Inflation Cools to 2.4% In A Clear President Trump Win

Corporate Media Forced to Admit Trump's Economy Win

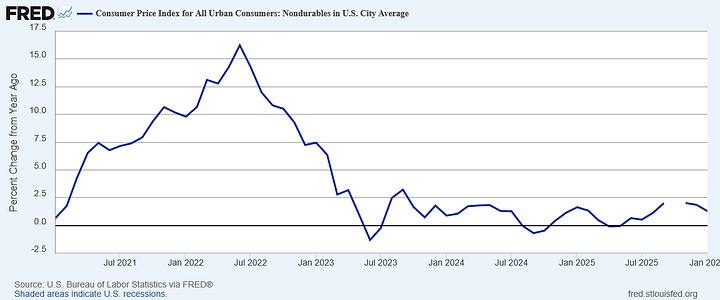

Even corporate media had to acknowledge that Friday’s Consumer Price Index Summary from the Bureau of Labor Statistics was a clear win for President Trump. How could they not, when the report showed consumer price inflation continuing to cool year on year?

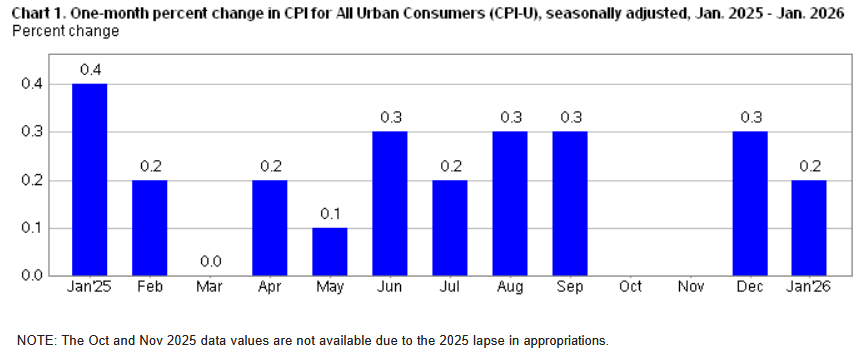

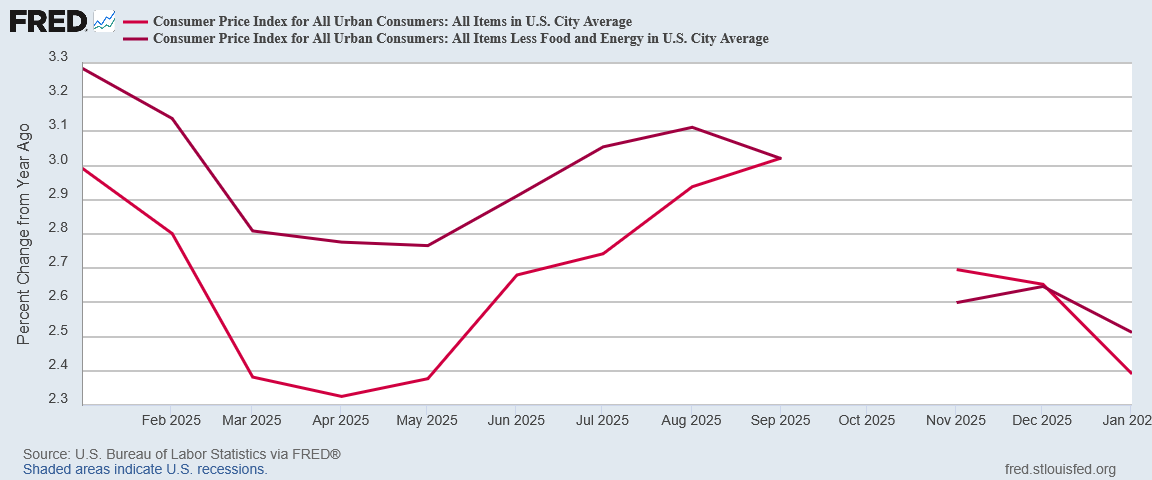

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis in January, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.4 percent before seasonal adjustment.

