Is The Ruble Actually Linked To A Fixed Price For Gold?

What Are The Impacts Of The Bank Of Russia's "Gold Peg"?

We are now right at the two-week mark since the Central Bank Of Russia announced its “gold peg”, whereby it was committing to buy gold from Russia’s banks at the fixed rate of 5,000 Rubles/Gram.

In order to balance supply and demand in the domestic precious metals market, the Bank of Russia will buy gold from credit institutions at a fixed price from March 28, 2022. The price from March 28 to June 30, 2022 inclusive will be 5,000 rubles per 1 gram. The established price level makes it possible to ensure a stable supply of gold and the smooth functioning of the gold mining industry in the current year. After the specified period, the purchase price of gold can be adjusted taking into account the emerging balance of supply and demand in the domestic market.

While currencies are in a constant state of flux by their very nature, at the two week mark we begin to have enough data to begin assessing the impact of the CBoR’s gold peg on the ruble. Does the gold peg mean the ruble is now firmly linked to gold, making it “sound money” as opposed to “fiat money”?

Let us consider the data we have.

Ruble Has Strengthened Against The Dollar

As of this writing, the Ruble was trading against the dollar at an exchange rate of 79.5205 RUB/USD.

This is just below where the ruble stood (79.6539) on February 23, just before Putin invaded the Ukraine, and well below the ~102 RUB/USD exchange rate that was in effect when the CBoR announced the fixed price for gold.

Some analysts, such as BuillionStar’s Ronan Manly, attribute the recovery of the ruble to pre-war levels to the announcement and implementation of the gold peg.

We can see this linkage in action since Friday 25 March when the Bank of Russia made the fixed price announcement. The ruble was trading at around 100 to the US dollar at that time, but has since strengthened and is nearing 80 to the US dollar. Why? Because gold has been trading on international markets at about US$ 62 per gram which is equivalent to (5000 / 62) = about 80.5, and markets and arbitrage traders have now taken note, driving the RUB / USD exchange rate higher.

However, that view fails to account for the strengthening of the ruble that took place between March 8, when the ruble bottomed out at ~140 RUB/USD, and March 25 when the CBoR made the gold peg announcement. With most of the recovery from the March 8 nadir taking place before the gold peg was in place, it is immediately apparent that the ruble’s recovery is not attributable solely to the gold peg. Indeed, just looking at the overall strengthening trend from March 8 through March 25, in particular the significant improvement that took place from March 14 through March 17, it is quite possible, and perhaps even probable, that the ruble would have recovered to pre-war levels against the dollar even without the gold peg.

This is not to say the gold peg has had no impact at all. The currency trend in the week following the announcement shows a decided strengthening beginning on March 28, which coincides with the implementation of the gold peg.

While we must always remember that correlation does not equal causation, the fact remains that, once the CBoR began buying gold at the fixed price, the ruble strengthened against the dollar. At a minimum, it is plausible to attribute at least some of that gain to the gold peg.

What The Analysts Got Wrong

As of this writing, a troy ounce of gold is worth ~154215 rubles, and briefly flirted with a price as low as 146483 rubles.

This poses a major problem for precious metals analyst Ronan Manly’s assessment that the fixed price constitutes a floor price for gold—the market price in rubles for a troy ounce of gold is now below the presumed “floor price” (and, by definition, a floor price is the lowest permissible price). Whatever else the fixed price for gold set by the Central Bank of Russia might be, it is unambiguously not a price floor for gold.

To be sure, the CBoR fixed price for gold, all else being equal, should have acted as a price floor and prevented any further drop in the price of gold in rubles. However, the lower conversion rates for gold indicate that there is more influencing the market price for gold than just the CBoR fixed price, meaning that all else is decidedly not equal.

With more than the gold peg at play, and with the gold peg decidedly not acting as a price floor, the durability of the gold peg is at a minimum problematic. Indeed, the market price of gold in rubles moving below the CBoR fixed price is conclusive proof that the ruble is not firmly bound to gold, and the market will continue to present its own ruble price for gold regardless of what the CBoR does. Even if the Bank of Russia holds the gold peg for some time, at the present time financial markets are superimposing their own prices, rendering the peg at least somewhat moot.

Russia Does Not Have Enough Gold To Sustain The Peg

One problem Russia is likely to have in sustaining the gold peg is that it does not have enough gold—an ironic problem since the CBoR is currently buying and not selling gold.

However, if the gold peg is to be a true linkage between the ruble and gold, following Ronan Manly’s analysis, the price must be bi-directional, and the CBoR must be willing to sell gold at the fixed price. Indeed, the proper understanding of a gold standard for any currency is that the currency is redeemable in gold at the set standard rate.

