What Exactly Is The UK Energy Crisis?

Is The Loss Of Russian NatGas The Problem The Media Says It Is?

One of the persistent themes in the corporate media reporting on the Russo-Ukrainian War has been how the war—and, by direct extension, Russian President Vladimir Putin—is causing an energy crisis in countries across Europe, particularly in Great Britain.

The war in Ukraine and the ensuing sanctions on Russia have created an energy crisis across the continent forcing some western countries to seek out new sources of fossil fuels, putting pressure on their economies and citizens.

There is, however, one teeny tiny problem with this narrative: Energy commodity prices, and the price of natural gas in the UK especially, aren’t showing a fresh “crisis” in 2022.

UK Natural Gas Prices Show Lots Of Volatility, But Not Much Year On Year Increase

The seeming disconnect between energy commodity prices and the corporate media narrative begins with the price for UK natural gas. As shown by the financial data site Trading Economics, UK Natural Gas prices have over the past twelve months shown considerable volatility, but not necessarily a sustained upward trend.

Certainly if one trends the peak prices over the past twelve months there is an upward trend, but at the trough prices that trend disappears. Moreover, the spot price for natural gas in UK markets actually lower than it was on the same day one year ago.

If we simply look over the past twelve months of commodity pricing data, we have to wonder where the corporate media is getting the idea that there is an energy “crisis”. Volatility alone does not a crisis make.

However, if we take a longer view of natural gas commodity prices, we immediately see a far different picture emerging. Since the beginning of 2020, the spot price for UK natural gas has risen significantly.

Not only are UK natural gas prices more volatile now, they are more volatile at a price level well above the historical norm.

We see the same behavior in coal….

…and we see the same behavior in the price for Brent crude.

Clearly, the prices of for energy commodities in the UK are significantly higher across the board. Yet just as clearly, they have been that way since before Putin invaded Ukraine and the EU responded with economic sanctions against Russia.

The Russo-Ukrainian War is not helping matters any, but the energy crisis in the UK definitely pre-dates Putin’s war. The commodity price data makes that abundantly clear.

UK Heads Into Winter In About The Same Energy Position As Before

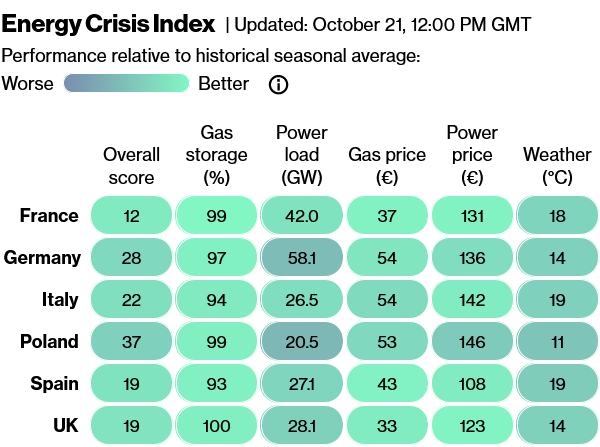

While the corporate media is ablaze about an energy “crisis”, the reported data suggests that the UK is in about the same energy position as in prior winters. Bloomberg’s own “Energy Crisis Index” indicates the UK is perhaps in one of the better positions in Europe with regard to winter energy demand.

However, the UK has long had a particular vulnerability to energy prices during the winter months, in that they have little natural gas storage infrastructure, and during the winter generally import much of their natural gas. Ironically, this vulnerability might prove a curious benefit relative to the rest of Europe in the coming months, given Europe’s apparent success at filling its natural gas storage capacity.

But there’s a catch: Almost all of that hoard is under the control of utilities and traders, rather than local governments, meaning it could be sold to the highest bidder when the weather gets cold.

That could work to the advantage of the UK, which has virtually no gas-storage capacity of its own. Britain is reliant on imports of liquefied natural gas and, particularly during the cold months, pipeline shipments from the continent. If UK fuel prices are high enough, the nation could benefit from other countries’ stockpiles.

Britain’s ability to tap in to EU natural gas stockpiles will of course come at a cost—and a significant cost, given how high natural gas prices have risen relative to the historical average—but it would be what Britain has always done during the winter.

Can business as usual be considered a “crisis”?

Britain’s winter tapping of European natural gas reserves also highlights one of the reason energy prices in the UK have reached “crisis” proportions—the extreme drop off of such imports during the 2020 pandemic-induced lockdowns. While consumption was a mere fraction of what it was in 2019 and in particular 2018—a peak year for natural gas consumption in the UK, apparently—overall energy prices in the UK did not drop commensurate with the consumption decrease. Consequently, the resumption of historically “normal” consumption in 2021 had an outsized upward price pressure, producing abnormally high energy price inflation.

This price pressure was exacerbated by a growing arbitrage phenomenon between natural gas prices in Europe and in the United States beginning in the spring of 2021.

Long before war in Ukraine jeopardized the availability of Russian natural gas to the European market, the price of natural gas in Europe regardless of source was rising rapidly.

Crisis Or Transition?

Far from Britain’s energy woes being the fault of Russia—Russia is one factor but no more than that—they are instead largely the result of change.

In the UK, in energy, as in the rest of the world and with the rest of the world’s goods and services, the 2020 lockdowns scrambled everything, including the relative costs of different goods. What the UK is experiencing with natural gas prices, energy prices more broadly, and the consumer prices for electricity particularly, is the consequence of rupturing all the world’s supply chains and distribution pathways simultaneously.

What the UK is grappling with in 2022 is that simply “reopening” the world’s economies is not enough to return the supply side of the global economy to the status quo ante. The reality is there is likely no going back to the status quo ante, and the world must adjust to new cost regimes, and new relative prices for goods and services.

While it would be a mistake to describe natural gas and energy prices, both in the UK and globally, as “transitory”, they are indicative of an energy economy and a global economy that is very much in transition. The old economic equilibria have been upended, and the global economy overall is still settling and establishing new economic equilibria.

If, as seems likely, there is no returning to the status quo ante, then the historical averages which we use to define “normal” availability of goods and services, and thus “normal” prices, are now history. What prices used to be is not what prices are, nor what prices will be.

Which is not to say that British consumers are not experiencing a crisis in energy costs. Costs are far higher than they have been before, and the rise has been far quicker than the world has seen in recent memory. For anyone not expecting such dramatic shifts in prices, both in absolute and in relative terms, suddenly high prices for energy unquestionably look and feel like a crisis—a crisis of change.

Still, eventually economic equilibrium will be reached and inflation (both in energy prices and consumer prices overall) will subside. The energy crisis for the UK is how do consumers adapt to a shifting set of prices until economic equilibrium is reached.

Problem solved:

https://twitter.com/bobscartoons/status/1565048610680672259/photo/1

A great post Peter. Thank you.

I'm a trader, and someone who has travelled the world facilitating commodity deals. Let's just say if "they" can manipulate the silver and gold price, then manipulating other commodities isn't going to be a problem.

Throw in some speculators and a bunch of algos and voila. Free markets don't exist anymore.

And yes, I'm guilty as hell because I also develop my own algos. In my defence I only run them on CFD markets where I can't actually do any real world damage, because CFDs are synthetic derivatives.