Producer Prices Just Blew Up. Are Consumer Prices Next?

Why The Latest Price Surge Is A Problem For Trump And Powell

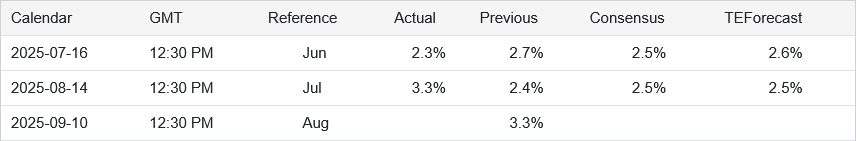

The July Consumer Price Index Summary showed consumer price inflation heating up.

The July Producer Price Index shows consumer price inflation could be heating up for the next few months.

The Producer Price Index for final demand rose 0.9 percent in July, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices were unchanged in June and moved up 0.4 percent in May. (See table A.) On an unadjusted basis, the index for final demand advanced 3.3 percent for the 12 months ended in July, the largest 12-month increase since rising 3.4 percent in February 2025

The PPI did not simply come in hotter than had been forecast. It surged well above the consensus forecast as monitored by Trading Economics.

The July producer price report was the strongest forward signal of coming inflation that the US economy has had in months.

This is not a good sign. It is not a good sign for the economy. It is not a good sign for Wall Street. It is not a good sign for President Trump, who is at last having to confront the probability that the Liberation Day tariffs are very likely contributing to inflation’s rise.

Remember how I have said all along that tariffs were always an inflationary price pressure? The July Producer Price Index report is why I have taken the time to draw that distinction.

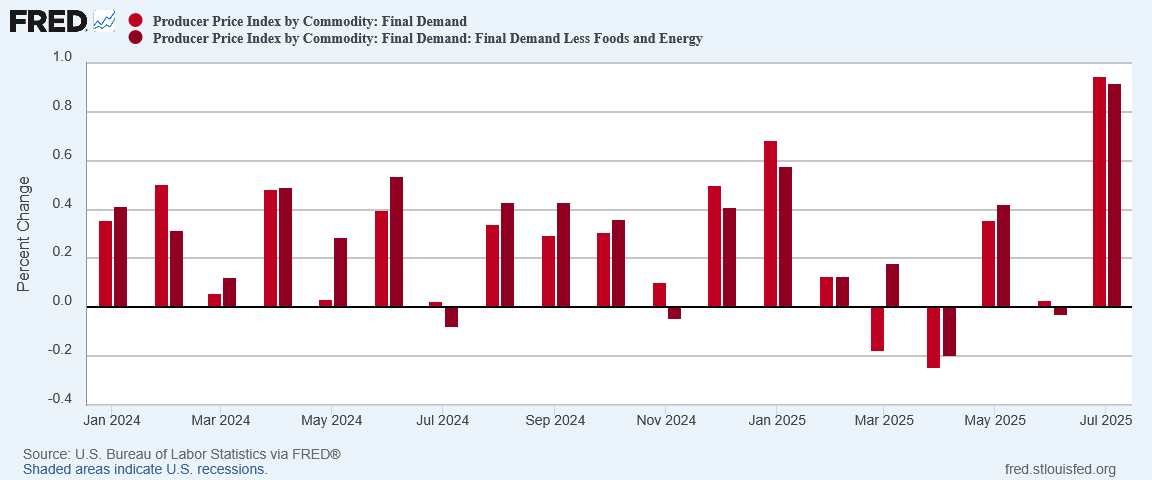

There is no escaping the magnitude of the surge in producer prices for July. It was big.

It was big month on month, with both headline and core producer price inflation rising 0.9%.

July was the largest increase month on month since March, 2022.

It was big year on year, with headline inflation rising 3.3% and core inflation rising 3.7%.

This was the largest rise in headline producer price inflation since February.

The PPI is indisputably signalling a near future of higher inflation. How much higher will consumer price inflation get? Less than we might presume the PPI to signal at first glance.

While the PPI can be a leading indicator of future consumer price inflation, we do well to note that the PPI is a more volatile index than the CPI, as we can see when we look at their year on year prints through the 2022 hyperinflation cycle.

Producer price inflation surged much higher than the consumer price index, and when disinflation set in fell much lower than the CPI.

It is unlikely that consumer price inflation will rise beyond 3%-3.2% year on year over the next few months based solely on the July PPI surge. To be clear, that would be a significant—and narrative-altering—uptick in consumer price inflation, although still not as large the 2022 hyperinflation cycle.

If the PPI surge in July presages an August surge in the CPI, it would give Jay Powell reason to postpone yet again a reduction in the federal funds rate.

