Wall Street got a bit of what it considered welcome news from the US Department of Labor when the final jobless claims statistics for 2022 were released yesterday.

In the week ending December 24, the advance figure for seasonally adjusted initial claims was 225,000, an increase of 9,000 from the previous week's unrevised level of 216,000. The 4-week moving average was 221,000, a decrease of 250 from the previous week's revised average. The previous week's average was revised down by 500 from 221,750 to 221,250.

The advance seasonally adjusted insured unemployment rate was 1.2 percent for the week ending December 17, unchanged from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending December 17 was 1,710,000, an increase of 41,000 from the previous week's revised level. The previous week's level was revised down by 3,000 from 1,672,000 to 1,669,000. The 4-week moving average was 1,679,500, an increase of 25,250 from the previous week's revised average. The previous week's average was revised down by 3,000 from 1,657,250 to 1,654,250.

That the insured unemployment rate of 1.2% was holding its own was considered good enough news for Wall Street to move stocks higher on the day.

On an unadjusted basis, the unemployment claims data is somewhat less optimistic.

Actual initial claims rose 23,146, while continuing claims declined 24,364.

The advance number of actual initial claims under state programs, unadjusted, totaled 271,590 in the week ending December 24, an increase of 23,146 (or 9.3 percent) from the previous week. The seasonal factors had expected an increase of 12,974 (or 5.2 percent) from the previous week. There were 257,870 initial claims in the comparable week in 2021.

The advance unadjusted insured unemployment rate was 1.1 percent during the week ending December 17, unchanged from the prior week. The advance unadjusted level of insured unemployment in state programs totaled 1,569,764, a

decrease of 24,364 (or -1.5 percent) from the preceding week. The seasonal factors had expected a decrease of 61,762 (or -3.9 percent) from the previous week. A year earlier the rate was 1.2 percent and the volume was 1,638,597.

How welcome is this news? While Wall Street considered it good enough to boost the Dow Jones some 269 points on the day, at the same time the actual number of initial claims not only rose, but rose more than expected. Moreover, this marked the third straight week where the unadjusted weekly change in initial claims rose, even as the weekly change in continuing claims dropped.

Still, it should be noted that the weekly change for both initial and continuing claims has been negative for the majority of the second half of 2022—a decline in unemployment claims is an unambiguous bit of good news.

However, on a seasonally adjusted basis, the weekly changes over the same period are considerably less optimistic, with considerably more frequent rises than falls for both initial and continuing claims.

Equally problematic is the 4-week moving average for initial and continuing claims.

While the 4-week moving average shows more rises than falls for both initial and continuing claims, overall, the 4-week moving average for initial claims over the past month has shown a decrease more often than an increase.

While the weekly unemployment claims data is built on reports from the several states’ unemployment insurance programs, it is for the most part a relatively complete census of insured unemployment claimants for the week. In theory, that should give the report enough of a sample to overcome the most common causes of statistical error.

However, after the Philadelphia Fed corrected the BLS jobs statistics, effectively eliminating all job growth in the US during the 2nd quarter (and likely up through November), all jobs data should be taken with at least a slight grain of salt.

As the numbers do get revised post-release, we should allow at least some variance on this week’s numbers as well.

Still, the unadjusted numbers unambiguously show a rise in jobless claims, which is a strange bit of “welcome” news for Wall Street, until one considers the Fed’s interest rate hikes and fight to reduce and contain consumer price inflation. The recessionary nature of rising jobless claims makes this week’s claims report indicative of a softening labor market, which tends to bolster the probability the Fed will limit its next rate hike to 25 bps, rather than the 75 or 50bps that has been the case over the past 5 months—the sort of “good bad news” that has become a staple of various assessments of economic statistics since the Fed began hiking interest rates back in March.

