Is Europe Heading Towards More Inflation Or Deflation?

Will They Follow The Fed Or The PBOC's Route To Economic Perdition?

On the surface, Europe is following the United States down the rosy path of declining inflation without recession.

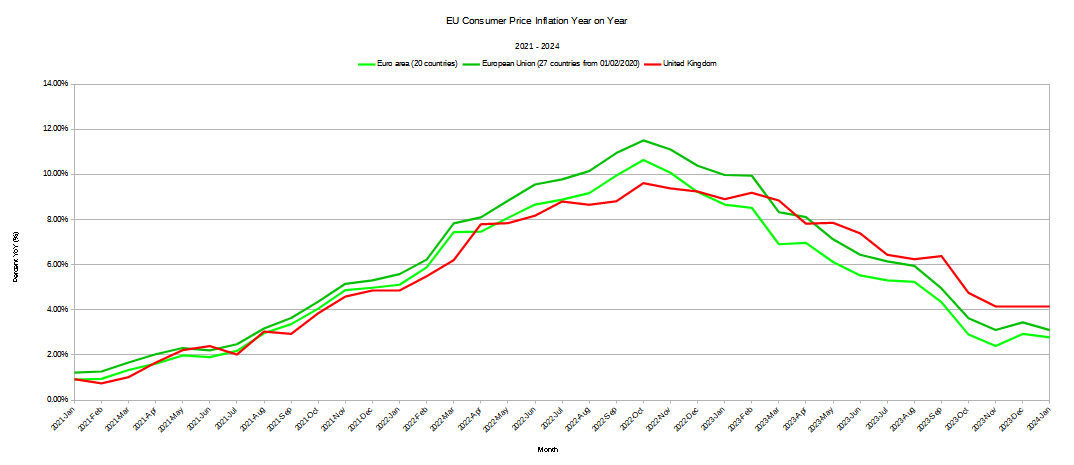

Euro area annual inflation is expected to be 2.6% in February 2024, down from 2.8% in January according to a flash estimate from Eurostat, the statistical office of the European Union.

Looking at the main components of euro area inflation, food, alcohol & tobacco is expected to have the highest annual rate in February (4.0%, compared with 5.6% in January), followed by services (3.9%, compared with 4.0% in January), non-energy industrial goods (1.6%, compared with 2.0% in January) and energy (-3.7%, compared with -6.1% in January).

As disruptive as consumer price inflation has been here in the United States, it is easy to overlook the extent it has been a major factor in economic growth elsewhere, and in the EU especially.

Yet as we have seen elsewhere—most notably in China—the concern is not always too much inflation. Deflation is also a major problem for any economy.

As the EU grapples with a seemingly forever war in Ukraine, and interminable sanctions against Russia, once a leading trade partner, as well as all the other challenges facing the global economy, a question now arises: Is the EU headed into deflation a la China, or will it see resurgent inflation a la the United States?

Intriguingly, the data is not entirely clear. There are signs of both stubborn inflation and incipient deflation—which may mean the answer is more like stagflation.

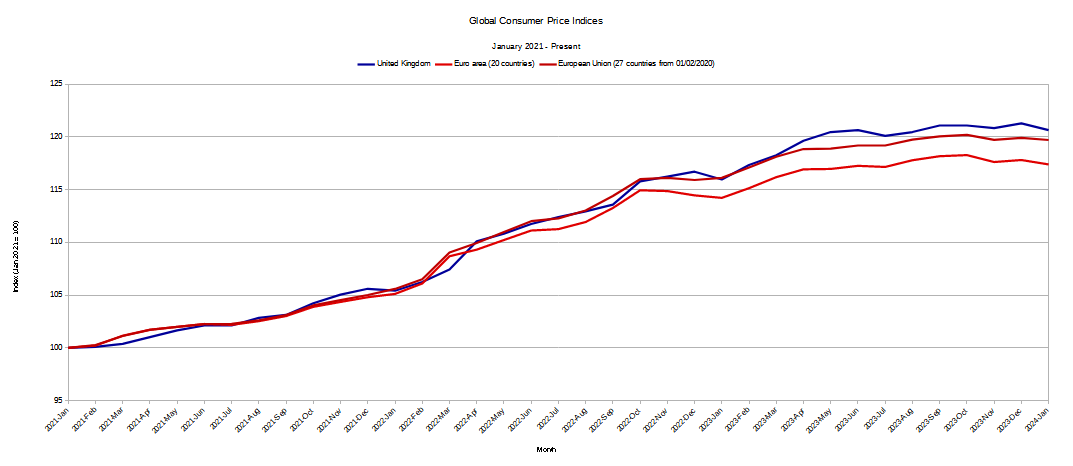

When we look at the trend in consumer prices in the EU, the indices themselves show recent outright price declines: inflation has, over the past few months, become deflation in the EU.

