The Iran-Israeli War is dominating the headlines for obvious reasons, but we do well to remember that other news has not stopped. The Fed continues its (mis)management of the money supply, and today begins its June session of the Federal Open Market Committee, where it will determine the federal funds rate for the next month.

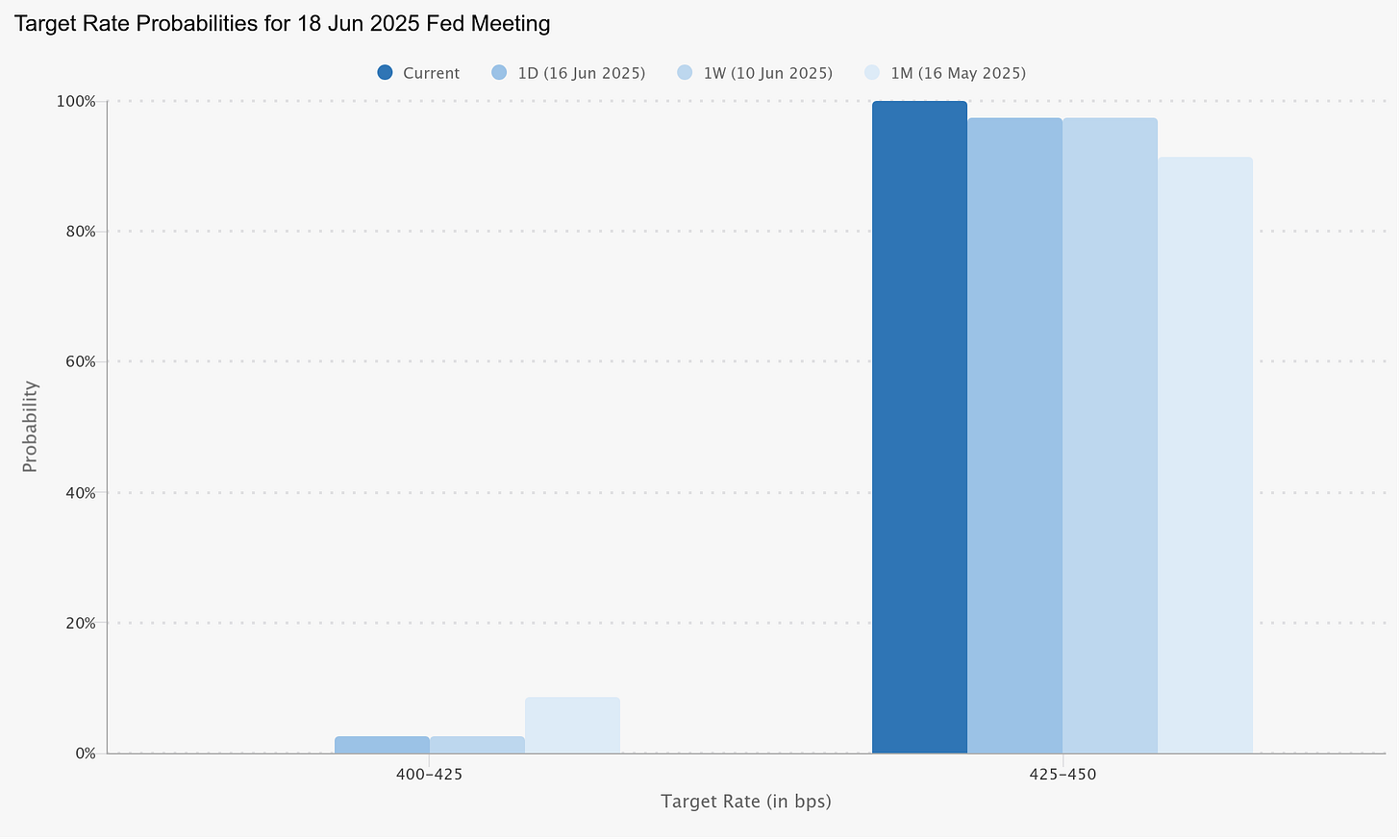

Quite literally no one on Wall Street is expecting the Fed to cut the federal funds rate at this meeting. CME Group’s FedWatch Tool puts the probability of the Fed standing pat at over 99.9%.

