When the BLS released the January Consumer Price Index report, one of the more troubling takeaways was that unadjusted monthly food price inflation in the US rose for the third month in a row.

With food becoming more expensive in the US, it is time to revisit the state of global food prices, and what the outlook might be for 2023.

Readers may recall I had a rather pessimistic take on the global food situation last fall, especially looking forward into 2023.

The rise in fertilizer prices and impacts on crops and crop yields is almost certain to produce a renewed surge in global food price inflation worldwide in 2023. For some countries—and even some communities here in the United States—a renewed surge in food price inflation will lead directly to an increase in food insecurity worldwide in 2023. For impoverished nations, the prospect of famine beginning in 2023 cannot be ruled out.

Hunger is coming….

Certainly in the US, food price inflation is creeping back to the fore, but what is the state of food price inflation (and, by extension, food insecurity) worldwide?

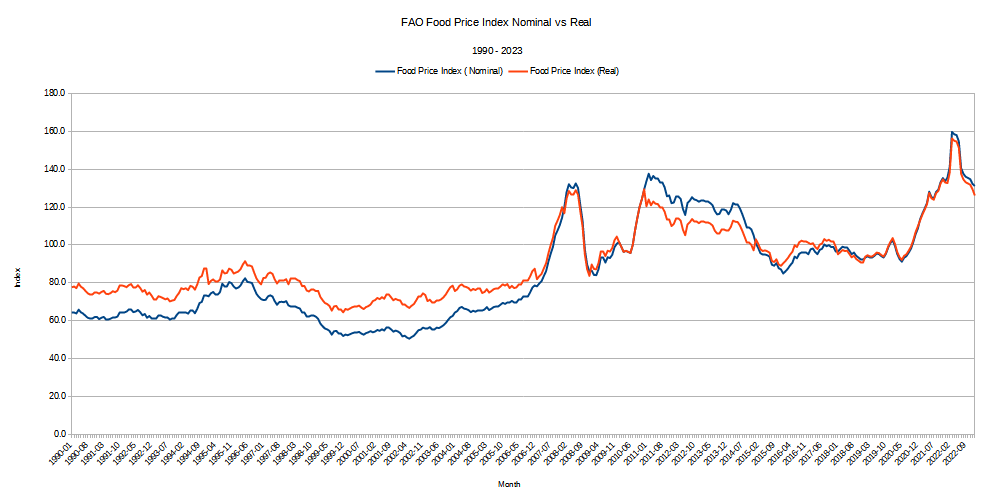

Encouragingly, the UN’s Food and Agriculture Organization reported the global food price index continued its steady downward in January.

The FAO Food Price Index* (FFPI) averaged 131.2 points in January 2023, down 1.1 points (0.8 percent) from December, marking the 10th consecutive monthly decline. With this latest decline, the index has fallen 28.6 points (17.9 percent) from the peak it reached in March 2022. The drop in the index in January was driven by declines in the price indices of vegetable oils, dairy and sugar, while those of cereals and meat remained largely stable.

Intriguingly, while global food price inflation has been far more volatile than in the US, the US has had a higher overall impact of inflation over the longer term.

Comparing the UN FAO Food Price Index to the US Consumer Price Index for food since 1990, food prices in the US have seen a larger relative increase over that time, including the major surge in food price inflation seen globally last year.

The global food price outlook continues to fare better than the US, even when looking at the yearly inflation trend since 2017 and the monthly inflation trend in 2022.

When we look at the state of global food price inflation, almost the entirety of yearly food price inflation across all the FAO subindices has abated. Food prices are not just down from last summer’s peak, in some instances they are down beneath last December/January’s levels.

Food prices have continued to fall worldwide since the last time I explored this topic last October.

After a major spike in global food price inflation in March, almost certainly owing to Russia’s invasion of Ukraine, monthly food price inflation has remained negative across the board.

On a global basis, the current trend is away from higher food prices, which means away from greater food insecurity and greater hunger. Hunger may yet still be coming, but for now it appears to have been delayed somewhat.

While food price inflation has been rising monthly in the US in recent months, on a yearly basis we have been seeing a steady disinflationary trend since August.

Food price inflation is still very high relative to pre-pandemic price levels, but the macro trend is at least moving in the right direction.

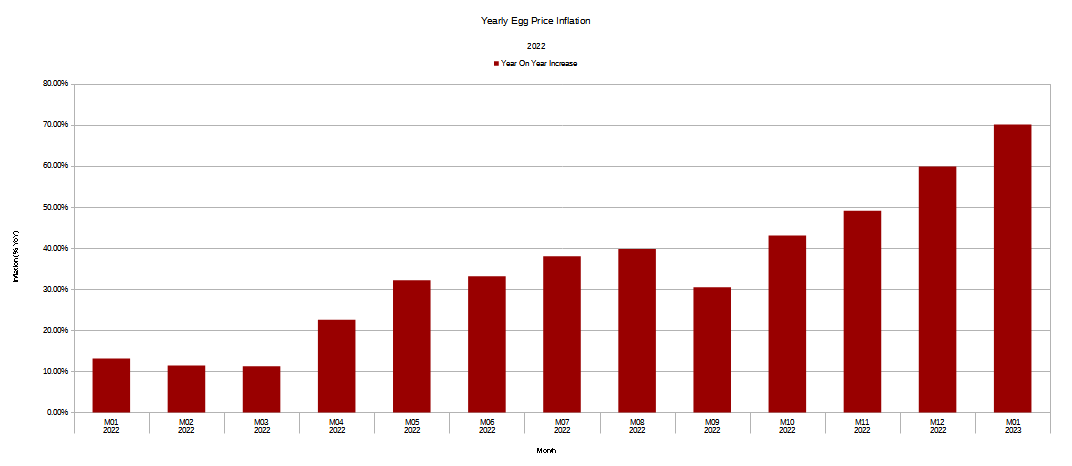

It is important to note, however, that while the macro trend for food price inflation has been disinflationary for several months now, the various subcomponents of food price inflation—food groupings such as meats/eggs, dairy, and cereals/breads—themselves can and have fluctuated significantly since the end of the 2020 pandemic-induced recession.