While the broad indices themselves are showing decline, we need to be careful about making too much of a case for deflation. When we look at the rate of inflation year on year, prices are still higher than they were a year ago in Europe.

However, confirming what we see in the raw indices themselves, the month on month inflation metrics are turning negative in Europe.

Perhaps more noteworthy is that month on month inflation has been softening steadily since the spring of 2023. Inflation pressures are easing up on the EU economy.

On its face, Europe should be glad that inflation pressures are easing up on the EU economy. Less inflation is always better than more—although if it tips into deflation that can quickly become too much of a good thing!

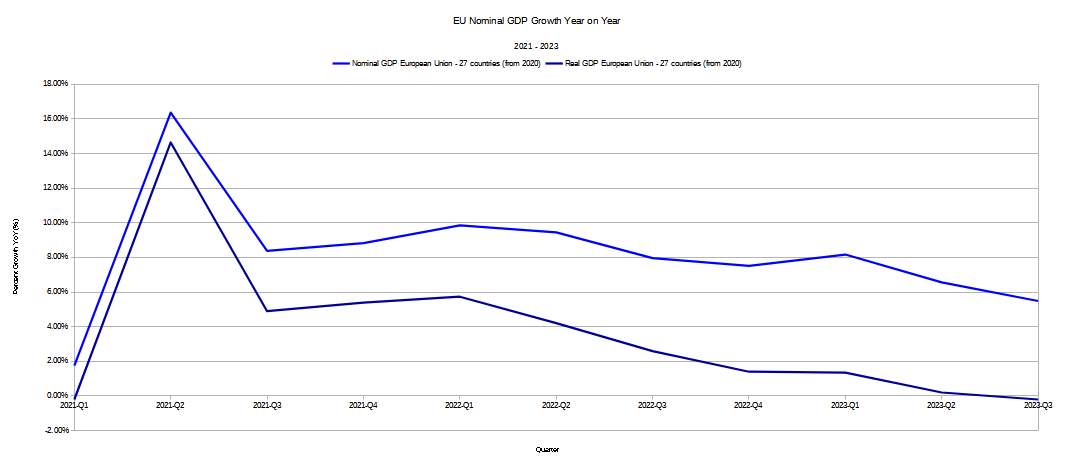

However, when we look at the trajectory of the EU economy, both as a whole, and for its major member nations, there is a trend that is all by itself rather disconcerting: economic growth has been slowing down since early 2021.

The EU itself is right on the cusp of recession as of Q3 2023, and Germany is already there, with France and Italy heading steadily in that same direction.

Nor is it terribly hard to see why this is happening. When we look at nominal GDP growth vs real GDP growth for the EU, we quickly can see the destructive impacts of inflation in the widening gap between real and nominal GDP, with real GDP steadily being eroded thanks to persistent inflation.

One interesting aspect of the inflation phenomenon in the EU is that the trends do not track with those in the United States all that well. In particular, the decline in year on year inflation has for many months been considerably slower than in the US, and only recently has the EU “caught up” to the EU.

