Inflation Is At 6.8%--But That's Not The Worst Part

The Economy Is Out Of Balance

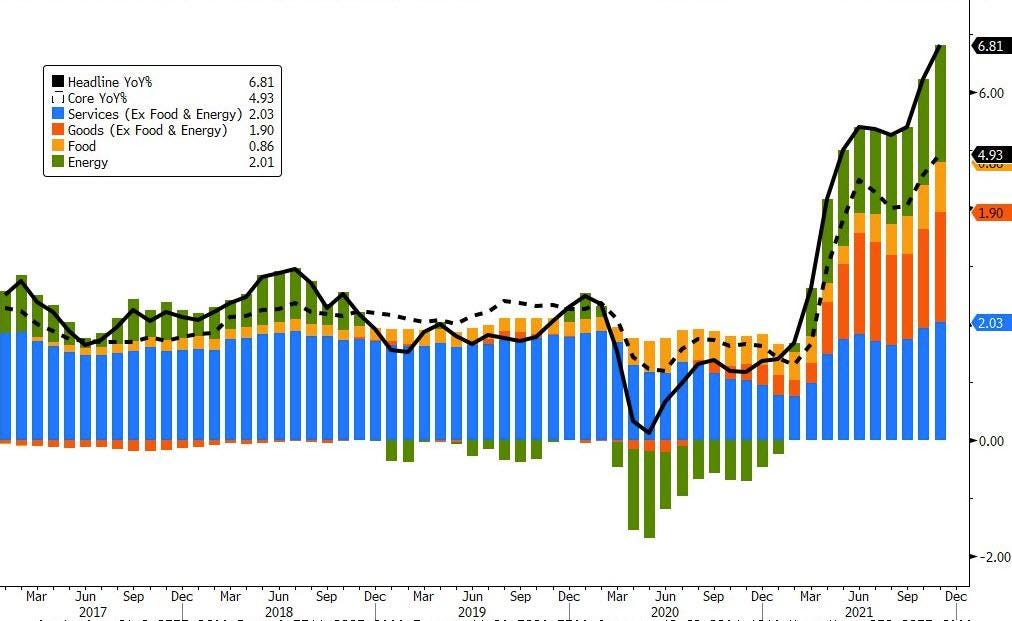

Today’s release of the latest Consumer Price Index numbers were, as many expected, not good. Inflation for November ran at an annualized rate of 6.8% across the entire “basket” of consumer goods, and inflation for specific consumer items, such as gasoline, jumped by nearly 60% annualized.

As was noted on ZeroHedge, the 6.8% rate was the highest official rate for top-level inflation since 1982.