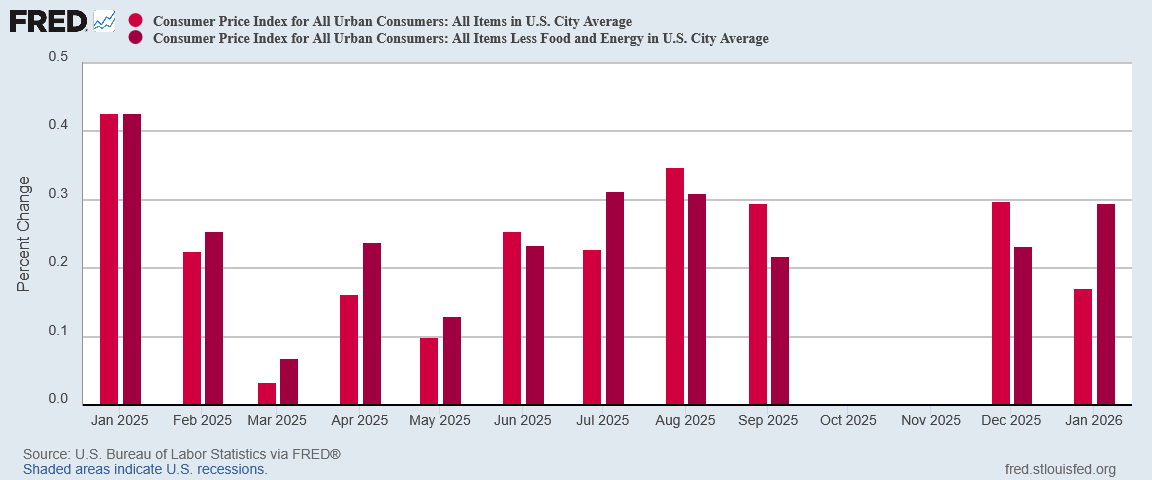

Consumer price inflation has not been heating up. Even drilling down through the data shows only marginal inflation increases month on month, and none so large as to signify a trend of rising inflation.

It would appear that winter really has come for inflation in the US economy.

Left unmentioned in the corporate media is the reality that continued disinflation means we must once again point out that President Trump’s tariffs are not pushing prices higher at present. Whatever inflationary pressure the tariffs represent is being more than offset by other deflationary pressures on prices.

This inflation report was good news. From the headline figure down through all the details, the January inflation report was simply good news.

Wall Street Expected Higher Inflation

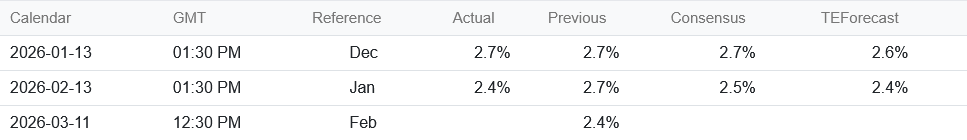

For Wall Street, the year on year inflation print was something of a surprise, although other projections and forecasts anticipated the continued disinflation.

Printing at 2.4% put the year on year inflation rate below the Wall Street consensus of 2.5% and right on line with the Trading Economics forecast.

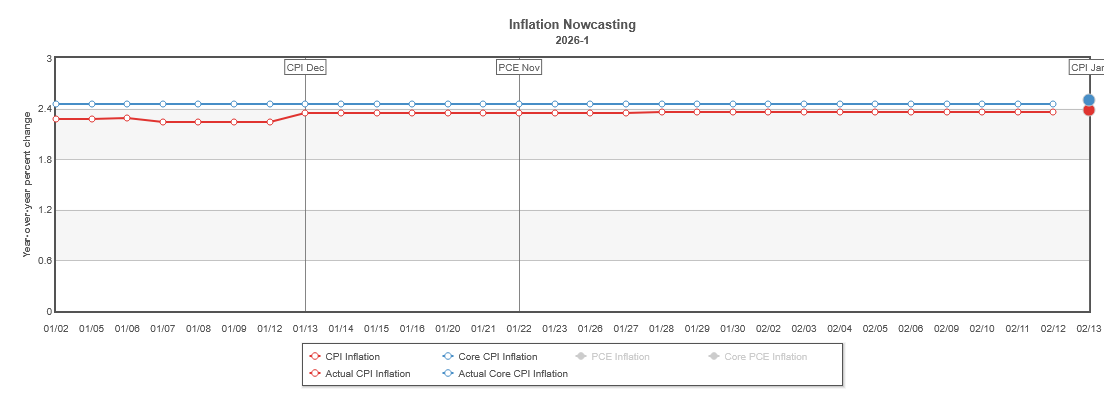

The forecast was almost perfectly in line with the nowcast projection from the Cleveland Fed.

