The "Experts" Finally Get It: Inflation Is Economic Poison

But Do Any Of Them Actually Understand Why?

As inflation in this country has gotten steadily worse, even the corporate media has swung around to a narrative of “recession is imminent”—with the primary culprit for said imminent recession not being inflation but rather a Federal Reserve “misstep” in its campaign to halt consumer price inflation by raising interest rates.

Big picture: Demand is slowing as customers balk at higher prices and talk of recession grows. While labor and supply shortages persist, high inflation and rising interest rates are overtaking them as the biggest worry of business.

The Federal Reserves hopes to quench inflation by sharply raising interest rates and tempering demand, but a central bank misstep could also drive the U.S. into recession, economists warn.

What the media—and the government’s economic “experts” at the Fed—continue to misunderstand, however, is that rising inflation means the recession has already arrived. The forces of economic contraction have already surpassed the forces of economic expansion, and now it is simply a matter of time before that contraction results in declining GDP. The Fed has already made the crucial “mis-steps” by not addressing honestly the consequences of the pandemic-era lockdowns and the ginormous fiscal and monetary “stimulus” measures that were taken as a result.

The Damage Has Already Been Done

As I noted at the beginning of the year, even a cursory inspection of the inflation numbers reveals the US economy to be gravely imbalanced and horribly distorted.

The corporate media at the time pushed the narrative that inflation was actually an indicator of robust economic health.

Much of the surge is actually a consequence of healthy economic trends. When the pandemic paralyzed the economy in the spring of 2020 and lockdowns kicked in, businesses closed or cut hours and consumers stayed home as a health precaution, employers slashed a breathtaking 22 million jobs. Economic output plunged at a record-shattering 31% annual rate in last year’s April-June quarter.

Everyone braced for more misery. Companies cut investment. Restocking was postponed. A brutal recession ensued.

But instead of sinking into a prolonged downturn, the economy staged an unexpectedly rousing recovery, fueled by vast infusions of government aid and emergency intervention by the Fed, which slashed interest rates, among other things. By spring this year, the rollout of vaccines had emboldened consumers to return to restaurants, bars, shops and airports.

Suffice it to say, the corporate media was completely wrong. None of the post-lockdown economic trends have been “healthy”, and the Fed’s interest rate manipulations have been at best not helpful and at worst extremely harmful.

The disruptions and dislocations of the lockdowns, the fiscal “stimulus” measures of the Federal government, as well as the insane money-printing by the Federal Reserve all set the stage for the dramatic upturns in inflation we are witnessing now. The economic damage depicted by today’s high inflation was inflicted long ago, from the moment the first lockdown measures began.

(Note: The Federal Reserve’s equally delusional Quantitative Easing policies that began after the 2008 Great Financial Crisis are also a significant contributing factor. I intend to discuss that aspect separately and so am not opening that can of worms here.)

Muddying The Waters: Which Inflation Measure Is The “Right” One?

While the corporate media—and even much of the alternative media—focuses on the Consumer Price Index as the barometer of inflation in the United States, to fully comprehend the state of confusion that exists among both the media and the “experts” one must understand that the CPI is not only not the only inflation metric out there, the Federal Reserve doesn’t even use it much.

The Federal Open Market Committee (FOMC) judges that an annual increase in inflation of 2 percent in the price index for personal consumption expenditures (PCE), produced by the Department of Commerce, is most consistent over the longer run with the Federal Reserve’s mandate for maximum employment and price stability. The FOMC uses the PCE price index largely because it covers a wide range of household spending. However, the Fed closely tracks other inflation measures as well, including the consumer price indexes and producer price indexes issued by the Department of Labor.

Thus, while the media focuses our attention on the CPI metric, the Federal Reserve is actually making decisions based on a completely different metric.

Small wonder Jay Powell frequently sounds insane. He’s speaking Greek and pretending it’s English.

What is this “Personal Consumption Expenditures” index to which the Federal Reserve genuflects over the Consumer Price Index? Fundamentally, it is an index based on more or less the same data as the CPI, albeit with a different measurement methodology.