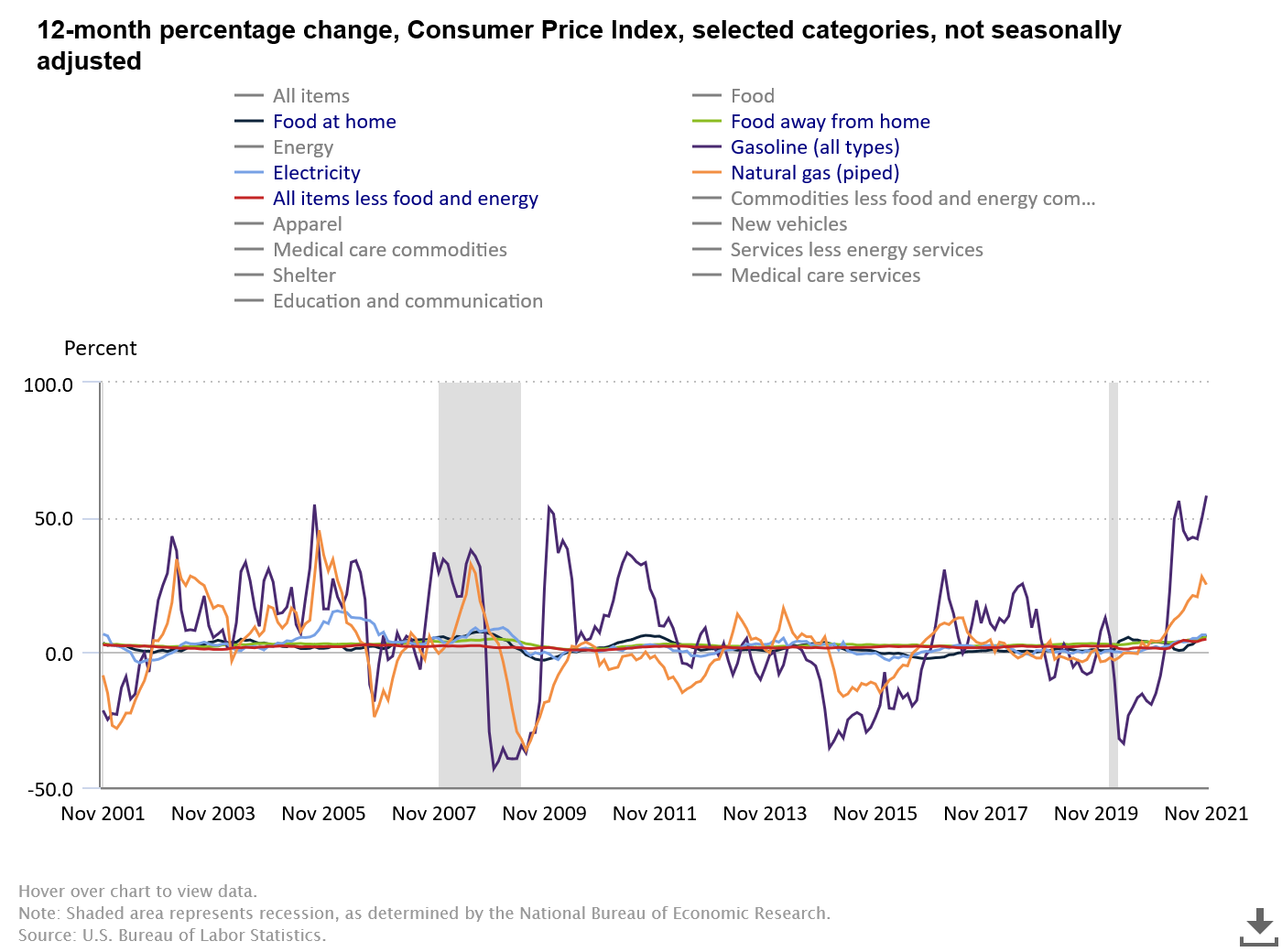

Yet what the top-level metrics obscure is the imbalances of price rises among different goods within the CPI’s “basket” of consumer items. Some items see minor price increases, other items, as noted at the top, are seeing extreme price fluctuations.

