A Government Shutdown Looms...Does Wall Street Even Care?

Markets Are Not Showing Usual Signs Of Stress

Congress once again is on the verge of a government “shutdown” because neither Democrats nor Republicans can figure out that they actually need to cooperate and—gasp!—compromise—to pass the spending bills that make up the US government’s “budget” for the coming fiscal year.

The U.S. Senate and House on Thursday were due to push ahead with conflicting government funding plans, raising the chances of the fourth partial shutdown of the federal government in a decade beginning in just three days.

The Senate planned a procedural vote on a stopgap funding bill that has broad bipartisan support in the chamber, while the House of Representatives is set for late-night votes on four partisan appropriations bills that have no chance of becoming law and would not alone prevent a shutdown even if they did.

We must, however, be clear on one thing: the “shutdown” will hit pause only on “nonessential” services. Social security payments and veterans benefits will still go out. Student loan payments would still go out. The FBI would continue to violate people’s civil liberties. FEMA’s disaster management efforts would continue to be a disaster.

With perverse irony, paying the “essential” workers is itself a “nonessential” service—which means that active duty military as well as civilian government employees will go without pay even while still expected to perform their jobs.

If a shutdown does happen and you are not a federal employee, however, chances are you won’t even notice, at least not right away.

If a shutdown does happen, chances are Wall Street won’t even care. The usual indicators of anxiety in the marketplace are strangely absent from this very bad, very serious, crisis of government.

As of this writing, the Vegas odds are that a government shutdown is going to happen.

With just three days until the deadline, concerns over a government shutdown are growing. Maya MacGuineas, President of Committee for a Responsible Federal Budget states that a shutdown is almost inevitable — “pretty much a sure thing.” MacGuineas notes that, long term, the “big, outstanding issues” with determining how to fund the government must be addressed.

Even if Congress could magically figure out how to behave like responsible adults (as if!), getting all 535 Representatives and Senators in the same place and to agree to the same thing would require levels of efficiency and focus Congress hasn’t had for decades.

With Congress still unable to figure out how to behave like responsible adults, passing constructive spending bills that can get all the way to the Oval Office for the President’s signature is not going to be happening any time soon. The deadline for all this legislating and sausage-making is midnight Saturday night.

We can safely assume that the government will shut down for a time. It might be a few days, or a few weeks. The record for the longest shutdown is 34 days, in late 2018 and early 2019, during Donald Trump’s Administration.

The prevailing narrative in the corporate media is that an extended government shutdown would be bad for the economy:

A US government shutdown would have a cascading economic effect, beginning mildly and deepening over time as millions of workers go without salary, private contractors aren’t paid and consumer uncertainty grows over Washington’s dysfunction.

Federal contractors ranging from Elon Musk’s SpaceX to janitorial service providers for local federal buildings are bracing for up to $1.9 billion a day in lost and delayed revenue as funding lapses Oct. 1.

About 1.3 million active-duty military and another 2 million civilian federal workers won’t receive pay for the duration of a shutdown, even essential employees who have to work anyway. While federal workers will automatically get their missed salary once a shutdown ends, contract employees historically haven’t received back pay.

A shutdown would also presumably be bad for Wall Street.

"The stock market is reacting just as badly to the prospect of a shutdown as in December 2018," economist Ian Shepherdson wrote in a note.

"The stock market tanked in the weeks before the record government shutdown from December 22, 2018, through January 26, 2019, and is on course for a repeat performance this time around," he said. "The S&P 500 (SP500) (NYSEARCA:SPY) (IVV) (VOO) fell by 15.5% from its December 3 high to its low on December 22, as the shutdown began."

While the markets quickly recovered during the last shutdown, presumably “this time is different” because more of the funding bills that make up the budget have not made it through the Congress yet.

"The shutdown story this time, however, is worse, because none of the 12 appropriations bills which authorize discretionary spending have yet been passed. All non-essential employees whose positions are financed by these bills, therefore, are subject to immediate furlough in the event of a shutdown."

A government shutdown under current conditions would presumably furlough around 800K workers, which would be more than double the number furloughed during the last shutdown.

Congress had passed five bills before the 2018 shutdown, which meant 380K workers were furloughed.

That will jump to more than 800K this time in the event of a shutdown "and a much greater number of contractors will be hit too by non-payment of invoices due from the federal government," Shepherdson said.

It is quite conceivable that, if indeed some 800,000 federal workers and contractors are furloughed, jobless claims in this country will spike at least briefly.

This happened in the last shutdown, when unadjusted initial jobless claims surged as the shutdown dragged on.

Continuing claims also soared and for a somewhat longer period.

A repeat of that phenomenon would definitely disrupt Dementia Joe’s unearned victory laps over jobs numbers he has done nothing to deserve.

Despite these seeming major “concerns”, Wall Street seems not too terribly worried about a shutdown at the moment.

