Bank Failures Won't Bring On The Recession. Recession Is Already Here

Banks Might Be The Headlines Today, But There's Still The Rest Of The Economy To Consider

Despite the fondest hopes of banking regulators everywhere and the corporate media, global banking remains an ongoing crisis, as was made plain on Friday. Not only did Credit Suisse and First Republic Bank remain very much topics of ongoing concern, but Deutsche Bank joined them, as its falling stock price and spiking bond insurance rates gave investors everywhere a fresh case of interest rate heartburn.

Yet banks are hardly the only economic area of concern at the moment. Recession signals continue to flash from all sectors of the global economy, and do not lose their impact merely because they are overwhelmed by media hysterics over banking.

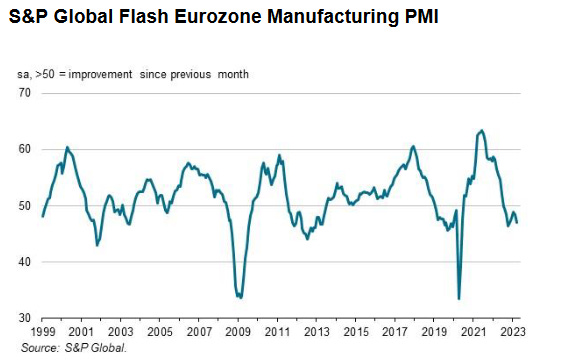

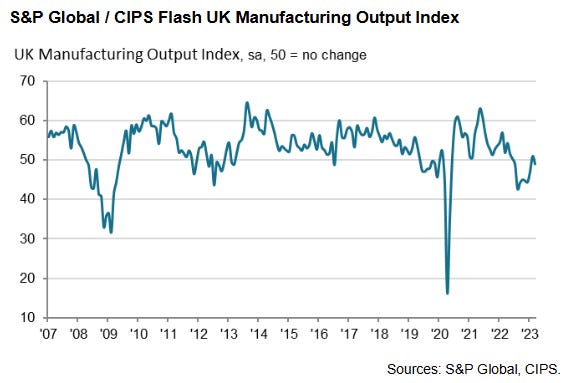

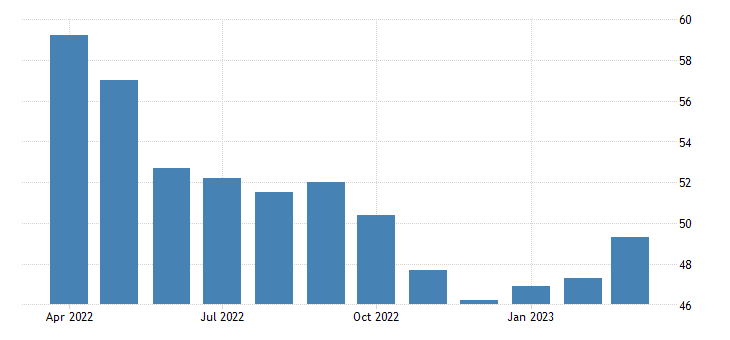

The latest manufacturing PMIs from Europe, the UK, and the US are all reminders that the productive economy around the world is not doing all that well at the moment.

It is hard to have a growing economy anywhere when people aren’t making enough things.

The corporate media and the “experts”, of course, are doing their level best to spin the data as being positive. In the Euro zone, for example, the manufacturing PMI dropped to a 4-month low at 47.1. Note that any PMI below 50 indicates economic contraction rather than expansion.

Wall Street would very much like to overlook this figure and focus on the composite PMI as well as the services PMI, both of which show overall economic expansion driven by expansion in Europe’s service sectors.

Eurozone economic growth accelerated to a ten-month high in March according to the latest flash PMI survey data, adding to signs that the economy is reviving after

falling into decline late last year. Inflationary pressures have meanwhile continued to moderate, with input prices even falling sharply in manufacturing. Jobs growth has also accelerated and business confidence in the outlook has remained resilient despite concerns stemming from recent banking sector stress and higher borrowing costs.However, the overall rate of growth remains modest and driven solely by the service sector, with manufacturing suffering a further loss of new orders, meaning current output is only being sustained via backlogs of previously placed orders. Furthermore, despite easing further, overall input cost and selling price inflation rates remain elevated by historical standards. In fact, charges again rose at a pace unseen prior to the pandemic.

However, a 10-month high in the services reading does not alter the reality that the Eurozone’s manufacturing base is contracting, and has been for quite some time.

Nor is the UK having any better time. Manufacturing and Manufacturing output both are in contraction, even as the services PMI declined.

March data pointed to a sustained increase in UK private sector output, largely reflecting a strong performance by the service economy. New business received by service sector companies rose at the sharpest pace for 12 months, although staff shortages acted as a constraint on growth. Manufacturing production dipped in March and was once again held back by subdued order books.

