As I noted earlier, the April Job Openings and Labor Turnover Summary report was very much a piece of good news for President Trump.

The number of job openings was little changed at 7.4 million in April, the U.S. Bureau of Labor Statistics reported today. Over the month, both hires and total separations were little changed at 5.6 million and 5.3 million, respectively. Within separations, quits (3.2 million) and layoffs and discharges (1.8 million) changed little.

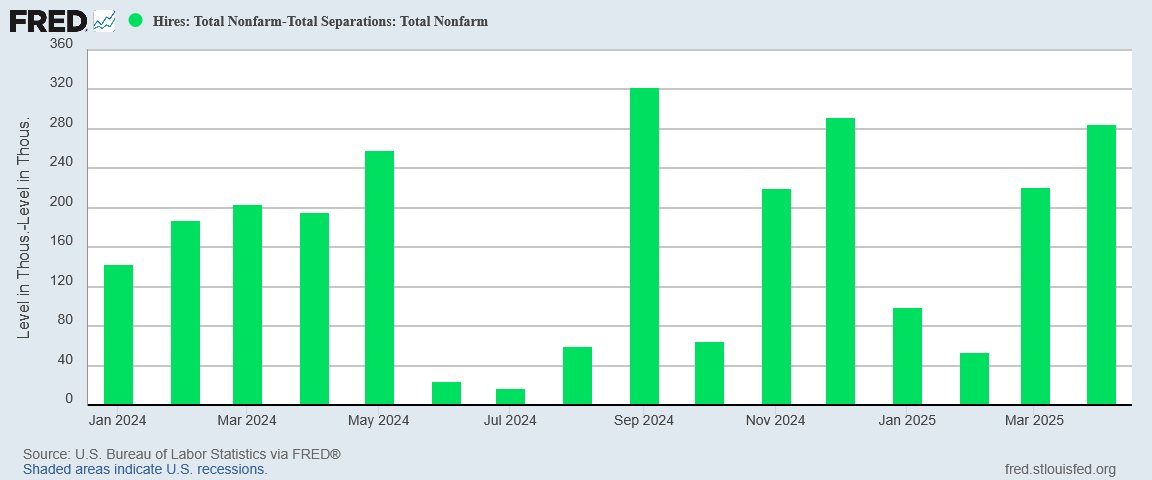

Despite the Bureau of Labor Statistics’ penchant for anodyne phrasing, the numbers within the JOLTS data set are clear: they show net hiring up in April.

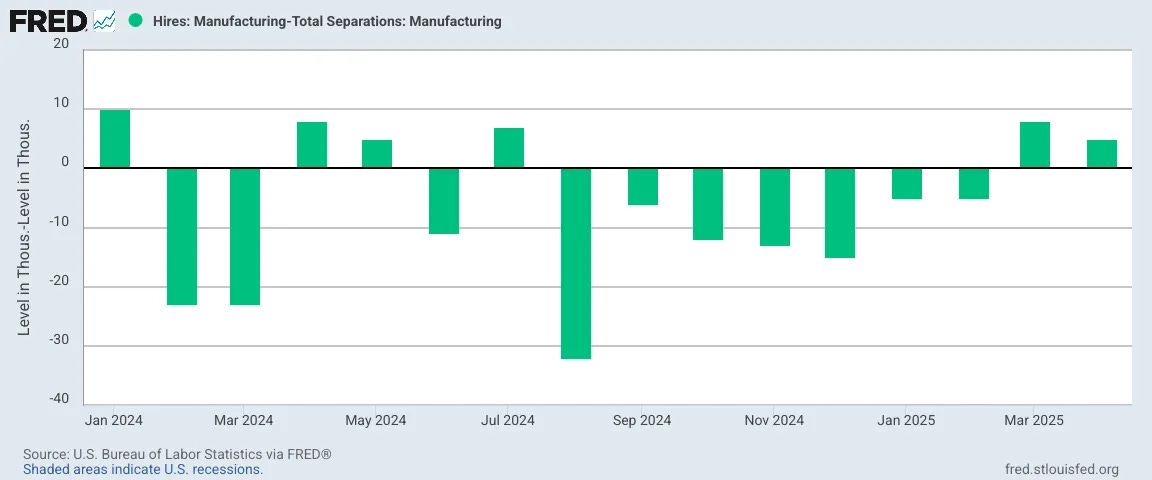

Manufacturing was still weak, but even that sector managed to generate at 5,000 jobs.

