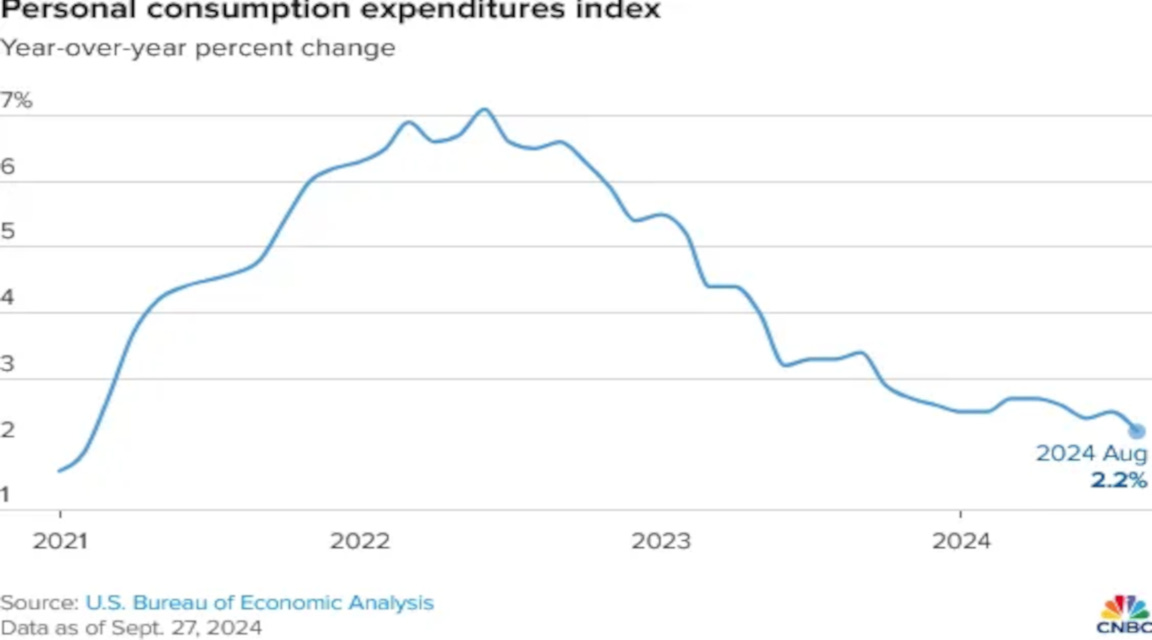

So the Bureau of Economic Analysis released the August Personal Income and Outlays Report, which includes the Fed’s preferred inflation metric, the Personal Consumption Expenditures Price Index.

Naturally, the media gaslights the report, talking up how inflation “cooled” yet again, and therefore the successful Federal Reserve will be able to lower interest rates even further.

The media is, as per usual, full of crap.

Energy prices did fall during August, and by a fair amount.

Food prices fell by a little.

Other prices—the core PCEPI less food and energy—rose, continuing a trend it has had for the past few months.

First, let’s recap the BEA’s report itself.

From the preceding month, the PCE price index for August increased 0.1 percent (table 5). Prices for goods decreased 0.2 percent and prices for services increased 0.2 percent. Food prices increased 0.1 percent and energy prices decreased 0.8 percent. Excluding food and energy, the PCE price index increased 0.1 percent. Detailed monthly PCE price indexes can be found on Table 2.4.4U.

From the same month one year ago, the PCE price index for August increased 2.2 percent (table 7). Prices for goods decreased 0.9 percent and prices for services increased 3.7 percent. Food prices increased 1.1 percent and energy prices decreased 5.0 percent. Excluding food and energy, the PCE price index increased 2.7 percent from one year ago.

Broadly, the hedline PCEPI year on year percent change declined to 2.2%, but the core PCEPI rose year on year to 2.7%.

The difference between the two metrics is the core PCEPI excludes food and energy (food and energy goods tend to be more volatile and therefore economists look to the core metric to assess broader pricing trends).

