Fed Raises Fed Funds Rate. Wall Street Shrugs It Off.

Powell's Plan Is Being Dragged Under By Market Inertia On Interest Rates

In the aftermath of the FOMC’s much-anticipated decision on Wednesday to raise the Federal Funds rate 25bps, to an upper limit of 4.75%, the financial media (corporate and alternative) is once again engaged in its favorite tea-leaf reading exercise: parsing what Jay Powell’s words “really mean”.

Despite FOMC implementing yet another interest rate hike, Wall Street was far more interested in Jay Powell’s remarks at his routine press conference after the FOMC announcement.

"We have more work to do" to bring down inflation after the central bank raised its rate by 25 basis points to 4.50%-4.75% Federal Reserve Chair Jerome Powell said in his post-monetary policy decision press conference.

That's emphasizing to financial markets that the central bank isn't planning on backing down from its policy tightening yet.

Despite this essential thrust of his prepared statement to the press, several media outlets concluded that Powell has finally turned “dovish”, meaning a "pivot” from rate hikes to rate cuts is in the not-too-distant future.

The Federal Reserve extended its fight against high inflation Wednesday by raising its key interest rate a quarter-point, its eighth hike since March. And the Fed signaled that even though inflation is easing, it remains high enough to require further rate hikes.

At the same time, Chair Jerome Powell said at a news conference that the Fed recognizes that the pace of inflation has cooled — a signal that it could be nearing the end of its rate increases. The stock and bond markets rallied during his news conference, suggesting that they anticipate a forthcoming pause in the Fed’s credit tightening.

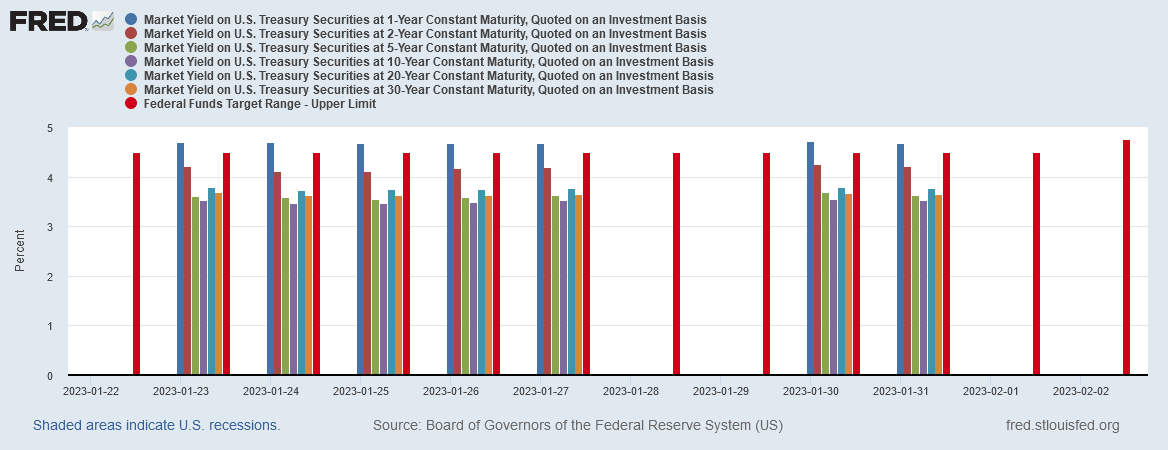

Lost in the Wall Street hooplah over the Powell presser was a rather important detail: Treasury yields across the yield curve have not risen in response to the Fed rate hike, but have instead declined.

One has to wonder what good Powell thinks can be had from a Fed Funds rate hike that has zero or negative impact on market yields.

To properly apprehend the current interest rate environment, one has to realize that, even before Wednesday’s rate hike, market yields on Treasuries were declining.

At the present time, the Federal Funds rate is having zero or even negative influence over market-set yields on Treasury notes and bonds regardless of maturity. From short to long term, yields are trending down.

