Good News! 2nd Quarter GDP Might Not Suck Quite So Bad!

(Just Kidding....There's Still A Lot Of Suckage Here)

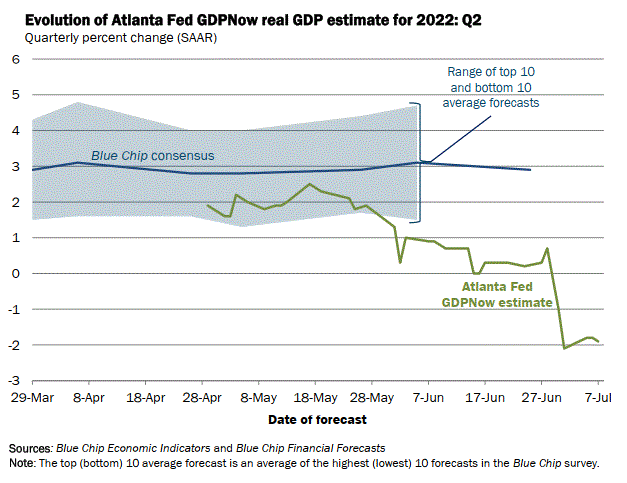

The Atlanta Federal Reserve has updated their GDPNow forecast for Real GDP Growth for the 2nd quarter.

The short version: there is no growth. Which my readers already knew (and, let’s be honest, just about anyone who’s not been living under a rock or drinking the corporate media Kool-Aid).

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is -1.9 percent on July 7, up from -2.1 percent on July 1. After this week's releases from the Institute for Supply Management, the US Census Bureau, and the US Bureau of Economic Analysis, the nowcasts of second-quarter real personal consumption expenditures growth and real gross private domestic investment growth increased from 0.8 percent and -15.1 percent, respectively, to 1.3 percent and -14.9 percent, respectively, while the nowcast of the contribution of the change in real net exports to second-quarter GDP growth decreased from 0.38 percentage points to 0.21 percentage points.

The longer translation: People are spending more, saving and investing less, and America on balance is importing more and exporting less. Money out and no money in is a good working definition of recession in the real world.

Money out and no money in also means the coming months are not going to be pleasant for most Americans.

Don’t Expect Any Fed Put This Time

While the economic outlook is undeniably grim and getting grimmer, do not expect the Fed to ride to the rescue by easing up on interest rates and loosening the monetary policy they have yet to tighten. As I explain to paying subscribers, the global situation means the Fed really can’t. Not if it wants to keep the dollar relatively stronger than the other collapsing fiat currencies.

Which means that the economy is going to continue to contract, and the Fed is going to do all it can to help it contract. Which means you, me, and every other ordinary individual is going to pay for the Fed’s decades of monetary madness. That’s not a prediction, remember, that’s the Fed’s stated policy.

Welcome to “interesting times”. And yes, for the short term, it’s all downhill from here.