Job Openings and Labor Turnover Summary: Good News For The Fed Or More Lou Costello Labor Math?

How Can Job Openings Drop By A Record Amount And The Economy Be Growing?

Yesterday, the Bureau Of Labor Statistics released the August Job Openings and Labor Turnover Summary, which showed a 1.1 million decrease in the number of job openings in the United States.

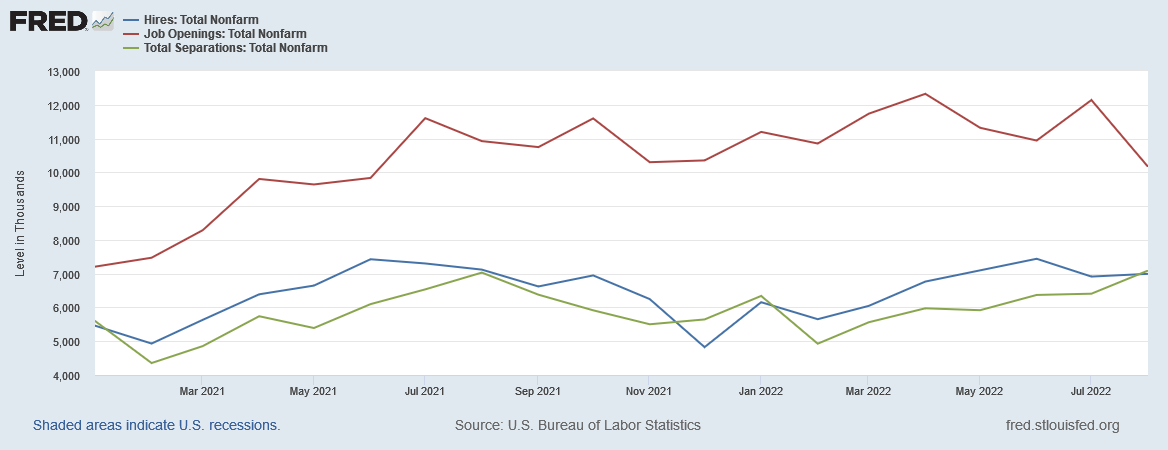

The number of job openings decreased to 10.1 million on the last business day of August, the U.S. Bureau of Labor Statistics reported today. Hires and total separations were little changed at 6.3 million and 6.0 million, respectively. Within separations, quits (4.2 million) and layoffs and discharges (1.5 million) were little changed. This release includes estimates of the number and rate of job openings, hires, and separations for the total nonfarm sector, by industry, and by establishment size class.

Presumably this is the sort of “good bad news” the Federal Reserve has been wanting to see—job destruction consistent with its mission to orchestrate a recession in order to bring inflation down to ~2% year on year.

There is just one problem with these numbers: they stand starkly at odds with the Atlanta Fed’s GDPNow nowcast showing the US economy grew by 2.3% during the third quarter.

Job destruction and economic growth don’t generally take place at the same time in the same economy.

The GDPNow Nowcast Came On Strong At The Last Minute

For most of September, the GDPNow nowcast languished near the zero-growth margin. Then, at the end of September, the nowcast surged to 2.4%, before retreating a 10th of a percentage point on Monday.

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2022 is 2.3 percent on October 3, down from 2.4 percent on September 30. After this morning’s construction spending release from the US Census Bureau and the Manufacturing ISM Report On Business from the Institute for Supply Management, a decrease in the nowcast of third-quarter real personal consumption expenditures growth from 1.0 percent to 0.7 percent was slightly offset by an increase in third-quarter real gross private domestic investment growth from -4.2 percent to -4.1 percent.

This much-improved nowcast is largely the result of the US Census reporting an increase in new home sales, given the trajectory of recent nowcasts and the cited inputs.

September 30, 2022

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2022 is 2.4 percent on September 30, up from 0.3 percent on September 27. After recent releases from the US Bureau of Economic Analysis and the US Census Bureau, the nowcasts of third-quarter personal consumption expenditures growth and third-quarter gross private domestic investment growth increased from 0.4 percent and -7.6 percent, respectively, to 1.0 percent and -4.2 percent, respectively, while the nowcast of the contribution of net exports to third-quarter real GDP growth increased from 1.10 percentage points to 2.20 percentage points.