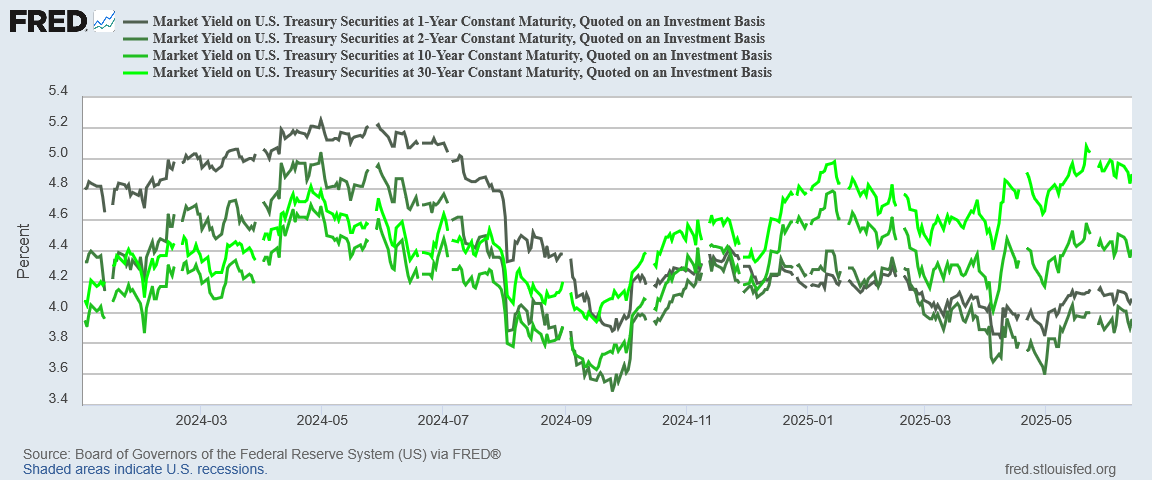

Even without a federal funds rate reduction, market interest rates have been trending down over the past month, after rising somewhat since March.

Add to the nonexistent expectations of a rate cut the faint but growing signals of increasing inflationary pressure from rising oil and commodity prices and Jay Powell has a workmanlike case for doing nothing in rates this month.

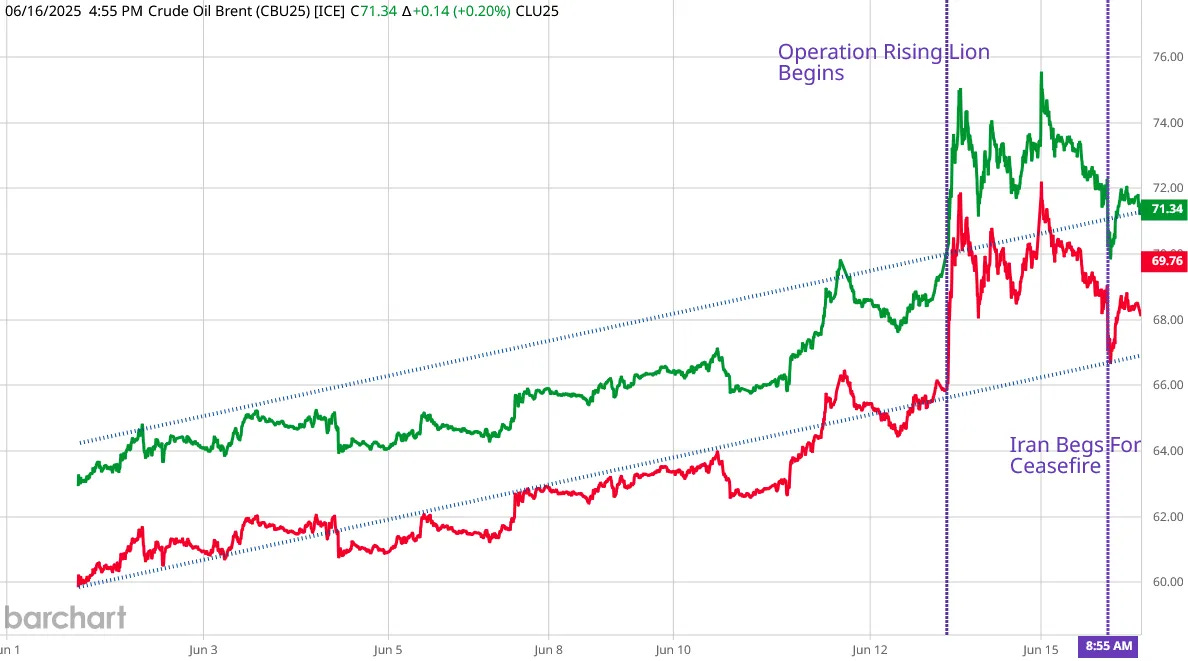

Certainly the Iran-Israeli War’s ever-shifting dynamics have added to the price instability in oil.

