The November Employment Situation Summary Report was good news for Wall Street and not-so-good for the Federal Reserve.

n normal times, a strong jobs market and surging worker paychecks would be considered high-class problems. But as the central bank seeks to stem persistent and troublesome inflation, this is too much of a good thing.

“The Fed can ill afford to take its foot off the gas at this point for fear that inflation expectations will rebound higher,” wrote Jefferies chief financial economist Aneta Markowska in a post-nonfarm payrolls analysis in line with most of Wall Street Friday. “Wage growth remains consistent with inflation near 4%, and it shows how much more work the Fed still needs to do.”

How strong was the November jobs report?

Total nonfarm payroll employment increased by 263,000 in November, and the unemployment rate was unchanged at 3.7 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in leisure and hospitality, health care, and government. Employment declined in retail trade and in transportation and warehousing.

263,000 jobs created in November is a nice big-sounding number, and presents as a sign the economy is doing well—too well for Fed Chairman Jay Powell’s purposes.

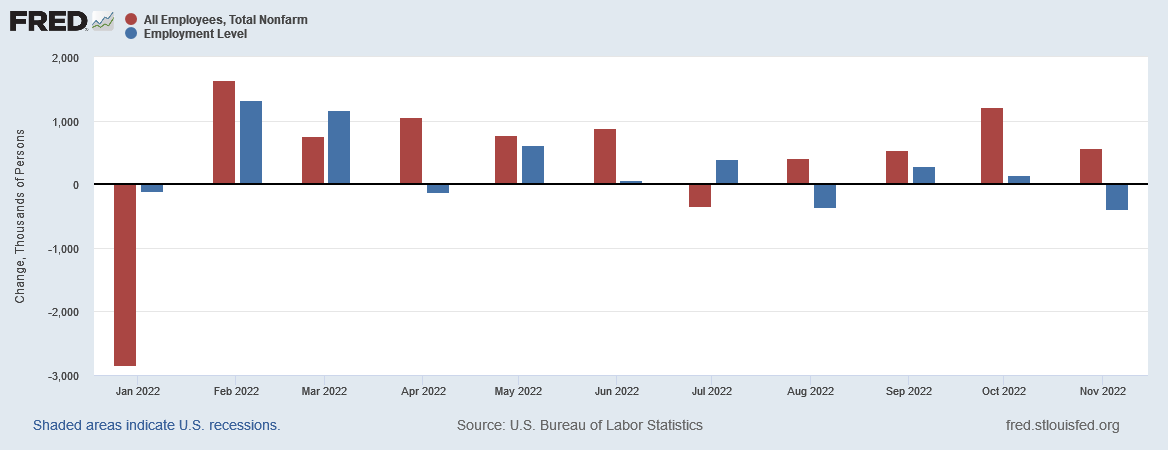

However, when we start comparing the tallies for the two surveys contained within the Employment Situation Summary, we straight away run into a problem: where are there 263,000 jobs?

The Establishment Survey is where we get the 263,000 jobs number, from the seasonally adjusted number of non-farm employees in the US.

However, when we look at the Household Survey side of the data, we see that jobs were actually lost, both in October and in November. With the Household Survey reporting a seasonally adjusted loss of 138,000 jobs, that leaves us right off the bat with a discrepancy between the two surveys of 501,000—a rather large margin of error.

That margin is even greater when we look at just the raw data—with an Establishment Survey gain of 574,000 and an Household Survey loss of 395,000, the discrepancy between the two rises to over 900,000 jobs.

Because the two surveys draw from different sources, we should expect some variance between the two, a variance of nearly one million jobs? That’s asking for a lot of credibility from a jobs report with a track record of relying on Lou Costello Labor Math for some of its figures, especially when it appears the November report is shaping up to be one of those “fudged” months.

Moreover, when we look at overall labor flows for November, the 263,000 jobs figure becomes simply indefensible. With the combined net flow from persons not in the labor force and unemployed persons into the employed category of -372,000, there is simply no way for there to be 263,000 new jobs created and being staffed during the month of November.

Moreover, the labor flows overall simply do not add up. With a net flow into the unemployed category of -163,000, net flow into the employed category of -372,000, for the net flow out of the labor force to be a paltry 75,000 seems mathematically impossible. To be in the work force one must be either employed or unemployed. If one is not seeking work, one is not in the labor force.

Even if there were not problems with how the Employment Situation Summary counts workers, we still have the reality that the summary’s “rising” payroll levels still far short of consumer price inflation, meaning that the real payroll growth is still a net loss of purchasing power for workers.

In short, the November Employment Situation Summary is little more than Lou Costello Labor Math from top to bottom and from start to finish. It is a work mainly of fiction, with numbers that are too far removed from reality to give us any meaningful insight into the state of employment currently.

The corporate media, as per usual, ignores the patent unreality of the numbers, preferring to sustain the government narrative of robust job growth and a robust economy.

The real danger from these patently unrealistic jobs figures is that Jay Powell and the Federal Reserve are going to treat them as legitimate—and the presence of apparently robust job growth in the US economy means he still must hike rates even further to choke off labor demand and drive the US recession even deeper. With the FOMC meeting in just under two weeks, the probabilities of another 75bps rate hike just jumped dramatically.

That will not be good news for the US economy, and so neither is this BLS masterwork of Lou Costello Labor Math, which once again aims to lead the US down an economic rabbit hole to an uncertain end.

I complained loudly and frequently that our hallowed scientist and bureaucrats couldn't seem to count COVID cases.

Seems it's just a fact of life that governments can't count, and accuracy was never the goal.

Look at this job..... unbelievable..... https://markcrispinmiller.substack.com/p/if-you-want-to-work-and-dont-mind?utm_source=post-email-title&publication_id=383085&post_id=87682194&isFreemail=true&utm_medium=email