The Light Up Ahead Is Not The End Of The Tunnel

A SHTF Freight Train Is Coming Down The Tracks

The message today is very clear and very simple: Be afraid. Be very afraid.

Yesterday was a bad day in the world’s financial markets. However, it was not just a bad day, nor even a collective bad day, but a synchronized bad day—where everything was bad in the same way at the same time—coming on the heels of a series of collective bad days.

When everything starts moving in the same direction at the same time, that is a good indication something is about to come off the rails and wreak havoc on everything else. We are now at such a juncture.

That is a very bad sign.

Stock Markets Following Each Other Down

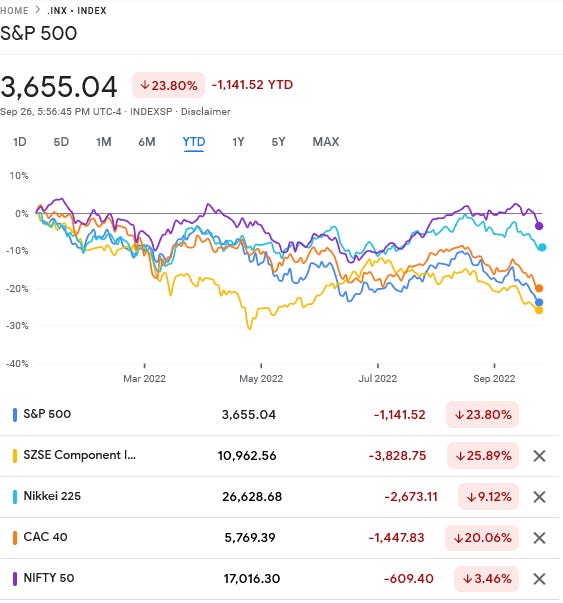

Over the past five trading days, the major indices around the world have been following each other steadily down.

This at a time when all these same indices are negative for the year, and most are in bear market territory.

Even Russia’s MOEX has had a very bad past week.

That this is happening at a time when Russia’s markets are beginning to decouple from the global marketplace is itself quite remarkable.

This begins to set the stage for a financial event in one market quickly spreading around to impact potentially all markets.

Soveriegn Debt Yields Are Following Each Other Up

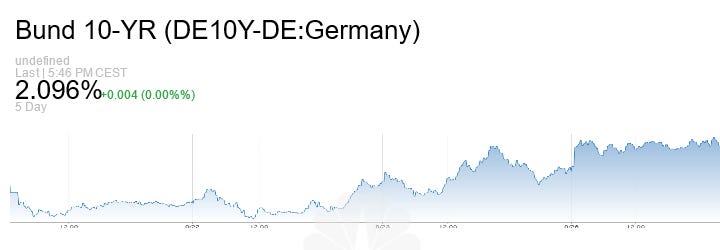

While global equities have had a bad day and a bad week, sovereign debt yields have also caused investors a fair amount of heartburn.

The 10 Year US Treasury Yield has risen considerably over the past five trading days.

As have German Bunds.

British Gilts have followed suit.

Italian 10 Year Bond Yields have also been rising.

Debt is becoming more expensive everywhere, with no seeming safe haven.

