In what is sure to be yet another hopeful sign for diehard believers in a Fed “pivot”, inflation as measured by the Consumer Price Index came in below expectations, at 7.7% year-on-year.

Most notably, inflation declined across all major components of the Consumer Price Index except shelter, which continues to show steadily rising shelter price inflation.

This is significantly below the Cleveland Federal Reserve’s inflation nowcast projection for October, which has been holding steady ~8.1% for most of October and beyond.

As late as yesterday, most economists were expecting an inflation figure of 8% year-on-year.

Economists expect monthly and annual core readings to dip from September, and the headline annual rate to fall to 8.0% from 8.2%. That would be the lowest since February.

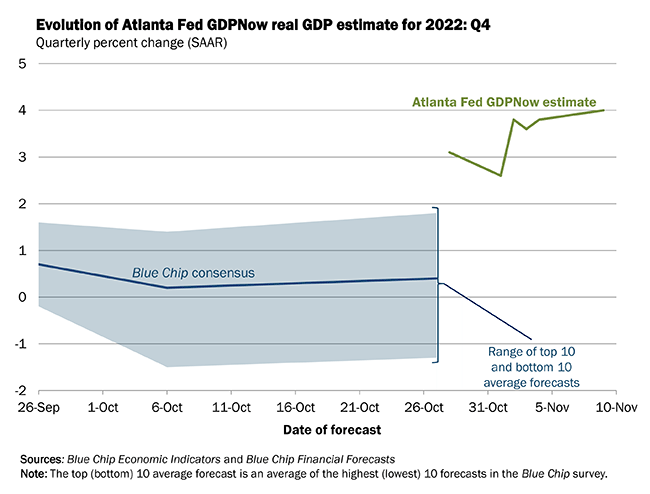

Somewhat paradoxically, this inflation report comes even as the Atlanta Fed’s GDPNow nowcast projects fourth quarter GDP growth of 4%.

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2022 is 4.0 percent on November 9, up from 3.6 percent on November 3. After last week's employment situation report from the US Bureau of Labor Statistics and this morning's wholesale trade report from the US Census Bureau, the nowcasts of fourth-quarter real personal consumption expenditures growth and fourth-quarter real gross private domestic investment growth increased from 4.0 percent and 0.7 percent, respectively, to 4.2 percent and 2.1 percent, respectively.

The general expectation is that higher rates of economic growth result in higher consumer price inflation, rather than lower, which puts the BLS Consumer Price Index data somewhat at odds with the Federal Reserve’s economic projections.

Are the Federal Reserve’s interest rate hikes starting to take effect? No doubt, that will be the prevailing view in certain circles, and especially on Wall Street, which will take the cooler inflation numbers as reason enough for the Fed to at least pause on further rate hikes.

Whether Jay Powell will share Wall Street’s inevitable optimism remains to be seen.

"Whether Jay Powell will share Wall Street’s inevitable optimism remains to be seen."

My prediction: He does not.