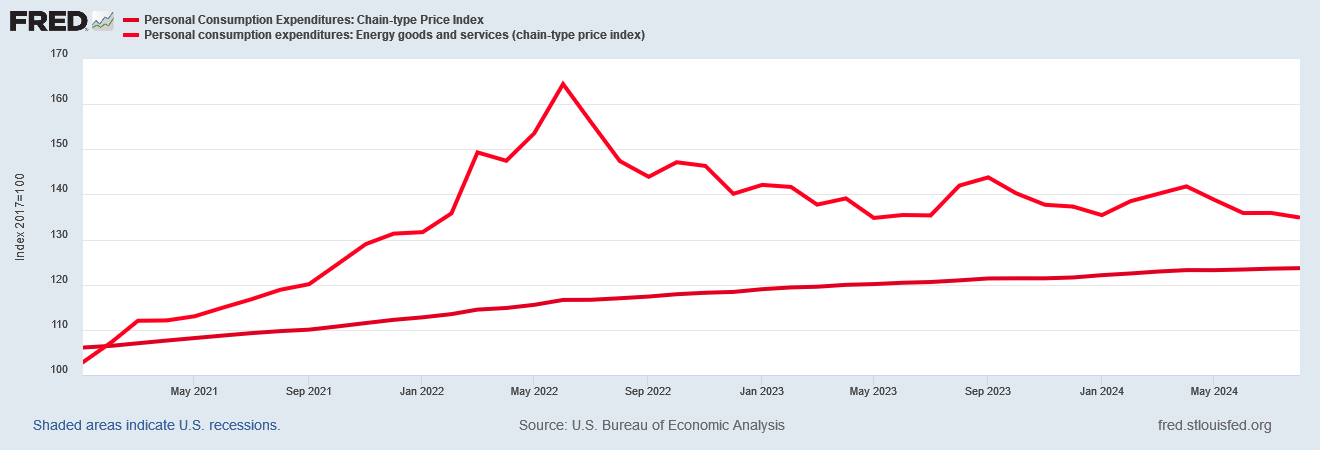

Energy prices were the primary engine of hyperinflation in 2022 and they have been the primary engine of disinflation since.

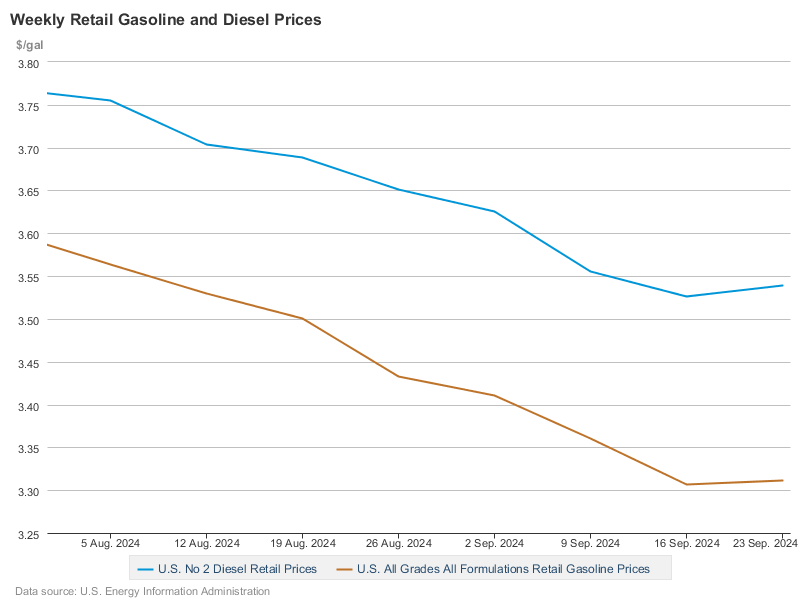

When we look at the benchmark prices for crude oil we see that energy prices have indeed been falling.

However, people do buy more things than gasoline and heating oil, so while energy prices are an important part of the overall consumer price inflation reality, they are not the whole story and arguably are not even the critical piece of the story at present.

The media chose not to report it that way.

CNN led off with the decline in headline inflation and opined that this would allow central bankers to cut interest rates further in the near future.

Americans and Federal Reserve officials have news to celebrate: Inflation cooled significantly last month, likely giving central bankers more confidence to continue cutting interest rates.