September 27, 2022

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2022 is 0.3 percent on September 27, unchanged from September 20 after rounding. After releases from the National Association of Realtors and the US Census Bureau, the nowcast of third-quarter gross private domestic investment growth decreased from -7.4 percent to -7.6 percent.

Based on the economic indicators maintained by the US Census, a sharp increase in new home sales is the only recent economic indicator showing a positive shift.

Certainly the Bureau of Economic Analysis’ August report on Personal Income and Outlays can’t justify the last-minute surge in the GDP nowcast, as it reported an increase of real disposable income of only 0.1%

Thus, even on its own the GDP Nowcast is a striking turnaround based apparently on a relatively narrow set of positively inclined nowcast inputs.

Job Openings Decreased, But Hirings And Separations Increased

Within the August JOLTS data itself, the most striking aspect is that, while reported job openings decreased, actual hirings and actual separations increased. Indeed, both hirings and separations have been trending up in recent months.

Even with the August decline in reported job openings, the overall trend in unfilled job vacancies since the beginning of 2021 has been generally increasing.

Moreover, while the decline in reported job openings might be a record, the net change in unfilled job openings is not quite a record, and is not at all out of line with recent fluctuations in the jobs data.

Intriguingly, of the separations components of the jobs data, the number of quits has been consistently the most dominant, with layoffs and discharges comprising a smaller and diminishing proportion of the overall separations.

The “Great Resignation” is alive and well, it seems!

Not Quite Lou Costello Labor Math, But Still Questionable

Overall, the number of hires and separations are in line with long-term historical trends, excepting, of course, the 2020 data which showed anomalously large swings surrounding the pandemic lockdown protocols.

Even the increasing significance of quits in the separations data is a trend that predates the pandemic, the lockdowns, and the ensuing recession in 2020. Indeed, the most significant change in the separations data is not that the quits have increased, but that layoffs and discharges declined from 2021 onward.

Consequently, the biggest historical deviation in the JOLTS data is the increase post-2020 in the number of reported job openings. While the number of job openings rose after the 2020 lockdowns, actual hirings and separations have not changed all that much outside of 2020 itself, which is going to be an outlier due to the lockdowns and resultant job dislocations.

One has to wonder, therefore, how legitimate the reported job openings are. Surely it is remarkable that the pace of hiring has not pace with the number of job openings. That much is quite a deviation from the historical norm.

When one disregards the reported job openings and focuses strictly on actual hirings and separations, the labor turnover data ultimately does not show any significant deviations from the historical trends (2020 excepted, of course). While the pace of separations for August did exceed the pace of hirings, the excess is not at all out of line with long term fluctuations in the data.

If anything, the JOLTS data illustrates yet again the increasing dysfunction and sense of unreality within US labor markets. With an increasing rate of people quitting their jobs, the reported job openings are simply an unrealistic expectation on the part of US employers—they are reporting a number of workers they would like to have, but which simply either are not available or are unwilling to accept the jobs that are being offered.

However, the JOLTS data does make the GDP Nowcast at a minimum highly unlikely. An excess of separations over hirings is incompatible with general understanding of economic expansion—which is most strongly typified by increasing employment. While the numbers of reported job openings are questionable just on their deviation from the historical trend alone, the overall labor turnover data is tantamount to a total rejection of the GDP Nowcast. The economy is not on pace to grow 2.3% in the third quarter. The economy might not still be in contraction, but it is hardly in a robust state where it can grow that much.

The August JOLTS data is marginally “good news” for the Fed, given its desire to see job growth squelched until inflation is tamed, but ultimately the data shows that the net change in employment in the US for the month of August is not that much. If anything, the data shows employers slowly coming back to reality about how many workers they can hope to hire with prevailing wages and working conditions—which means that the Fed’s interest rate hikes are once again far less impactful than the Fed wants to admit.

PNK, I wanted to make one comment not actually related to your terrific series of articles, but to yourself and your outstanding ability to answer questions and assist our understanding.

I am damn glad you are on our side!