The Nobel Prize-winning economist Milton Friedman once observed that “Underlying most arguments against the free market is a lack of belief in freedom itself.” A great many notable economists from Ludwig von Mises and Friederich Hayak to the progressive (and frequently pandering) Paul Krugman have commented at length on the intersection of economics and politics, and of the correlation between a free society and a free marketplace, culminating in the Friedman quote just cited.

If we are to have a free society, we must have free markets. If we are to have free markets, we must have a free society.

Thus it is when the Federal Reserve's policy statements and forward guidances on interest rates are treated with scorn by financial markets, we should pay attention. When central banks around the world pursue interest rate policies that are demonstrably harmful to the world's banking systems, we should pay attention. When the Federal Reserve appears to talk out of both sides of its institutional mouth, we should pay attention.

We should ask questions. We should seek answers.

What we should not do is trust the media. As has become all too apparent, the media is less interested in informing than it is in entertaining. Narrative has displaced even a biased presentation of facts, and many of the media narratives have been shown to be demonstrably false.

Thus, when I witness the nonsensical statements that have been made by officials of the Federal Reserve, such as Fed Chairman Jay Powell's disingenuous statement recently that the economy "is in a good place" even as the Fed mounted emergency "repo" operations to inject liquidity into financial markets--emergency actions are not my notion of a "good place"--or Atlanta Federal Reserve Bank President Raphael Bostic proclamation the US economy is not headed into a recession, glossing over the aforementioned "emergency" actions by the Fed, the desire to research and answer the question "what the heck is going on here?" becomes overpowering.

In an essay I posted on LinkedIn last year, I argued that the essential question in any analytical framework is "does this make sense?" Any explanation for anything has to make sense or it is of no value. The logic has to be consistent, it has to be complete, and it has to be comprehensible; when it is neither consistent, nor complete, nor comprehensible, the one conclusion we must draw is that more research is needed.

Accordingly, after reading on ZeroHedge and other sites various criticisms of Federal Reserve monetary policy--all of which had compelling arguments behind them--it had become clear that a greater familiarity with the actual data underpinning reports of that policy was needed. While I am no professional economist, I do believe in doing my own research on important matters, and so I set out to perform a bit of research and analysis on my own, using only raw data, independent of any other analysis or report. This post is the results of that research.

The data sets I used were the historical M1 money supply data downloaded from the Federal Reserve, going back to January 1 1997, the historical monthly CPI numbers from the Bureau of Labor Statistics going back to the same date, and the historical Dow Jones Industrial Average and S&P 500 stock indices, reported monthly and also going back to January 1, 1997.

Those wishing to review my source data may download a file with the data sets gathered together in either Excel format or in CSV format.

The questions in my mind were as follows:

How did the Federal Reserve find itself confronted with a crisis of liquidity during the month of September, 2019?

How is it that, after more than a decade of near zero interest rates and "quantitative easing" by the Federal Reserve, inflation has not ever materialized in the US economy (or anywhere else in the world, for that matter)?

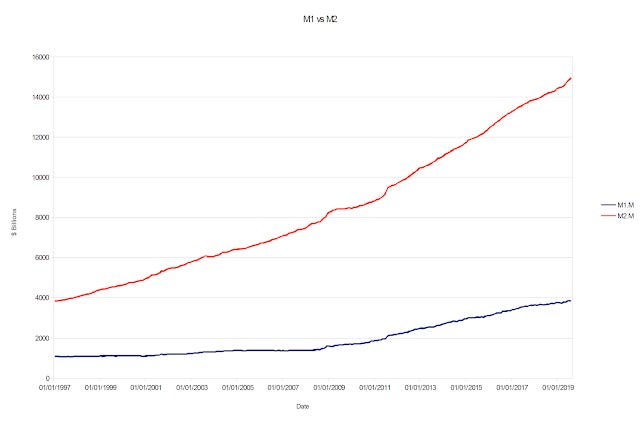

I began by focusing on the reported size of the money supply from the Fed, looking at both the M1 and M2 numbers. The M1 money stock figure is that amount of money readily available for spending--physical currency and deposits in various on-demand bank accounts--whereas the M2 figure includes "near money" accounts such as various money market accounts and time deposit instruments. There had been a third figure, the M3, which included an even broader array of money equivalents, but reporting of that figure was discontinued by the Federal Reserve in 2006.