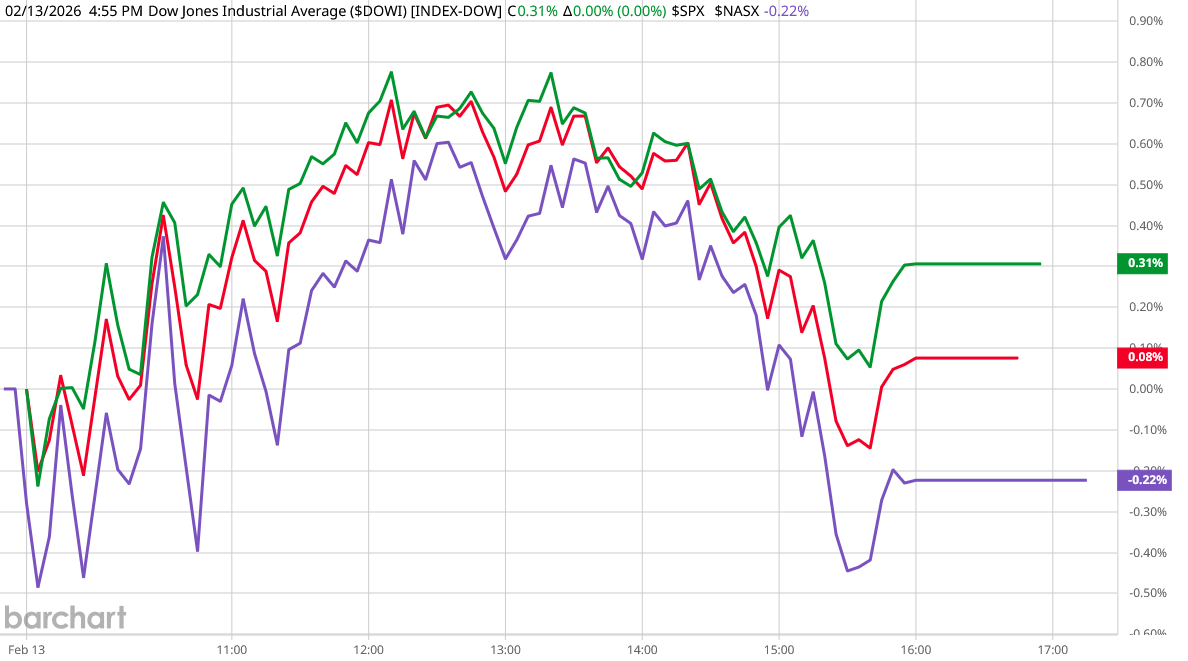

Wall Street’s initial reaction was positive on Friday, although afternoon selling muted the overall impact on equities.