Currency Is All Tilting Towards The Dollar

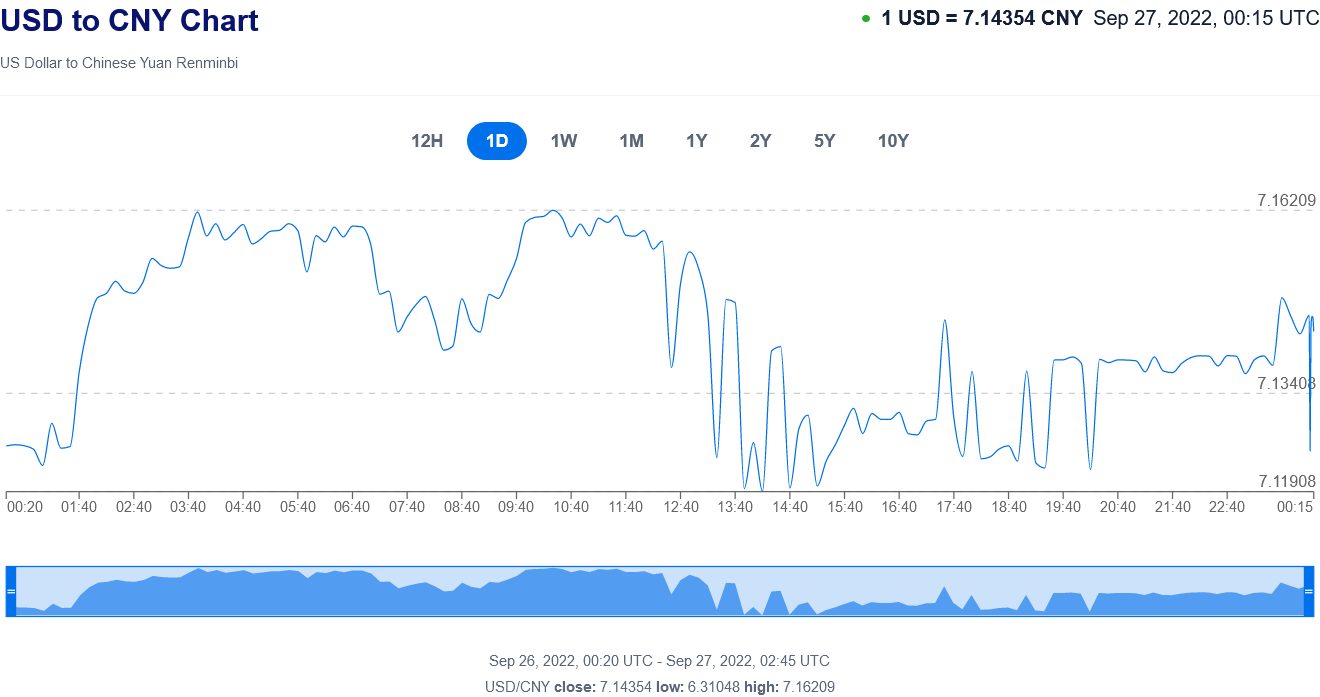

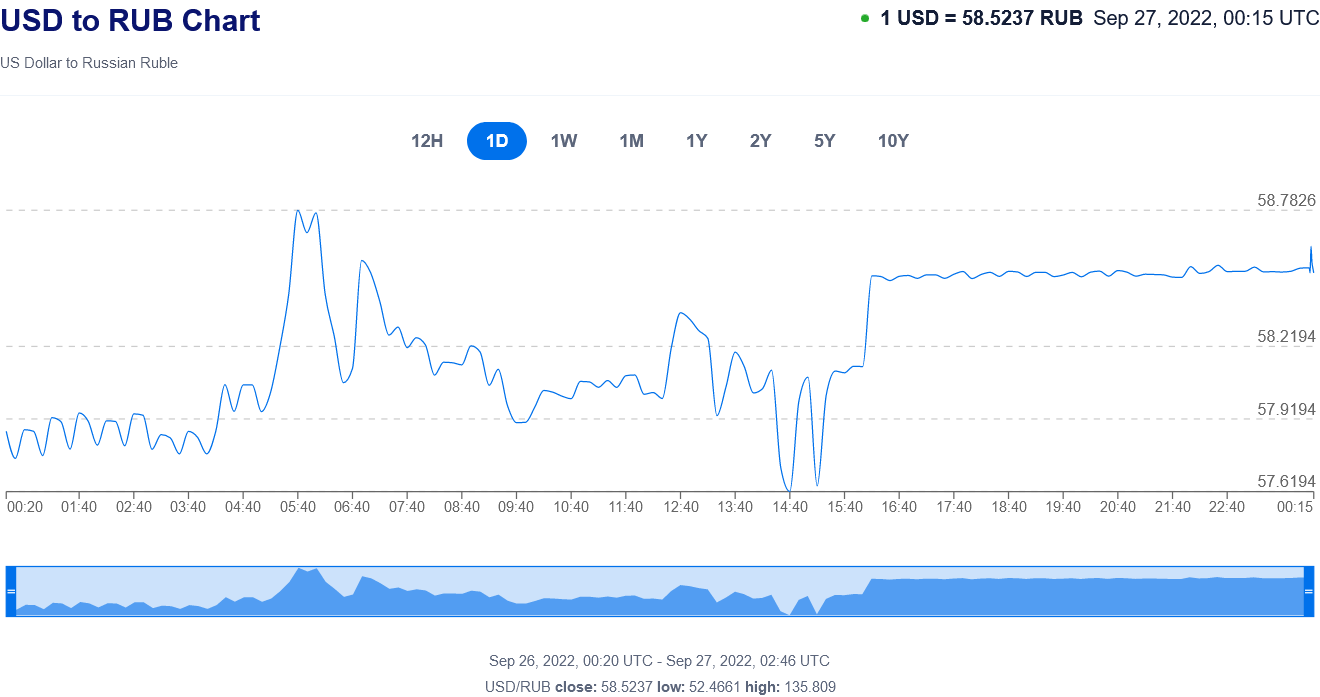

At the same time, the dollar strengthened yesterday against all major currencies.

The dollar advanced against the yuan.

The dollar reached 20-year highs against the euro.

The dollar is even approaching parity with the British pound sterling.

Meanwhile, the Bank of Japan’s defense of the yen has already begun to fail.

Even the Russian ruble has conceded ground to the dollar.

Among currencies, the prevailing safe haven is the US dollar, and flight to safety was the order of the day yesterday.

Are Investors Running Scared?

Whenever the markets show a flight to safety movement, the initial question is naturally “what is scaring Wall Street?” Certainly there is no shortage of global bad news to spook investors.

However, no single news event suffices to capture all of these market movements.

Central bank battles with inflation and defending their currency would explain the rise in bond yields, but as central banks tighten and raise interest rates the general expectation is that their currency should strengthen—the only currency that is strengthening at the moment is the dollar.

Italy’s elections might explain the rise in Italian bond yields, but more factors are needed to justify the decline of the euro.

China’s ongoing economic crisis is obviously battering the yuan, and calls into question China’s ability to support Russia in its war with Ukraine.

There is plenty of bad news in the world, and the markets appear to be processing that bad news all at once—and reaching all the same conclusions at the same time.

What does that mean? There is no way to say with any degree of specificity, but the most basic function of financial markets is to act as a global clearinghouse of risk. If there is a known way something can go horribly wrong in the world, the investor class, seeking to hedge its bets against whatever cataclysm is out there, will buy or sell whatever asset, futures contract, or derivative contract it deems most relevant to reduce their exposure to impending disaster.

With sovereign debt yields rising everywhere, equities (stocks) dropping everywhere, and the dollar becoming everyone’s new financial best friend, the investor class appears to all be running in the same direction at the same time. The investor class is expecting something somewhere to go horribly wrong, in a way that has major economic ramifications. I expect events will prove them correct, and fairly soon.

Hence the warning at the top of this article: Be afraid. Be very afraid.

Good article Peter. Will be linking today as usual@https://nothingnewunderthesun2016.com/

I have been trying to warn people about this as well, as have many others such as Bill Holter, Greg Mannarino, Gerald Celente. as well as a few others that I link consistently. People don't understand that this is part of the plan, if not the most important part of the plan!!!

to what degree does the vatican repatriation of assets (to the vatican bank) correspond to the synchronized decline in market value? are they that much of a market maker? hmmm...

if you wanted to create a one-world government and buy up assets on the cheap, and your assets were in dollars...?