Hooray! The US Economy Is Growing...Or Is It?

The Official GDP Numbers Say The Economy Is Expanding. Other Equally Official Metrics Say Not So Much.

Ostensibly, the latest GDP Nowcast of the Atlanta Federal Reserve is an optimistic bit of good news, as it highlights continued robust economic growth in the United States during the fourth quarter of the year.

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2022 is 3.4 percent on December 6, up from 2.8 percent on December 1. After recent releases from the US Census Bureau, the US Bureau of Labor Statistics, and the Institute for Supply Management, increases in the nowcasts of fourth-quarter real personal consumption expenditures growth and fourth-quarter real government spending growth from 3.2 percent and 0.8 percent, respectively, to 3.7 percent and 1.1 percent, respectively, were slightly offset by a decrease in the nowcast of fourth-quarter gross private domestic investment growth from 2.0 percent to 1.7 percent. Also, the nowcast of the contribution of the change in real net exports to fourth-quarter real GDP growth increased from 0.16 percentage points to 0.37 percentage points.

The US economy is expanding, powered mainly by personal consumption and a rise in net exports.

Yet a complete examination of the numbers indicates the economic outlook is not as rosy as the nowcast presents.

The Atlanta Fed’s nowcast reflects a continuation of the economic assessment of the Bureau of Economic Analysis, which put GDP growth for the third quarter at 2.9%, driven by largely the same factors as the nowcast.

The increase in real GDP reflected increases in exports, consumer spending, nonresidential fixed investment, state and local government spending, and federal government spending, that were partly offset by decreases in residential fixed investment and private inventory investment. Imports decreased (table 2).

The increase in exports reflected increases in both goods and services. Within exports of goods, the leading contributors to the increase were industrial supplies and materials (notably nondurable goods), "other" exports of goods, and nonautomotive capital goods. Within exports of services, the increase was led by travel and "other" business services (mainly financial services).

According to the BEA, growth in personal consumption and exports lifted the economy up after two successive quarters of GDP contraction to start the year.

To be sure, according to the official data, even though growth in personal consumption expenditures decreased from 1.38% in the second quarter to 1.18% in the third quarter, final sales of domestic product surged, nearly tripling to 3.9%.

However, this increase in personal consumption has been mirrored by an ongoing reduction in private inventories, suggesting that the production of goods is not increasing in the US.

Can the US economy truly be regarded as expanding when what is being bought and sold are merely existing stocks of goods? The BEA and the Atlanta Fed are suggesting the answer is “yes”, but how can that be if goods are not being produced (or, more accurately, the output of goods is not matching the growth in consumption)?

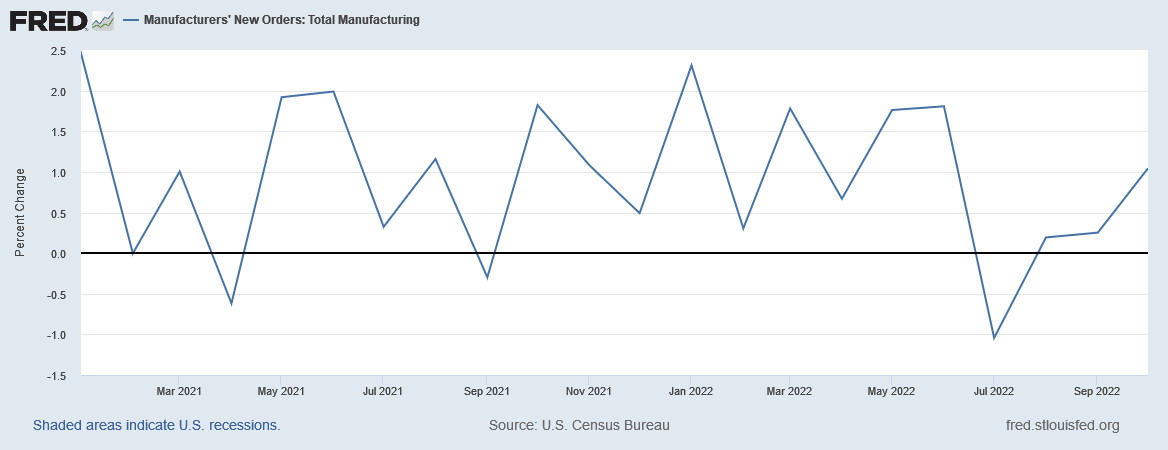

Indeed, the third quarter started with a steep reduction month-on-month for manufacturing new orders, with only marginal increases in August and September, indicating that new orders declined for the quarter overall.

Year on year, new orders trended down from June until September, and continued the decline after a momentary uptick in September.

Slowing new orders is indicative of economic contraction, not economic expansion.