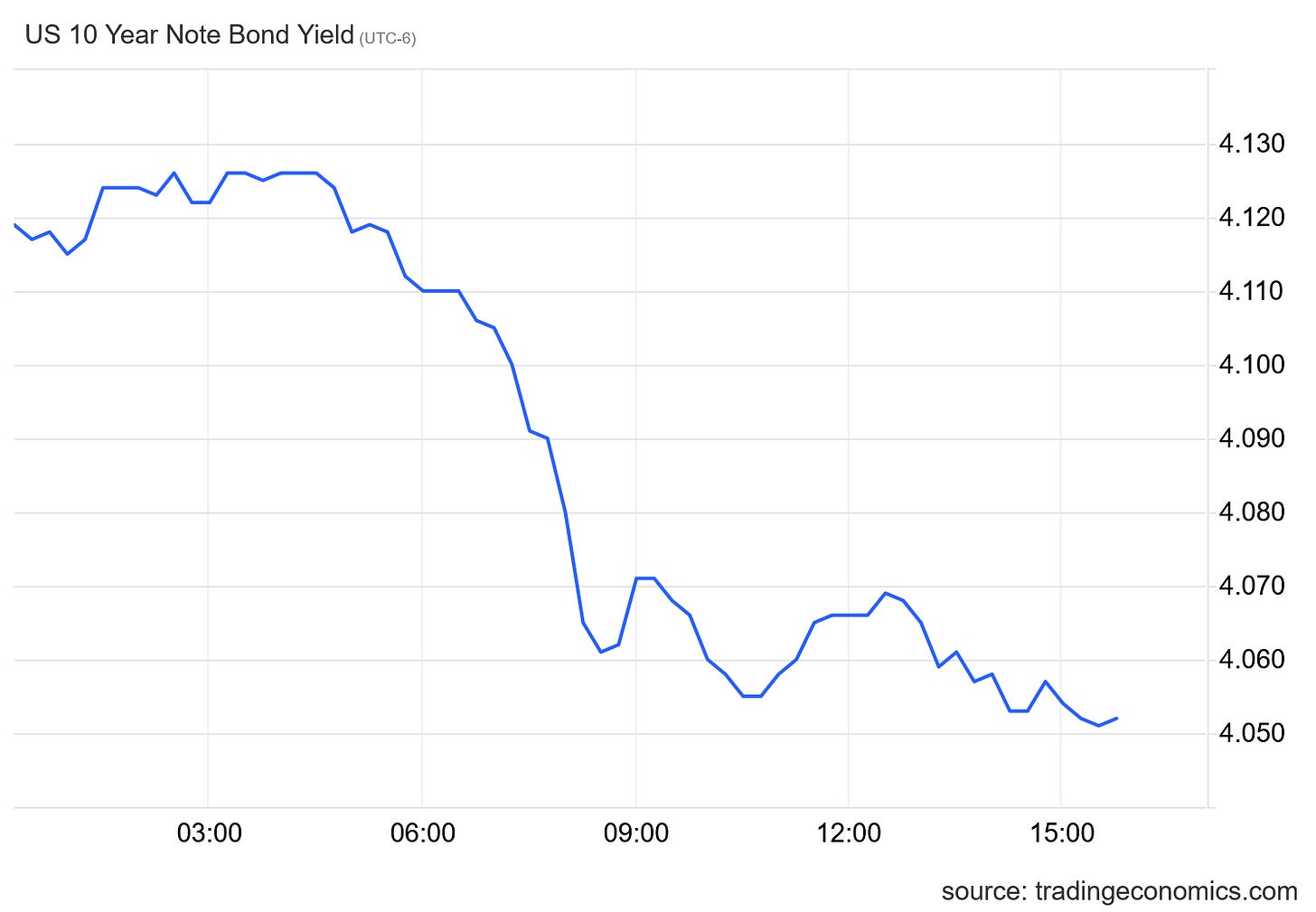

Treasury yields had a far more emphatic response, with the 10-year yield accelerating its decline on the day.

Even CNN was obliged to concede that inflation had improved across the board in January.

Economists had forecast a 0.3% monthly increase, which would bring the annual rate to 2.5%, an expectedly cooler reading that benefited from “base effects,” or comparisons to last year when inflation was running higher.

For similar reasons, the core CPI gauge – a closely watched measurement of underlying inflation that excludes volatile food and energy prices – also saw its annual rate of inflation ease.

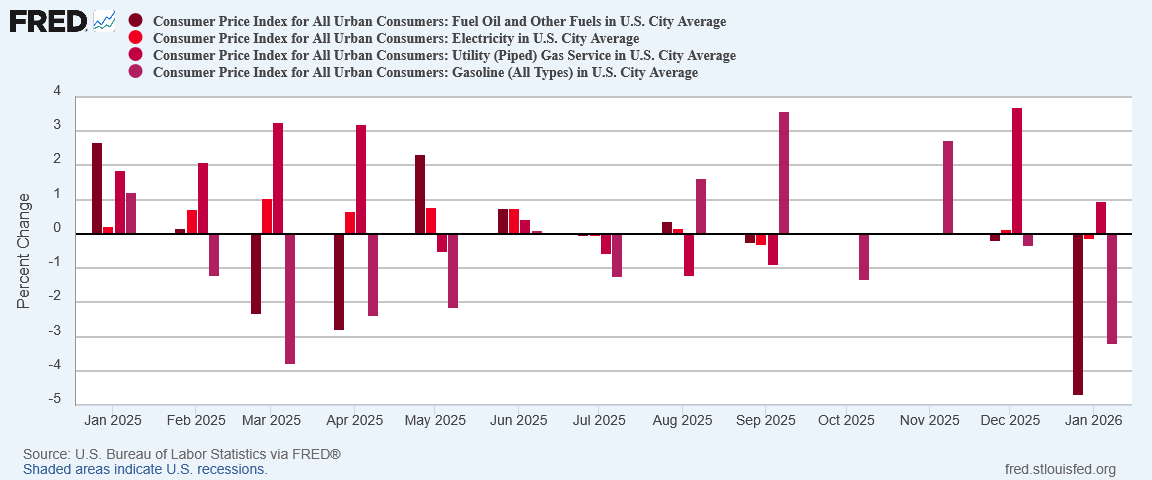

For its part, the Washington Post acknowledged easing prices for energy as well as for used cars and trucks, two significant consumer goods categories.

When even the reliably anti-Trump corporate media cannot find reason to carp and criticize the data, there can be no doubt that the data is reporting cooling inflation, which is always good news.

Details Remained Good

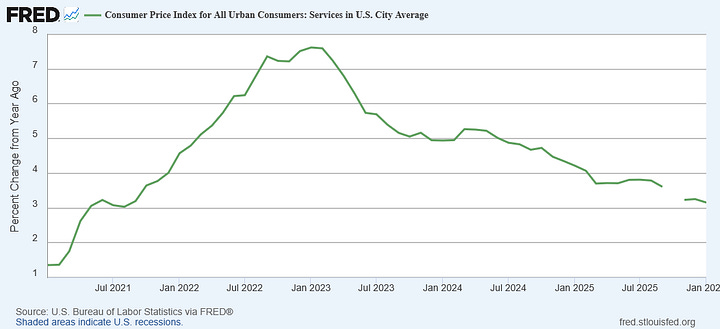

There is no disputing the headline inflation numbers are good. Both headline and core inflation are continuing to trend down, year on year.

While core inflation did tick up month on month, it remains below summer’s level and is well below the month on month rate for January 2025.

In a promising replay of the December data, the data remains largely positive even as we drill down past the headline number.

