The ADP Payroll Report Shows Strong Gains...But Strong Enough?

Data Shows Job Recovery Still Has A Long Way To Go

There is no denying the obvious: Adding 807,000 jobs to private payrolls in a single month is a strong performance. That top-level number from the December ADP National Employment Report is unequivocally good news. So, too, are the job numbers when broken down by various categories:

Small, Midsized, and Large companies all reported employment gains of 200,000 or more (Large companies did the best with 389,000).

Goods-producing sectors and service sectors saw gains (138,000 and 669,000, respectively).

Leisure and Hospitality saw 246,000 jobs added in December.

As is to be expected, the media was uniformly upbeat and positive about the numbers.

From CNN:

A closely watched barometer for the job market offered a happy surprise for the new year: The ADP Employment Report was doubly as strong as expected in December.

Economists had predicted 400,000 private sector jobs were added last month, but the report came in at a whopping 807,000.

From US News & World Report:

Employers added a massive 807,000 jobs in December, a strong end to 2021 and a good omen for 2022, private payroll firm ADP reported on Wednesday.

The number was more than double estimates of 360,000 and compares with 534,000 jobs added in November.

While the numbers are undeniably good, the question that must be asked is “are they good enough?” The answer is far from certain.

New Jobs? Or Just Different Jobs?

As I argued in my last article, the November JOLTS report painted a muddied and uncertain picture of the state of employment in the US. In spite of continued high job openings, the number of unemployed workers per job opening remained stuck at 0.7, and the numbers only managed to move the labor force participation rate up 0.1%.

Additionally, what many commentators have termed the “Great Resignation” continued in November, with 4.5 million individuals quitting their jobs in November.

The December ADP report may give some explanation as to why. As Forbes notes, many people may have quit their jobs in November to move into other jobs, and thus were counted in the December ADP report.

The JOLTS report also showed a decrease in job openings in November. The Great Resignation continues as the “quits” rate remained high. In the light of Wednesday’s ADP report, it may be that workers were simply quitting one job to take another job. Friday’s Employment Situation report could provide greater insights to these job market developments.

Such a migration trend would also explain how a seeming strong jobs market with ample demand for labor fails to make significant inroads into the labor force participation rate. With the extraordinarily high job churn indicated by a persistently high quits rate in JOLTS, the ADP report (and the official government stats due out on Friday) would need to report an even higher number of jobs added to show significant net jobs added.

Still Feeling The Effects Of COVID Lockdowns

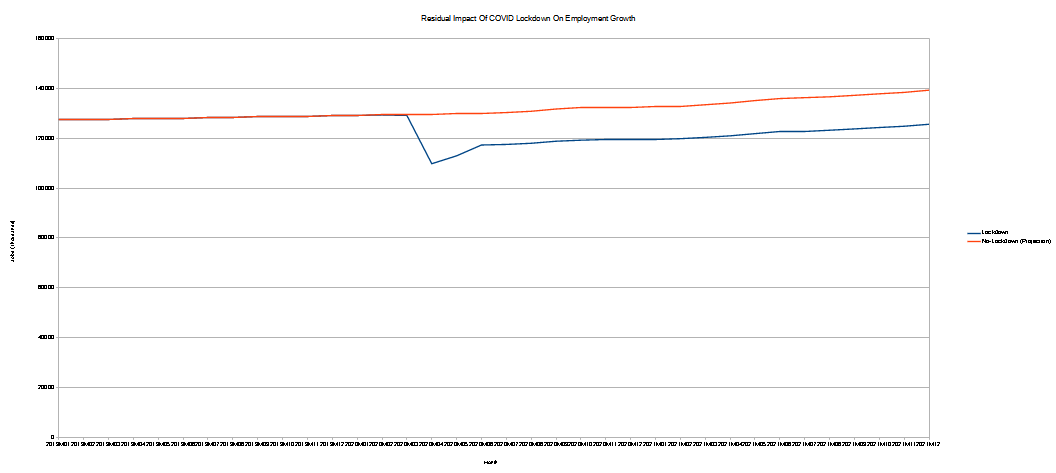

Nor can we view the December numbers in isolation. As ADP’s own data shows, even after 20 months of “recovery” the United States is still feeling the effects of the 2020 lockdowns due to the COVID pandemic.

March and April of 2020 saw huge numbers of jobs lost in this country—approximately 20 million (~15% of total jobs at the time). From May of 2020 through December ~15.9 million of those jobs have been restored, and the country still faces a deficit in jobs of roughly 4 million just to get back to pre-pandemic levels.

Moreover, the past 20 months of job recovery is 20 months of no new net job creation by definition. If the job additions of the past 20 months had occurred but without the lockdown’s destruction of some 20 million jobs, the United States would have some 13 million more jobs than it does today.

(Note: the impact of the lockdown was “eliminated” for conceptual purposes by imputing the percentage job gains of November, 2019 through February, 2020 into March, 2020 through June, 2020. This eliminated not only the dramatic drop in employment in March and April but the “rebound" effect in May and June as well. The percentage gains for all subsequent months remained as reported in the historical data.)

Even if the United States merely replicated the job gains and losses of the 22 months that preceded the lockdown during the two months of lockdown (March and April, 2020) plus the 20 months since, there would still be 7 million more jobs today than there are.

While projected numbers are always open to debate, what is not open to debate is that, had pre-pandemic employment trends continued, a great many more people would be employed in the US than there are today. The labor force participation rate would be higher than it is today.

Much More Is Needed. Not Much More Is Likely.

Even with the strong December numbers, as ADP’s own historical data shows, many more such strong months are needed before the United States can claim to have fully eliminated the job loss consequences of the lockdown.

Unfortunately, as ADP’s own historical data shows, after the crash in employment in 2020, there were 2 months of strong rebounding job numbers, after which job growth in this country largely returned to the long-term historical trend of <1% job growth month-on-month. Even the December numbers, strong as they are, represent job growth of only 0.65%. Month-on-month job gains of 2% or better are simply not likely scenarios based on the current situation, even though such gains are what the economy needs to fully recover.

The ADP National Employment Report does show strong numbers. It does show marked improvement in the nation’s employment.

It also shows the nation will be recovering from the COVID lockdown for many more months (years?) to come.