The Jobs Recession Is Here

There Is No Economic Growth When There Is Sustained Jobs Loss

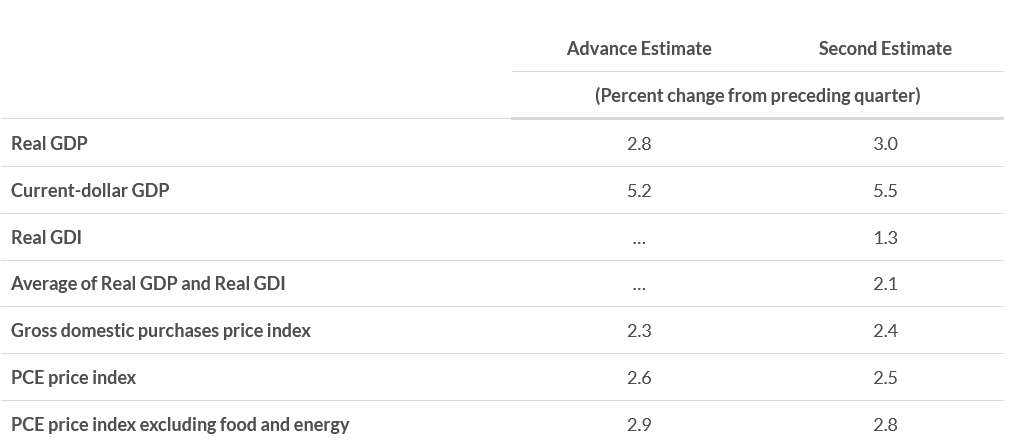

According to the Bureau of Economic Analysis, the US economy grew at a healthy 3% during the second quarter of 2024.

Real gross domestic product (GDP) increased at an annual rate of 3.0 percent in the second quarter of 2024 (table 1), according to the "second" estimate released by the U.S. Bureau of Economic Analysis. In the first quarter, real GDP increased 1.4 percent.

This is, of course, good news…if it is accurate. Is it?

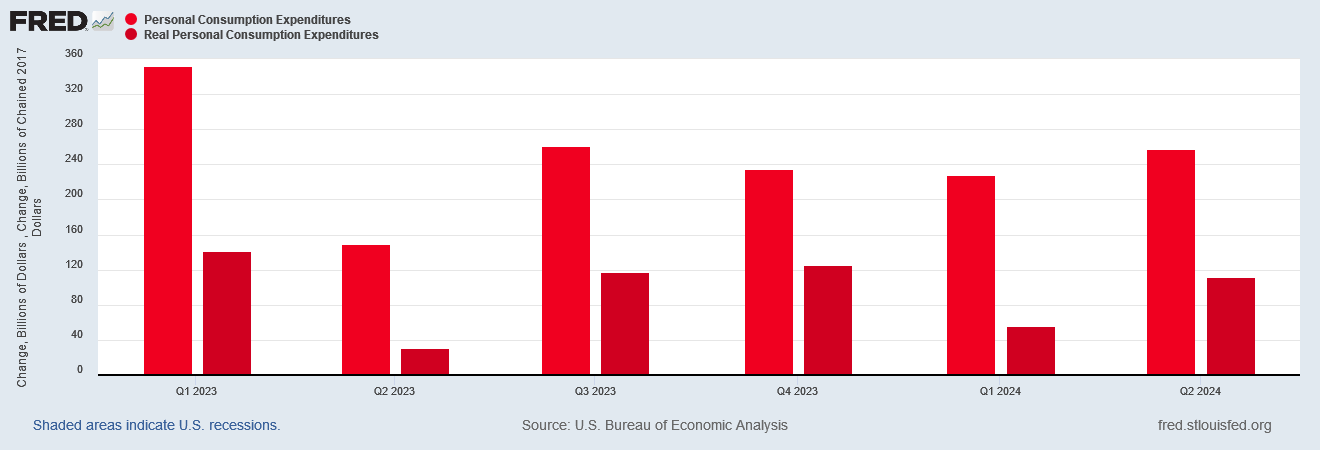

We have reason to be skeptical. Not only is joblessness on the rise, but personal consumption expenditures, which the BEA credits with a bulk of the Q2 growth, have been getting softer, not more robust.

Both of these are problems.

Presumably, consumer spending led the way in powering economic growth for the quarter.

Consumer spending, which accounts for about 70% of U.S. economic activity, rose at a 2.9% annual rate last quarter. That was up from 2.3% in the government’s initial estimate. Business investment expanded at a 7.5% rate, led by a 10.8% jump in investment in equipment.