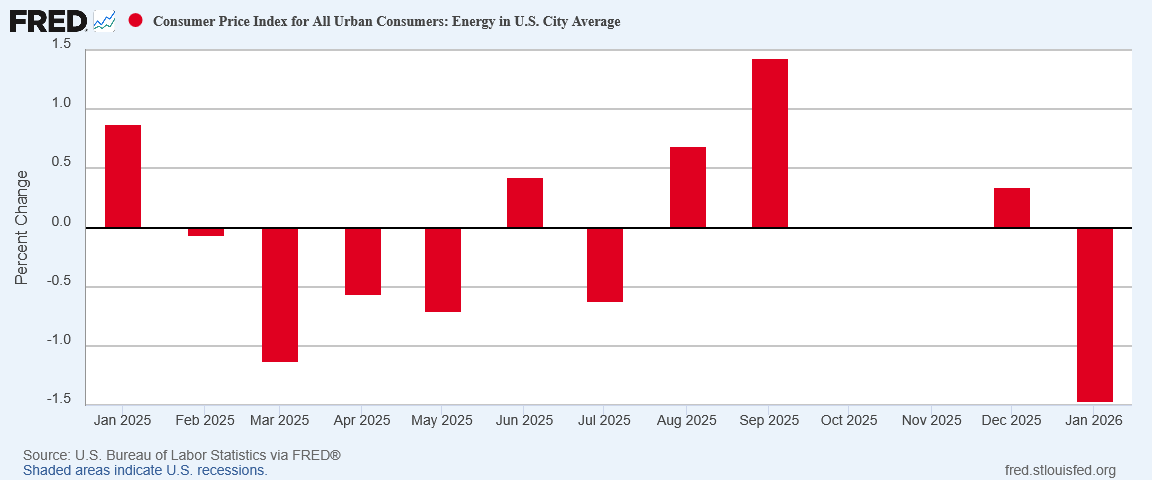

Energy prices returned once more to their recurring theme of energy price deflation.

Even more encouraging was that, drilling into the energy commodities category, most energy prices are in outright deflation.

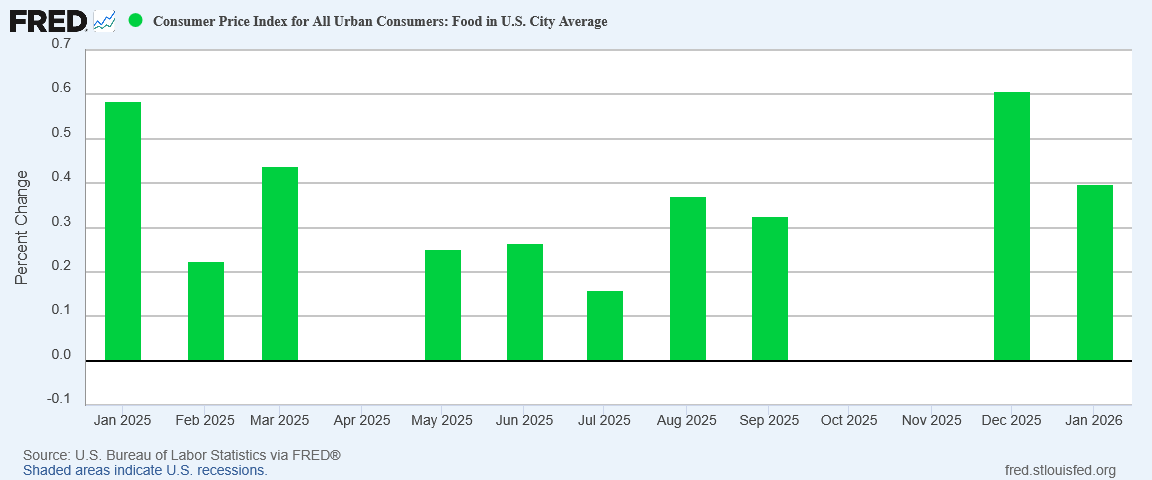

Food price inflation eased substantially, cooling from 0.6% month on month to 0.4%

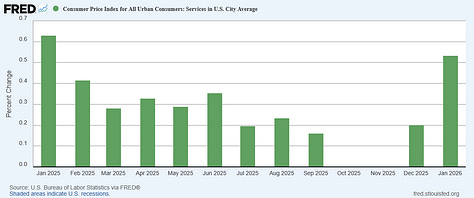

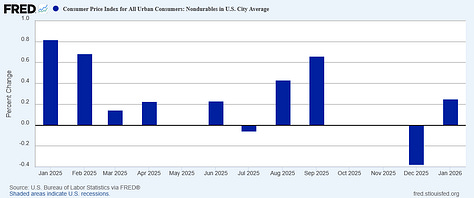

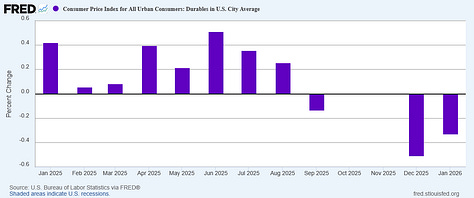

Within core inflation, only services exhibited any significant inflation increase month on month, while durable goods printed deflation yet again and nondurable goods printed a 0.25% inflation increase.