PCE measures the goods and services purchased by “persons”—that is, by households and by nonprofit institutions serving households (NPISHs)—who are resident in the United States. Persons resident in the United States are those who are physically located in the United States and who have resided, or expect to reside, in this country for 1 year or more. PCE also includes purchases by U.S. government civilian and military personnel stationed abroad, regardless of the duration of their assignments, and by U.S. residents who are traveling or working abroad for 1 year or less.

While the PCE index is a measure of expenditures, the CPI is a measure of prices.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a representative basket of consumer goods and services. The CPI measures inflation as experienced by consumers in their day-to-day living expenses. Indexes are available for the United States and various geographic areas. Average price data for select utility, automotive fuel, and food items are also available. CPI indexes are used to adjust income eligibility levels for government assistance, federal tax brackets, federally mandated cost-of-living increases, private sector wage and salary increases, poverty measures, and consumer and commercial rent escalations. Consequently, the CPI directly affects hundreds of millions of Americans.

While both metrics attempt to gauge changes in consumer purchases, the subtle distinction in focus results in a different presentation of inflation—and in particular the magnitude of inflation.

Consequently, inflation measured by the PCE index tends to understate both inflation increases and decreases relative to the CPI.

Note that inflation as a 12-month percent change in PCE is not only less than the corresponding value based on the CPI, but the disparity is widening. Given that PCE change peaks and troughs are consistently muted relative to the CPI, it is not a reach to conclude that the PCE systematically understates consumer price inflation.

This brings up an important point to understand about both the CPI and the PCE as inflation metrics—they both arguably understate the magnitude of actual inflation in this country.

Economist Walter J. “John” Williams, creator of the “Shadow Government Statistics” web site and alternate metrics for a variety of government-produced economic indicators, gives a very detailed and compelling discussion of the how and the why behind the CPI’s structural understating of inflation. The ShadowStats Alternative CPI metric seeks to unwind some of the structural distortions he believes exist in the official CPI, and, as those who follow the ShadowStats indices are well aware, suggest that actual inflation is considerably higher than the official CPI numbers indicate.

Why do I not use the ShadowStats CPI metric? The reasons are both economic and methodological. Access to the ShadowStats data is a subscription service. Not only would I have to pay for access to the data, but I can’t simply link to or otherwise provide access to that data within my articles without violating intellectual property rights.

In order to ensure people can interrogate my analyses and thoughts directly, I need data that is effectively “open source” that anyone can freely access. While the ShadowStats arguments for developing an alternative CPI metric are compelling, the proprietary nature of its alternative CPI metric makes it unsuitable for direct inclusion here. Readers are encouraged, however, to look at the publicly available ShadowStats charts and presentation in order to get a fuller picture of the inflation phenomenon.

Inflation Is Simple: Rising Prices

Inflation is perhaps the easiest of all economic measurements to grasp. Simply put, inflation means rising prices.

Inflation is the increase in the prices of goods and services over time. Inflation cannot be measured by an increase in the cost of one product or service, or even several products or services. Rather, inflation is a general increase in the overall price level of the goods and services in the economy.

However, this basic definition risks overlooking two important characteristics of inflation—and the corporate media article reference at the beginning certainly overlooks both of them.

The first is that, as I have noted many times before, inflation is not created equal. This is immediately obvious from even the CPI charts put out by the BLS.

We see the same unequal changes within the PCE data sets as well.

Thus inflation is not merely a rise in prices but a distortion in relative price levels—and that is an indicator of economic disequilibrium.

The second characteristic of inflation is that it is an erosion of actual economic output. All inflation by definition is a reduction in economic output. This is made very clear when we use either the CPI or the PCE as a “GDP Deflator” to remove the effects of inflation from nominal GDP shifts over time.

Even small notionally “positive” amounts of inflation over time are a signicant reduction in economic output. There can therefore be no such thing as a “good” level of inflation, even though the Fed claims a 2% year-on-year inflation rate is good for the economy—”balderdash” is the polite term for that thinking.

