New York Fed Cuts Against Government Narrative Of Strong Economy

Empire State Manufacturing Survey The First August Survey To Show Recession

While I frequently frame discussions of the state of the US economy in the context of the Federal Reserve’s interest rate hikes and agenda of demand destruction and (slightly) higher unemployment, the actual state of the economy is still an important topic all on its own.

An economy in rude health means jobs, wages, and ideally a chance at some prosperity. An economy in distress means fewer jobs, lower wages, and diminishing chances for some prosperity.

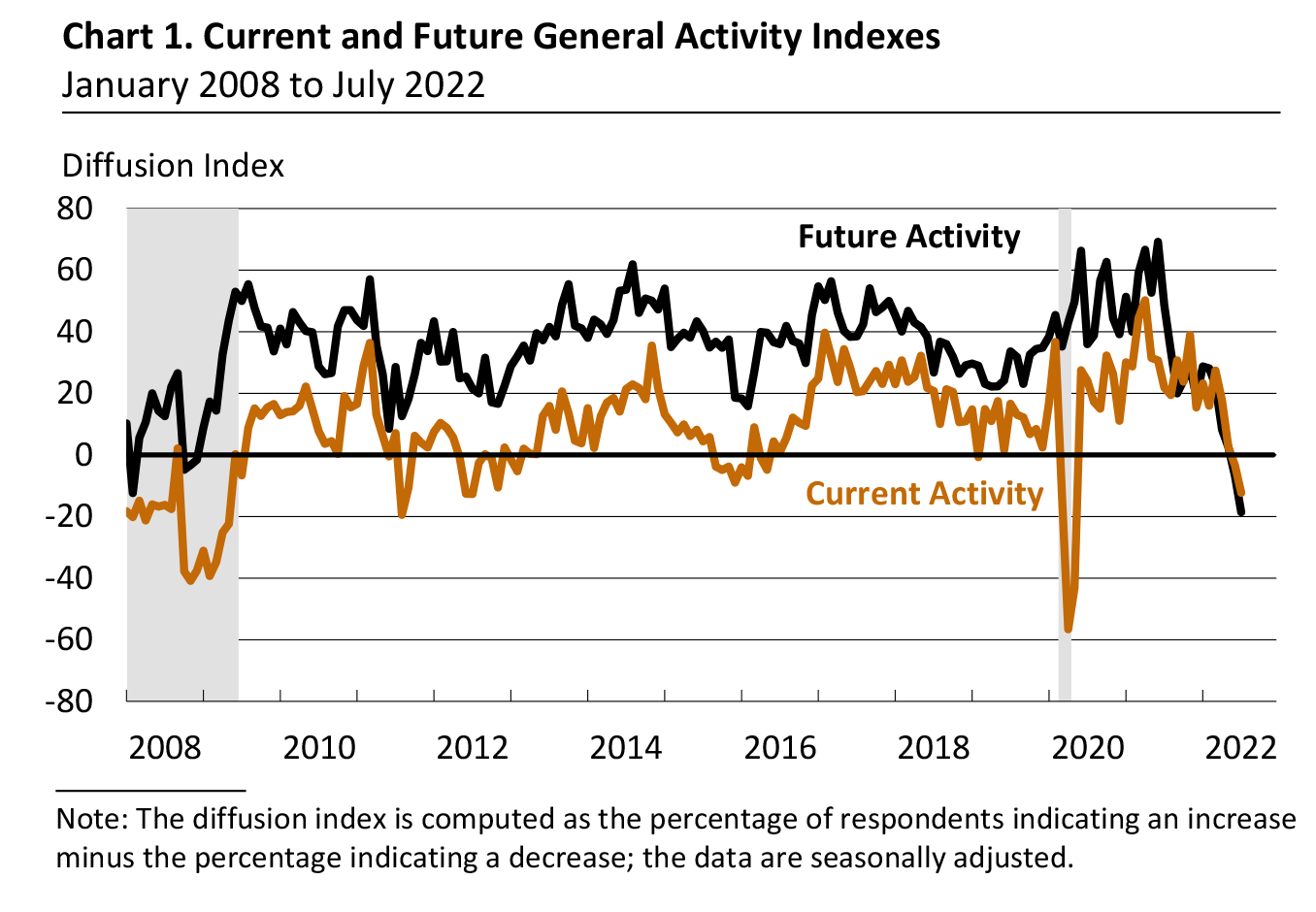

Today the New York Federal Reserve published its monthly Empire State Manufacturing Survey, which puts at least New York State’s economy firmly in the realm of “distress”, with general business conditions plummeting 42 percentage points from July to August.