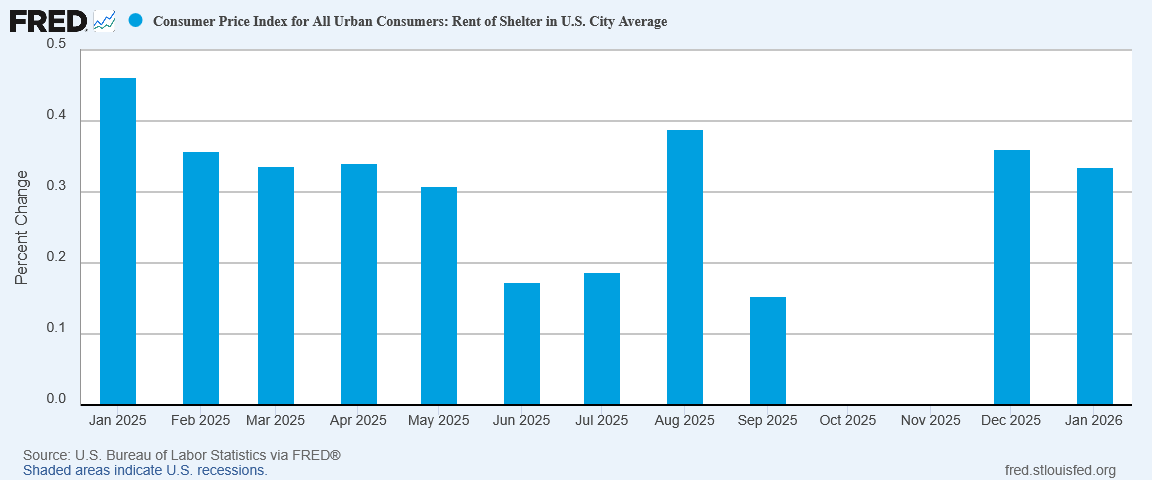

Even Rent of Shelter, generally a trailing indicator on inflation, printed a slight cooling from December.

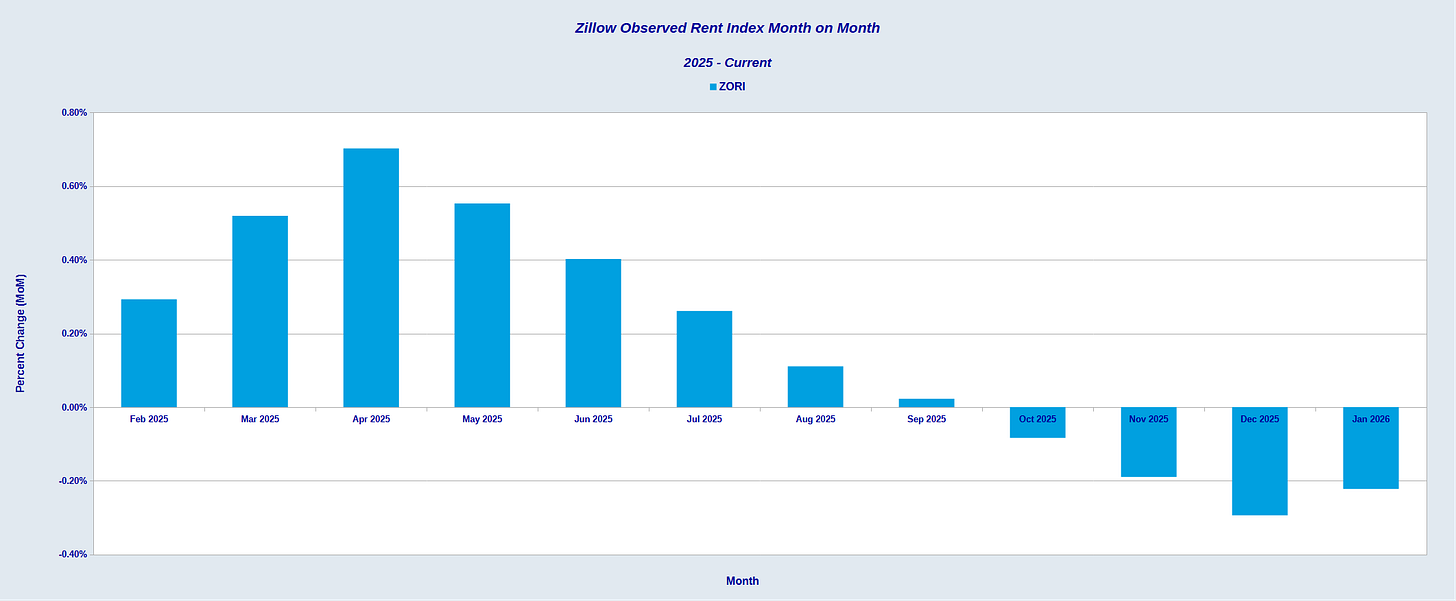

Even the forward looking Zillow Observed Rent Index shows month on month deflation for shelter.

