When Jay Powell Speaks, Markets Tank

Despite Giving Wall Street Its Expected Rate Cut, Powell Once Again Spooked Investors

If the only thing the Federal Reserve did today was reduce the federal funds rate by a quarter point, it would scarcely be newsworthy. Wall Street certainly took the announcement in stride.

In support of its goals and in light of the shift in the balance of risks, the Committee decided to lower the target range for the federal funds rate by 1/4 percentage point to 3-3/4 to 4 percent. In considering additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee decided to conclude the reduction of its aggregate securities holdings on December 1. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

When the rate cut was announced, Wall Street was decidedly ho-hum about it, with the major indices barely registering the announcement.

Then came Powell’s press conference, and once again he moved markets as only he can—straight down.

Powell is truly a phenomenon—a one man walking talking bear stock market. With but a word he makes market capitalization vanish.

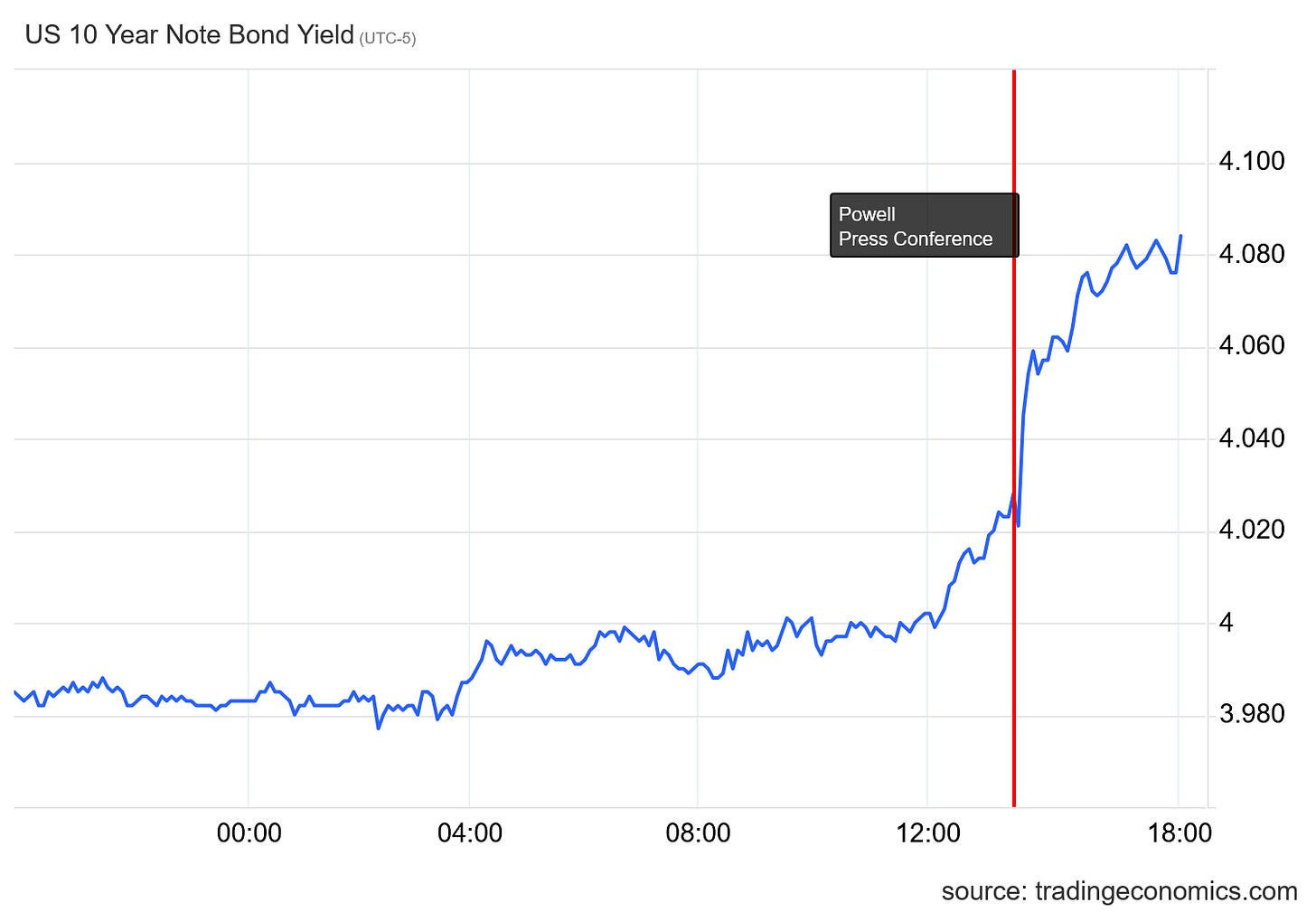

While equities nosedived as soon as he began speaking, Treasury yields surged.

Nor was it hard to understand the reason for the market hiccup—Powell went out of his way to throw shade on the idea of a December rate cut.

The first blow came near the end of his opening statement.

With today’s decision, we remain well positioned to respond in a timely way to potential economic developments. We will continue to determine the appropriate stance of monetary policy based on the incoming data, the evolving outlook, and the balance of risks. We continue to face two-sided risks. In the Committee’s discussions at this meeting, there were strongly differing views about how to proceed in December. A further reduction in the policy rate at the December meeting is not a forgone conclusion—far from it. Policy is not on a preset course.

Nor was the seeming unlikelihood of a December rate cut the only reason Wall Street was roiled by Powell’s presser. In those same opening remarks he announced that the Fed’s efforts to shrink its bloated balance sheet—what is termed "Quantitative Tightening”—will end as of December 1.