While a second month of positive net hiring in manufacturing is a good thing, we should however, be mindful that the April Employment Situation Summary charted a loss of 1,000 jobs in manufacturing.

Nor is manufacturing the only sector where the JOLTS data differs from the Employment Situation Summary.

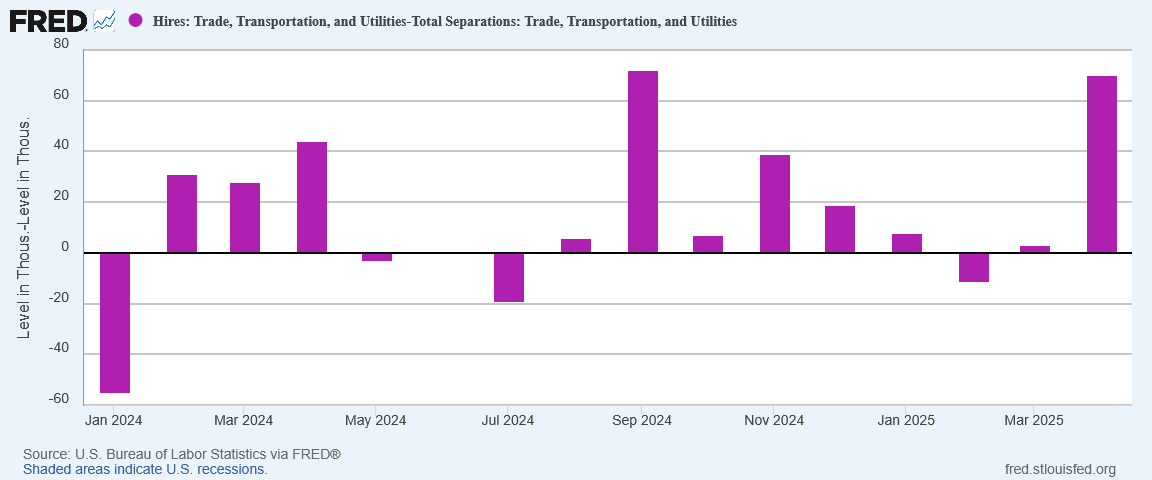

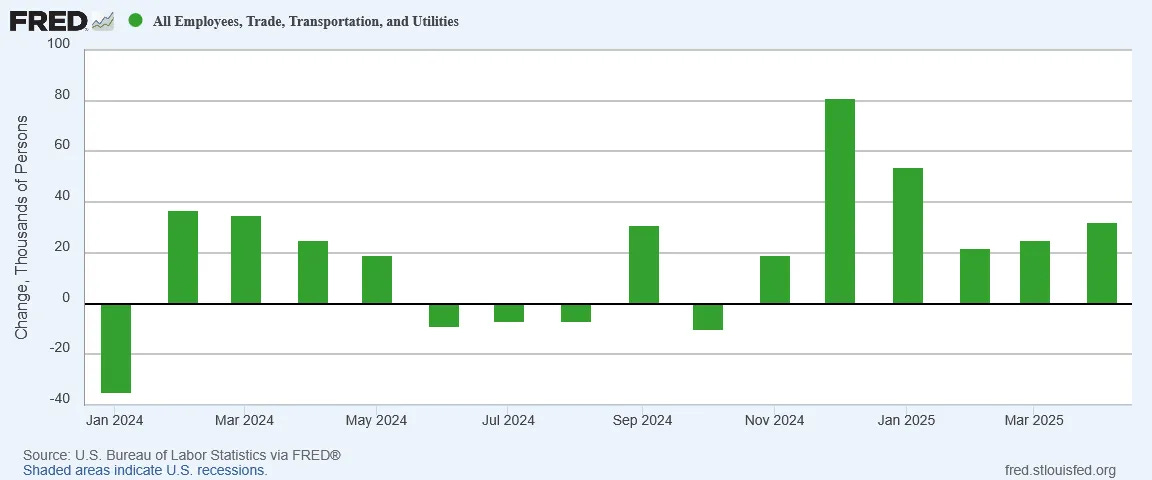

Net hiring in Trade, Transportation and Utilities surged in April.