If the CBoR is unwilling to redeem rubles at the stated rate of 5000 rubles per gram of gold, then there is no actual linkage between the ruble and gold, and it is only a matter of time before arbitrage forces within the marketplace force the CBoR to abandon the gold peg. It is in this hypothetical gold-selling scenario that the lack of sufficient gold reserves comes into play.

As of the end of 2021, Russia’s gold reserves stood at 2298.53 metric tons (also referenced “tonnes”). To fully support a gold peg for the ruble, those 2298.53 metric tons of gold must be adequate to account for every ruble within the money supply—and that is mathematically impossible given the current supply of rubles in the world.

By any of the three common metrics for money supply, labeled the M0, the M1, and the M2 respectively, Russia’s supply of rubles is far greater than what the fixed price for gold can support given ~2300 metric tons of gold reserves.

If we look at the most conservative metric for the ruble money supply, the M0, which currently stands at 13913.40 billion rubles, at the CBoR gold peg the amount of gold reserves needed should every ruble be redeemed would be 2782.68 metric tons, or ~484 metric tons more than Russia currently has.

If we loosen the metric to the broader M1 measure, standing at 37248.4 billion rubles, the required gold reserves jumps to 7449.68 metric tons, or ~225% of Russia’s current gold reserves.

Loosening further to the M2, which stands at 66659.7 billion rubles, the required gold reserves more than doubles, to 13331.94 metric tons, or ~480% of Russia’s current gold reserves.

(Note: there are 32150.75 troy ounces per metric ton and 31.10348 grams per troy ounce)

Moreover, Russia has been expanding its money supply recently, as the data illustrates:

The M0 money supply metric:

The M1 money supply metric:

The M2 money supply metric.

A greater supply of rubles means a greater required amount of gold reserves to sustain any linkage between the ruble and gold.

Conversely, support for the ruble money supply with existing gold reserves would require a repricing event which would have unfathomable inflationary impacts in Russia, as the jump in gold prices would push prices up across the Russian economy by anywhere from another 21% to another 480%—a level of hyperinflation even Weimar Germany did not experience.

What Is Strengthening The Ruble?

If the fixed gold price is not behind the recent strengthening of the ruble, what is driving the ruble up in price relative to the dollar?

The assessment within the financial media is that the desire for Russian energy resources is what is fueling the ruble’s rise.

What's pushing the rally? It appears to be a massive interest in Russian oil reserves, which Bloomberg Economics now thinks will actually see inflows grow by a third, thanks to higher oil prices and despite the war and international sanctions.

The linkage to watch, following this logic, is between the ruble and Russian oil, rather than between the ruble and gold.

However, as I have noted previously, the influence of Russian oil on the world markets may not be as great as some have speculated, given that it did not present a barrier to Saudi Arabia introducing a significant price hike to its Asian customers.

Absent more conclusive data (which may yet appear), there is little at this point to sustain a contention oil is now underwriting the ruble. At the present time, the ruble is still “fiat” money backed by government promises rather than “sound” money backed by commodities.

The Significance Of The Gold Peg

If the CBoR gold peg is not a true gold standard, what are we to make of it? More importantly, what is its significance?

As some economists have noted, the immediate function of the gold peg is to provide a measure of credibility for the ruble as an international currency and to bolster its value in the wake both of the war in Ukraine and resulting international sanctions against Russia.

The main goal of these moves is to try to ensure the credibility of the rouble by making it more desirable in the forex market, though it also fits into longstanding attempts by Russia and China to weaken the US dollar’s dominance as global reserve currency (meaning it’s the currency in which most international goods are priced and which most central banks hold in their foreign reserves).

However, the violation of the “floor price” position putatively established by the gold peg means that while Russia is succeeding in increasing at last short term confidence in the ruble, the market is still very much in command of the value of the currency. As markets tend to be fickle, and will change on the slightest alteration of the currency landscape, the probability this increased confidence in the ruble will last is fairly low.