The variances among these food groupings was particularly evidence throughout 2022, with different groupings experiencing greater inflation than others at different times of the year.

Long-time readers will recall a recurring theme I have had regarding inflation, which is that a primary aspect of the economic damage done is the distortions and dislocations among various goods and services, as relative prices tend to fluctuate considerably in an inflationary environment. Food price inflation in 2022 has been exactly this sort of distortion.

Thus, even while food price inflation overall has been trending down year on year, monthly food price inflation for groups such as meats/eggs and cereals/bakery products have been up and down.

Nor should we overlook the reality of the cumulative impact of rising prices. Even with monthly inflation trends moving down, food prices have increased by as much as 21% just since January of 2022, with staples such as dairy and cereal products increasing by 14-15%.

Even though prices of foods within the meat/eggs group have “only” increased by about 8%, over the course of 2022 the price of eggs has soared over 70%.

In large measure this has been attributed to an ongoing epidemic of avian influenza among poultry producers, which has decimated flocks.

Egg prices across the country hit record level prices in 2022 as they are selling for more than twice the median price from 2021 ($1.78). The avian flu started back in February 2022 with Iowa, the largest egg producer in the U.S., hit the hardest and before it spread to 47 other states. In 2015, the previous avian flu outbreak affected 21 states and 50 million birds were culled as a result of containing the spread of the flu and was, at the time, the most serious animal health event according to a USDA report.

It is illustrative of the magnitude of these distortions that we can see such significant price increases for a single food item such as eggs while still discussion a decline in the macro trend for food price inflation. The constant caveat when referencing particular levels of inflation for anything is always “your mileage may vary.”

Thankfully, there are signs the macro trend will continue at least for now, the most significant sign being that fertilizer and fertilizer input prices are in decline.

This tracks well with Bloomberg’s North America Fertilizer Price Index, which has been recording steady decreases since last April.

However, we should not lose sight of the reality that fertilizer prices at the start of 2023 are still some 59% higher than they were at the start of 2017, with the bulk of that increase coming since the 2020 recession.

Fertilizer prices have come down significantly from their summer 2022 peaks, but they are still significantly higher than historical norms.

How much more downward trend there will be is somewhat problematic, as the global outlook for fertilizer prices is not encouraging. Data analytics firm DTN, which provides data services to the agricultural sector, in December assessed the global outlok for nitrogen fertilizer and determined that prices were likely to remain high, with only marginal improvements likely.

The many issues facing the global nitrogen market in 2022 are going to continue to test the market in 2023. These include the war in Ukraine, rising natural gas prices, weather and currency concerns.

As a result, the supply and price of nitrogen fertilizers will be subject to the various geopolitical world events. Nitrogen prices are already at high levels and fertilizer analysts don't believe prices will decline any time soon.

DTN had a more mixed assessment for phosphorus fertilizer prices.

The bad news is that various challenges remain to the global fertilizer market. Top of the list is the continuing war in Ukraine, as well as some nutrient logistics concerns in the United States because of weather.

The good news is with record high prices, there was less demand globally for fertilizer in 2022: Many farmers decided not to apply P fertilizers. This situation could lead to lower P fertilizer prices in 2023.

Meanwhile, the outlook for potash fertilizers is also mixed, with much hinging on what happens next with the war in Ukraine.

The global potash (K) outlook in 2023 looks to be a bit of a mixed bag. The entire world fertilizer industry continues to watch closely the continuing war between Ukraine and Russia which could disrupt supply. Russia and Belarus account for 41% of the globally traded K and are the second and third largest producers.

Because of record-high fertilizer prices, farmers across the world cut back on these nutrients which caused much demand to fall. With more supply on deck in 2023, potash prices should push lower in the New Year.

The state of the global fertilizer markets can perhaps best be described as “dicey”. Price and availability for various fertilizers could impact fertilizer usage globally, which would in turn have a negative impact on crop yields per acre.

While fertilizer prices globally remain a concern and a potential drag on agricultural output, North America—particularly the US and Canada—appears to be fairly well positioned as far as agricultural outputs for 2023. The downward trend should mean the recent increases in food price inflation will abate in the near term, as farmers are able to afford greater applications of fertilizer and thus increased crop yields per acre.

If global fertilizer prices remain too high, and farmers elsewhere are forced to cut back on fertilizer use, resulting in diminished crop yields per acre, the resultant increases in global food scarcity will inevitably produce upward pressure on food prices even in North America.

So long as fertilizer prices in North America continue to trend downwards, the long term outlook for food prices in North America similarly should broadly trend downwards (outside of items such as eggs, which will see the greatest impact on supply from the avian influenza pandemic). Even with surging egg prices, yearly food price inflation has trended down in the United States, and the current indications are that trend will continue.

Depending on how fertilizer prices move globally, global food price inflation may begin increasing in the near term, as farmers grapple with reduced fertilizer supply and increased fertilizer price, which is bound to impact global crop yields per acre.

Overall, there is room for some guarded optimism about food price inflation within the US for 2023, even as the global outlook is likely to be rather more pessimistic. Food insecurity, the inevitable followup to rampant food price inflation, is for now a little less likely in the near term.

There is enough instability in the world, however, that the outlook on food price inflation and food insecurity could shift dramatically literally overnight.

Eat, drink, and be merry, for tomorrow it might be too expensive!