Business activity declined sharply in New York State, according to firms

responding to the August 2022 Empire State Manufacturing Survey. The headline

general business conditions index plummeted forty-two points to -31.3.

New orders and shipments plunged, and unfilled orders declined. Delivery times

held steady for the first time in nearly two years, and inventories edged higher.

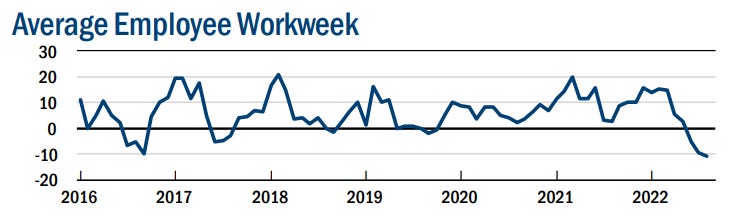

Labor market indicators pointed to a small increase in employment, but a decline in

the average workweek. While still elevated, the prices paid index moved lower, and

the prices received index held steady. Looking ahead, firms did not expect much

improvement in business conditions over the next six months.

A 42 percentage point month-on-month decline in even one Federal Reserve Bank’s manufacturing survey is not merely a recession “signal”, it’s a blaring klaxon screaming “recession is here and depression is coming.”

Not The Government’s Preferred Narrative

The Biden Regime, of course, would prefer a different signal to be received.

The President likes to tweet anodyne word salad how this economy “works for everyone”.

When the Bureau of Labor Statistics released the Employment Situation Report for July, he could not resist taking a victory lap on Twitter about “528,000 jobs”.

For her part, Treasury Secretary Janet Yellen loves to wax rhetorical about the “miracle” of the US economic “recovery” from the government-mandated 2020 COVID recession.

Coming in with the dips of the pandemic, the United States experienced an historic economic recovery. A rebound that’s unmatched in our nation's modern history in its speed and scale. Right now, even in the face of global headwinds, including a war in Europe and successive variants of the pandemic, our economy remains resilient. Our unemployment rate stands at 3.6%, household finances are strong, and industrial output continues to grow.

Secretary Yellen consistently credits the Biden Regime for creating the strongest labor market since WWII:

Through our Administration’s fiscal response, we experienced the fastest recovery in history with the strongest labor market post-World War II.

Despite runaway inflation, despite declines in the labor force participation rate, despite innumerable signals warning anyone who cares to listen that the economy is not in the best of health, the Biden Regime persists in promoting this deluded narrative of a robust, vibrant, expanding economy.

Certainly the Atlanta Federal Reserve’s GDPNow nowcasting tool, which as of its latest update projects a 2.5% growth rate for the third quarter, appears to echo the preferred Biden narrative.

The New York Fed today threw some cold water on that narrative.

The New York Fed Has A Different Narrative—Recession

The Empire State Manufacturing Survey for July is little more than a litany of bad news and negative projections.

Just 12% of businesses participating in the survey reported improved business conditions, while 44% reported business conditions worse than in June.

The survey’s new orders index dropped 36%.

Shipments nosedived 50%.

Inventories increased.

Unfilled orders shrank for the third consecutive month.

The number of employees in a manufacturing firm dropped by 10.6 percentage points.

The average employee workweek dropped 17.4 percentage point.

There were a few faint bright spots in the Empire State survey:

Inventories are expected to decline over the next six months.

Delivery times were unchanged in July, the first time in two years they were not getting longer.

On balance, however, the Empire State survey painted a grim picture for New York manufacturing.

Nor does the future hold any economic hope that things will get better in the near term.

The index for future business conditions came in at 2.1, suggesting that firms were not optimistic about the six-month outlook. The indexes for future new orders and shipments were positive, but remained at low levels. Employment is expected to pick up, and delivery times are expected to decline over the next six months. Only modest increases in capital spending and technology spending are planned for the months ahead.