The M1 and M2 charts are fairly mundane and even predictable.

One point that is fascinating about the M2 curve was that there was no dramatic spike up beginning in 2008/2009, when the Federal Reserve instituted quantitative easing policies in response to the 2008 financial crisis. "Quantitative Easing" is broadly defined as an expansion of a central bank's open market operations, which are specifically intended to increase the money supply. There is an upward trend in the the M1 figure, but in moving from the M1 measure to the M2, the increase in money effectively disappears.

In part, this is almost certainly due to more rapid expansion of the M2 money stock vs the M1. Going back to at least 1997, the differential between the two figures is steadily increasing.

If we look at just the M1 in isolation, we do see a significant upward trend beginning in 2009, which is exactly what quantitative easing would produce.

But here is also the first surprise. The official Fed pronouncements on quantitative easing declared the quantitative easing programs to be fully ended on October 29, 2014. Yet the pace of money creation did not show any signs of diminishing until 2017. There is at most a brief pause in 2014-2015, after which the pace of money creation resumed. This presumably was during a time of gradual tightening by the Federal Reserve. Either the Federal Reserve is greatly misinformed about the impacts of its various operations, or it was greatly deceptive in describing the same.

The initial rationale for quantitative easing was easy enough to understand: with stock markets plummeting and financial markets seizing up, the Federal Reserve wanted to avoid a repeat of the mistakes in an earlier era, when the Federal Reserve allowed the money supply to shrink dramatically following the 1929 stock market crash, producing the deflationary downward spiral known as the Great Depression. Based on that rationale, and based on the behavior of the stock market indices in the wake of the Fed QE policy, quantitative easing certainly appears to have been a success, in that it prevented complete stock market collapse. This, at least is what the performance of the S&P 500 stock index shows.

After giving up all of the gains made between 1997 and 2008, the S&P began climbing steadily starting in 2008, and has largely kept on climbing.

Another curious aspect of the Fed's quantitative easing program was that it failed to produce significant inflation. As this chart from Trading Economics shows, inflation during the past ten years has only rarely been above 2%, and only briefly below 0% (deflation) during 2008/2009.

source: tradingeconomics.com

The Consumer Price Index--the change in which is the primary benchmark for inflation--shows the same lack of inflation.

In monetarist economic theory--the primary developer of which was Milton Friedman--expanding the money supply ultimately produces inflation, as too many dollars end up chasing too few goods and services. The lack of inflation after 2008 would appear to discredit much of this.

Or did it?

(If you have hung with me this long, I promise this is where we get to the point of this entire post).

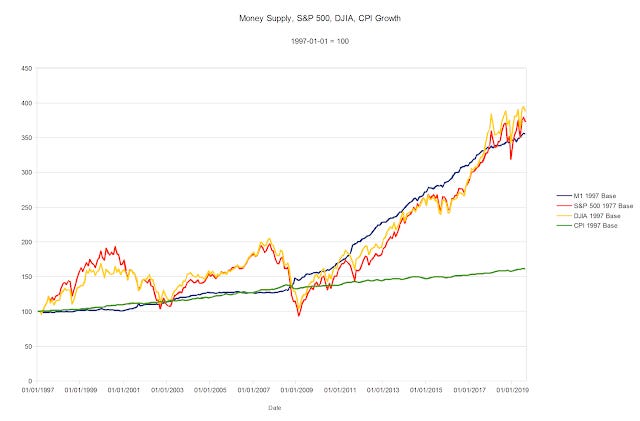

If we set the money supply, the CPI, and various stock market indices to a baseline value of 100, thereby eliminating differences in scale and units of measure, we can look at all of the values together. When we do, something interesting and unexpected shows up.

Prior to 2008, CPI and the M1 track very closely together, with only minor and transient deviations. The stock market indices, however, show absolutely no correlation to changes in the money supply. The stock bubbles of 2000 and 2008 occurred without any dramatic expansion in the M1 money supply.

After 2008, however, the exact opposite is true. The stock indices move along roughly the same upward slope as the M1 money supply, and the CPI continues on its same roughly linear trajectory completely divorced from the money supply. Only in 2017 do the stock indices show any sign of breaking free from the M1 trajectory.

What do we make of this? How do we explain this?

