The Technical Recession Cometh

Only The "Experts" Think It Can Be Avoided. Sane People Know Better

In response to continued high (and rising) inflation, the Federal Reserve somewhat predictably raised interest rates again this past Wednesday, this time by 75 basis points (bps)—or 0.75%—the largest rate increase in decades.

The Federal Reserve on Wednesday launched its biggest broadside yet against inflation, raising benchmark interest rates three-quarters of a percentage point in a move that equates to the most aggressive hike since 1994.

Ending weeks of speculation, the rate-setting Federal Open Market Committee took the level of its benchmark funds rate to a range of 1.5%-1.75%, the highest since just before the Covid pandemic began in March 2020.

Just as predictably, mortgage interest rates responded by also rising rapidly. The 30-year mortage rate for the US rose by more than half a percentage point—the largest such increase since 1987.

The U.S. 30-year fixed-rate mortgage averaged 5.78% for the week ending June 16, according to data released by Freddie Mac on Thursday. That’s up 55 basis points from the previous week — one basis point is equal to one hundredth of a percentage point.

The average rate on the 15-year fixed-rate mortgage rose 43bp over the past week to 4.81%. The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 4.33%, up 21bp from the prior week.

“Mortgage rates surged as the 30-year fixed-rate mortgage moved up more than half a percentage point, marking the largest one-week increase in our survey since 1987,” Sam Khater, Freddie Mac’s chief economist, said in a press release.

The “Technical” Recession Will Not Be Avoided

Amazingly, the key players and decision makers at the Federal Reserve are still thinking and acting as if a deep recession and contraction will somehow not happen.

On Friday - the first day that Fed rules allow any policymaker other than Powell to publicly air their views following a policy meeting - St. Louis Fed President James Bullard said he believes both the Fed and the European Central Bank will be able to avoid causing a deep recession with their rate hikes.

"The Fed and the ECB have considerable credibility, suggesting that a soft landing is feasible in the U.S. and the euro area if the post-pandemic regime shift is executed well," Bullard said at the Barcelona School of Economics Summer Forum.

Exactly how future interest rate rises won’t lead to a recession remains very much a mystery. The closest we seem to get to an explanation of how this will happen is St Louis Fed President Bullard tossing out some canard about Federal Reserve “credibility” somehow magically shrinking year on year consumer price inflation.

The historical reality is that the last time Fed Chairman Jerome Powell tried to raise interest rates back to their historical norms, the stock markets went south, putting pressure on the Fed to reverse course on rates.

With or without “credibility” on the part of the Fed, interest rate rises generally act to shrink the money supply and inhibit financial markets so as to produce a “technical” recession—defined as two successive quarters of declining GDP. For Bullard to float a “credibility” argument against the inevitable consequences of significant interest rate hikes on the economy is simply arrant nonsense.