To be sure, the BEA is telling people that is what the data shows.

Certainly the data shows what appears to be substantial rises.

However, when we look at the dollar shifts in personal consumption expenditures, the quarter’s growth is clearly a lesser amount than has been the norm in the past.

Moreover, the widening gulf between nominal and “real” personal consumption expenditures indicates inflation might not be all that well tamed. When we zero in on the data since the start of 2023, it becomes clear that the real expenditures are softer in 2024 than they were overall in 2023.

When we look at the Personal Consumption Expenditure Price Index and the GDPDeflator index the Fed uses in calculating GDP data, we see that inflation has indeed increased, and by more than what we should count as economic growth.

This is not performance one associates with a robust and growing economy. It’s an economy that is still sending out danger signals.

The assessment that the economy is expanding is even harder to accept when one considers that joblessness is on the rise in this country.

That the data shows joblessness to be rising is absolutely indisputable.

Rising joblessness is accepted as part of the backdrop in the latest Bankrate job seekers’ survey.

Today, that’s no longer the case. The U.S. job market has been slowly weakening over the last few months, as further evidenced by the latest jobs report. The economy added far fewer jobs than expected in July — just 114,000 — the third time in the past eight months that job growth has fallen below 200,000. The unemployment rate, meanwhile, unexpectedly jumped 0.2 percentage points to 4.3 percent.

Even corporate media grudgingly concedes that job markets have “cooled”.

Last month, U.S. employers added just 114,000 jobs, well below the 175,000 projected, and the unemployment rate leaped from 4.1% to 4.3%, highest since fall 2021. The developments triggered recession fears and a steep market sell-off until encouraging data on retail sales and layoffs calmed nerves. The Labor Department’s recent preliminary revisions renewed some of the worry, revealing the economy added an average 174,000 jobs a month in the year ending this past March, down from the 242,000 first estimated.

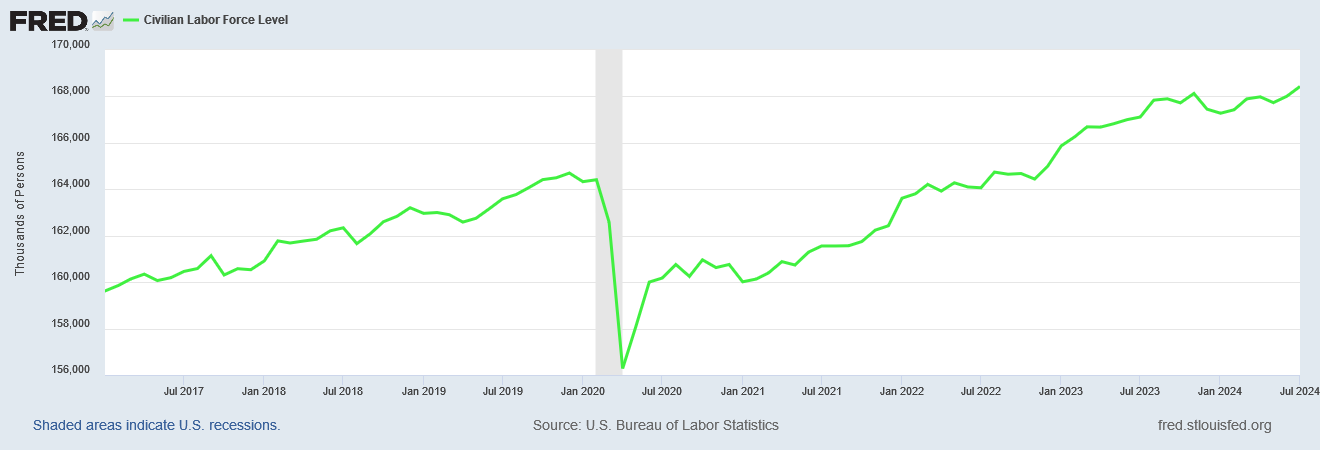

To be sure, the labor force has been growing overall, and that means people are going to work. As far as that goes, that’s a good thing.