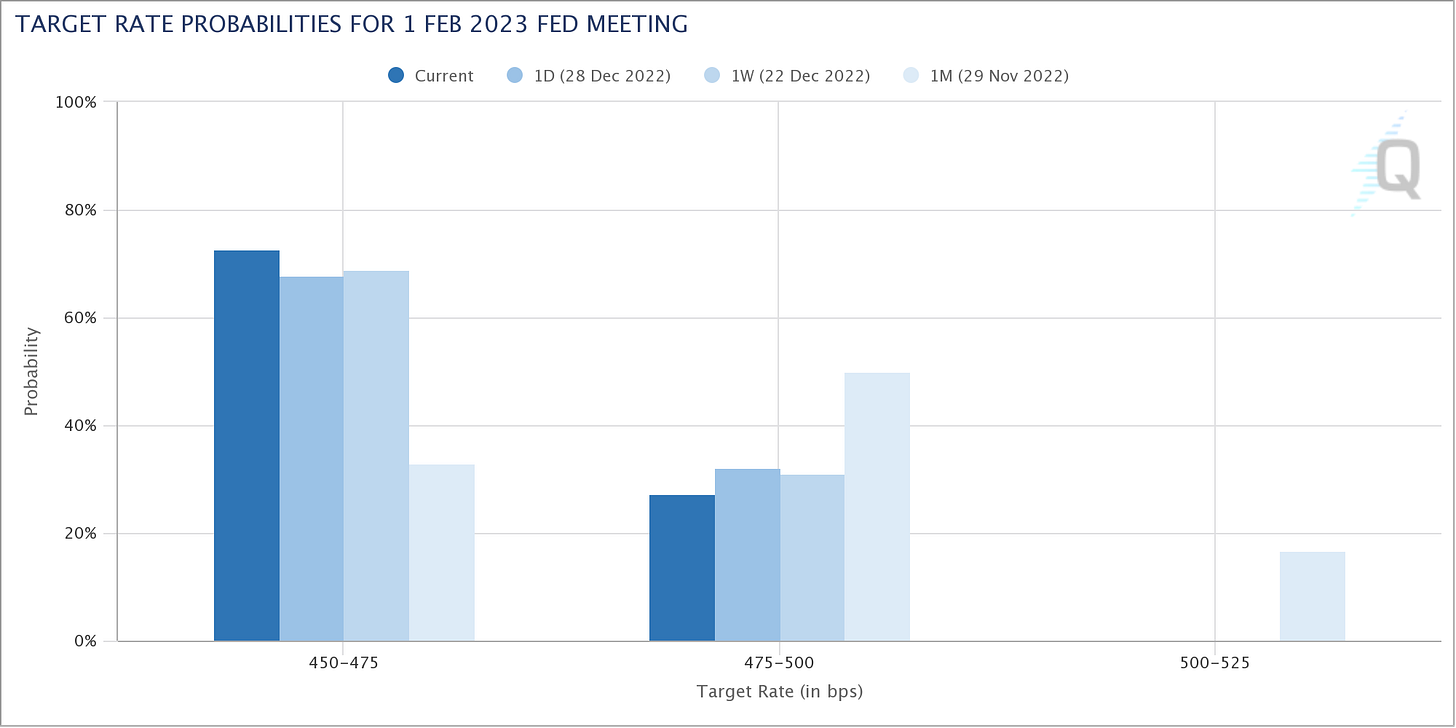

Currently, Wall Street is expecting a 25bps rate hike on 1 February 2023, the date of the next FOMC meeting.

While the jobless claims data is another instance of “good bad news”, the underlying reality is that jobless claims increased this past week. Not only is indicative of a softer labor market, it reinforces the trend from the BLS’ Employment Situation Summary’s Household Survey of little to no job growth in the United States since March.

Regardless of how Wall Street views that trend, it is still a recessionary trend that extends back to the beginning of the year and is yet one more item illustrating that the US economy is mired in recession already. The trend in jobless claims is yet one more item that shows the recession steadily getting deeper, with the economy getting slower.

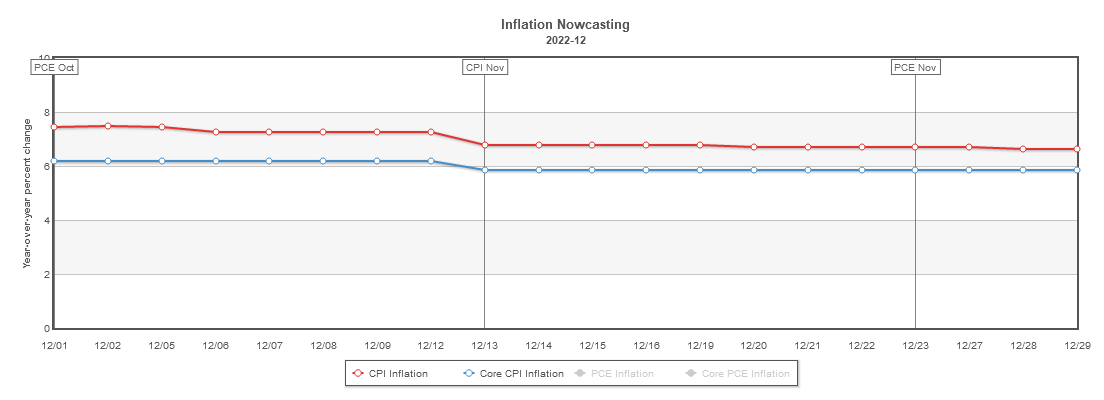

Coupled with persistently high inflation even in the face of a worsening recession—the Cleveland Fed’s inflation nowcast projects December’s year on year inflation rate to fall to 6.6%, a half percentage point drop from November’s 7.1%—the “best case” scenario for the economy moving into 2023 is more stagflation, with inflation remaining elevated even as the economy slows and contracts.

While Wall Street welcomes such data, as it means fewer and smaller interest rate hikes from the Fed, a slowing and contracting economy is always bad news for Main Street. Economic contraction means fewer jobs, less opportunity, and generally less prosperity all around. Regardless of how Wall Street views the data, less is never more on Main Street.

This week’s rising jobless claims numbers were not so large as to signal an employment apocalypse. Still, rising claims numbers are only “good news” to Wall Street hedge fund investors who see financial gain in loss of jobs in the real economy, who gain even when the economy loses.

That makes it hard to see them as any sort of “good news.”