It is hard to argue a prosperous and vibrant economy when manufacturing is contracting. A <50 manufacturing PMI means companies are not making new widgets, are not shipping them to wherever, and are not employing people in typically higher-paying manufacturing jobs.

Economies across Europe are not producing an abundance of widgets, and their economies are suffering because of it.

Nor is the United States doing any better. Even though the S&P PMI report speaks of a “renewed expansion in business,” the reality is that, 49.3, manufacturing business is not expanding in the US, but merely contracting at a slower pace—a point subtly conceded in the PMI report itself.

At 49.3, the S&P Global Flash US Manufacturing PMI was up from 47.3 in February, and signalled a slight deterioration in operating conditions across the manufacturing sector during March. The rate of decline in the health of the sector was the slowest in the current five-month sequence of deterioration amid a renewed rise in production and a softer fall in new orders.

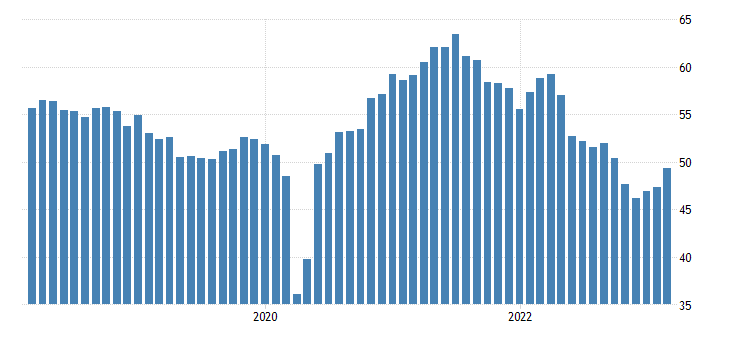

Even at that, the Manufacturing PMI for the US has been in steady decline for over a year—contraction is not merely unavoidable, it has been the near-term trend.

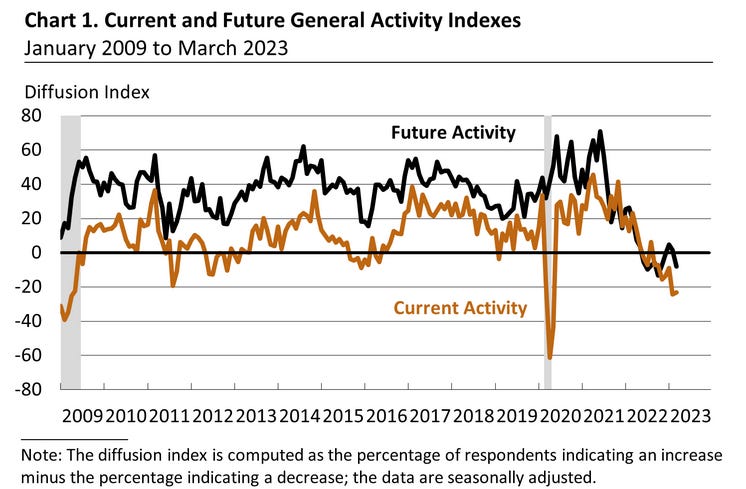

This signal is echoed by business surveys from both the Philadelphia and New York Federal Reserve banks.

The Philadelphia Fed Manufacturing Business Outlook Survey saw a weakening of the economy generally.

Responses to the March Manufacturing Business Outlook Survey suggest continued declines for the region’s manufacturing sector. The survey’s indicators for general activity, new orders, and shipments were all negative, and the firms reported a decline in employment, on balance. The survey’s broad indicators for future activity continued to suggest subdued expectations for growth over the next six months.

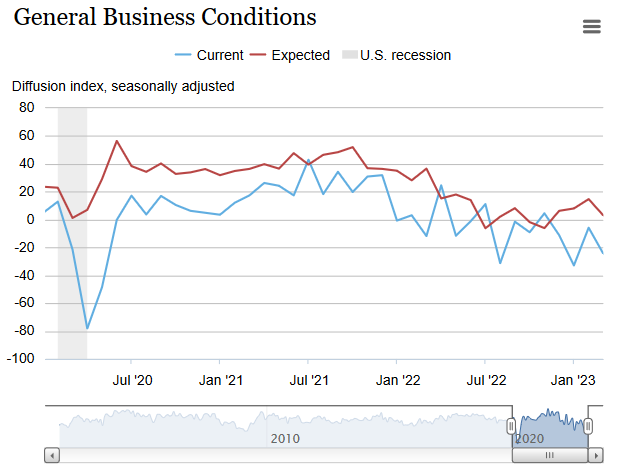

The Empire State Manufacturing Survey showed similar weakness in manufacturing.

Business activity continued to decline in New York State, according to firms responding to the March 2023 Empire State Manufacturing Survey. The headline general business conditions index fell nineteen points to -24.6. New orders dropped significantly, and shipments declined modestly. Delivery times shortened for a second consecutive month, suggesting supply availability improved, and inventories were steady. Both employment and hours worked declined for a second consecutive month. Input and selling price increases slowed somewhat. Looking ahead, businesses expect little improvement in conditions over the next six months.