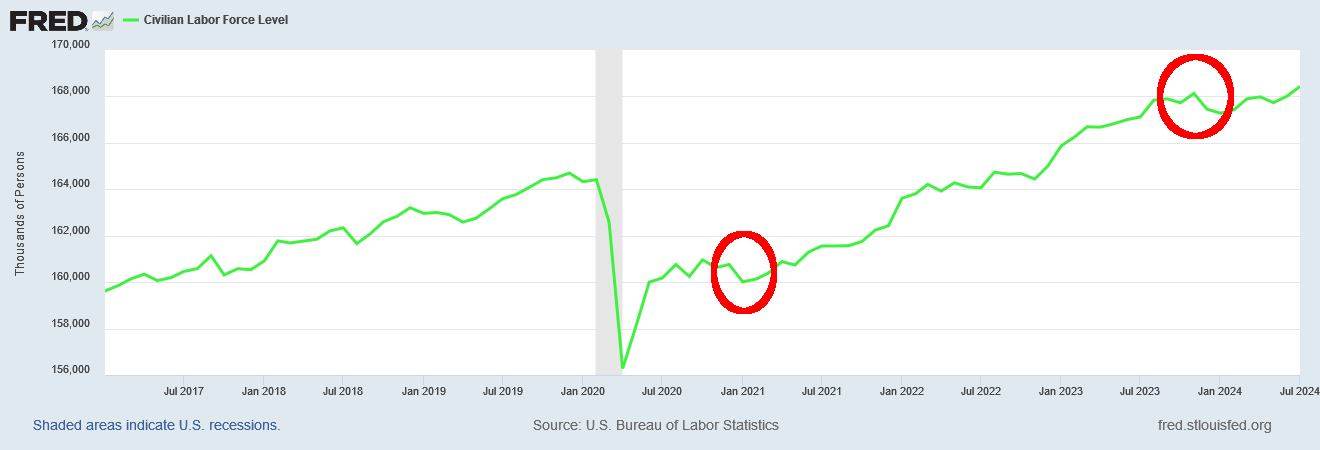

However, what constantly gets overlooked is the existence of key inflection points where the growth trend shifts.

During the Biden-Harris Administration, those shifts have not been positive ones.

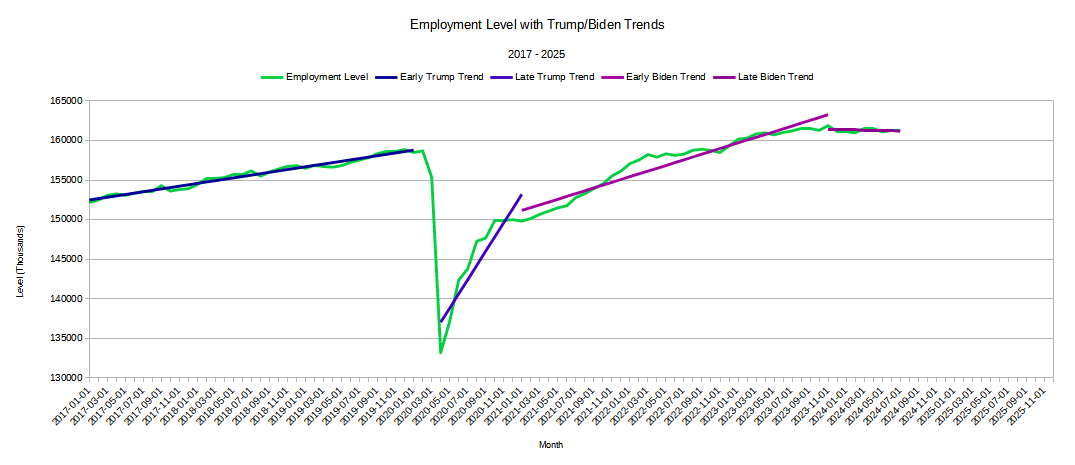

This becomes readily apparent when we fit trend lines to the labor force data. Factoring in for the dislocations of the COVID Pandemic Panic nonsense, since 2017 we see four definable trends within the labor force data.

During the Trump Administration pre-COVID, the trend was one of fairly steady growth within the labor force. The COVID Pandemic and associated lockdowns naturally threw growth trends for a loop, but by the time the 2020 recession ended labor force growth under Trump resumed at a predictably faster rate than pre-COVID.

However, when the Biden-Harris dynamic duo took office, the trend shifted down. The labor force continued to grow, but at a significantly slower rate.

The trend lines show an additional inflection point in November of 2023, when labor force expansion in this country slowed yet again.

The impact of these shifts becomes clear if we extend the trend lines out into 2025.

Extrapolating trends is, of course, assumes that all factors remain the same with the same influence to the same degree. That is a dangerous assumption for prediction, but we’re on safe ground using them to illustrate what the shifts within the trends mean overall.

What they illustrate is that at the pace of labor force expansion under Donald Trump post-COVID lockdowns, the labor force would have by October of this year reached the same level the Trump Administration would have reached had the COVID lockdowns not disrupted the labor force as much as it did.

