Trump Tops Biden on Wages—With a Catch

The Data Says Trump Helped Wages. It Also Says That’s Not the Whole Story.

As has been apocryphally attributed to Mark Twain, there are lies, damned lies, and statistics.

I completely agree with the legendary American humorist on this point. Having dealt with numbers and statistics all of my working life, I fully appreciate all the ways that statistics can be manipulated and even perverted to advance a particular narrative.

Thus we are obliged to treat with caution the White House’ typically Trumpian claim last week that real wages in the US rose by $1,400 in 2025, far surpassing Biden-era wage growth.

Real average hourly earnings for all private-sector workers rose in January, up 1.2% over the past year; for middle- and lower-wage workers, gains were even stronger at 1.5%.

In President Trump’s first year back in office, real earnings for all private-sector workers have outpaced inflation by nearly $1,400 — earning back some of the nearly $3,000 they lost under Biden.

Mining workers: +$2,400

Construction workers: +$2,100

Manufacturing workers: +$1,700

Goods producing workers: +1,700

If these numbers are accurate, they represent genuine wage gains and genuine improvement for American workers.

The key word, as always, is “if”.

Are they accurate? The answer is, frustratingly, “maybe, maybe not.”

Such is the dilemma when calculating “real” values from nominal economic data.

The data does show President Trump having positive impact on wages and earnings. The data also shows that success is not the entire story.

“Real” Wages And Earnings

When we speak of “real” earnings, or “real” wages, we are adjusting nominal wages for the effects of inflation. With memories of the 2022 hyperinflation cycle still fresh in most people’s minds, it is intuitively obvious that inflation reduces apparent wage gains over any period of time. If consumer prices rise 2% but nominal wages rise only 1%, real wages actually decline.

This is the origin of the Democrats’ abortive “affordability” narrative.

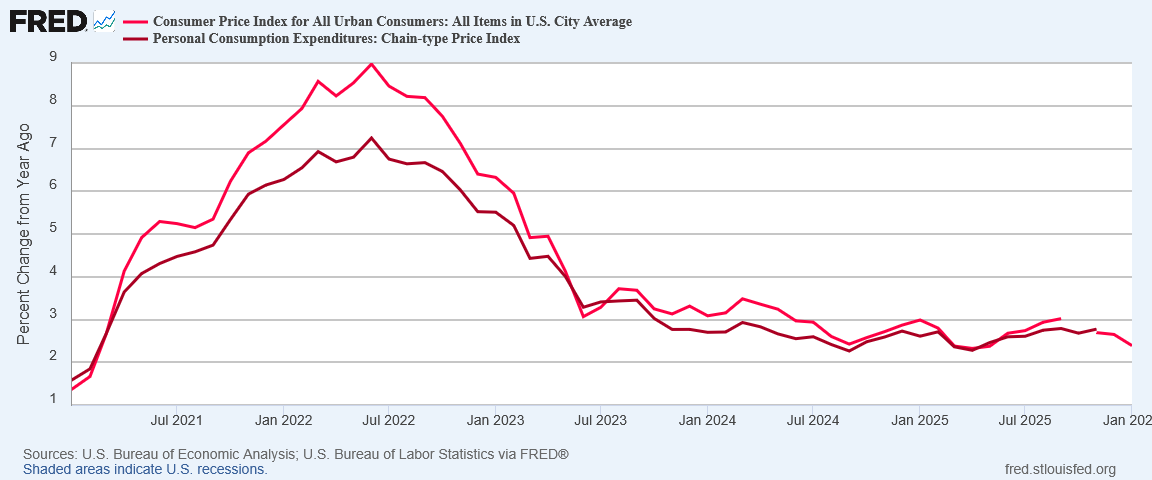

However, as I regularly discuss, there are two “official” inflation metrics that the government uses: the Consumer Price Index (CPI) and the Personal Consumption Expenditures Price Index (PCEPI). The CPI is the index calculated monthly by the Bureau of Labor Statistics, while the PCEPI is maintained by the Bureau of Economic Analysis. Of the two, the PCEPI tends to be the more conservative figure, printing a lower overall inflation rate at the height of the 2022 hyperinflation cycle.