That burst of jobs strength was not reflected in the Employment Situation Summary.

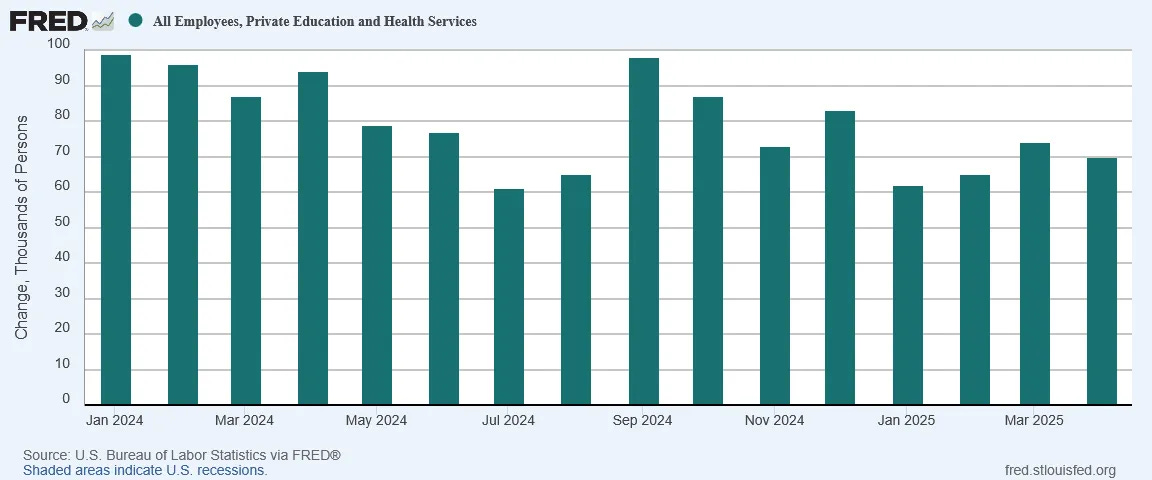

Rounding out the dichotomy between the JOLTS report and the earlier Employment Situation Summary, the one bright spot in the April Employment Situation Summary, Private Education and Health, showed actual job loss on the JOLTS report.

JOLTS paints a dramatically different picture for the sector from the Employment Situation Summary.

These deviations between the two job reports—reports which nominally cover the same data set, are reminders that a healthy skepticism is always warranted when looking at employment data.

We especially need to remember that skepticism when we look at the separations data. April saw a continuation of the separations trend of rising layoffs coupled with falling quits.