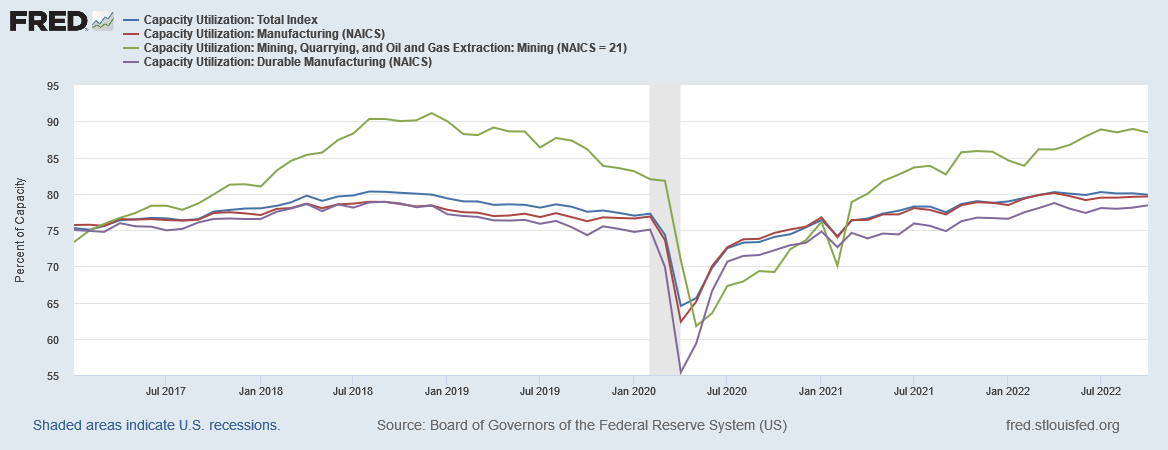

While there has been some increase month on month in industrial production in the US, there certainly has not been 2.9% of GDP’ worth of increase.

We should note, however, that on a yearly basis, industrial production has increased in line with 2.9% GDP growth.

Yet overall capacity utilization in this country has been decreasing in recent months, rather than increasing, with only July showing significant uptick in capacity utilization.

It is hard to reconcile declines and only marginal increases in capacity utilization with robust economic growth.

This is especially true when overall capacity utilization has been relatively constant, except for mining and extracting capacities.

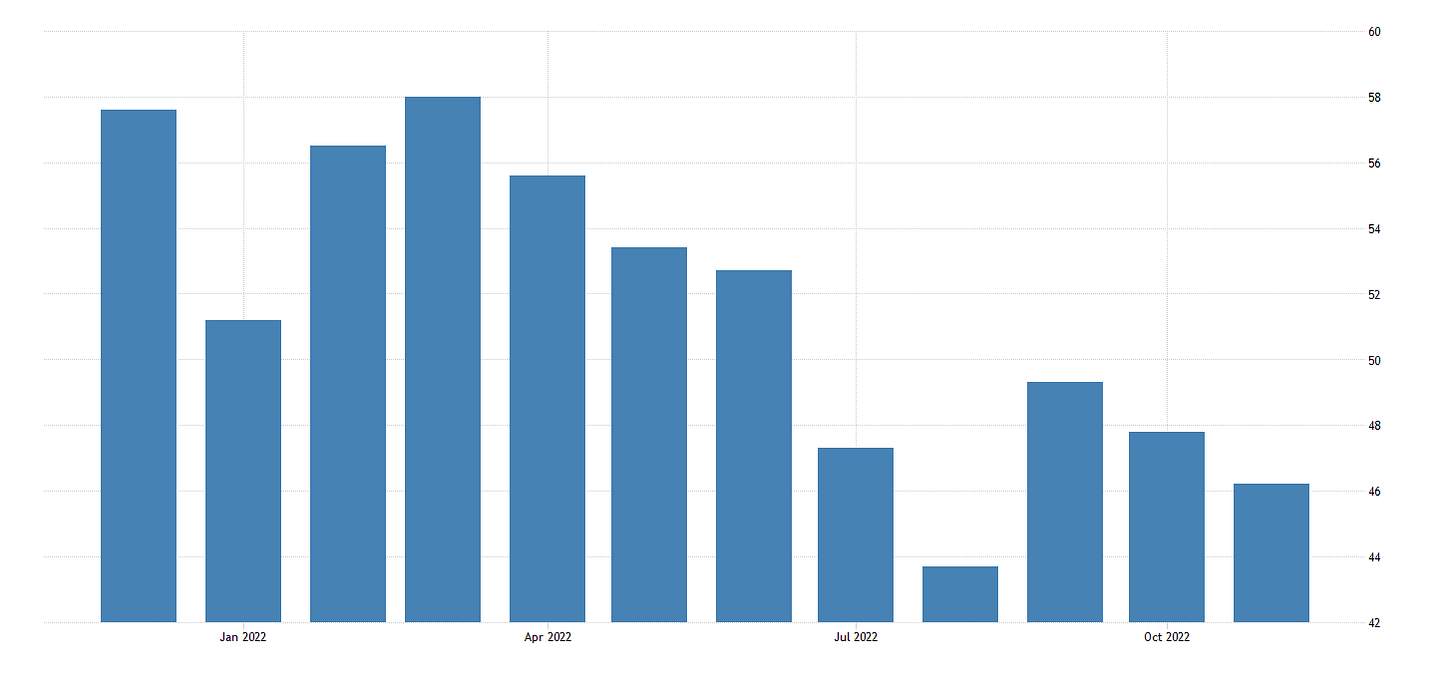

With regard to services, the indicators are equally mixed. The S&P/Markit Services PMI shows the service sectors of the US economy to have been in contraction for the past five months.

The ISM Non Manufacturing PMI, on the other hand shows the US service economy to be expanding.

The one thing contradictory indicators can never be is a clear signal of economic growth and expansion.

While the official top-level economic numbers say the US economy is growing, once again when we look at the details underneath the headline numbers we see an economic picture that is far more uncertain and muddled.

What the details do not show is an economy that grew by 2.9% during the third quarter, and is currently projected to do even better during the fourth quarter.

With inflation still high, with labor force participation still low, and with productive industry seemingly moving sideways, the economy may not technically have been in recession during the 3rd quarter, but neither was it expanding robustly, and nor is it showing signs of doing so during the fourth quarter.

Stagflation is still the predominant characteristic of US economic performance for 2022.

It isn't just the US, it's all of Europe as well. I own small business and about half my sales are to customers in Europe (in which I include the UK). Things have definitely slowed this year.