For obvious reasons, the Federal Reserve prefers the PCEPI as an inflation gauge. As the BEA is the agency which generally computes real wages and real GDP, it also favors the PCEPI.

However, if we use the CPI to calculate real wages and earnings, we will get different results, and we will get less attractive results.

Longtime readers may recall that I have been using the CPI to restate real wages for quite some time. The mathematics are fairly straightforward, and I discuss them here for those who are interested.

I use the CPI for calculating real wages because it tends to be the more “dismal” of the two inflation metrics, and thus overall yields the most conservative estimate of real wages and earnings. This is a deliberate choice on my part, as the accountant in me prefers the estimate be too low rather than too high.

Thus, while I will not challenge the White House numbers directly, I will offer a different computation of wage growth since 2021, using the monthly CPI numbers to calculate real hourly wages and real weekly earnings.

Nominal Wages And Earnings

The raw data for this exercise is easily obtainable from the Federal Reserve Economic Data (FRED) service.

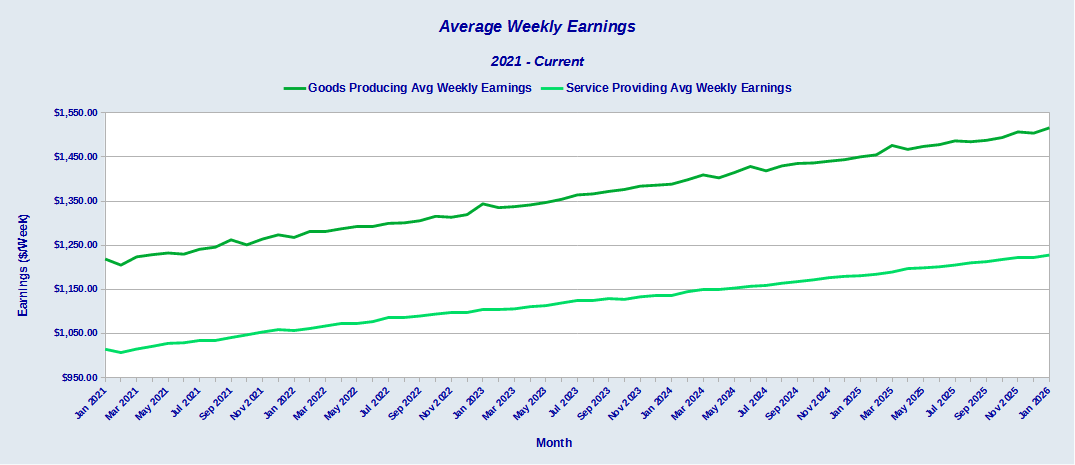

On the surface, nominal average wages and earnings in this country have appeared to grow at a fairly steady rate since 2021.

However, even within the nominal data there are a few data points that are worth noting:

Between January 2025 and January 2026, nominal weekly earnings for goods producing jobs rose $65.56.

Between January 2025 and January 2026, nominal weekly earnings for service providing jobs rose $46.73.

Between January 2024 and January 2025, nominal weekly earnings for goods producing jobs rose $61.86.

Between January 2024 and January 2025, nominal weekly earnings for service producing jobs rose $44.69

2025 is, of course, Donald Trump’s first year back in the Oval Office, while 2024 was Joe Biden’s final year. Thus, even on a nominal basis, President Trump’s first year has seen nominal wage growth greater than Joe Biden’s final year.

Two more nominal data points allow us to flesh out a Trump-Biden comparison on earnings:

Between January 2021 and January 2025, nominal weekly earnings for goods producing jobs rose $231.38.

Between January 2021 and January 2025, nominal weekly earnings for service producing jobs rose $166.45.

As that increase covers the entirety of the Biden era, that gives an average weekly earnings increase for the Biden years of $57.85 for goods producing jobs and $41.61 for service producing jobs.

President Trump’s first year performance on nominal earnings not only surpasses Biden’s final year, but also Biden’s average across all four years.

If we wanted merely to build a conclusive “Trump Beats Biden” narrative on worker paychecks, we could stop right there. President Trump’s first year economic policies have resulted in more money in worker paychecks then Biden’s final year economic policies as well as Biden’s economic policies across the whole of his Reign of Error.