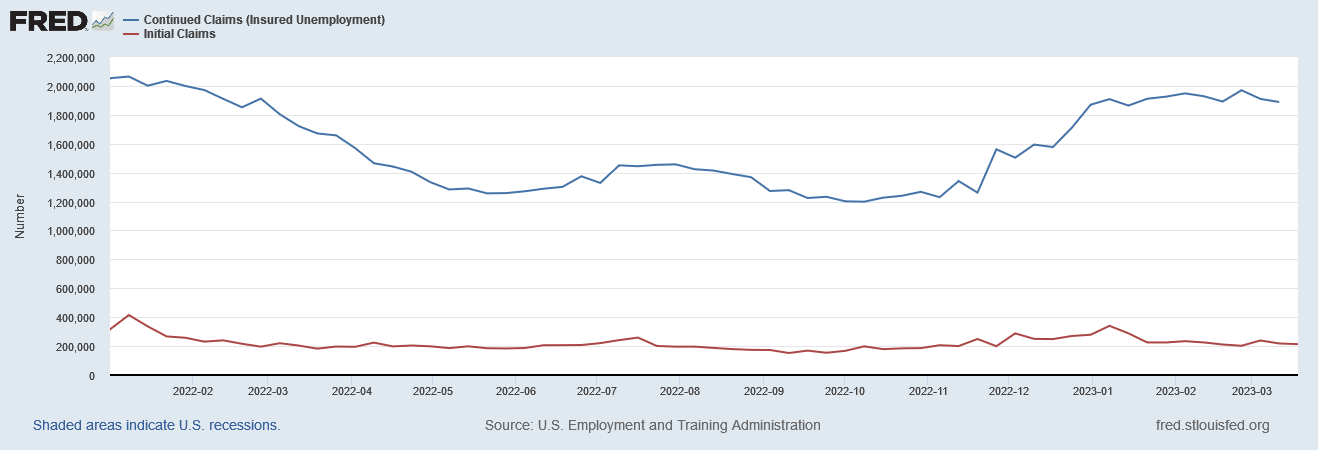

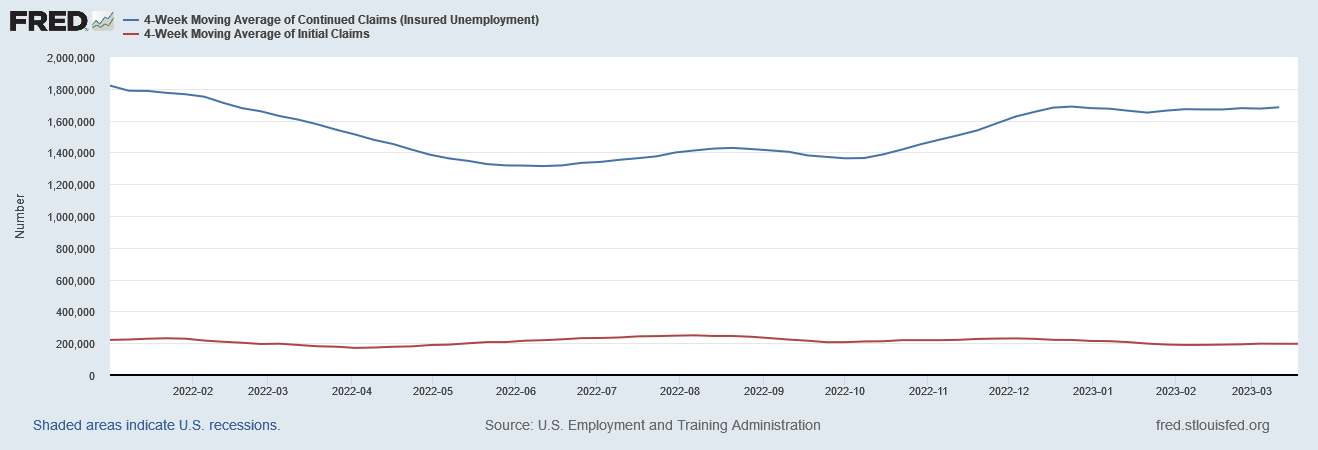

Weakness in manufacturing goes a long way towards explaining the sustained elevated levels of continuing unemployment in the US, both when viewed weekly and on a 4-week moving average.

All of these recessionary signals have been flashing even as bankers occupy the major headlines with their inability to balance their own checkbook.

Let us not forget that this banking crisis is still a crisis of epic stupidity.

While the bankers are shrieking because the tide ran out and showed them swimming naked without a towel nearby, the rest of the world still has to contend with that receding tide which is the contracting global economy.

There are economic concerns beyond the damaged modesty of immodest and immoderate bankers, and we do well not to lose sight of them.

Indeed, the recession is already here. It's like Wile E. Coyote over the edge of a cliff, but he hasn't looked down yet.