Against that backdrop of softening interest rates, it is perhaps less surprising to see that, in response to the FOMC announcement of the rate hikes and Powell’s press conference after, Wall Street promptly bid most Treasury yields lower, and as of this writing, nearly all maturities are down since the rate hike announcement.

One interesting point to note about Treasury yields: as of this writing, these declines mean that only the 6-month note has a yields above the Fed Funds rate. All other maturities have a yield less than the upper limit of the Fed Funds rate (4.75%).

If the goal of raising the Fed Funds rate is to push yields higher in order to choke off inflation, this rate hike is already a complete failure—the markets are moving yields in the opposite direction, completely ignoring the Fed’s actions.

Much of this is being attributed to Wall Street persuading itself that, because Powell acknowledged that inflation is coming down (which it is, by every metric in common usage), the Fed is going to go soft on inflation and not push rates higher, or at least not much higher.

Yet Wall Street investors have priced in only one more hike. Collectively, in fact, they expect the Fed to reverse course and actually cut rates by the end of this year. That optimism has helped drive stock prices up and bond yields down, easing credit and pushing in the opposite direction that the Fed would prefer.

Even alternative media finance site Zero Hedge noted the dichotomy between the spin on Powell’s remarks and the reality of yet another Fed rate hike.

The euphoric mood was set by Powell’s comment Wednesday that the “disinflation process has started” suggesting that the aggressive tightening cycle is starting to reduce the pace of price growth, even as he warned of a “couple” more hikes to come. Positioning in US swaps markets assumes the Fed is getting closer to cutting rates as traders bet that economic conditions are likely to keep it from the additional rate increases that policy makers still anticipate.

"The more he talked, the more dovish he was,” Charles-Henry Monchau, chief investment officer at Banque Syz, said of Powell’s briefing. “It’s possible we’ll continue to see a series of volatility, but definitely the conditions seems to be more risk-on than last year,” he said on Bloomberg Television.

Wall Street appears to have swooned over two statements Powell made in his press conference—that disinflation has begun, and that financial conditions in the US have tightened (by several metrics they have, in fact, loosened).

Q: Howard Schneider with Reuters. And thanks, as usual.

So I just want you to connect a couple dots here. The statement made a number of changes that seemed to be saying things are getting better. You’re saying inflation has eased. That’s new. You’ve taken out references to the war in Ukraine as causing price increases. You’ve taken out references to the pandemic. You’ve eliminated all the reasons that you said prices were being driven higher. Yet, that’s not mapping to any change in how you describe policy. We still have ongoing increases to come. So I’m wondering, why is that the case? And does it have more to do with uncertainty around the outlook, or more to do with you not wanting to give a very overeager market a reason to get ahead of itself and overreact?

MR. POWELL: So I guess I would say it this way, we can now say, I think, for the first time, that the disinflationary process has started. We can see that. And we see it really in goods prices so far. Goods prices is a big sector. This is what we’ve thought would happen since the very beginning, and now here it is actually happening, and for the reasons we thought. You know, it’s supply chains. It’s shortages. And it’s demand revolving back towards services. So this is a good thing. This is a good thing.

It is difficult to see why this statement would produce any strong reaction, as it is clearly supported by the fact that consumer price inflation as measured by both the CPI and PCE indices, declined through the last half of 2022.

However, more than a few media outlets called attention to this statement as somehow newsworthy.

Powell’s other notable comment, that financial conditions are tightening, seems a bit odd given that many indicators are showing financial conditions in this country remaining fairly loose.

Q: Chris Rugaber, Associated Press. Thank you for doing this.

As you know, financial conditions have loosened since the fall with bond yields falling, which has also brought down mortgage rates and the stock market posted a solid gain in January. Does that make your job of combating inflation harder and could you see lifting rates higher than you otherwise would to offset the increase in—or to offset the easing of financial conditions?

MR. POWELL: So it is important that overall financial conditions continue to reflect the policy restraint that we’re putting in place in order to bring inflation down to 2 percent, and, of course, financial conditions have tightened very significantly over the past year.