At today’s meeting, the Committee also decided to conclude the reduction of our aggregate securities holdings as of December 1. Our long-stated plan has been to stop balance sheet runoff when reserves are somewhat above the level we judge consistent with ample reserve conditions. Signs have clearly emerged that we have reached that standard. In money markets, repo rates have moved up relative to our administered rates, and we have seen more notable pressures on selected dates along with more use of our standing repo facility. In addition, the effective federal funds rate has begun to move up relative to the rate of interest on reserve balances. These developments are what we expected to see as the size of our balance sheet declined and warrant today’s decision to cease runoff.

While on the one hand the Fed is talking down the possibility of another rate reduction in December, the Fed is also done cleaning up its balance sheet.

How the Fed proposes to respond to the next economic shock was a topic Powell declined to cover.

That Powell is serious about wanting to refrain from a December rate cut was made evident in his very first answer after his opening statement. With no prevarication or hesitation, he doubled down on the possibility of there being no December rate cut.

Nick Tamarosa, The Wall Street Journal: Chair Powell, are you uncomfortable with how market pricing has assumed a rate cut as a foregone conclusion at your next meeting?

Chair Powell: Well, as I just mentioned, A further reduction in the policy rate of the December meeting is not a foregone conclusion, as I’ve just said. So I would say that that needs to be taken on board. We had, you know, I would just say this. 19 participants on the committee. Everyone works very hard at this and takes their obligations to serve the American people very seriously. And at a time when we have tension between our two goals, we have, you know, strong views across the committee. And as I mentioned, there were strongly differing views today. And the takeaway from that is that we haven’t made a decision about December. And, you know, we’re going to be looking at the data that we have, how that affects the outlook and the balance of risks. And I’ll just say that.

Part of Powell’s seriousness about no rate cut was made apparent later on, when another question touched on one of the ramifications of the Fed’s decision to end Quantitative Tightening—next year begins Quantitative Easing.

Steve Leesman, CNBC: If you stop at the runoff now, does that mean you have to go back to actually adding assets sometime next year so that the balance sheet doesn’t shrink as a percent of GDP and become a tightening factor?