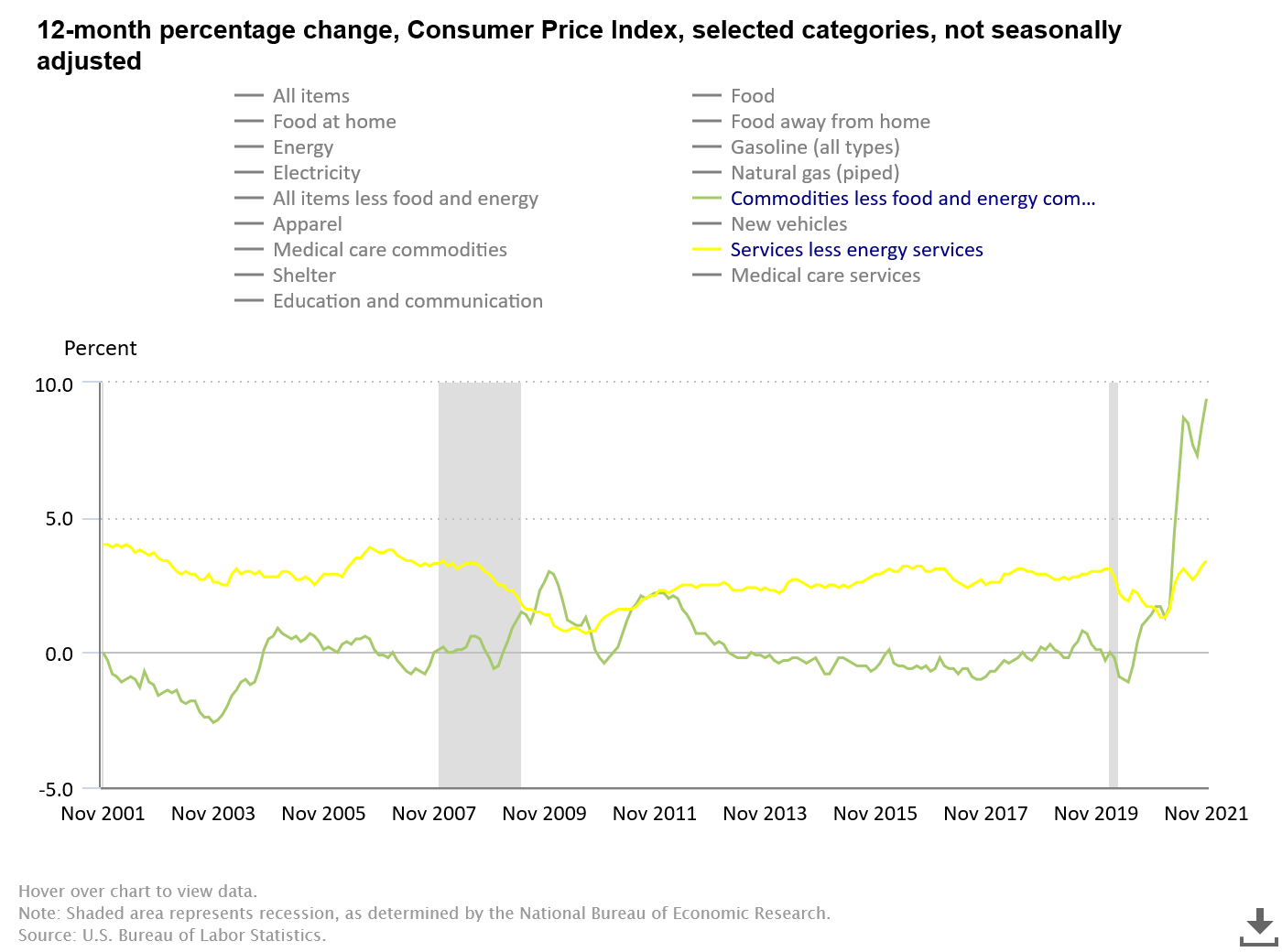

When viewed graphically, the extent of the variance is all too clear.