The US economy does not have much going on in the way of inflation at the moment. The data is crystal clear about that. There is service price inflation and that is all.

This is a double win for President Trump. It is a clear win on the question of “affordability”, and it is yet another month where the inflation data rejects the premise that Trump’s tariffs are causing inflation.

Still Tariffs, Still No Inflation

Corporate media and the usual cadre of TDS-infected “experts” are committed to pushing the premise that President Trump’s tariff and trade policies are driving prices up.

The tariff thesis’ latest problem is that even in areas where inflation has move up month on month—services and nondurable goods—year on year inflation has still cooled.

When the overall trend is disinflation, the clear conclusion to be drawn is that tariffs are not a dominant inflationary pressure pushing prices up.

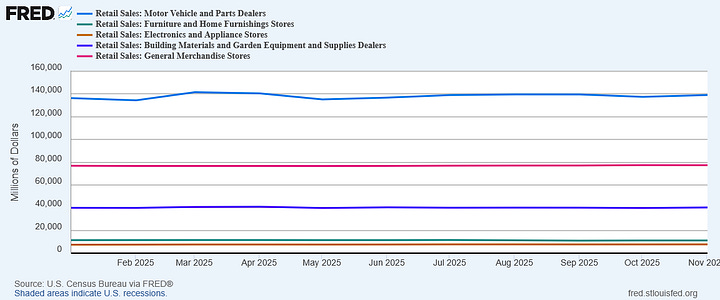

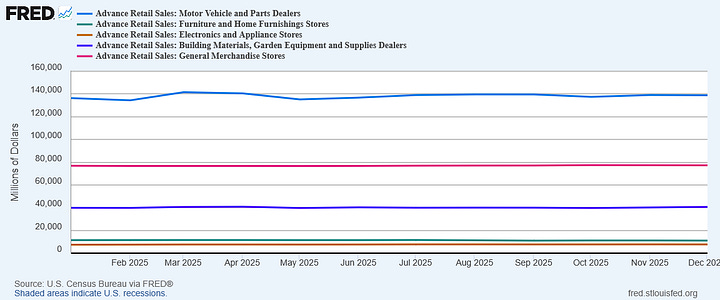

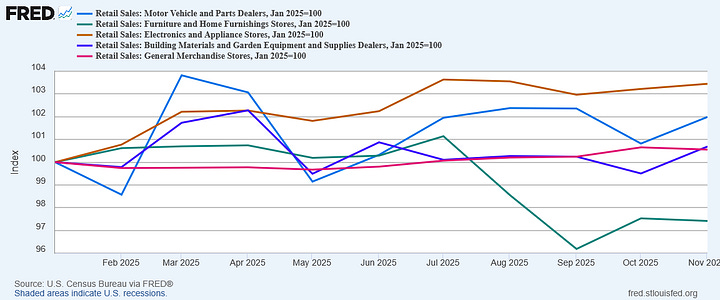

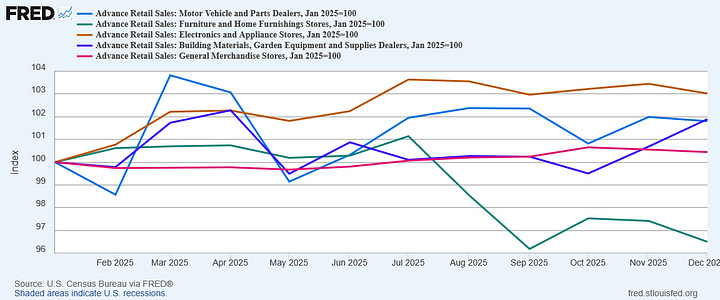

This is further reinforced by the reality that retail sales in major categories of goods were largely unchanged in 2025.

For both the Advanced Retail Sales Estimate from the US Census and the follow-up Retail Sales Estimate, the overarching trend across most major goods categories was horizontal, with no significant increase or decrease over the year.

Even indexing the data reveals that only the Furniture category saw a decline in sales volume over 2025 in both the Advanced Estimate and the Retail Estimate.

Whatever other impacts President Trump’s tariffs might be having, the impact they are not having is diminishing retail sales.

No price increases and no retail sales diminution means no impact on consumer prices from tariffs. The data just does not allow for any other interpretation.