Chair Powell: So you’re right. The place we’ll be on December 1 is that the size of the balance sheet is frozen. And as mortgage-backed securities mature, we’ll reinvest those in Treasury bills. which will foster both a more treasury balance sheet and also a shorter duration. So that’s what, in the meantime, if you freeze the size of the balance sheet, the non-reserve liabilities, currency, for example, they’re going to continue to grow organically.

And because the size of the balance sheet is frozen, you have further shrinkage in reserves. And reserves is the thing that we’re managing that has to be ample. So that will happen for a time, but not a tremendously long time. We don’t know exactly how long. But at a certain point, you’ll want to start reserves to start gradually growing to keep up with the size of the banking system and the size of the economy. So we’ll be adding reserves at a certain point. And that’s the last point. We’ll be-we didn’t make decisions about this today, but we did talk today about the composition of the balance sheet. And there’s a desire that the balance sheet be-right now, it’s got a lot more duration than the outstanding universe of Treasury securities. And we want to move to a place where we’re closer to that duration. That’ll take some time. We haven’t made a decision about the ultimate endpoint, but we all agree that we want to move more in the direction of a balance sheet that more closely reflects the outstanding Treasuries, and that means a shorter-duration balance sheet.

Now, this is something that’s going to be-take a long time and move very, very gradually. I don’t think you’ll notice it in market conditions, but that’s the direction of things.

Simply put, the Fed is expecting that sometime next year it will feel pressure to expand its balance sheet—expanding the money supply by so doing.

Keep in mind that Powell has already helmed the largest expansion of the US money supply in history, by multiple orders of magnitude:

The loose money policies of Alan Greenspan and Ben Bernanke were nothing compared to Jay Powell’s magic money printing press.

It’s also worth noting that, although Powell announced the official end of Quantitative Tightening yesterday, the money supply has been growing incrementally since the middle of last year.

Why would the Fed anticipate a need to expand the money supply as early as next year? One might think it suspects an economic shock is right around the corner, although Powell dropped no hints about what he thinks it might be.