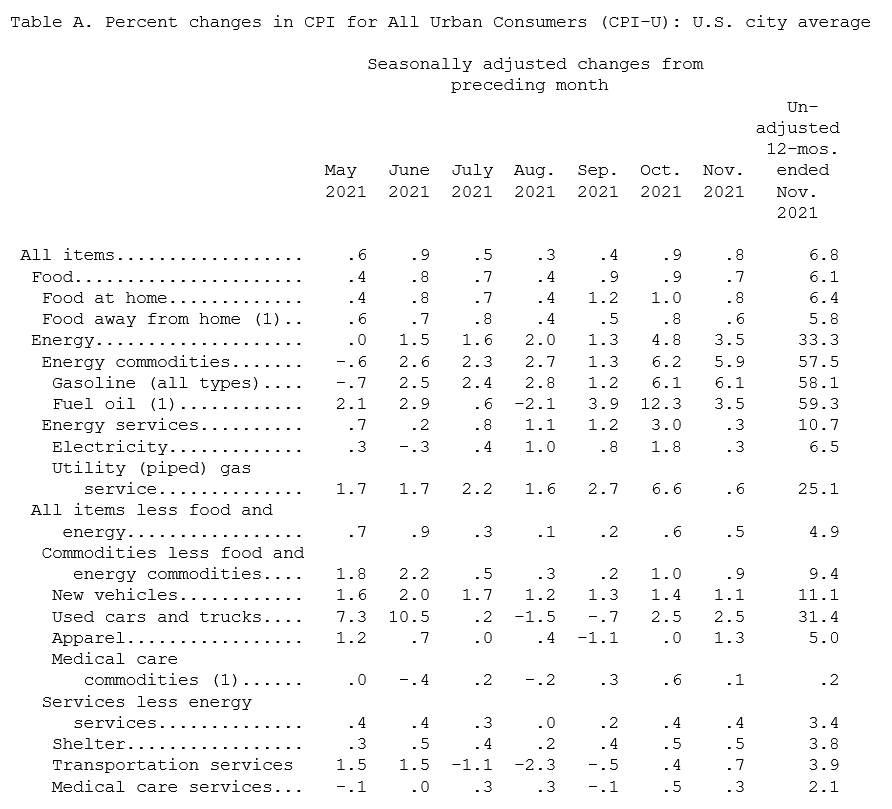

Over the past 20 years, CPI for all items charts like this:

The shaded regions are the recorded recessions in the US, and the significant drop in prices in 2008-2009 is, of course, the fallout from the 2008 financial crisis and the subsequent “Great Recession”.