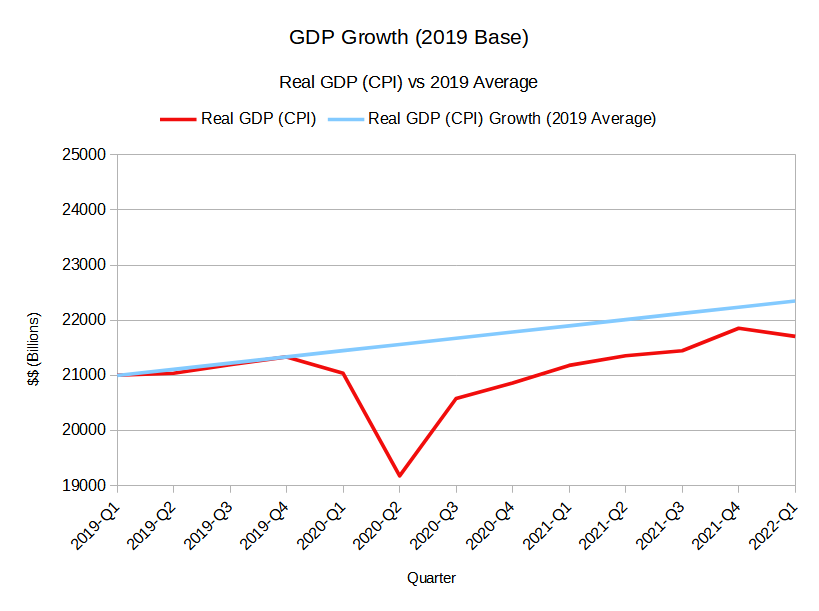

This also debunks the media narrative of inflation being the result of “robust” economic growth. When we look at the nominal growth of GDP from 2019 forward, nominal economic growth exceeded the 2019 average rate extrapolated forward around the 3rd quarter of last year.

In other words, on the surface the economy is better now than before the pandemic.

However

That same comparison on the “real” GDP figures with the effects of CPI-measured inflation factored in shows the economy has not yet crossed that threshold, even though it is already contracting.

In other words, once you account for inflation, economic growth has hardly been robust, nor has it yet overcome the effects of the lockdown induced contraction of 2020.

The media has been pushing a narrative driven primarily by the nominal GDP growth curve, while the reality is closer to the Real GDP (CPI) growth curve. If one were to access the Shadowstats CPI data and apply the same analysis, it would almost certainly paint an even less flattering picture of economic growth.

Inflation Is Economic Poison

Regardless of why inflation occurs—and there are a myriad of reasons why inflation erupts in an economy—it is always an economic toxin. If I were to attempt a metaphor involving the human body, inflation would be those toxic byproducts the liver and kidneys flush out of our bodies daily—and which would kill us if they remained.

Similarly, as the effects of inflation accumulate over time, the result is an economy that is substantially less than it otherwise would have been. When inflation is allowed to grow unchecked, the rising disequlibriums within the economy that it produces will create more and more economic distress until at last there is a reversion to equilibrium—which is an economic “crash”.

Which is also why the Fed’s efforts to check inflation must result in a contraction in every instance. A successful check on inflation moves the economy back towards the equilibrium state, which means that at best the Fed is buffering the “crash” that would otherwise be inevitable. A “buffered” crash is still going to be a contraction, merely without the suddenness (and hopefully some of the magnitude) of the unbuffered crash. For the Fed to pretend that this is not the case is simply nonsensical in the extreme.

The corporate media and the economic “experts” at the Fed have reluctantly come around to the realization that inflation is economic poison. They have embraced the notion that inflation must be checked or worse economic dislocations will occur. Yet with their pollyannish optimism that inflation can be checked without recession, they are showing just how far removed from reality their thinking still is.

Despite the shift in rhetoric, both the Fed and their corporate media apologists are still very much clueless on what inflation is doing to the economy. That gives no comfort on what the Fed’s future actions to combat inflation will bring. Just as they do not understand what inflation’s true impact on the economy is, they have no idea what impacts their corrective measures will bring.

Brace for those impacts. They will not be mild.

PCE Data can be downloaded from the Bureau of Economic Analysis here.

CPI Data can be downloaded from the Bureau of Labor Statistics here.

GDP Data can be downloaded from the Federal Reserve here.

Buffered crash....oy. Praying for wisdom as we watch 401k melt away...

“The way to crush the bourgeoisie is to grind them between the millstones of taxation and inflation.”

--Vladimir Lenin