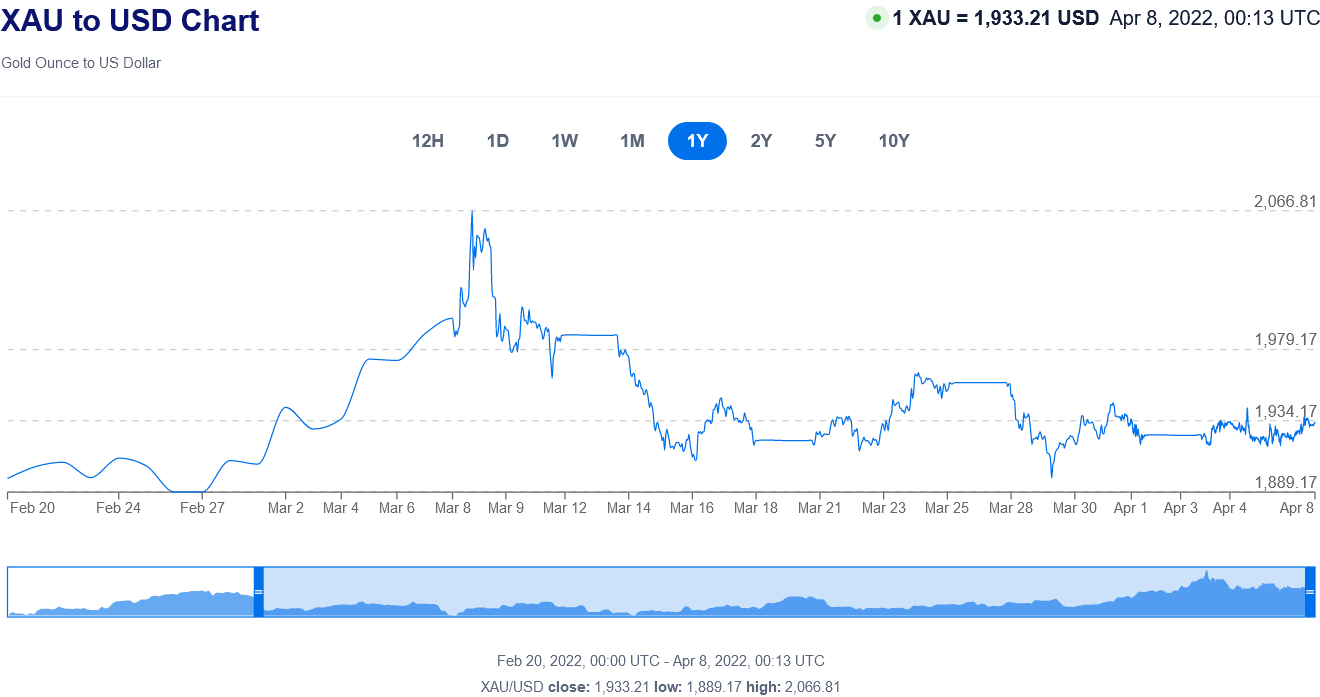

As for the CBoR gold peg undermining confidence in the dollar, the data does not support that assessment. If there were a true loss of confidence in the dollar, not only would there have been significant strengthening of the ruble against the dollar, but there would also have been a dramatic spike in the price of gold in dollars, and thus far such a rise has not happened. In fact, since the implementation of the gold peg, the US dollar has strengthened against gold, pulling the gold price down.

As the gold price in dollars demonstrates, when war first broke out in Ukraine, there was a “flight to safety” reaction where the markets flocked to gold rather than to the dollar. However, this shift in market sentiment has not lasted, and even before the announcement of the CBoR gold peg the dollar had largely recovered against gold.

The End Of Dollar Hegemony? Not Quite

Contrary to some prognosticators, the CBoR gold peg does not mark the beginning of the end of the dollar’s dominance in global currency markets. While that end will come eventually, and indeed may even have been accelerated by the economic events swirling around the war in Ukraine, the data does not yet show an ending of the dollar’s pre-eminent place among the world’s currencies.

However, the gold peg can also be viewed as a cautionary tale. The myriad economic and financial forces at play against the ruble also influence the dollar, and it is not unreasonable to presume that the dollar would encounter similar hurdles to any attempted reversion from fiat back to sound money.

The gold peg also illustrates the fundamental arbitrary nature of currency itself. The CBoR set the gold peg based on where it wanted the ruble to be valued, not where it was valued. The gold peg, much like other currency manipulations that occur regularly in financial markets, is more an imposition of a perception on reality rather than a reflection of reality. One could even argue that any “gold standard” for currency is itself is more perception than reality, and that governments can, have, and will manipulate such perceptions to their own imagined benefit with or without a declared standard.

The gold peg is an attempt by the Bank of Russia to sustain the ruble at least through the duration of the Ukraine War. It is not, based on the evidence, a firm linkage of the ruble to gold, nor is it likely to endure for very long if market trends continue as they are. The data does not yet let us conclude anything more than this about the gold peg.

"To fully support a gold peg for the ruble, those 2298.53 metric tons of gold must be adequate to account for every ruble within the money supply"

Has any country's currency ever been "fully supported" in that manner? I.e. has any country's central bank or treasury ever had enough gold to redeem every unit of physically printed currency, much less any of the broader measures of "money supply"?

It seems to me that currency ostensibly backed by PMs has always been a confidence game. It doesn't require full backing. It just requires enough to withstand "runs". As long as the small number of people who show up at the window can successfully redeem their paper for specie, and confidence remains, most of them won't.