One day before the Bureau of Economic Analysis released its January Personal Income and Outlays Report, JPMorgan Chase CEO Jaime Dimon acknowledged what has been evident for a while now: the Fed has little to no control over consumer price inflation.

JPMorgan Chase CEO Jamie Dimon said Thursday that containing inflation remains a work in progress for the Federal Reserve, while noting the U.S. economy continues to show signs of strength.

“I have all the respect for [Fed Chair Jerome] Powell, but the fact is we lost a little bit of control of inflation,” Dimon said in an interview with CNBC’s Jim Cramer during the “Halftime Report.” It’s the first of a two-part interview with Cramer, with the second installment airing later Thursday on “Mad Money.”

This, of course, is something that the data has been showing for quite some time, as the Fed’s increases in the Federal Funds Rate has not been matched by rises anywhere along the yield curve, to the extent that the last rate hike was for the first few days all but ignored by Wall Street.

In every scenario that proceeds from this week’s Fed rate hike and Wall Street’s reaction, the proper characterization of Jay Powell is neither that he is “hawkish” nor “dovish” on inflation and interest rates. The image that emerges for Jay Powell from this latest hike is “impotence”.

The Fed arguably has lost control over interest rates in this country, and that is not a scenario that seems likely to end well for anybody.

Today the BEA proved that thesis is correct, as the January Personal Income and Outlays Report showed inflation heating up even more than the January CPI report.

Personal income increased $131.1 billion (0.6 percent) in January, according to estimates released today by the Bureau of Economic Analysis (tables 3 and 5). Disposable personal income (DPI) increased $387.4 billion (2.0 percent) and personal consumption expenditures (PCE) increased $312.5 billion (1.8 percent).

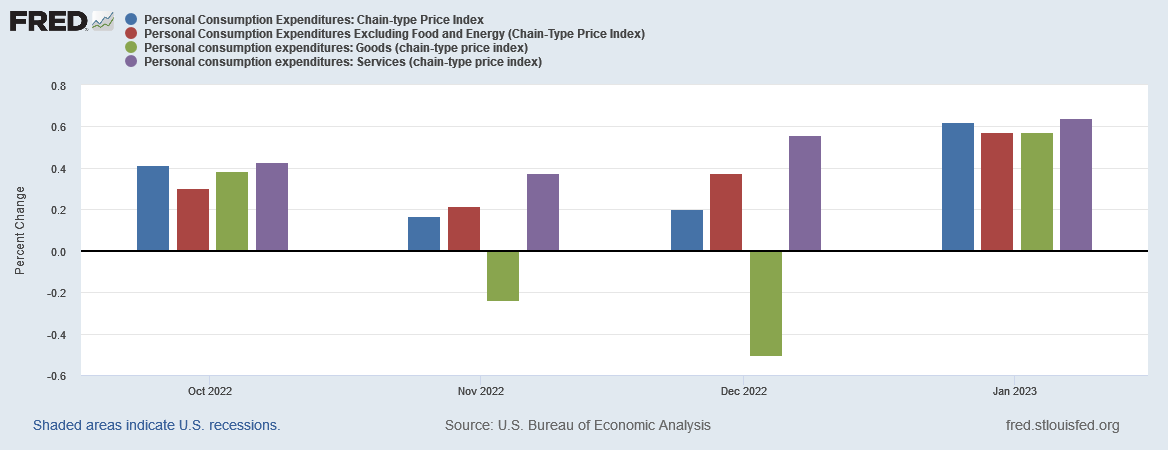

The PCE price index increased 0.6 percent in January. Excluding food and energy, the PCE price index also increased 0.6 percent (table 9). Real DPI increased 1.4 percent and Real PCE increased 1.1 percent; goods increased 2.2 percent and services increased 0.6 percent (tables 5 and 7).

Despite the Fed’s best efforts to destroy demand and crush the economy through interest rate hikes, inflation still surged in January, with the PCE Index replicating the Consumer Price Index’ disheartening performance.

To appreciate just how discombobulated consumer spending in this country has become, start with the two income values given in the BEA snippet above:

Personal Income rose by $131.1 Billion

Disposable Personal Income rose by $387.4 Billion

In other words, Disposable Personal Income—that part of Personal Income left over after certain non-discretionary deductions are taken out—for January was nearly three times Personal Income.

How does that happen? In the normal scheme of things, it doesn’t. However, this is the BEA, so “normal” is probably not the right context here.

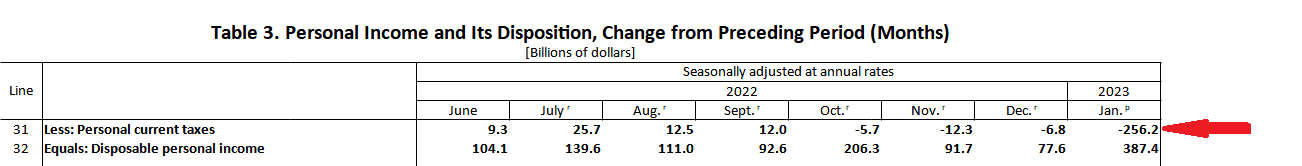

When we dig farther into the data, particularly into Table 3 of the spreadsheet which accompanies the news release, we find a very suprising line item:

Somehow the BEA recorded a $256 Billion drop in personal taxes, which artificially boosted disposable personal income.