Why did prices surge? A closer examination of the data underneath the headline figures shows there are likely a number of forces at play. The Liberation Day tariffs are almost certainly one inflationary pressure, but they are hardly the only one.

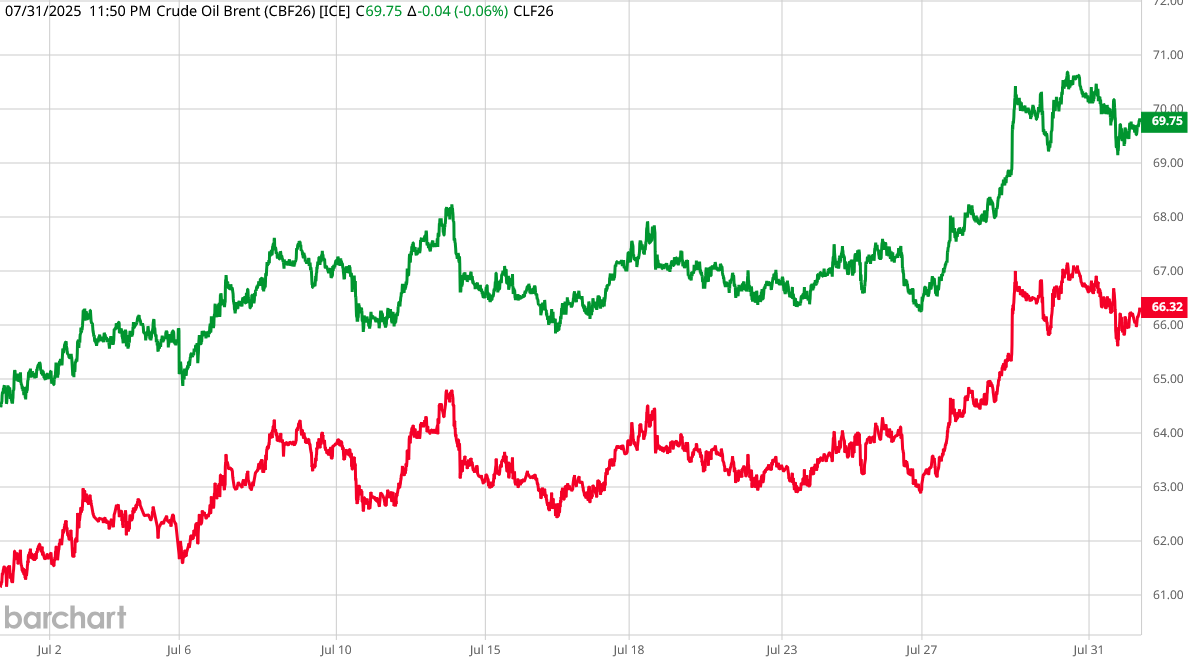

Energy price inflation was very much a factor, as July’s print was marginally higher than June’s PPI print for energy.

This was to be expected, given the rise in oil prices during July.

We should also take note of the recent increases in diesel prices.

Rising diesel prices were specifically identified as a factor in rising producer prices for intermediate demand.

Energy’s role in rising prices warrants notice because energy was specifically exempted from Donald Trump’s Liberation Day tariffs. Energy price inflation can be caused by many things, but tariffs simply are not among them.

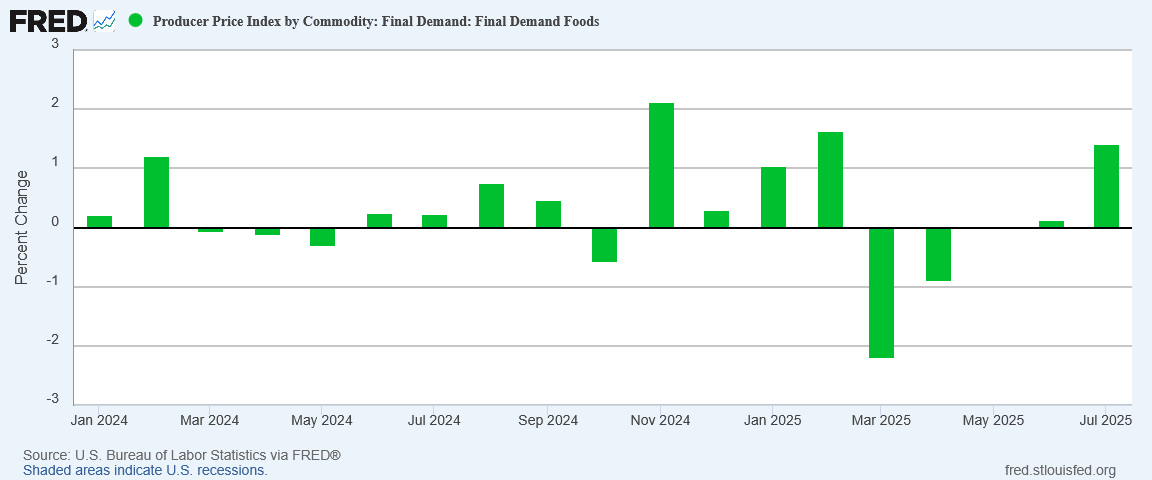

Food producer prices also surged in July.