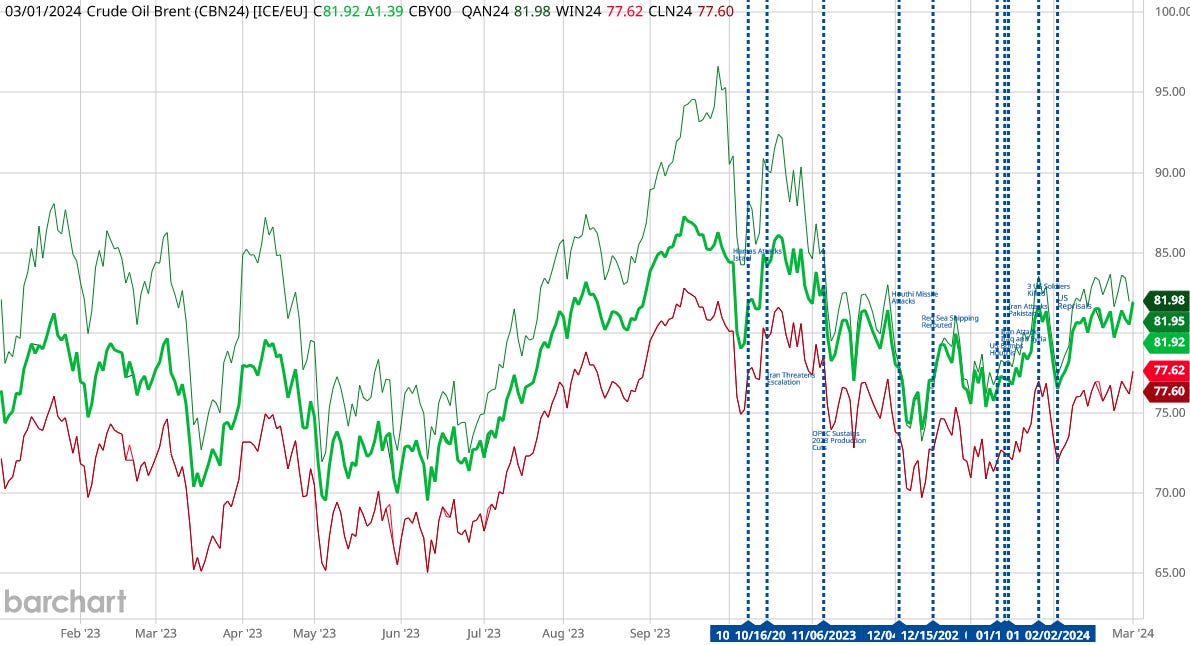

The primary reason for the EU’s disinflation trend overtaking that of the US is that the US trend more less ended in late summer of last year, as oil prices began moving back up again. Somewhat surprisingly, energy prices seem to have less impact on overall prices structures in Europe than in the US, which we can see when we look at the prices for Brent Crude and West Texas Intermediate oil.

One reason for the seeming disconnect between energy prices and inflation may be Europe’s steady slide into deindustrialization.

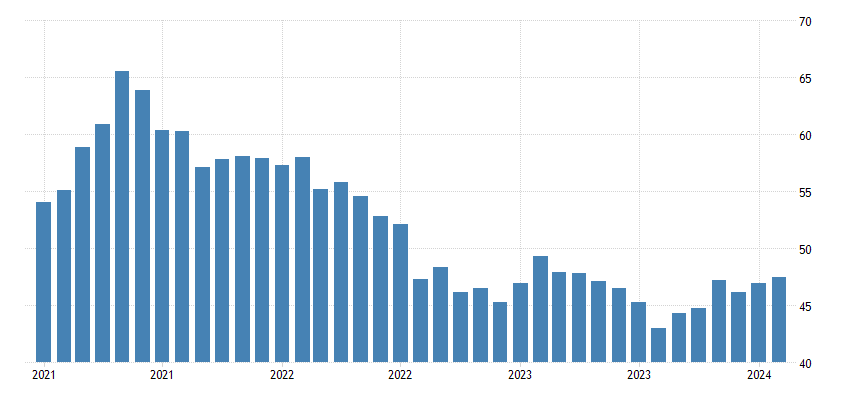

Starting at around the time Russia invaded Ukraine, the PMI metrics for the EU have been stuck in a long term (and most likely structural) state of contraction.

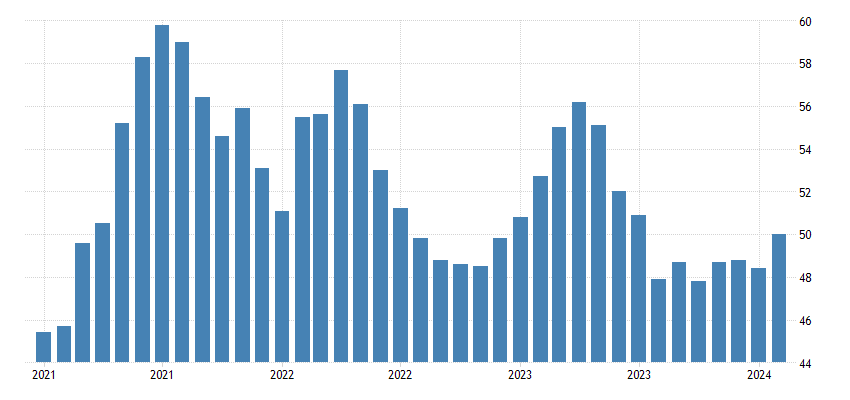

The UK PMI metrics are just as bad.