However, when we compute the influence of inflation on wages and earnings, we see not only just how badly Biden’s policies hurt American workers, but also how President Trump’s policies have helped American workers recover.

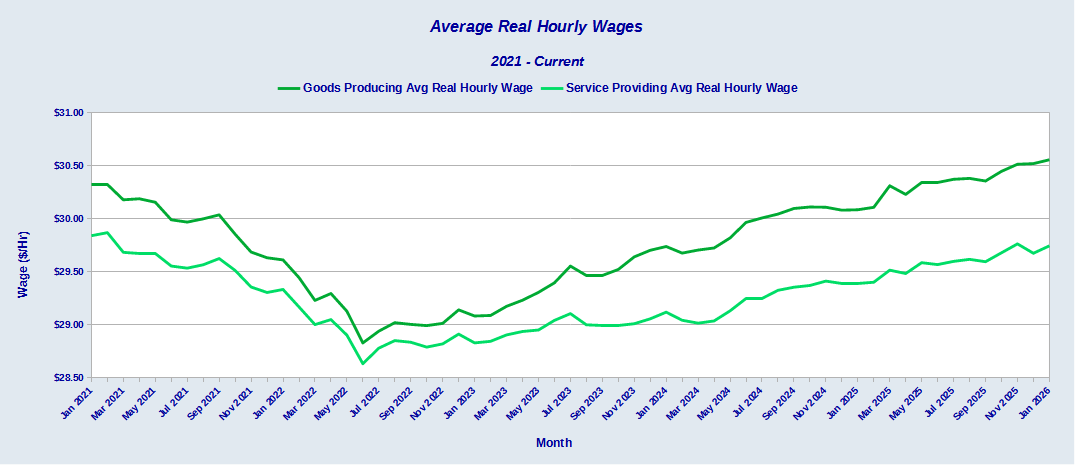

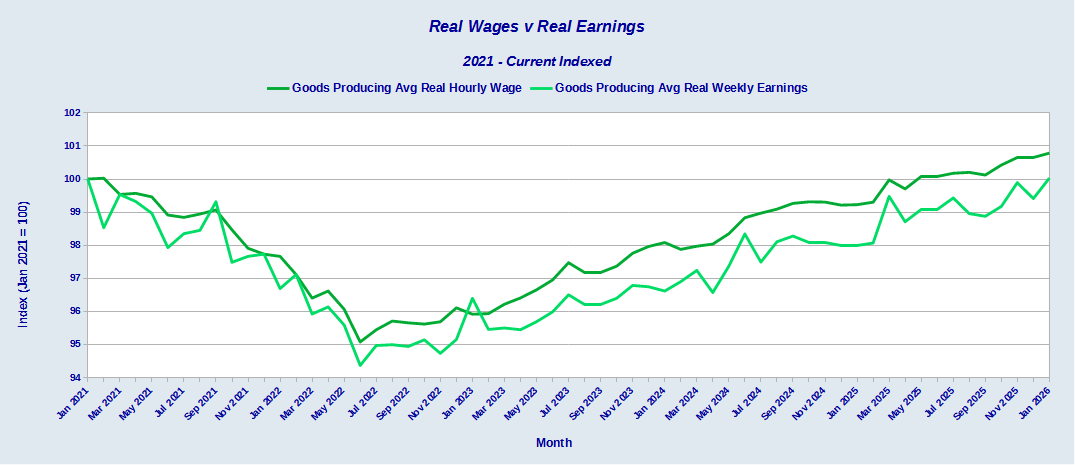

Real Hourly Wages (CPI Calculation)

Longtime readers will no doubt recall that declining real wages and subsequent wage stagnation has been a persistent criticism I leveled against the Biden Administration. The degree to which wage growth has been restored is one of the gauges I use to measure the success or failure of President Trump’s policies.

There is no gentle way to describe the Biden Administration’s track record on wages and earnings. It sucked massively.

Workers lost a significant portion of their paychecks to the 2022 hyperinflation cycle, and did not recover it during Biden’s term of office.

Again, a few data points suffice to illustrate the difference between Donald Trump and Joe Biden:

Between January 2025 and January 2026, average real hourly wages for goods producing jobs rose $0.47.

