This Is Why The Fed Can't Stop Hiking Rates

In A Race To The Bottom, The Strongest Currency Comes In Last

For obvious reasons, most financial pundits in both the corporate and alternative media focus on the impact the Federal Reserve’s interest rate manipulations have on domestic financial markets and on the domestic economy.

At the time of last month’s meeting, the policymakers said the economy appeared to be expanding in the April-June quarter, with consumer spending “remaining strong.” Since then, though, the economy has shown signs of slowing, with consumer spending falling in May, after adjusting for inflation, for the first time this year. Home sales are plunging as mortgage rates have jumped, accelerated by the Fed’s rate increases.

However, that outlook ignores the impact the Fed’s policies have on currency markets. Interest rates do not merely address inflationary prices rises, but also influence currency exchange rates. This is why the euro is coming under duress recently, as the Fed’s rate hikes have caused currency speculators to price the dollar up against the euro—which in turn restricts the European Central Bank’s policy options.

The currency’s downward spiral has been swift and brutal, given it was trading around $1.15 in February. Russia’s invasion of Ukraine has worsened the outlook for growth in the euro zone and pushed up the cost of its energy imports, while a string of increasingly-large Federal Reserve interest-rate hikes has supercharged the dollar.

Thus the Fed’s rate hikes, coupled with the ECB’s relatively passive stance, have caused the dollar to rise significantly against the euro this past week.

Nor is this an isolated instance. The dollar has been generally tracking ahead of the Japanese yen as well.

With the global economy also spiraling into recession and contraction, fiat currencies the world over are under increasing duress.

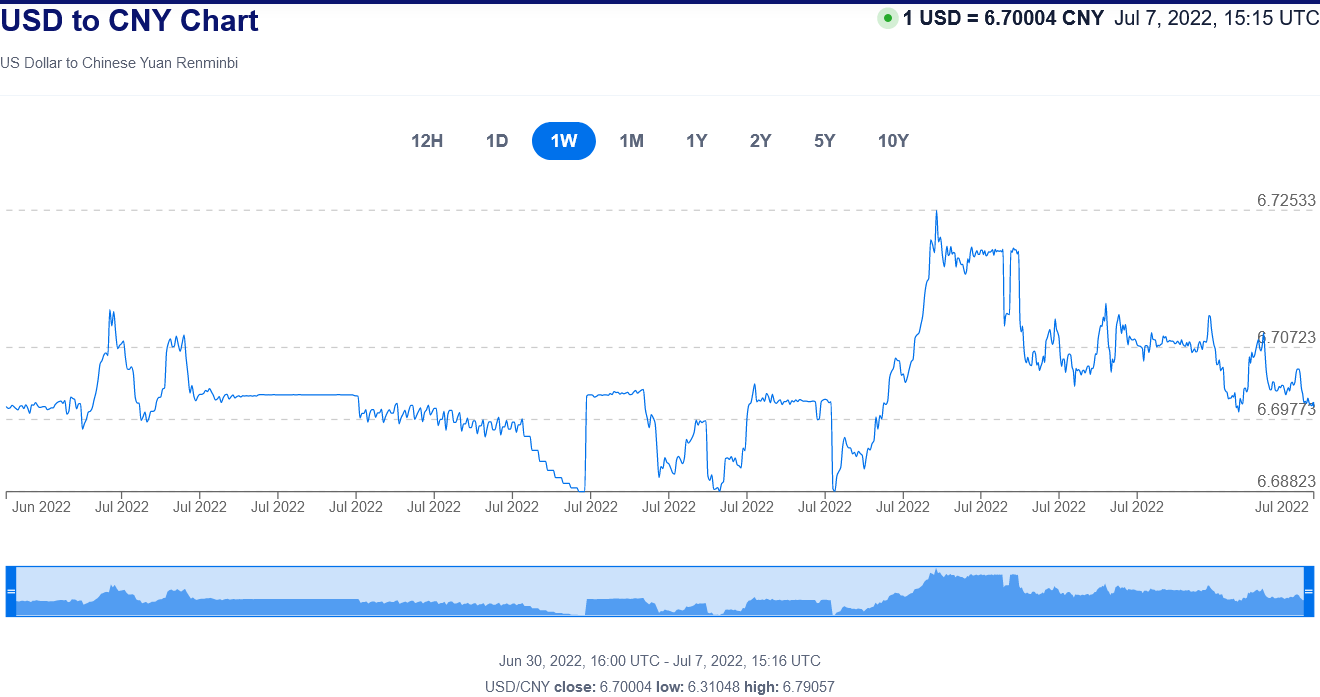

While the Fed’s rate hikes are either not aggressive enough or are too aggressive, depending on how one views their impacts on the domestic economy, the Fed does have the singular virtue of being the first central bank to even somewhat aggressively raise rates. Thus, despite the roller-coast roiling of financial markets over the past week, the dollar has eked out gains even against the Chinese yuan.

Bas van Geffen of Rabobank alludes to why the Fed wants to be in last place in the currency and economic race to the bottom: the strongest currency will be the one that crashes last.

While the Fed’s experience –how did we ever get from ‘transitory’ to ‘entrenched’?– serves as a warning for its peers, the bright spot of a more aggressive FOMC is that the ECB might just manage to get away with less tightening, possibly allowing European policymakers to take a little more care of the economy. If the Fed squeezes the life out of the US economy, that will undoubtedly have a global impact. It may therefore cool global aggregate demand just enough to take the biggest sting out of inflation. Yet, as the decline in the euro over the last week highlights, the ECB will obviously understand that a free ride does not exist.

Despite all the magic money printing of the past decade, and the loose money policies going back to Alan Greenspan’s tenure as Fed Chairman, by keeping a tighter hand on the monetary reins now, in the form of higher interest rates, the dollar may yet prove to be the strongest and most resilient of the world’s fiat currencies.

If this proves to be the case, it would put the dollar in a rather enviable position on the other side of the global economic downturn.

In the near term, however, playing for that prize means the Fed has no choice but to take a hard line on interest rates, regardless of the impatct to the overall economy.