To my layman's eye, what this is showing is the reason why the Fed's quantitative easing strategies did not produce measurable inflation--the increase in the money stock never filtered out into the broader economy, but was completely soaked up by financial markets. Within financial markets, we see exactly the sort of inflation we would expect to see when the money supply expands.

There is something else that this chart suggests, something which is fairly disturbing. It suggests that much, if not all, of the economic growth posted during Barack Obama's Presidency was merely inflation--that there was no real growth at all.

This is further suggested if we reset the baseline to January 1 2008:

The deflationary sag in 2008 is of course the consequence of the financial crisis in that year and the onset of the "Great Recession". Yet the deflationary "sag" never really disappears, as both the CPI and the stock indices run below the M1 growth level, and to an increasing degree over time. The influx of dollars into the economy did not produce a corresponding level of inflation even within financial markets. Moreover, if we were to flatten out the M1 chart (i.e., express the money supply in terms of constant dollars), we would see the stock indices as well as the CPI declining. This would be especially true after the formal end of quantitative easing, where we see the M1 trend line essentially unchanged but the S&P 500 and DJIA lines appear to flatten out for a time

In other words, quantitative easing only served to mask deflation that was triggered by the 2008 financial crisis.

Only in recent years do we see this trend change. Resetting the baseline to 2016, we see the stock indices finally running above the M1 curve, showing a rise in asset prices in real term, and not just due to the inflationary effects of growth in the money supply.

Real economic growth did not occur in the United States, it seems, until around 2016-2017. The policy of monetary stimulus begun in 2008 almost completely failed to stimulate, in large part because the money created by the Fed never trickled out into the general economy. Rather, it remained bottled up in the financial markets, which is to say it was parked on the balance sheets of the nation's banks--nominally there, but completely idle.

Thus we have a preliminary answer to the questions posed at the beginning. The Federal Reserve found itself facing a liquidity crisis over the past few weeks because the financial markets have been fundamentally illiquid since 2008, with banks essentially sitting on all the new money created. By the same token, quantitative easing never produced core inflation because the money created never made it into the general economy.

This also means that quantitative easing could not have had any material impact on the general economy, and only a muted impact on financial markets. The monetary stimulus of quantitative easing fundamentally failed to stimulate.

Having arrived at that conclusion, the next step was to test the conclusion using an independent metric. For this I downloaded the reported Real GDP data from the St Louis Federal Reserve for the same time period, January 1, 1997 to the present, and charted it against money supply growth, again using a baseline of January 1, 1997.

Two things at once leap out. First, prior to 2008 there was rough correlation between money supply, inflation, and GDP growth. Second, beginning in 2008, the money supply decoupled from GDP growth. There is no comparison to be made between the two measures after 2008. Drilling into the GDP and CPI numbers, however, is insightful. Notice what happens when we set a baseline of January 1, 2008 for both metrics:

For most of the decade since Janaury 1, 2008, the CPI inflation curve is above the real GDP curve. Thus, even while the economy was technically growing, inflation was growing faster, and the economy overall was losing ground to inflation. Only when we reset the baseline to January 1, 2016, do we see the real GDP curve rising above the CPI.

From January, 2008, until approximately July, 2017, the CPI curve lies above the GDP curve, yielding the same conclusion that a comparison of the money supply and stock indices produces--that there was little to no actual economic expansion under Barack Obama, and it is only during the past two years that the economy has expanded in real terms at all. All previous GDP "growth" from 2008 onward can be ascribed almost entirely to inflation.

A further note on Real GDP and inflation: the Real GDP data is "real" because it has already been adjusted to account for inflation, using "deflator" factors calculated by the Bureau of Economic Analysis (these deflator factors are similar in concept to CPI but differ in computation). The Real GDP data currently available from the St Louis Fed reports Real GDP in "chained 2012 dollars".

Yet if Real GDP is already adjusted for inflation, there should be no correlation between Real GDP and the CPI (the benchmark measure for inflation). Real GDP is supposed to reflect economic growth independent of inflation, and independence precludes correlation. We should no more see Real GDP and CPI following similar trend lines from a common base year than we should see stock market indices and the money supply following similar trend lines. Yet we see both.

These graphs show that, since 2008, there is a strong and persistent correlation between Real GDP and inflation via the CPI. Only very recently do the graphs deviate from each other. If Real GDP fully accounted for inflation, we should see significant variations between the trend lines, and we do not. We see this lack of correlation between 1997 and 2008, but the trend lines converge in 2008.