Between January 2025 and January 2026, average real hourly wages for service providing jobs rose $0.36.

Between January 2021 and January 2025, average real hourly wages for goods producing jobs fell $0.23.

Between January 2021 and January 2025, average real hourly wages for service producing jobs fell $0.45

Note that the decline under Biden includes both the initial wage crash during 2022 and the slow and demonstrably inadequate recovery afterwards.

Donald Trump’s policies are looking better and better.

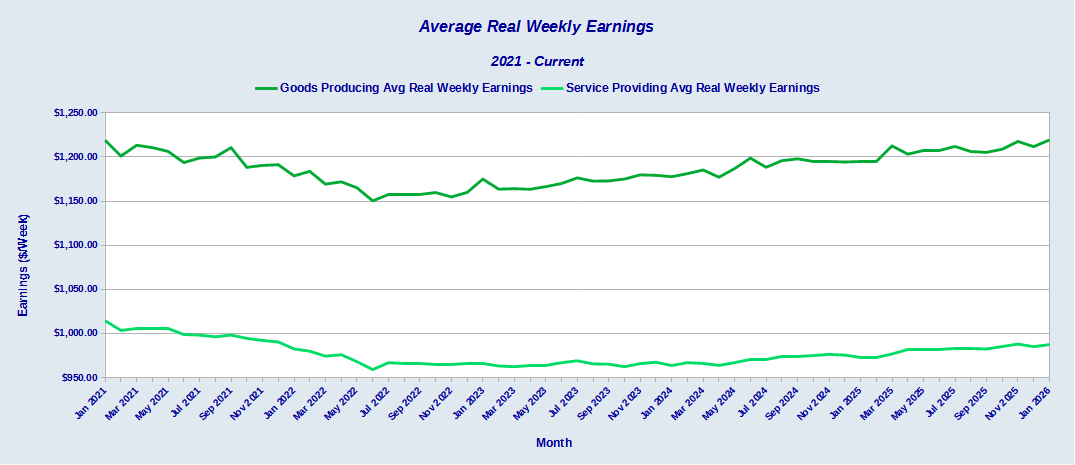

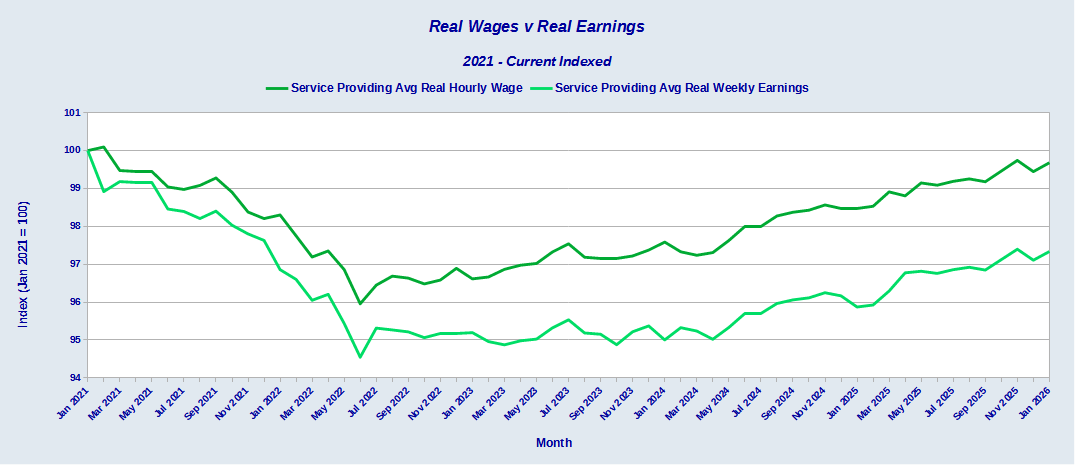

When we consider weekly earnings since 2021, we see the same collapse and recovery.

The numbers for weekly earnings tell the same story as hourly wages for both Trump and Biden.

Between January 2025 and January 2026, average real weekly earnings for goods producing jobs rose $24.84.

Between January 2025 and January 2026, average real weekly earnings for service providing jobs rose $14.87.

Between January 2021 and January 2025, average real weekly earnings for goods producing jobs fell $24.48.

