The Devil always hides in the details. This has long been one of my guiding principles in assessing the economic nonsense news that comes out of the Federal bureaucracy.

The recent GDP estimates for 2022 released by the Bureau of Economic Analysis are no exception. If you merely read the first two paragraphs of the news release, you might reasonably conclude the economy was in good health and all was right with the world.

Real gross domestic product (GDP) increased at an annual rate of 2.9 percent in the fourth quarter of 2022 (table 1), according to the "advance" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.2 percent.

The GDP estimate released today is based on source data that are incomplete or subject to further revision by the source agency (refer to "Source Data for the Advance Estimate" on page 4). The "second" estimate for the fourth quarter, based on more complete data, will be released on February 23, 2023.

Certainly, President Asterisk’s handlers think that way, judging by the self-congratulatory tweets they put out after the BEA news release.

They even persist in denying that the US economy is in a recession.

Reality check: The United States economy is in a stagflationary recession and has been for some time now.

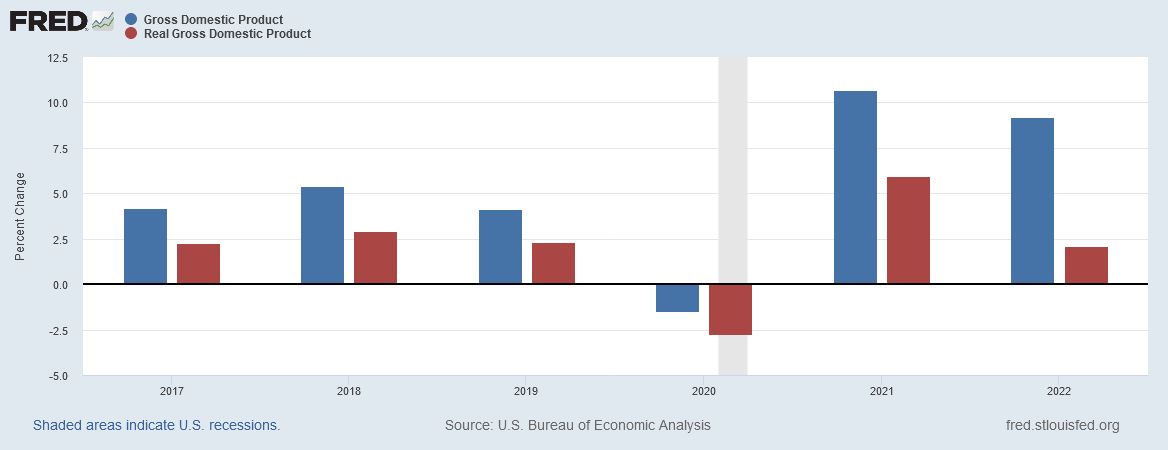

Certainly, when one just looks at the top level GDP numbers, particularly on an annual basis, the economy does not appear to be in bad shape.

Real GDP is higher in 2022 than in any year going back at least to 2017. While one can quibble about the amount of growth, on the surface it would seem that there is at least growth.

Yet we should reflect a moment on the “Real” GDP numbers. What makes them “real”? The BEA reports Real GDP figures in 2012 dollars, which means they presume to account for inflationary effect on prices and incomes from 2012 until today. Can we be certain they are accounting for inflation properly?

Not really.

If we look at the percentage change for nominal and real GDP, and evaluate the difference between the two in the context of consumer price inflation, we immediately begin to see that the “real” GDP number might be something less than real.

In theory, the difference between nominal (current dollar) GDP and “real” (2012 dollar) GDP is the impact of consumer price inflation. Yet when we examine that difference against a backdrop of consumer price inflation as measured by the Consumer Price Index and again as measured by the Personal Consumption Expenditures index, we immediately see that the inferred rate of inflation found by subtracting Real GDP from Nominal GDP does not match well with either of the two common consumer price inflation metrics during the past couple of years.

The difference between nominal and real GDP comes close to matching consumer price inflation per the CPI from at least 2017 up through 2020. However, in both 2021 and 2022 that difference deviated significantly from CPI-measured consumer price inflation.

It is clear that inflation was considerably more significant in 2021 and 2022 than in prior years, given the wider disparity between nominal and “real” GDP after the pandemic-inspired recession in 2020.

That the US economy is out of balance is easily intuited from the disparity post-2020 between these two core economic metrics.

We can get a glimpse of just how out of balance the economy is by noting the increasing disparity between nominal and real GDP throughout 2021 up through the second quarter of 2022.

One important consequence of that growing disparity between nominal and “real” GDP is that the “real” GDP figure is somewhat less than real. Keep in mind that “real” economic metrics are the nominal data with the effects of (consumer price) inflation adjusted out.

In theory, this means that the difference between nominal and real GDP for any period should equal consumer price inflation for that period. No matter how we look at the data, this is not an equality we can derive from the data.