The Fed’s favorite inflation gauge, the Personal Consumption Expenditures price index, showed consumers paid 2.2% more for goods and services for the year ended in August, versus 2.5% in July. This marks another step closer toward the Fed’s 2% inflation target, as well as the lowest inflation rate seen since February 2021, when inflation clocked in at 1.9%.

The annual increase was below the 2.3% rate economists projected, according to FactSet consensus estimates. On a monthly basis, prices rose 0.1% in August versus the 0.2% increase in July, matching estimates.

Only then did they note the rise in core inflation.

CNBC said substantially the same thing, and even threw in the year on year percentage change chart for headline inflation.

The Financial Times led with how the year on year shift printed below “experts” expectations.

The Federal Reserve’s preferred measure of US inflation dropped by more than expected to 2.2 per cent in the year to August, paving the way for the central bank to cut interest rates again in November.

The data on the personal consumption expenditures price index compared with economists’ expectations of a 2.3 per cent annual gain and July’s figure of 2.5 per cent.

Lost in the mix is that overweight influence of energy prices and what that means for core consumer prices.

Is corporate media telling you things that are not true? Not exactly, but they are not telling you everything, and what they are either leaving out or burying well below the lede amounts to inflation rising rather than falling.

We do well to remember the rationale for having a “core” inflation metric—energy prices tend to be more volatile, with larger movements both up and down, and can have an outsized influence on overall price index computations.

We can see that just looking at the energy subindex against the headling PCEPI.

We need to be mindful of this because, as I observed the other day, crude oil prices are coming off their floor price established in the wake of Russia’s invasion with Ukraine.

Gasoline futures are similarly coming off historic lows.

This suggests that energy price deflation likely will not be a factor in the very near future.

Remove energy price deflation from the mix and what is left is core price inflation, which is what the core metric shows. If (meaning when) energy prices start moving up again, inflation quickly comes roaring back.

We should anticipate energy price inflation returning, or at least energy price deflation pausing, as it is not just energy futures which are coming off their floor prices. Gasoline and diesel prices themselves have also shown signs of reaching a floor price.

Thus the primary factor in bringing headline inflation down is not likely to be a factor past September.

Yet inflation is cooling and so the Fed will bring interest rates down even further! Corporate media said so!

Yeah, about those interest rates…..

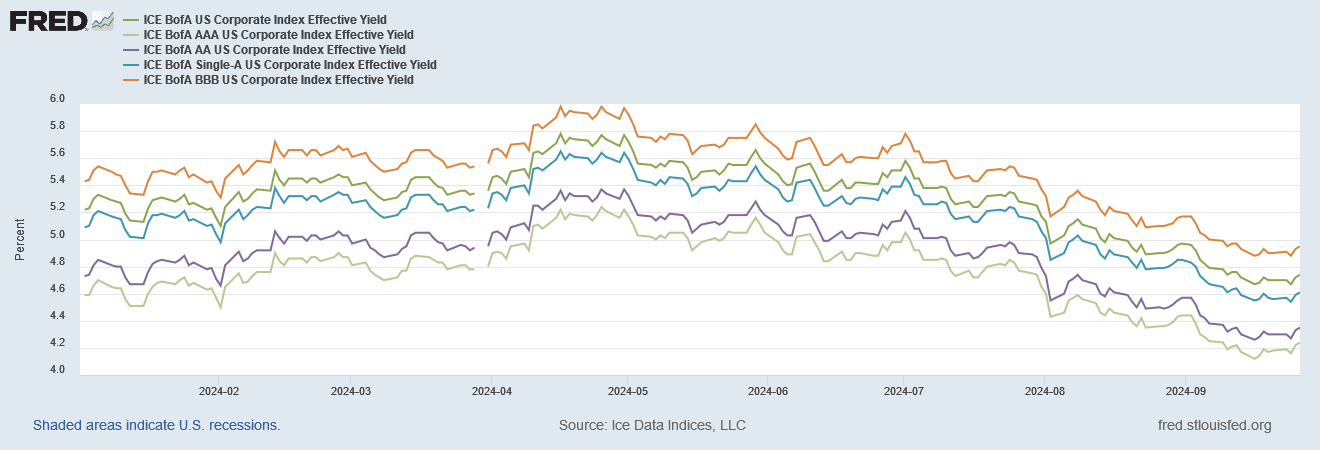

Market interest rates have already been coming down since late May. It was only since the FOMC trimmed the federal funds rate by 50bps that 10-Year and 30-Year Treasury yields have been moving up.