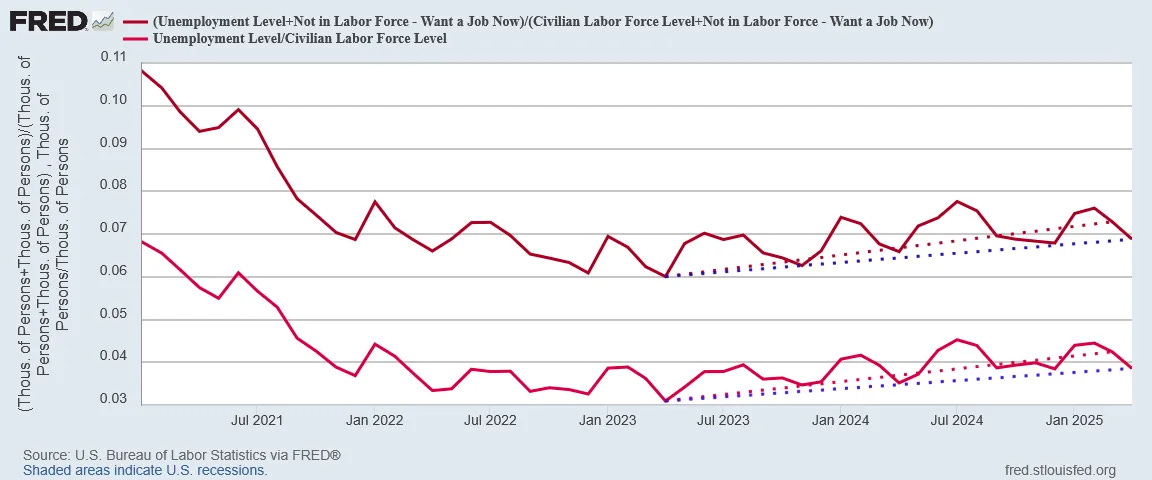

Those two trends do fit well with the rising unemployment trend charted in the April Employment Situation Summary.

In both the “official” unemployment data and the “real” unemployment statistic (calculated by adding those not in the labor force but who want a job now to the unemployment level), recent declines moderate the rising trend of joblessness but does not end it.

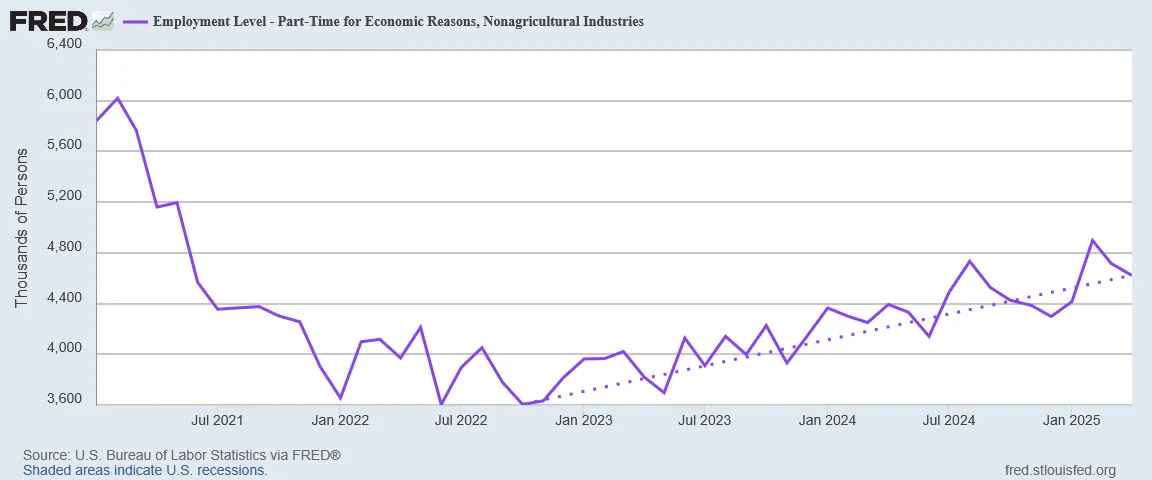

The cautionary note sounded by the rising number of people working part-time for economic reasons certainly has not been invalidated by the JOLTS report.

The good news that is the April JOLTS report is not good enough to allow us to declare the jobs recession in this country at an end. We still have not overcome the deficit in actual job creation that was the norm during the (Biden-)Harris Reign of Error.

Rising joblessness remains a concern, and the layoffs vs quits dichotomy does nothing to mitigate that concern.

Still, the JOLTS report offers a few reasons for a measure of guarded optimism. Positive net hiring across nearly all economic sectors is always going to be good news for any President, and Donald Trump is certainly no exception.

Given the murky and ultimately pessimistic outlook available within the February JOLTS report, that guarded optimism is itself fairly remarkable.

If the April JOLTS report proves to be the beginning of an extended trend in good jobs data, it will be very good news for the US economy as well.

It is not a perfect jobs report, but there are more reasons to smile than to frown in the April JOLTS report.

Real data is good, even if the BLS fudges it. The information that’s going to be of real interest is after the effect from tariffs kick in. Someone, somewhere, probably using AI, has probably modeled different jobs scenarios based upon the presumed effect from Trump’s tariffs - but, of course, nobody knows exactly how that will unfold. Peter, I sure hope the data that results is a pleasure for you to analyze. I know your analysis will catch the errors that others make, and I hope yours gets wide attention!