At least one corporate media outlet identified this statement as the catalyst for Wall Street’s pushing yields down and equities up.

And then came the bizarre moment that really excited the bulls. Asked whether he was concerned about the recent easing of financial conditions caused by the rally in sharemarket and the fall in bond yields, Powell fluffed his chance to sound hawkish.

“So it is important that the overall financial conditions continue to reflect the policy or strength that we’re putting in place in order to bring inflation down to 2 per cent and of course financial conditions have tightened very significantly over the past year,” he said, suggesting that short-term trends in financial conditions were less important that the overall direction.

While interest rates are up, which would notionally indicate tighter monetary policy, overall financial conditions have never tightened much throughout the Fed’ rate hike campaign.

When the National Financial Conditions Index (NFCI) or the Adjusted National Financial Conditions Index (ANFCI) is negative, financial conditions are loosening. When the NFCI or the ANFCI is positive, financial conditions are tightening. According to the metrics, Jay Powell’s statement about financial conditions tightening is simply in error.

At the same time, the Fed is at last starting to shrink its balance sheet, which tends to tighten monetary policy.

One can argue how impactful the amount of reduction thus far will be, but there is no denying the reality that the Fed removed roughly 3% of its total assets from its balance sheet during 2022.

As that 3% decline comes after the Fed actually increased its balance sheet during the first few months of 2022 by over 4%, the reduction for 2022 is in some ways fairly dramatic.

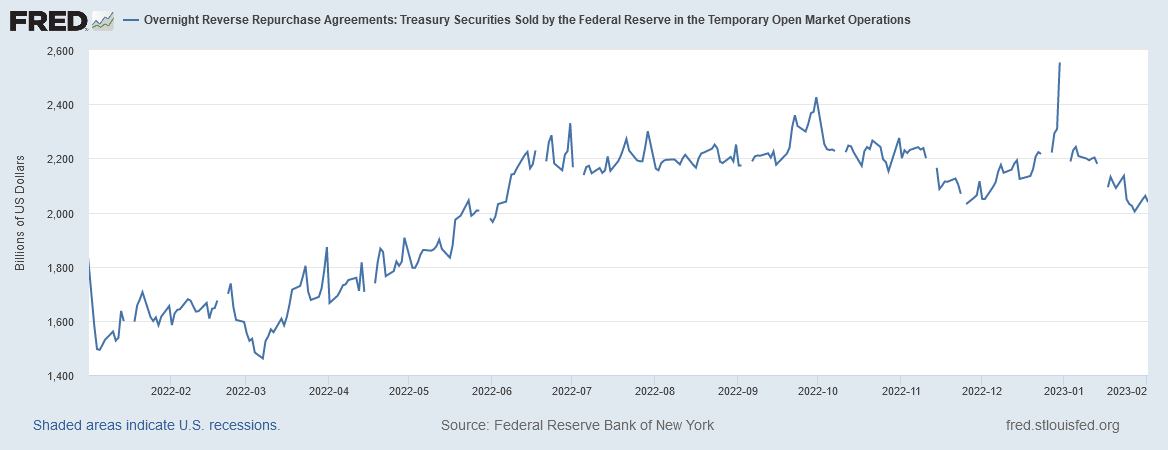

Additionally, overnight reverse repurchase operations have declined during the 4th quarter of 2022.

Banks are, at least for now, parking a bit less cash at the Fed than they were.

Moreover, the overall money supply, at both the M2 and M1 levels, trended lower in 2022.

Thus Powell’s statement about financial conditions being tighter is not entirely a fabrication—at least some dimensions of financial conditions are measurably tighter than they were a year ago.

Yet it is being argued that Wall Street is more impressed by the softer tone of Powell’s remarks than previous rate hikes, hence the upward movement in stock prices.