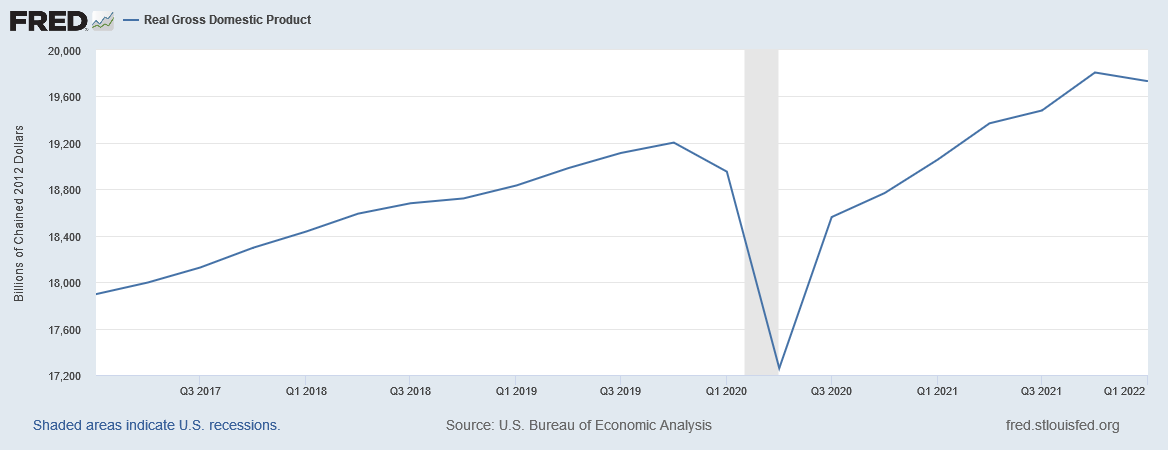

With Real GDP already having declined from the 4th Quarter of 2021 to the 1st Quarter of 2022, and thus only needing another quarter of decline to meet the criteria for a technical recession, it is simply ludicrous to argue that the technical recession will not happen.

Moreover, the Fed’s interest rate hikes and consequent rises in mortgage rates are already negatively impacting both new and existing home sales, with both metrics in steep decline recently.

Continued increases in interest rates by the Fed equates to continued increases in mortgage rates, which can only push the declines in new and existing home sales out even further, making the technical recession even more likely.

With both 15 and 30-year mortgages becoming increasingly expensive in terms of their interest rate, more and more people are going to be priced out of a house purchase. Federal Reserve “credibility” does not alter this fundamental reality.

The Actual Recession Is Already Here

As I pointed out last week, the Atlanta Fed’s GDPNow projection for the second quarter is all but an outright admission that recession is already happening.

Moreover, hitting that technical recession mark is itself merely an admission by the “experts” that recession is, in fact happening. As last week’s PPI numbers illustrated, inflation and economic distortion are getting worse, not better. Disequilibrium is increasing, not decreasing.

The economy is already on the retreat. Recession is already happening. Everyone who feels the pain at the gas pump or when buying groceries already knows this is the case. The technical recession marker is merely the government dropping the pretense that the economy is robust and doing well—the truth is the polar opposite of that.

No economy with the distortions evident in the US economy based on the Consumer Price Index can be said to be doing well.

History tells this same story over and over again. Inflation not only brings on recession, but effectively IS recession.

Indeed, since 1955 every time inflation ran hotter than 4% and unemployment fell below 5%, the economy has tumbled into recession within two years, according to a paper published this year by former Treasury Secretary Lawrence Summers and his Harvard University colleague Alex Domash. The U.S. jobless rate is now 3.6%, and inflation has topped 8% every month since March.

Trying To Avoid Recession Is What Got Us Here

We must not lose sight of the reality that the Fed’s monetary policies are what brought us to this point.

It has been the Fed’s willingness to conjure up endless dollars out of nothing catalyzing the inflation we now see throughout the economy.

It has been the Fed’s “Quantitative Easing” fueling asset price inflation on Wall Street since the 2008 derivatives shock and subsequent “Great Financial Crisis”.

It has been the government’s willingness to distribute some of this “free money” in the form of “stimulus checks” and other benefits stoking consumer demand at the very moment supply chains were rupturing worldwide.

It has been the determination to avoid economic contraction and recession almost at any cost distorting the economy to the point where economic contraction and recession must now happen.

For years the Fed has been kicking the economic can down the road, always looking to postpone the inevitable economic reckoning for its deficient stewardship of the money supply.

The Fed has finally run out of road. The reckoning—the contraction, the recession, the deflation—is here.

The “experts” at the Fed might hope to still postpone that reckoning. Sane people know they no longer can.

"Inflation not only brings on recession, but effectively IS recession."

Forking Bravo!

Are we back to thinking the federal funds rate is directly correlated with long term mortgage rates? I remember reading articles over the last 25 years explaining why that was not the case. They weren't all that clear in any case. But I do tend to believe that the two aren't directly correlated in a "normal" functioning economy. They used to say that mortgage rates were more correlated with long term treasuries.

Also I can't tell but do you believe a rise in mortgage rates and collapse of the housing market is a bad thing?