As the earlier graphs show, when we start from 2008 and 2016, Real GDP and CPI lie on very similar lines, and only in 2017/2018 do we begin to see any significant variation.

Thus, the conclusion from above is confirmed: The monetary stimulus of quantitative easing fundamentally failed to stimulate. It certainly did not stimulate the general economy. Looking at the trend line in GDP growth, very little if anything has had a stimulative effect on the economy. Stimulus would show as fluctuations in the trend line, appearing as the stock market bubbles did in the early 2000's, rising above the money supply only to drop back down again when the bubbles burst. The trend lines on GDP growth have been almost linear since the Great Recession.

Again quoting Milton Friedman, "One of the great mistakes is to judge policies and programs by their intentions rather than their results." The policies of the Federal Reserve might have been well intentioned, but, looking at the data those policies produced, looking at the results, can we truly say those policies have been appropriate, effective, and successful?

No, we cannot.

These data sets tell a story vastly different from what the legacy media has reported, and continues to report. The legacy media argues that, after the "Great Recession", economic growth resumed and has continued on largely the same trajectory under President Trump as under President Obama. However, that assertion ignores the fact that inflation overcame almost all of the economic growth of the Obama years. While CNN crowed that Barack Obama had been one of the "best" Presidents for the stock market, most if not all stock market gains appear to have been the result of the Federal Reserve printing money during his term of office.

Much like Russian Collusion, the Obama Recovery appears to have been a long, drawn-out hoax foisted upon the American people by a corrupted and co-opted legacy media, pushing a particular narrative without regard for what the objective facts themselves indicate. Not only has the United States gone through a demonstrable "lost decade" of economic stagnation from which it has only recently and still briefly emerged, but it has endured a "false decade" of media denials that such stagnation was even occurring. While the legacy media paints a picture of the US economy being rescued from collapse by the bold efforts of then Fed Chairman Benjamin Bernanke and President Obama, the real story is considerably less flattering: given that Ben Bernanke arguably triggered the 2008 financial crisis with a series of interest rate hikes in 2006, his program of "quantitative easing" failed to clean up the economic mess he helped cause, while the best that can be said of Barack Obama is that he did not make things measurably worse.

The real story is that, in many regards, financial markets have truly not recovered from the 2008 financial crisis, and we are seeing the after-effects of that massive correction reverberate more than a decade on. We are seeing financial markets dependent upon constant streams of new liquidity just to function normally day to day. We are seeing banks still failing "stress tests" that examine how their loan portfolios respond under "worst case" assumptions. We see large banks such as JP Morgan pulling cash out of their balance on deposit with the Fed in response to the Fed taking steps to trim its own very large balance sheet (the more the Fed sheds its portfolio of bonds acquired in the aftermath of 2008, the more cash banks pull out of the reserves on deposit with the Fed), thus triggering the September liquidity crunch.

The real story is that the Federal Reserve, and perhaps all of the world's central banks, have lost what little control over money supplies, interest rates, and financial markets they ever had.

The real story is that even as the legacy media covers the real story, it continues to bury the lede, and assure the world that all is well.

The real story is that central banks are locked into a perpetual cycle of money creation, and woe betide the currency whose central bank opts to stop the printing presses.

The real story is that the great unanswered question even now, more than a decade after the 2008 financial crisis, central banks still do not have an answer to the question "what happens when the music stops....again?"

Is the US headed for a repeat of 2008? It is quite possible--and there is no way to know for certain. The financial crisis of 2008 had its origins in the US, but first boiled over in Europe. Perhaps that history will repeat itself. Europe certainly has its share of banking and economic challenges, with the ECB arguably intentionally poisoning European banking systems with negative interest rates, even as Europe slides into recession and a chaotic Brexit looming on the horizon. It hardly requires a degree in economics or finance to envision a global banking crisis originating in Europe and spreading to the rest of the world.

What is certain is that central bank money printing cannot continue indefinitely. There is a limit, beyond which people lose faith in fiat money, where the printing presses simply will not suffice.

What is also certain is that the "too big to fail" big banks are inextricably tied to the Fed's current liquidity problems just as they were tied to the 2008 financial crisis.

And what is also certain is that this story, as with so many other relevant stories, has been and will continue to be under-reported and misreported by the legacy media. There will be no crisis acknowledged until the crisis is too big to be avoided.