For the most part, consumer price inflation in any given year is greater than the difference between nominal GDP and the reported “real” GDP figures.

This means that the “real” GDP figures we are given by the BEA are, in all probability, at least somewhat overstated. If we take the annual percentage change in nominal GDP and subtract the annual rate of consumer price inflation, we see that difference varies significantly from the reported “real” GDP growth from the BEA.

If the annual nominal GDP growth less annual consumer price inflation is the actual “real” GDP growth metric, then the reported “real” GDP was greatly overstated in 2021 and only slightly understated in 2022.

Nuances like this are what “experts” such as Paul Krugman, who even managed to win a Nobel Prize for his economic illiteracy, manages to ignore completely.

3.6% growth in 2021 and 2.7% growth in 2022 amount to 6.3% over President Asterisk’s Reign of Error, not 6.7%. That’s not a minor difference, particularly when at the size of the US economy we are talking about billions of dollars worth of discrepancy.

Yet what Krugman also overlooks is that, using either “real” GDP metric, the reality is that GDP growth slowed significantly in 2022 from 2021. Even in the most optimistic reading of this data we are still left with an economy that is doing less and less well over time.

Most importantly, we are left with an economy that has not yet even recovered from the 2020 recession, and has been badly distorted and unbalanced by the consumer price inflation that we have endured since.

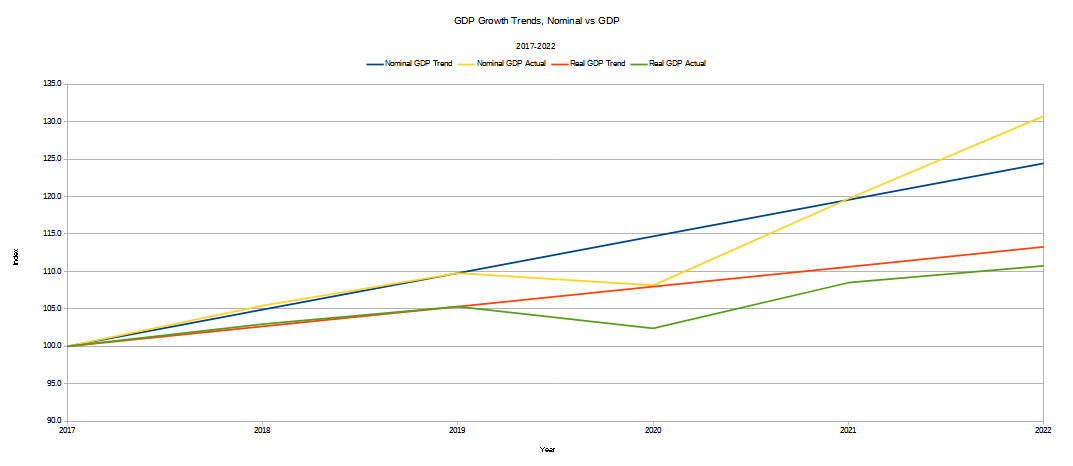

If we compare the trend lines for nominal and reported “Real” GDP growth from 2017 against the actual values for both GDP figures, this becomes immediately clear.

Assuming all things had remained equal in the intervening years, nominal GDP is approximately 6.3% higher than we should have expected it to be, while “real” GDP is 2.5% lower. Moreover, because the reported “real” GDP growth is lower than the pre-2020 trend, all of the reported nominal GDP above the trend must be ascribed to inflation; it is merely price increases, not output increases.

This is how bad inflation is in the US economy. This is the damage being done by inflation. This is what the “experts” do their damnedest to ignore—which means it is something you absolutely should not ignore.

None of the underlying GDP data speaks to an economy that is strong, healthy, or robust. Rather, it all speaks to an economy that is stagnant, distorted, and unbalanced—the epitome of an economy in stagflationary recession.

The bureaucrats and corruptocrats in President Asterisk’s regime will happily ignore this reality, and their supine lackeys in the corporate media will happily tell you, in the manner of the old joke1, to believe them and not your lying eyes that see the evidence of an unhealthy economy every time you go shopping.

Yet when you look past the headline numbers the bureaucrats and corruptocrats love to highlight, when you drill into the details they’d rather you ignore, it becomes clear where the lies are being told. And they’re not being told by your own eyes.

The expression “who ya gonna believe, me or your lying eyes?” has its roots in vaudevillian comic routines. One of the best renditions of this comes from the Marx Brothers movie “Duck Soup”, where Chico Marx’ character Chicolini attempts to bamboozle Margaret Dumont’s Gloria Teasedale with the question “Well, who ya gonna believe me or your own eyes?”

As with most things said by the Federal government, the ironies and malapropisms of vaudeville do more to explain them than mere objective analysis ever could.

I would explain it as a "shitty" economic year.

And it is about to get even "shittier."