somewhere the goods have to be produced for people to consume. Declining manufacturing globally means fewer goods are being produced globally, which in turn means there are fewer goods being bought and sold.

One of two things will ultimately happen. Either continued demand for services will lead to an uptick in demand for manufactured goods, at which point we will see recovery of manufacturing PMI stats for at least some parts of the global economy, or the demand for services will peter out, and join manufacturing in a sustained global decline.

The longer the manufacturing contraction continues, the more likely it is that it will lead to a services contraction as well.

Officially, the expectation is for 2% growth in the US economy this quarter. How will that happen, with so many economic indicators pointing in the opposite direction?

As usual, the local liberal newspaper has covered none of these economic indicators, instead devoting most of the articles to sports, pop concerts, and utter fluff. What was it the Romans said about ‘bread and circuses’?

“When everything is heading south there can be no thought of economic recovery by definition.”

-Peter Nayland Kust