The impact of this adjustment is to make Disposable Personal Income jump well above not only the nominal Personal Income level but also the Personal Expenditure level.

The BEA wants you to believe that Real Disposable Income magically replicated itself until it not only exceeded Personal Income but Personal Expenditures as well.

What produced this sudden personal tax windfall? A variety of tax changes, principally at the state and local level, where several tax reform initiatives are underway, is the most likely explanation.

Wealth tax legislation introduced in multiple state capitals in late January is noteworthy not only because of the unprecedented and coordinated nature of the effort, but also because it accentuates the contrasting approach to fiscal policy taken by lawmakers in blue and red states. While legislators in California, Connecticut, Hawaii, Illinois, Maryland, New York, and Washington are pursuing first-of-its-kind wealth tax legislation, their counterparts in red states have proposed and are poised to pass more income tax rate-reducing, flattening, and eliminating tax reform in 2023.

While some of these measures have yet to take effect, what the BEA is reporting for January is the single largest drop-off in tax revenue on record.

Without this adjustment, Personal Income would have been but a third of Personal Consumption Expenditures, which is the other shoe to drop from the distorted depiction of Disposable Personal Income in the January report.

How did consumers fund this spike in Personal Consumption Expenditures? Most likely with credit card debt. That is the obvious conclusion to be drawn from the fact that the monthly percentage change in credit card debt very nearly matches the surge in Personal Consumption Expenditures at 1.8%.

Note that growth in credit card debt has exceeded the month on month change in personal consumption expenditures every month except December for the past year. Americans are funding more and more of their consumption with debt instead of with income—which also means that, contrary to the BEA’s assessment, Americans also aren’t saving as much as the BEA claims.

The reality is that for both 2021 and 2022, net savings for consumers have been negative.

Americans are falling ever deeper into a financial abyss even as the “experts” on Wall Street proclaim the economy to be “strong”.

The PCE price index and overall level of personal spending could extend that string of surprises, considering January's robust labor market data, said Amelia Bourdeau, managing director of market strategy at Diamond Standard.

"You wouldn't expect to get inflation moving down too significantly because consumers are obviously out there spending, and one of the reasons why they're probably spending is jobs are picking up but also inflation has come down," she said in an interview with Seeking Alpha. "Things are a little more affordable than there were a few months ago, but they're still pricey."

Elsewhere in the BEA report, we have the further bad news that monthly consumer price inflation has actually been increasing from last November.

This echoes the rise in monthly core consumer price inflation from the Consumer Price Index Summary.

To say this was not the inflation news Wall Street was expecting is putting it mildly.

Wall Street was sufficiently unsettled so as to finish the day and the week significantly in the red.

Unsurprisingly, Wall Street also began pricing in a higher probability of a 50bps hike in the Federal Funds Rate at the next FOMC meeting next month.

Regardless of whether or not another rate hike will have any impact on inflation, Wall Street senses that the Fed may very easily feel pressured for another large rate hike in light of consumer price inflation heating up again.

The bitter irony of another hike in the Federal Funds Rate is that interest rates have been largely flat for quite some time, and even yesterday’s inflation news did not change that outlook for several of the key rates—interest rates are doing as they will, other economic news be damned.

The benchmark 10 year Treasury Yield finished the day largely unchanged.

The 1 year Treasury yield actually declined.

The 2 year Treasury yield ticked up slightly.

While yields have risen beginning a few days after the February 1 rate hike, overall, yields have largely moved sideways since last November, despite the Fed pushing the Federal Funds rate ever higher.

As of this writing, on maturities of a year or more, only the 1-year and 2 year among the longer maturities are above the Federal Funds Rate.

Moving the Federal Funds Rate higher is having less and less of an impact on interest rates, and thus is not advancing the Fed’s inflation fighting strategy much if at all. While yields were rising along with the Federal Funds Rate in the beginning of November that changed, as interest rates stopped rising cross the entirety of the yield curve.

Despite interest rates hitting a plateau until very recently, inflation has still gone up. Despite interest rates having risen dramatically since March of 2022, inflation has still persisted, and is now showing signs of heating up again—and if increasing the Federal Funds Rate does not result in both rising yields and declining inflation rates, the rationale for raising the rate evaporates.

Even more concerning, however, is that if interest rates refuse to rise in accordance with the Federal Funds rate, the Fed’s ability to restrain inflation at all also evaporates.

With inflation rising and yields still moving mostly sideways, the conclusion that the Fed has lost control over consumer price inflation is becoming harder and harder to avoid.

Interesting times….

I keep waiting for house prices to go down. The vast majority of homes for sale seem to be going up in price - despite sales going down.

Even in places like Costa Rica & Portugal where ex-pats have fled to, to live less expensively, cost of housing has increased. Many golden visas have terminated due to the high cost of housing..