Mortgage rates have likewise been trending lower.

Even corporate debt yields have come down significantly since the summer.

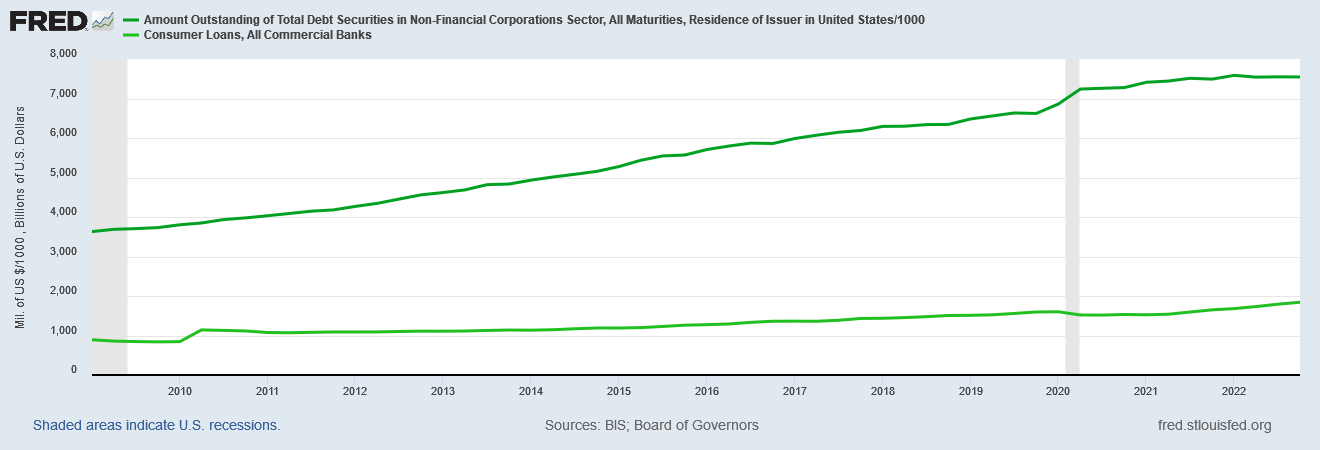

We must remember that the federal funds rate affects primarily consumer debt, which is a small fraction of corporate debt traded in the marketplace.

Wall Street already took its interest rate cut. You will have to wait until your next credit card statement to see a small rate cut on your bill.

Wall Street not only has taken its interest rate cut, it has already taken its profits from those interest rate, and is anticipating taking still more profits. When bond Exchange Traded Funds price higher, the market is expecting debt instruments to be worth more, which in turn means yields (interest rates) are expected to continue to trend lower.

The FOMC may or may not make further reductions to the federal funds rate, depending on what consumer prices do—which is to say depending on what energy prices do—but Wall Street has already made its decision on interest rates — they are coming down. The Fed was not consulted.

Is inflation likely to move higher?

Probably. Barring an outbreak of peace in Ukraine and the Middle East, the long-term trends in energy prices are that they have gone as low as they are going to go, and are likely to move upward again at least a little bit. Energy price inflation might be small when it returns, but it is likely to return, and it will bring consumer price inflation with it.