Food price inflation was identified as a major contributor to overall goods price inflation.

A quarter of the July advance in the index for final demand goods can be traced to prices for fresh and dry vegetables, which jumped 38.9 percent. The indexes for meats, diesel fuel, jet fuel, nonferrous scrap, and eggs for fresh use also rose.

The impact of food and energy price inflation on goods prices can be seen when we compare overall goods prices to goods less food and energy.

Roughly half of the increase in goods price inflation is attributable to increases in food and energy prices, and tariffs are not going to be a culprit for that half.

Also not likely to be tariff-driven is the rise in service prices.

Within the BLS analysis, service prices accounted for three-quarters of the overall increase in producer price inflation.

While the Producer Price Index is signalling significant future consumer price inflation, the composition of that signal precludes tariffs for the bulk of that increase.

Although tariffs are demonstrably not the only inflationary pressure within producer prices for July, and certainly not the leading inflationary pressure, we should not blind ourselves to the potential for tariffs to be contributing to producer price inflation.

When we exclude food and energy goods, we are still looking at a significant increase in goods prices from June.

We are also faced with a surge in producer prices across the phases of intermediate demand.

While energy price inflation is a factor within rising producer prices for intermediate demand, rising goods prices exclusive of food and energy demonstrates that energy price inflation is not the only factor. Straight away that leaves ample room for tariffs to play a role in rising producer prices.

Another reason to consider tariffs as a potential culprit is the mixed pricing signals we see in commodities prices for July.

Commodities prices were trending somewhat higher for most of July, before showing significant reversals at the end of the month. Clearly some input prices were rising in July, although perhaps not all.

Thus when we consider the likely roles all potential pricing factors played in moving July producer prices higher, we cannot reduce the role played by tariffs to zero, even as we reduce that role to a relatively minor one.

Politically, the presence of diverse inflationary forces in the July PPI print makes the report a political problem for both Donald Trump and Jay Powell, as it undercuts both of their economic narratives.

The surge in producer price inflation, and the likely increases in consumer price inflation over the near term the surge anticipates, are a major contradiction to Donald Trump’s narrative of economic health and vitality. Surging inflation is a sign of many things, but a healthy economy is not one of them.

At the same time, the fairly minor role tariffs are playing in that producer price surge continues to dismantle Jay Powell’s insistence that tariffs are going to drive consumer prices higher over the near term. Thus far, tariffs have not done so, and are not signalling they are about to do so. While we can reasonably presume that tariffs are indeed contributing to higher prices, we must at the same time acknowledge that contribution is a minor one. Other factors are considerably more influential.

This was not a good producer price report. This report advanced nobody’s economic narrative. Corporate media’s “blame Trump” narrative is not advanced by this report. Jay Powell’s “tariffs are bad” narrative is not advanced by this report. Donald Trump’s “economy is booming” narrative is not advanced by this report.

Narratives aside, the July Producer Price Index report is telling us to prepare for more inflation rather than less in the coming months. That’s not good news for both Main Street and Wall Street.

Not the news we were hoping for. And, although you’ve noted that the data does not advance corporate media’s “it’s Trump’s fault” narrative, they WILL use that headline. And the worldwide tariffs are just getting started, so they will use that as fuel. I’m expecting lots more Trump Derangement Syndrome during the coming months.

Two nitpicky questions, Peter. Government data is frequently “seasonally adjusted”. Gas prices almost always go up during the summer, so do you know if the figures given here are seasonally adjusted? And vegetable prices going up 38.9% - what the hey? That’s huge, and the only factor I can think of is that much of the illegal labor force for harvesting has been deported, and now the farmers are having to pay a living wage. Do the government reports give reasons why the price for veggies soared?

As always, Peter, thank you for your factual reporting and great analysis!

Peter, OT but very interesting:

https://open.substack.com/pub/autonomoustruckers/p/an-open-letter-to-the-vestigial-remains?r=bbwgp&utm_medium=ios