Oil was rising before the war began, spike when the war began, and has been up and down on talk of Iran asking, even begging, for a ceasefire.

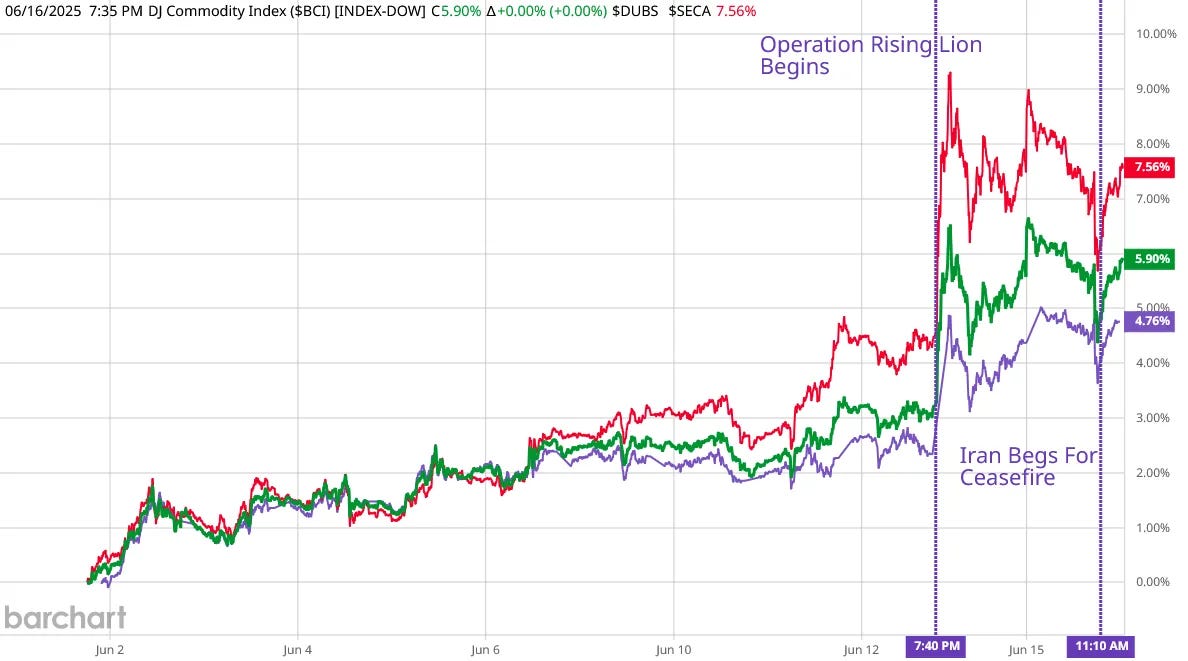

Commodity price indices have displayed the same trends.

The war itself would give Jay Powell considerable cover for doing nothing at the moment.

Unfortunately, doing nothing is what Jay Powell has been good at of late. The Fed essentially shrugged last month, deciding that nothing was a good thing to do.

Yet the Fed also claims a mandate for pushing full employment in the economy, and the unemployment trends of late have been towards more joblessness and less employment.