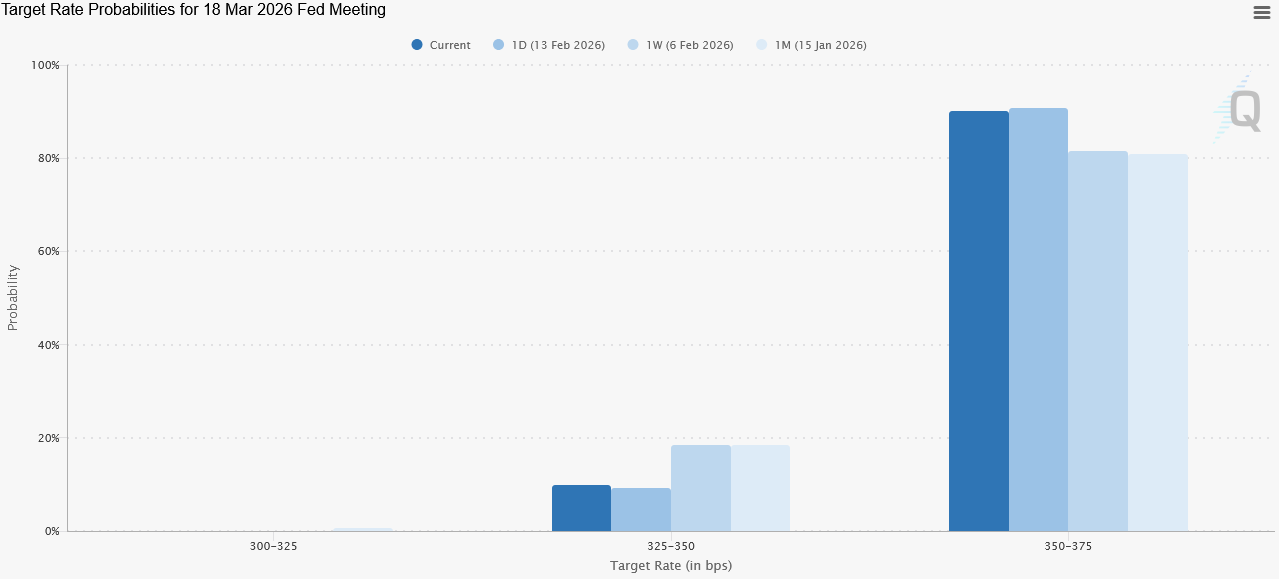

This lack of tariff impact may be one reason why Wall Street may be warming to the possibility of a federal funds rate cut next month. The shift is not large, and the release of the PCEPI data later this month may push the prediction trend the other way, but at present the pressure may be beginning to build for Jay “Too Late” Powell to trim the federal funds rate another 25bps.

Inflation Is Stablizing

While consumer price inflation year on year is continuing to move slowly down, the broader trend both at the headline level and within much of the supporting consumer price detail is one of stabilization and a moderately dynamic equilibrium.

A broad aggregate metric such as consumer price inflation is never going to be completely static, nor is it particularly desirable that it be static. Markets must be fluid to function effectively, and that means there will always be some fluctuations up and down in consumer prices.

However, barring extraordinary shifts in money velocity or supply chain disruptions, we should expect to see consumer prices—and consumer price inflation—moving within a certain range of values. Despite that modicum of price volatility, prices are broadly stable if the long-term trend year on year or month on month inflation is horizontal.

While the Federal Reserve is still maintaining as its “holy grail” 2% inflation year on year, the data is accumulating that inflation is stabilizing at between 2.5% and 3% year on year. If that is indeed happening, the Fed’s own stated dual mandates say it should focus instead on maximizing employment, and that implies interest rate reductions.

Will the Fed acknowledge this at last and start to do the right thing? At present, that seems unlikely. Jay Powell seems determined to carry his unseemly and unprofessional political opposition to Donald Trump to the very end of his tenure in May (which cannot come too soon, given the incompetence he has displayed over the past eight years).

However, with even Wall Street acknowledging that inflation is not rising, the case for holding the line on interest rates simply does not exist, not any more. With market rates for Treasuries being bid down, Wall Street is making plain its desire for lower interest rates, and the one thing which surpasses Powell’s Trump Derangement Syndrome is his eagerness to bend the knee to Wall Street. That leaves hope for a federal funds rate cut in March.

The US economy has its share of problems still. At least for now, inflation is not one of them.

Didn’t Kevin Warsh state that his inflation “goal” was between 2.5 and 3%? Guess he’s going to manage to that going forward.

Who doesn’t love to see good economic news on a Monday morning. Thanks, Peter!

Not to be a downer, but the other day you posted a substantial drop in home sales for January. In today’s post, you show that furniture sales volume is also down (unsurprisingly, because if people aren’t buying houses they don’t need to furnish them.) You’ve followed economic data for a long time, Peter - should we be concerned that these are leading indicators of trouble?