Between January 2021 and January 2025, average real weekly earnings for service producing jobs fell $41.91

One obvious victory lap for Donald Trump in these numbers: In one year his policies have allowed goods producing weekly earnings to fully recover to their pre-inflation real levels.

One obvious challenge for Donald Trump in these numbers: service providing weekly earnings have not fared nearly as well.

Has Donald Trump’s policies produced the wage gains claimed in the White House announcement? Not if we are calculating real earnings using the CPI. Multiplying the average weekly earnings increase for 2025 under Donald Trump by the 52 weeks in a year gives a weekly earnings increase of $1,291.65 for goods producing jobs and $773.34 for service providing jobs.

That increase is considerably less than the numbers touted by the White House, and the primary reason for the variance is the selection of inflation metric against which to calculate real wages and earnings.

This is not to say the White House is peddling a false claim. This is to say that context matters when considering such claims, and part of the context for the White House wage claims is that it is choosing the best calculations and not the worst. White House announcements being intrinsically political messaging, we should not be surprised at that, but we owe it to ourselves to remember it.

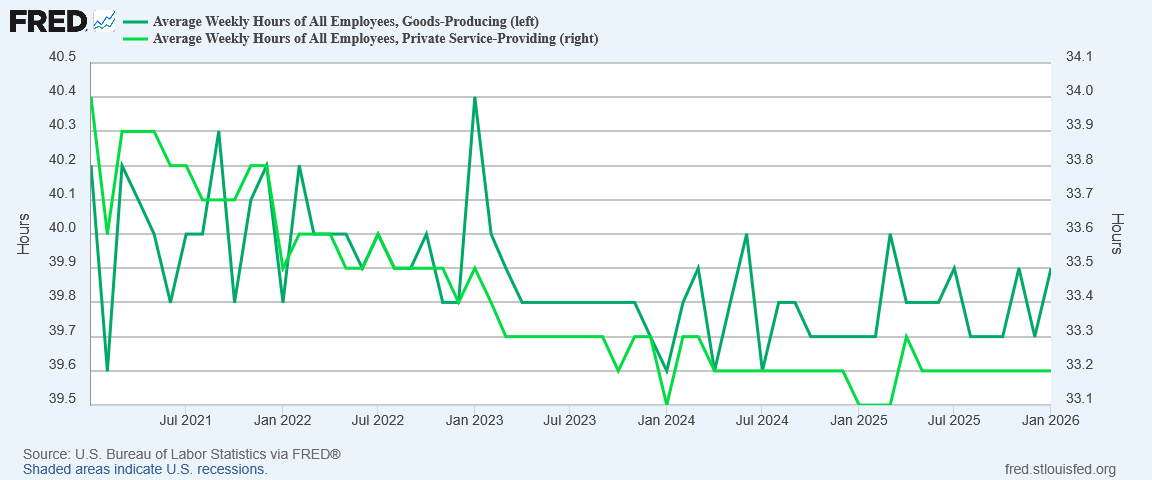

Wages Are Not Earnings

What the White House announcement does not encompass is the degree to which wage growth and earnings growth have diverged since 2021.

While wages and weekly earnings for goods producing jobs have by now fully recovered from the 2022 hyperinflation cycle, they have done so at different paces.

While real weekly earnings have only just recovered to their January 2021 levels, real hourly wages reached that threshold around March.

Service providing earnings have lagged service providing hourly wages to an even greater degree.

Neither has fully recovered from the 2022 hyperinflation cycle, but real weekly earnings for service providing jobs have recovered only about half of what was lost in 2022.

There is no mystery for the differential. Average weekly hours have declined across the entire private sector, with the greatest declines coming in service providing jobs.

Increased hourly wages when working fewer hours have diminished impacts on the weekly paycheck.

Even with job growth people are overall working less, and that is a drag on weekly earnings growth across the private sector.