What they also illustrate is that the trend intially under Biden-Harris would not have caught up to the initial Trump growth trend until October of next year. The Biden-Harris Administration was on a path of jobs recovery, albeit a slow one, up until last November.

Which brings us to the particularly troubling trend, the one we see in the labor force expansion currently. With the slowdown in growth from November, the labor force never catches up to the early Trump trend. In terms of workers contributing to the economy we are not on track to ever getting back to where we should be had it not been for the lunacy of the lockdowns.

Looking at the overall civilian labor force means we are looking at employed and unemployed workers. However, if we focus on just the employed we see the same two inflection points within the overall data.

Removing the unemployed from the analysis has the effect of removing a buffering influence within the data which moderates the trends somewhat. We see this especially in the “Late Trump” trend—the post-COVID data—as well as the “Late Biden Trend” since November of last year.

The late Trump trend is much steeper, and is reflective of the bounceback from the labor shock of the lockdowns. The inflection as we move into the Biden-Harris Administration is an unsurprising easing from a pace of job growth that was almost certainly unsustainable over the longer term.

The late Biden trend, however, is where we see definite problems—this is a negative trend. Employment has been decreasing in this country since late last year, and the data shows that.

Again, when we run the trends out through 2025 we can see the impact of these inflection points on the overall trend.

Had the Biden-Harris Administration been able to sustain the pace of jobs recovery experienced under Trump, employment would have caught up to the pre-COVID trend by May or June of 2021. That didn’t happen—and to be fair it might be unrealistic to expect that it should have happened. Yet the Biden-Harris Administration was maintaining a pace of jobs recovery that would have caught up to the Trump Administration’s pre-COVID trend again by October of next year.

Unfortunately, beginning in November employment levels began to decline. As of last November the Biden-Harris Administration has been losing jobs. This is what that rise in unemployment as well as the cohort not in the labor force means. Rising joblessness is equating to declining employment.

Since November, not only has there been no net gain in jobs, there has been an unambiguous net loss in jobs. When fewer people are employed, that is job loss by definition.

Every time the Biden-Harris Administration has crowed about job creation since last November they have been straight up lying. The BLS has also been lying—Donald Trump’s claims of manipulated and fraudulent data get considerably closer to the mark than anyone wishes to admit.

Which means also that the BEA is now lying. There is no economic growth happening at present, and hasn’t been since last fall. An economy that is shedding jobs is not an economy that is growing.

Sustained jobs loss—and the data shows unambiguous sustained jobs loss—means the economy is in recession and has been since last fall. Call it a “jobs recession” if one wishes to make that distinction, but it is simply not rational to speak of economic growth when there is sustained jobs loss.

Longtime readers are by now well familiar with my constant refrain to never look at just the headline numbers. With all data sets, but especially with economic data, the real understanding always comes from the details embedded within the totality of the data.

It is easy to look at the BEA estimate and conclude the economy is growing and that, overall, all is well. If you are a certain Presidential candidate, it is easy to look uncritically at the BEA estimate and cackle “Bidenomics is working!”

It is considerably less easy to say that with a straight face or even a smile if one digs under the hood to see what other factors and forces might be in play. For that certain Presidential candidate, the statement and the cackle would be greatly misplaced at the moment. Bidenomics is definitely not working.

Would Trumponomics be the right medicine? It might be. Certainly Trump’s Agenda 47 plataform of regulatory roll back and a renewed focus on manufacturing, while taking issue with outsourcing, are the sort of economic objectives that should arguably lead to increasing employment—which is what this country needs at the moment. How well Trump would execute on those agenda items remains a question, although his pre-COVID track record definitely gives room for hope.

Regardless of who wins in November, the next Administration is going to have to contend with an economy that, if current trends hold, will have shed as many as 260,000 jobs just between now and Inauguration Day, and as many as 460,000 jobs since last November, when the employment contraction began.

This is the economic policy discussion which is needed right now, and urgently needed right now: how is the United States going to halt job loss in this economy and get back on the track of jobs recovery?

This is the discussion that both candidates need to be having with the American people, but are not.

We’re in a jobs recession, and no one is trying to figure out what to do about it.

Yet more great data and analysis from you, Peter - thank you! Seriously, the mainstream media should be ashamed of themselves for consistently uncritical, left-wing-biased reporting. They are a complete waste of resources. And you, Peter are a voice crying in the wilderness, but reality will force more people to hear you eventually.

Those 400,000+ people who have lost their jobs are potentially all votes for change - votes for Trump! What this nation needs is increased productivity, and Trump understands that. America can still turn everything around; we’ve done it before. Truly, we need to make America great again!