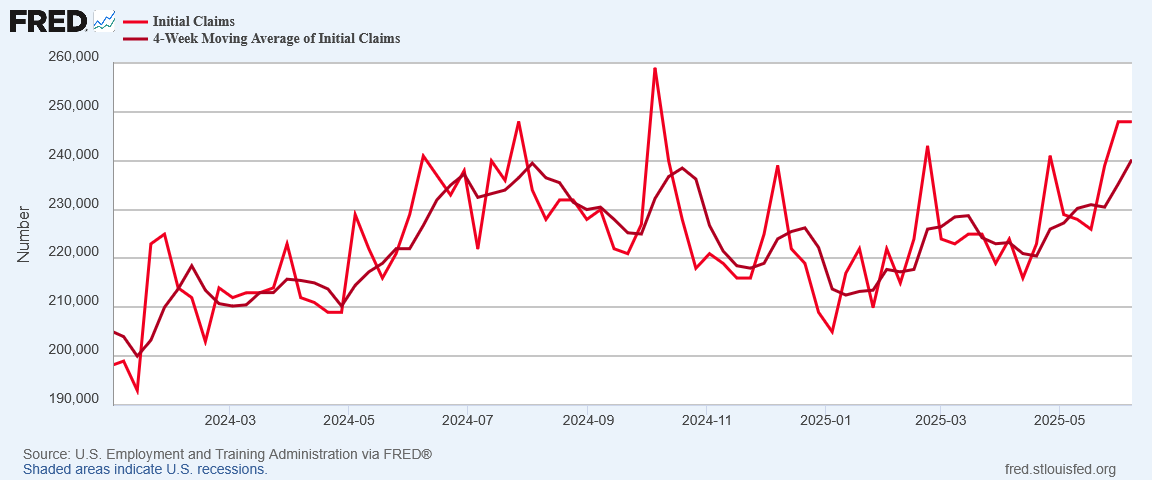

Initial unemployment claims have been trending up all year.

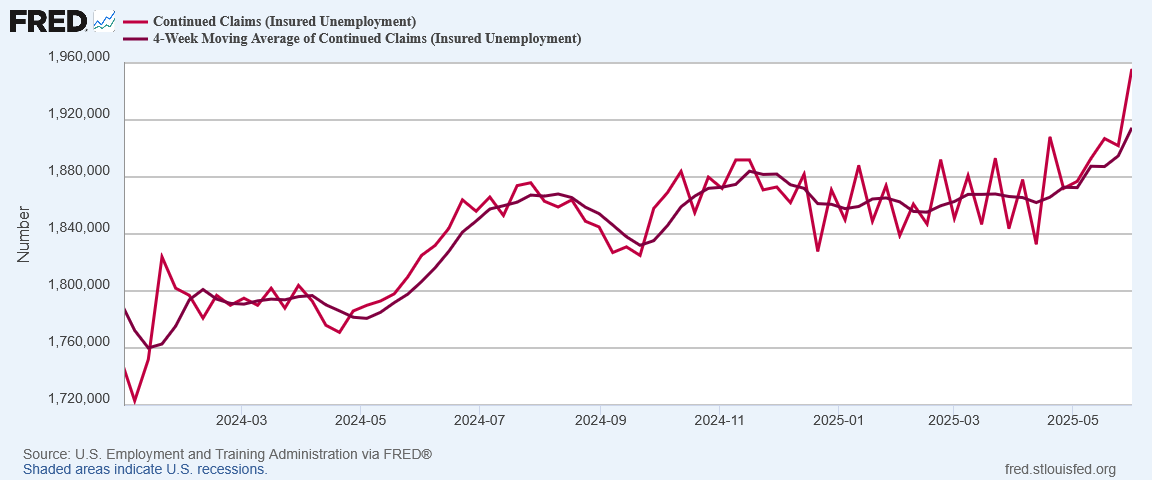

Continuing unemployment claims have been moving steadily higher for over a year.

Rising joblessness is, within the Fed’s theory of the magic of rate cuts, a reason for reducing the federal funds rate. The BLS jobs data has been showing rising joblessness for quite some time. In some respects, this country’s ongoing jobs recession may be getting worse and not better.

Could the Fed have pushed through a 25bps rate cut in May? Yes. Was it essential then? Probably not.

However, had the Fed cut rates in May, even with rising joblessness the case for standing pat this month would be greatly bolstered. Rising joblessness means the pressure is rising for the Fed to trim the federal funds rate, war or no war.

Jay Powell probably missed his best moment to trim the federal funds rate by shrugging it off in May. He is almost certain to shrug it off again this month because of Israel’s war with Iran.

What the joblessness outlook will be in July when next the Fed considers interest rates is not a contemplation brimming with optimism.

The Fed is meeting this week and will likely once again do nothing but shrug.

That is probably not good news for the economy or for the American worker.

Peter, several weeks ago you stated that Trump would not fire Powell. Since then, Trump has had his patience severely tested by Putin, Zelenskyy, Iran, and other irritants. He probably feels that he has been very patient with Powell, although Trump has made clear that he wants Powell to lower rates. Do you still think Powell’s job is safe, or do you now think Trump might fire his slow-moving hiney?