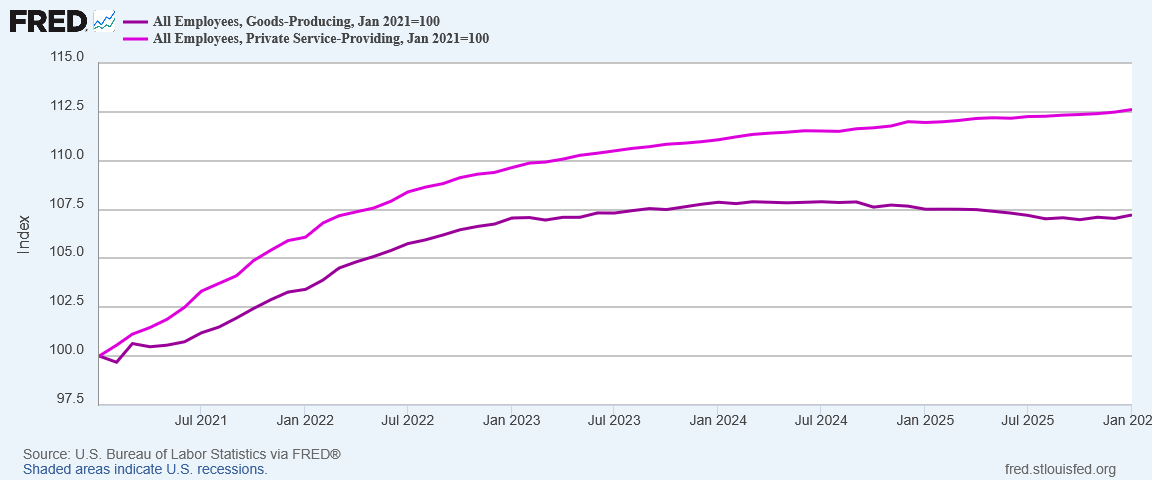

Nor does it help that goods producing employment declined beginning in late 2024.

However good the wage and earnings growth has been for goods providing jobs, that growth is being enjoyed by fewer workers. The lack of wage and earnings growth for service providing jobs is being endured by more workers.

These are nuances to the wages and earnings the White House announcement does not mention. While we should not expect the Trump White House to publish arguably negative statistics any more than we would have expected that from the Biden White House, we still owe it to ourselves to be cognizant of the negative data.

In some ways, that negative data contradicts the White House stance. Yes, there has been wage growth, but there has been less job growth than first recorded, and even within the job growth we have had people are still working less, which is hindering earnings growth.

The Data Matters. The Narrative Does Not

The data not mentioned by the White House in its wages and earnings victory lap underscores the importance of looking at all the data, even the data which does not fit neatly in to a prevailing narrative.

The White House is not lying when they brag about earnings growth under President Trump. Even a conservative reading of the nominal wage and earnings data proves that President Trump’s policies have been met with better wage and earnings data than Joe Biden’s policies were. Even a conservative calculation of real wages and earnings proves President Trump’s policies have done better than Joe Biden’s policies.

The White House is shading the data by picking the more conservative inflation metric to build its wage and earnings claims—although one could just as easily claim I am shading the data by picking the more volatile inflation metric to build mine.

The White House is also not talking about the negative data which still lingers within the jobs data set. While the data is negative, it is still meaningful and still important.

That negative data reiterates the employment dimensions where the jobs recession is still very real and still ongoing. Not only has job growth been less than reported under both Biden and Trump, wage and earnings growth is also arguably less robust than the White House wants to present or even admit.

The wage and earnings growth during President Trump’s first year have been real and superior than any year under Joe Biden. The data is unequivocal on that point, and President Trump should take a victory lap for the success his policies have had with wages and earnings.

That superior wage and earnings growth is not the entire employment story, however, and while we should not ignore Trump’s clear successes, neither should we ignore those areas where success has yet to be seen. We need President Trump to succeed in those areas as well.

You are consistently impressive in your expertise with numbers, Peter!

I’d like to highlight one thing that is largely the Democrats’ fault. You note that the average hours worked have declined “ with the greatest declines coming in service providing jobs.” I’m convinced that it’s been the Democrats’ policies on mandating increases in minimum wages that have resulted in hours of work lost. A restaurant or retail shop that has to increase hourly wages cannot hold prices down to where customers can afford them, and so has to cut back hours and reduce staff. They must make do with less. Entry-level workers, who are the most inexperienced and inefficient, are the ones who lose hours and employment opportunities.

One of many, many reasons why the Democrats must not get back into power!