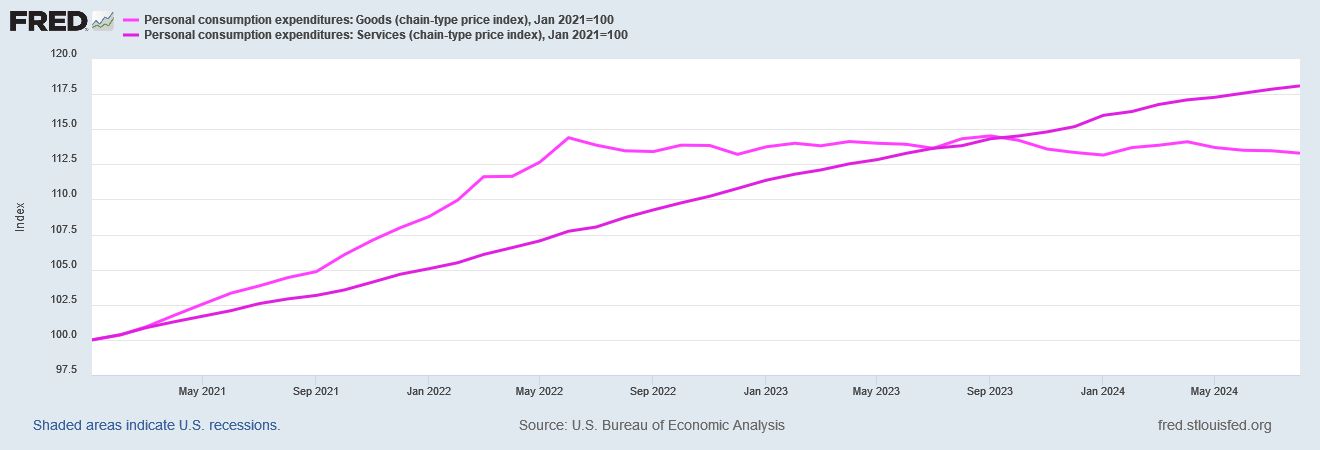

It’s also important to understand that consumer price inflation for services has been fairly consistent and well above the Fed’s desired 2% threshold since 2021 and the start of the (Biden-)Harris Reign of Error.

Consumer prices for goods experienced significant inflation in 2022, and have largely exhibited deflation since. Service prices, however, keep going up…and up…and up.

Year on year, service prices have been rising between 3.7% and 4.2% since the beginning of the 2024, even as goods prices have been falling as much as 1% year on year during that same period.

It is egregiously inaccurate and even ignorant of the corporate media to speak of inflation “cooling”. In several regards inflation has not cooled, and in some regards consumer price inflation is even heating up again. Falling energy prices are not a compensation for the prices that do rise.

It is equally inaccurate to speak of the Federal Reserve and the FOMC reducing interest rates. Corporate bonds and similar debt instruments are not beholden to the Federal Reserve for setting their interest rates. Even mortgage interest rates are moving more or less indpendently of the federal funds rate.

Only consumer interest rates such as credit card interest rates and the Bank Loan Prime Rate move in close coordination with the federal funds rate.

The pieces of debt about which Wall Street actually cares have already seen their interest rates drop significantly, and are forecast to see them drop even further. The debt about which you most likely care will be lucky to see much, if any, further rate reductions through the end of the year.

Contrary to what corporate media wants you to believe no, inflation did not fall in August—energy prices did. There is a difference, and an important one.

Contrary to what corporate media wants you to believe, no, interest rates are not coming down because the Fed trimmed the federal funds rate — market interest rates have already been coming down, without the Fed’s input.

When discussing inflation, or interest rates, the details matter. Neither inflation nor interest rates are monolithic entities, and neither impacts everyone the same way or to the same degree.

Glossing over those details is just corporate media’s way of saying the little people do not really matter. Glossing over those details is just corporate media’s way of saying you are not important.

That is simply not true. People do matter, and you are important. Not just in discussions about interest rates and inflation, but in everything.

If we remember nothing else, we need to remember that.

I'm sure you've referenced this Chart in your articles and I'm not sure if it's okay to link this article, if not please delete... The chart of Public Debt to GDP at the end of this article should indeed be on a poster, at every intersection! You've proven they don't care about us little people, inflation or manufacturing...

https://thebahnsengroup.com/dividend-cafe/special-issue-2024-election-edition-september-27-2024/

Peter thank you. You are one of 3x people in public speaking the truth when it comes to financials. Keep translating the garbage being sold as "financial facts" because the it's in the nuance th aa t the truth lies.

🎩🎩🎩📣📣📣🙏🙏🙏