Most notably, while employment is projected to increase, the average employee workweek is projected to decline even further.

Overall, if one were to sum up the survey in a single word, that word would be “grim.”

This is not a survey outcome that reflects a robust economy rebounding strongly from a deliberate shutdown in 2020. Nor is it a survey that reflects a robust economy capable of creating 528,000 jobs in a single month—yet another reason to consider the July Employment Situation Report an exercise in Lou Costello Labor Math.

The narrative of the Empire State Manufacturing Survey is one of recession, not growth. It is very nearly a complete rebuke to the Biden Regime’s “official” narrative on the economy.

The New York Fed Is Not Alone

The New York Fed’s August manufacturing survey is in fact a continuation of an economic narrative laid down by the manufacturing surveys performed by the Richmond and Philadelphia Federal Reserve Banks for their respective districts.

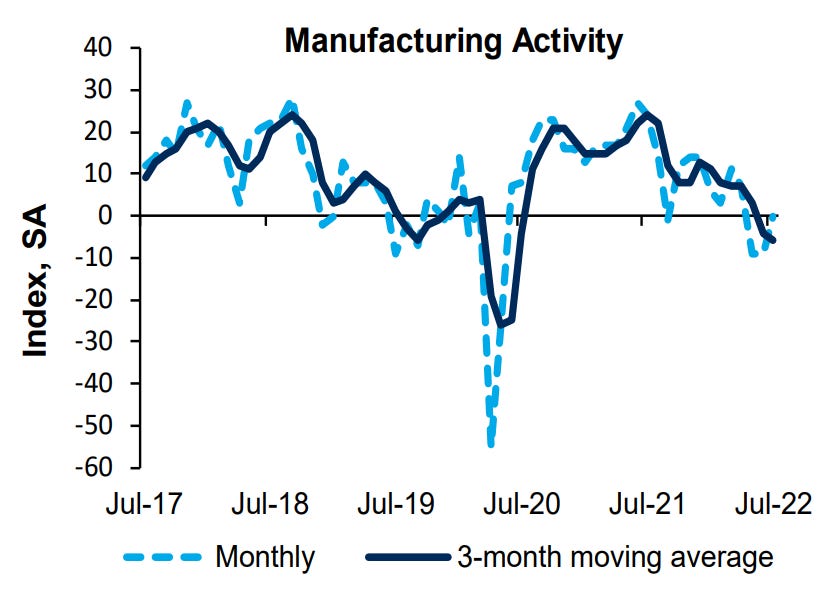

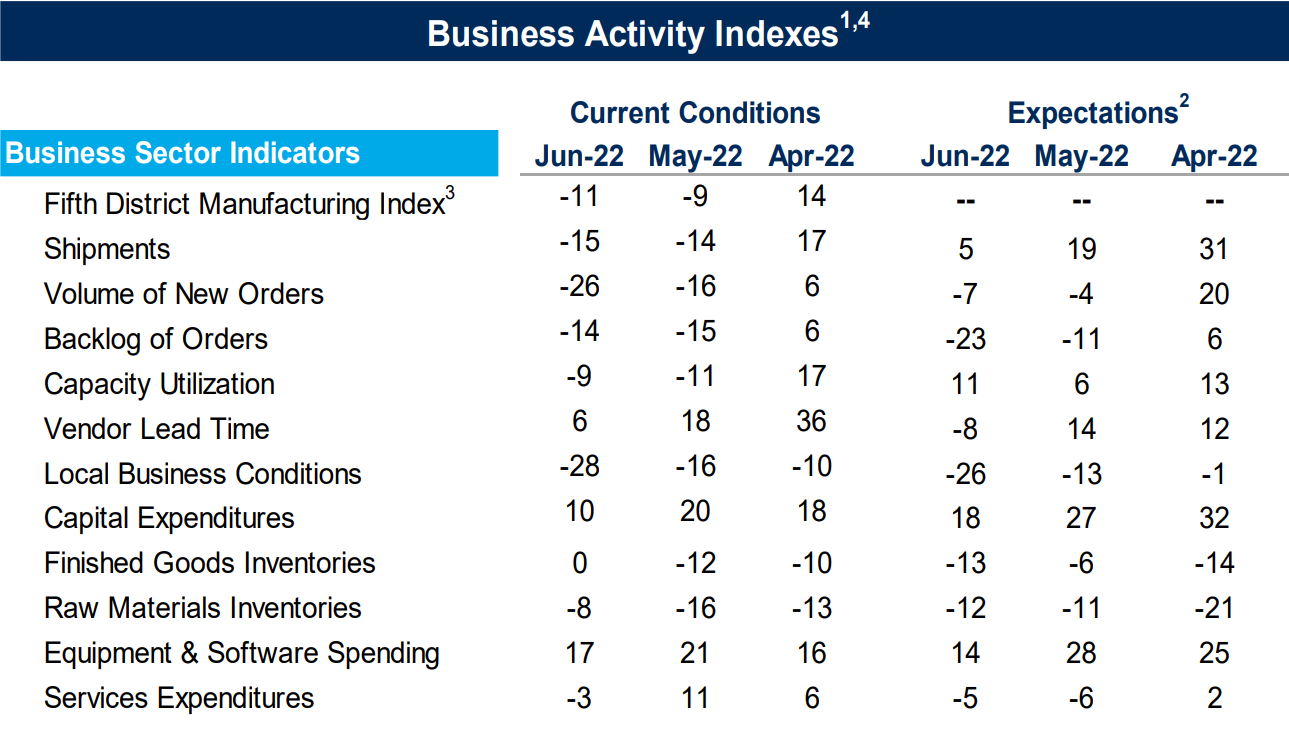

In the Richmond Fed’s Fifth District Survey of Manufacturing Activity for July, manufacturing activity overall managed to hold steady on the month, posting neither an increase nor a decrease month-on-month. However, the three-month trend in activity was remained very much in decline.

Of 11 business sector indicators in the Richmond Fed survey, two were unchanged, five showed decreases, and only four posted any increase, with the overall manufacturing index itself showing no change.

This was actually an improvement over the June survey, where 7 of the 11 indicators declined for the month.

For its part, the July Manufacturing Business Outlook Survey conducted by the Philadelphia Federal Reserve painted a manufacturing picture of worsening decline compared to June, with a 9 percentage point decline in the General Activity Index, following a 6 point decline in June.

It should be noted that the general activity index in each of these surveys in all three Federal Reserve Districts has been declining for the past several months, having peaked during 2021. The recession narrative being articulated by these Fed-sponsored surveys is not something that appeared out of nowhere in July; it has been gathering strength for quite some time.