The European economy appears to be slowing down because its industrial plant is steadily shutting down. Every month where the PMI registers below 50 is a month where the industrial base is contracting rather than expanding.

Even the services PMI data are less than encouraging, although they have at least moved up into expansion territory during the early part of 2023.

The UK services PMI data is a little stronger than that of the EU, but not by much.

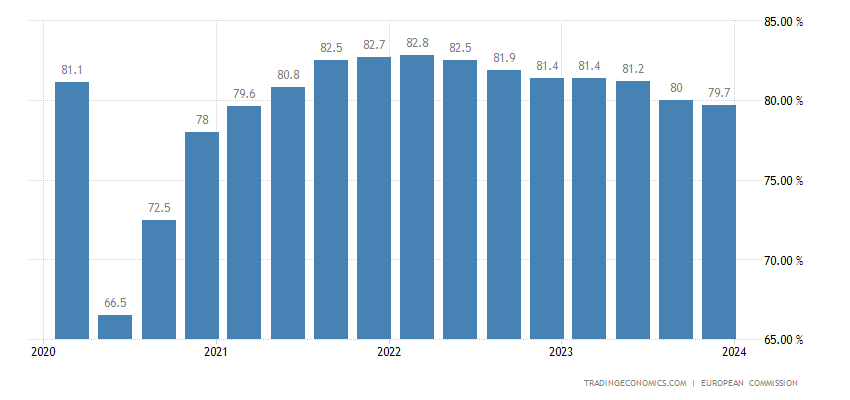

The EU is proving to be an interesting economic laboratory. With the manufacturing base in contraction for well over a year, Europe is steadily producing less, and its capacity utilization is lower than it was right before the Pandemic Panic lockdowns.

At the same time, industrial production declined significantly in the latter half of 2023.

If we look at the EU’s industrial production all the way back to 2017, we can see that there is less of it now than there was even three years before the Pandemic Panic lockdowns.

The 2020 lockdowns did much to shred Europe’s industrial output, but since then things have really not recoverd, save for a brief burst of manufacturing activity in early 2021.

Shrinking output may very well be contributing to what is making inflation so sticky. Reduced output contributes to overall scarcity which pushes prices up, even as the deflating economy is pulling prices down.

Yet if the European economy continues to lose its manufacturing base, if industrial production and capacity utilization continue to decline, there is a point at which the economy itself will break down completely—whether that means rampant deflation or hyperinflation it is impossible to say.

Unlike China’s economy, which has entered into a deflationary death spiral, and unlike the United States, where things are merely stagnating for the most part, the European economy is simply coming to a halt. Broadly across the European economy, everything is slowing down, shrinking, and eventually stopping.

Unless Europe can reverse that trend and restart its manufacturing base, there is a point some years out—perhaps a decade or more in the future—where Europe will simply cease to be a leading economy. Unless Europe can re-energize its economy soon, we will be looking at the eventual cessation of the European Union as an economic entity at the very least, and possibly as a political entity as well.

Very interesting information! It raises many questions (and I certainly don’t expect you to have the answers, Peter).

Germany’s economy started to drastically tank a year ago or more,so now, do the other EU countries blame Germany for their economic woes? Are they uniformly blaming the Ukraine situation, or immigrants, or government policies? Are any of the EU countries doing okay by themselves, and are any of them convinced that if only they hadn’t joined the EU they would be more prosperous by now? I seldom hear anything in the news regarding resentment in the EU, at least not since Brexit. I suspect you will be proven right, Peter, that if the EU doesn’t get its economic act together the whole Union could fall apart.

Forty years ago, when the idea of a EU and shared currency was first being fleshed out, there was enormous skepticism in Europe that the idea could functionally succeed. I remember reading that there was a joke making the rounds of diplomatic circles. It went something like this:

Two Europeans are sitting in a sidewalk cafe, drinking wine and discussing the big questions of life. One says to the other, “What do you suppose Heaven will be like?”

“Ah”, says the other. “ In Heaven, all of the chefs will be French, all of the mechanics will be German, all of the bankers will be British, and all of the lovers will be Italian.”

“Yes, that sounds right”, sighs the first. “ So what do suppose Hell will be like?”

In Hell, all of the chefs will be British, all of the mechanics will be French, all of the bankers will be Italian, and all of the lovers will be German.”

Yep. I think it will be much quicker than 5-10 years, more like 2-4, but EU is definitely tanking. The government's will be forced into a new type of economics😉