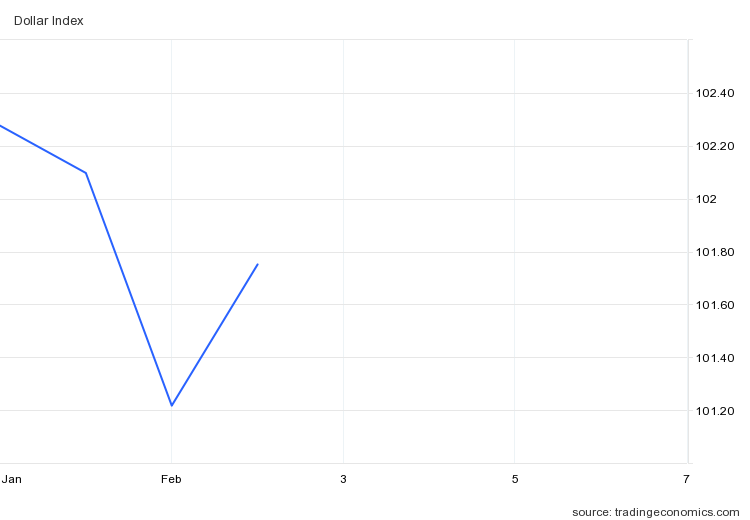

Ironically, even as Wall Street celebrated Powell’s presser by pushing equity markets up, the forex community seemed to derive more confidence from the actual rate hike.

Although the Dollar Index dropped initially on Wednesday in response to the rate hike, by Thursday the index had recovered much of its original Tuesday position.

Moreover, after the rate hike announcement, the dollar moved up against the yuan.

The dollar also strengthened against the euro, the pound, and the Japanese yen.

Meanwhile, the yen continually fails to hold its own against the dollar.

Wall Street might not give a damn about Powell’s rate hikes, but the other major currencies of the world certainly appear to be paying attention to them—at least for now.

Yet Wall Street, for all its obsession with reading Powell’s tea leaves, is failing to address a key question: if raising the Federal Funds rate does not push yields (and thus interest rates as a whole) higher, what does the Federal Reserve gain by further rate hikes?

Alternatively, if the Fed Funds rate hike does not produce higher Treasury yields, how can the Fed cause a recession cool off the economy by choking off demand? The stated rationale for rate hikes, a rationale that has been economic gospel since Paul Volker’s equally problematic “shock therapy” in the early 1980s, is that hiking interest rates chokes off demand while shrinking the money supply, thereby forcing inflation lower.

Yet that rationale does not apply—can not apply—if Treasury yields and other interest rates trend lower as the Fed Funds rate moves higher, for the simple reason that the Fed is, at least this time, demonstrably not raising interest rates. Quite surprisingly, the Fed would appear to have absolutely no control over interest rates at this point, as the market has the wherewithal to shrug off a Fed Funds rate hike and still push yields down.

Similarly, if Wall Street is setting yields independent of the Fed Funds rate, what need have investors for a “Powell pivot”? If Wall Street is in the driver’s seat on yields, to where it does not matter if the Fed Funds rate goes up, it also does not matter if the Fed Funds rate goes down (or doesn’t).

In every scenario that proceeds from this week’s Fed rate hike and Wall Street’s reaction, the proper characterization of Jay Powell is neither that he is “hawkish” nor “dovish” on inflation and interest rates. The image that emerges for Jay Powell from this latest hike is “impotence”.

The Fed arguably has lost control over interest rates in this country, and that is not a scenario that seems likely to end well for anybody.

[the financial media (corporate and alternative) is once again engaged in its favorite tea-leaf reading exercise: parsing what Jay Powell’s words “really mean”.]

That right there tells you everything you need to know:

Our entire economic existence is built on a base of bullshit.

We take for granted that a man in his position will never tell the truth.

And we'd be right to think that.

Personally, I can't think of a less interesting, less useful topic than what this man really thinks, or what he "really means."

"what does the Federal Reserve gain by further rate hikes?"

Room act like it's doing something by lowering them again when the markets finally crash.