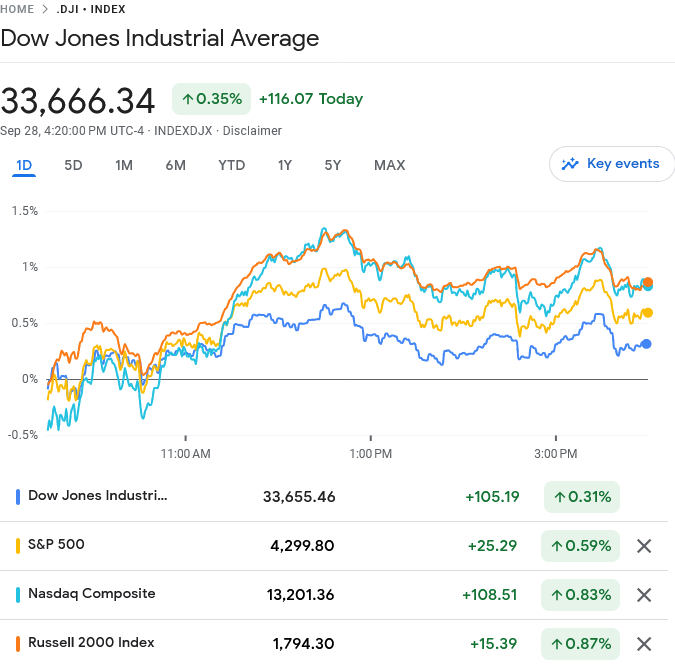

As of this writing, the stock markets close up on the day’s trading.

That itself is a rather surprising vote of confidence overall, considering that by early afternoon on September 27, all major indices were down on the week, and most were down by more than 2%.

Even so, to the extent that stocks are down in the longer term, one has to wonder what else is at play, particularly given recent rises in the price of oil.

That stocks have taken a bit of a beating for the month, therefore, is difficult to ascribe to fear over a government shutdown. They are down, but perhaps not (or not exclusively) due to concern over a government shutdown.

Even at the 1-month horizon, however, stocks still staged a significant rally in recent days and managed to recover a fair amount of the lost ground.

If Wall Street is worried about a shutdown the stock market is certainly not showing any of that anxiety.

Even Treasury yields are indicating less Wall Street angst rather than more as the shutdown deadline looms large.

Although yields have been rising in recent weeks, as of this writing they had retreated significantly from their highs.

During the most recent trading day, yields moved consistently lower throughout the day.

Much as with the stock markets, bond markets are not reflecting any sense of rising anxiety over a shutdown.

Even currency markets are only showing modest signs of angst which could be attributed to fears of a government shutdown. For the month the dollar index is up, and the dollar itself is up against all major foreign currencies.

Intriguingly, the dollar’s greatest gains have come as the shutdown deadline has come closer.

It is only in the most recent trading day that the dollar has retreated even a little.

It is difficult from the currency trading data to divine even among international markets any grave concern over the looming government shutdown.

With the prospects of a shutdown seemingly near certain, if there were any such fears the expected behavior would be a flight to safety reaction across all markets—meaning stocks would be down, bond yields would be up, and the dollar would be down. Those trends simply are not in evidence, and thus any narrative predicated on Wall Street fear of a shutdown must be taken with a grain of salt.

This is not to say that shutdowns are even on balance a good thing. If nothing else, government shutdowns show once again how dysfunctional and self-destructive the Congress has become. Ultimately, the function of the Congress is to enact legislation, and the most fundamental pieces of legislation the Congress must enact each year are the appropriations measures to fund the government.

Eventually, these appropriations measures must be passed, and a budget enacted. No good comes from Congress delaying this inevitability. There is no benefit to Congress kicking this can down the road yet again.

It is the job of the Congress to fund the government, and it is the job of the Congress to figure out where the government will get its funds—will the government be in deficit (again), or will it do something novel and actually operate at a surplus? Funding the government is a task that requires both Democrats and Republicans, progressives and conservatives, centrists and party radicals, to find common ground and identify levels of funding that the Congress as whole can accept. Presumably, what the Congress as a whole can accept is what the nation as a whole would accept if it were to decide the matter directly.

That Congress is not doing its job is obvious to anyone who bothers to look.

That people actually care, or that Wall Street does care, is not nearly so certain.

Shut it down!

They can't do their jobs, we can't do ours.

"They pretend to pay us and we pretend to work."

Gee... I sure hope we can continue to pay all the salaries of the gov't workers in Ukriane through this (sarcasm off)

I worked in Ottawa (hint: capitol of Canada) for many, many years. By my back of the serviette (aka napkins in the US) calculations, I estimate that gov't workers there do about 50% of the work of a similar private sector employee for 75% more money, if you include all the time off, pensions, etc.

My wife's cousin was vile Trudeau's nanny, we were friends with his health minister back before we left to the US, we used to go weekly to what is now a senator's home (yes, Canada DOES have senators), and I used to see former PM Chretien wandering around my bldg on 50 OConner when he was in the political wilderness; I also used to work with RCMP quite a bit. I know whereof I speak. My wife, when young, worked for Indian and Northern Affairs; she quit after one summer, saying it was like working with dead people. She said she would them on the bus, with just deadness on their sullen visages.

But we NEEEEEED the govt for all the welfare if provides people whine. Look, mes amis, I can to 10 times the work for 10% of the money, and a million times more human compassion that the govt could ever even THINK of doing. Leave me my money, and I will do it.