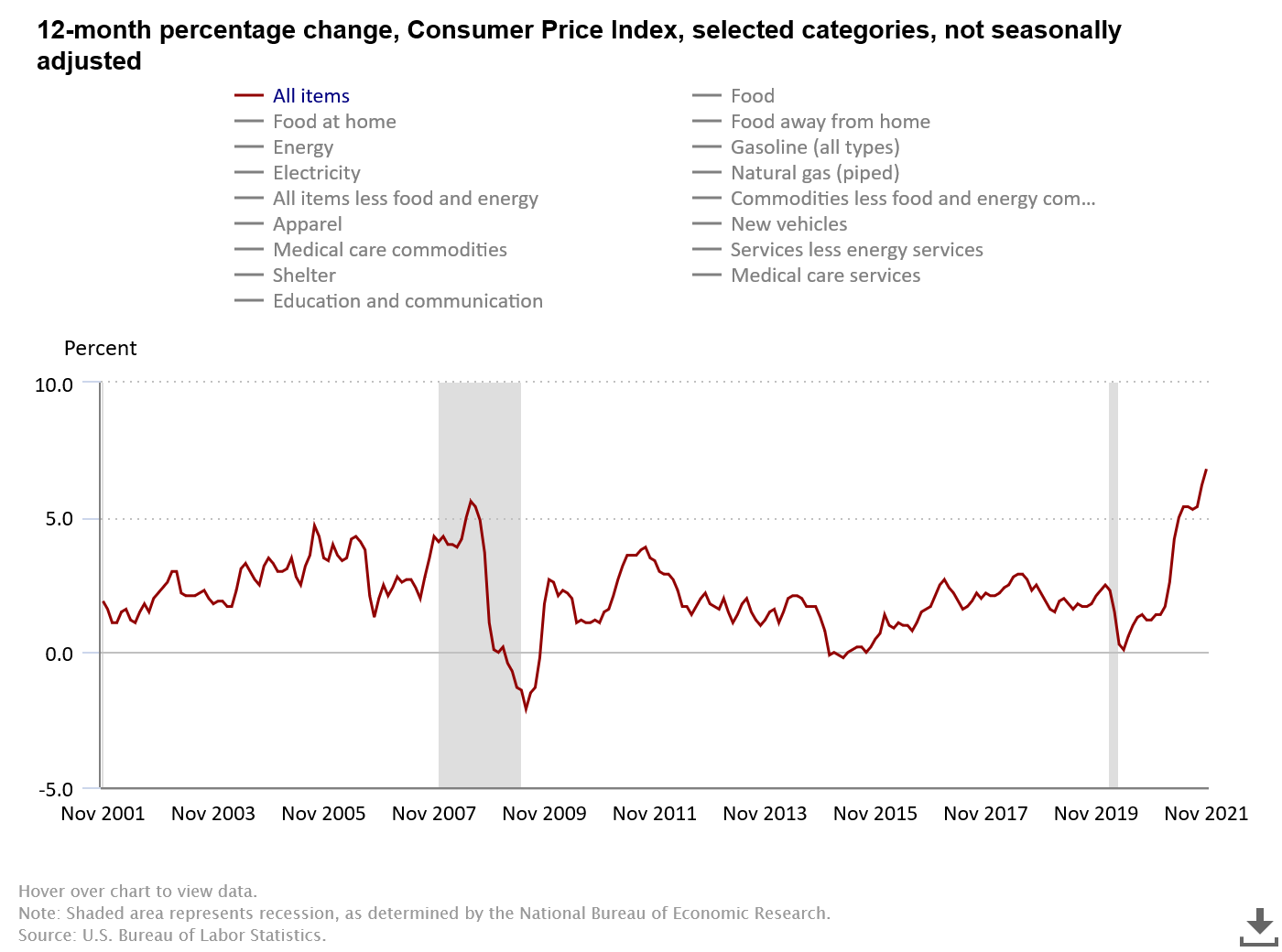

When food and energy items are stripped out and charted separately, however, the comparison graphs looks like this.

Gasoline prices have fluctuated to a far greater degree over the past 20 years than has CPI, and for 2021 is outpacing top-level CPI by multiple orders of magnitude. Natural gas is running a not-too-distant second.

Moreover, while historically price rises for services have outpaced commodities (physical goods), since the beginning of this year the reverse has been true, and commodity price inflation is now many times greater than service price inflation.

As the extreme fluctuations in energy-related prices shows, inflation invariably involves distortion of relative prices within the CPI “basket”, and across the broader economy. If we take energy prices at face value, energy commodities are now many times more valuable than other goods, including food. If we take price rises at face value, during 2021 commodities became much more valuable to consumers than services, a phenomenon which is distinctly at odds with the prevailing trend of the past two decades.

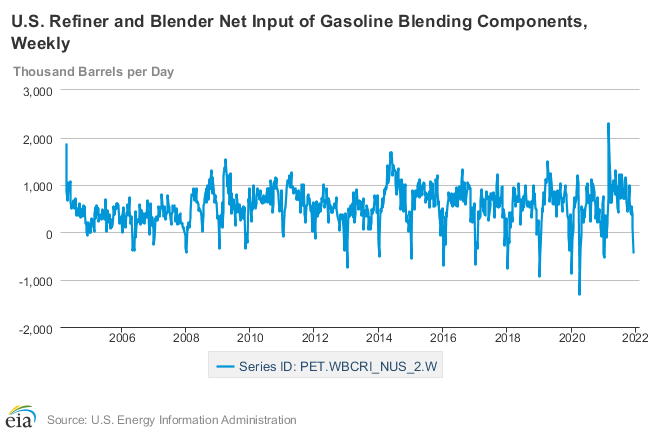

However. “more valuable” does not mean people are buying more. In the case of gasoline, they are buying less, when you look at the refiner and blender inputs for gasoline production.

Gas price inflation means people are literally getting less bang and paying more bucks. As dollars spent on gasoline cannot be spent on anything else, gas price inflation means that not only are people buying less gas, they have less money with which to buy anything else. The same thing can be said for any CPI component with a price rise greater than the overall index—the rise in commodity prices does not mean that services have become somehow less valuable overall, just that consumers have less money available to spend on services.

In other words, rising inflation translates to reduced consumption and, by extension, reduced economic output overall. The higher the inflation, the less economic output there is.

While the government economic “experts”—not to mention Wall Street—talk of the economy being “robust”, the reality is high inflation and inflation imbalances are signs of an economy that is anything but. High inflation and inflation imbalances are signs of an economy that is fundamentally out of balance and not headed in a positive direction.