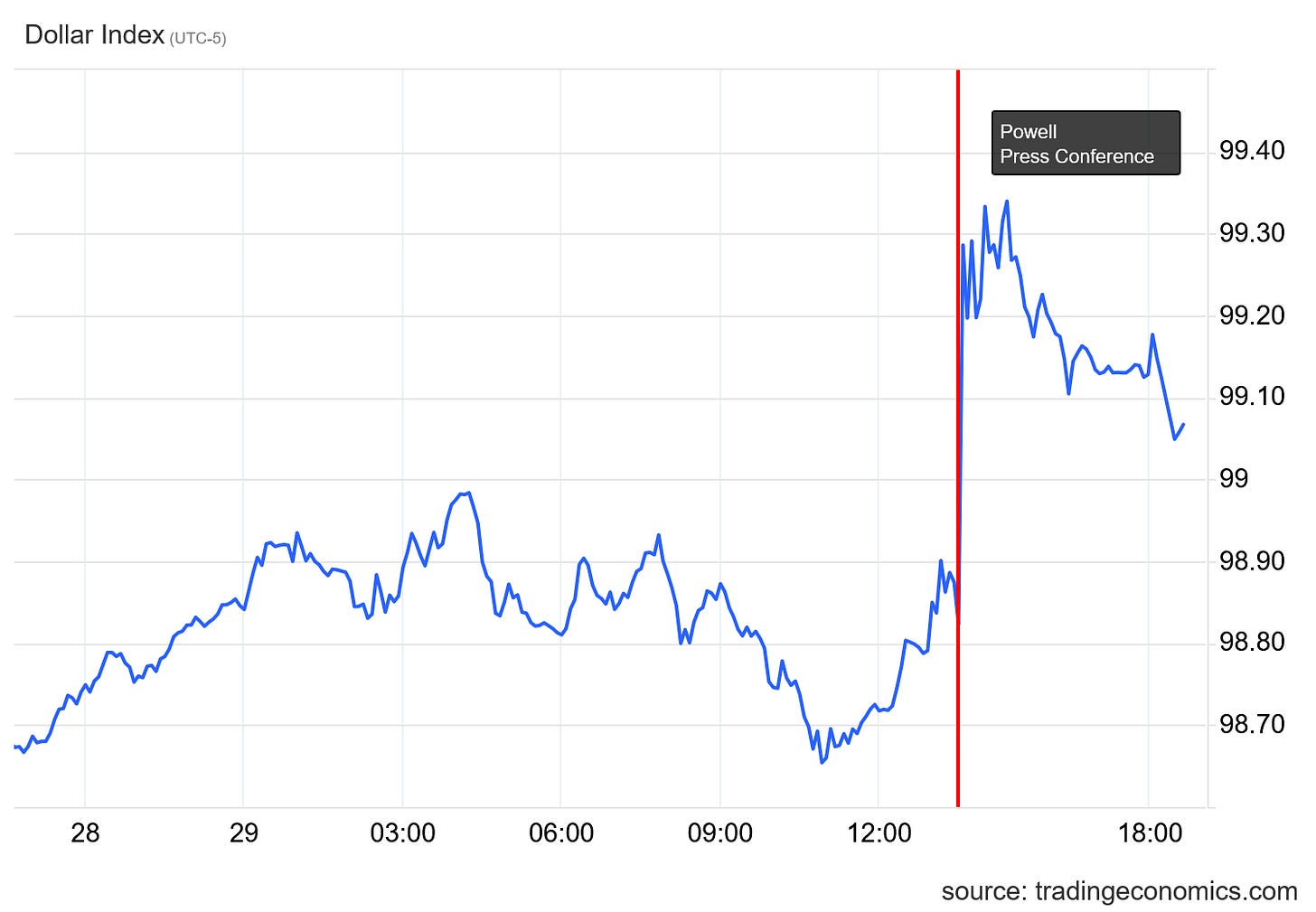

Despite Powell’s reluctance to lean towards a December rate cut, as well as the Fed’s preparations to grow its balance sheet as early as next year, forex markets were as pleased by Powell’s remarks as Wall Street was displeased.

The Dollar Index surged when Powell spoke. Whatever else Fed policy might hold for Wall Street, currency markets liked what they heard.

If the coming economic shock that the Fed fears is global in nature, currency traders are apparently concluding that the dollar will be the asset to hold—the reflex “flight to safety” response that occurs when anything major roils financial markets.

Sprinkled in between these bits of monetary madness Powell reiterated his usual roster of economic errors, most notably his beliefs that tariffs are driving inflation (they aren’t) and that labor markets are soft because of reduced immigration (they aren’t).

Longtime readers will no doubt be familiar with my numerous explorations of these topics, and how Powell is apparently unable to understand the data which is put before him every month. One only has to peruse the “Economic Matters” section of All Facts Matter to know my stance on both tariffs and job growth in this country.

By the end of the press conference Powell had completely undone any good that the rate cut itself might have done. Wall Street got the rate cut it wanted, but it did not get the warm and fuzzy reassurances from Jay Powell that it expected. Wall Street did not even get a sense from Powell that he knew what he was talking about (mainly because he didn’t). Wall Street reacted the way it usually reacts when it does not get what it wants: badly.

Does the Federal Reserve have any real grasp on monetary policy in this country, or where the US economy might be headed next? Jay Powell certainly wants people to think so, and said as much multiple times. Powell’s problem is that he clearly does not, and so every time he speaks, Wall Street tanks.

Jerome Powell’s term cannot end soon enough.

Powell increasingly strikes me as being like Biden: insulated from reality, clueless, uncomprehending. Surely there must be some financial geniuses left on Wall Street who understand the situation as well as you do, Peter. Are they going to play this in ways that make them richer, all the while seeming to “go along” with the Fed’s narrative? The rest of us are going to be left without a musical chair to sit on when the music stops. Disturbing.

The betting markets are putting their money on another cut in December. Can you explain the disconnect? All of this is Way above my pay grade and I lean heavily on you to help me make it make it sense for a lay(wo)man like me…