Three Fed Districts Is A Definite Downward Trend Into Recession

One grim manufacturing survey in one Federal Reserve District is a warning signal of recession. Six such surveys in three Fed Districts over two months is more than a signal, it is confirmation that recession is here, is happening, and is getting worse not better.

These manufacturing surveys illustrate what it means to have stagflation, rather than simple inflation. Inflation alone is merely a broad albeit unequal rise in prices, distorting and destroying the purchasing power of the average consumer. Stagflation, on the other hand, that inflation occurs despite economic recession. Stagflation means not only is there inflation in the economy, but the supply of available goods is unable to rise to match the upward pressures in prices. Stagflation means a recessionary tipping point must be reached before relative prices can reset and recalibrate.

What does this trend mean for the average consumer? Nothing good, unfortunately.

It means the shortages of desired goods will likely continue until demand erodes to match supply—supply is not going to rise to meet demand, certainly not right away.

It means that demand is poised to erode because incomes are poised to diminish.

It means that consumer expectations have to undergo an extended and painful readjustment. For a large portion of the American people, quality of life is going to get worse over the near term, not better. Privation is on the rise in this country, and is likely to keep rising for a little while before it finally bends down again.

These are the recession signals being sent by these assessments of manufacturing in the New York, Richmond, and Philadelphia Federal Reserve Districts. These signals, if their warning trend continues, are a forecast for economic depression, not just recession. These signals are telling anyone who will pay attention that lean times are ahead of us.

The Biden Regime wants to ignore these signals. The “experts” in government are persuaded they can outmaneuver the “invisible hand” through legislating and regulating a supposed path to prosperity. These signals are clear proof that they have already failed.

Government interventions cannot quiet these signals. Government interventions can—and most likely will—amplify them, to the misfortune of us all.