BLS Jobs Numbers Look Good, BUT....

Much Like ADP Report, Top Level Good Obscures A Lot Of Bad

The Federal government chose not to tweet about the ADP jobs numbers, with the President opting instead to cheerlead over the BLS Employment Situation Summary report released this morning. It’s not hard to see why: The BLS report is much better than the ADP report.

Total nonfarm payroll employment rose by 390,000 in May, and the unemployment rate remained at 3.6 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in leisure and hospitality, in professional and business services, and in transportation and warehousing. Employment in retail trade declined.

A net gain of 390,000 jobs is an undeniably good figure, much better than the ADP 128,000 net gain—so much better that both alternate and corporate media were anticipating something not nearly as good. Alternative economic media site ZeroHedge went so far this morning as to anticipate a negative jobs number.

If there is one thing that can stop the Fed dead in its tracks from hiking rates by 50 bps for the foreseeable future, it's a negative one million (or slightly better) print in monthly payrolls. While we won't get a print that ugly tomorrow, it is almost certain that will get a big drop on Friday morning followed by negative print in the coming months, especially when considering the plunge in new job postings...

CNBC was not as skeptical, but even their forecast was below the numbers that came out.

Economists forecast that employers added 328,000 new jobs, less than the 428,000 added in April, according to Dow Jones. The unemployment rate is forecast to decline to 3.5% from 3.6%.

ADP, alt-media, corporate media, all missed on the May jobs numbers to some degree. This invariably begs the question: did ADP get the data wrong or did the BLS?

More Lou Costello Math?

After the embarrassingly obvious manipulations to the January jobs numbers, we do well to approach the BLS report with a healthy dose of skepticism.

Is the May report a similarly contrived exercise in vaudevillian math? Let’s consider some of the key points in the report:

The overall unemployment rate did not change from April’s 3.6%

The number of unemployed individuals remained at 6 million.

There were 1.4 million permanent job losers in May, roughly the same as in April.

Temporary layoffs in May was 810,000—”little change” from April.

The number of people in part-time employment for economic reasons rose 295,000 in May.

The number of people not in the labor force who want a job was 5.7 million—roughly the same number as in January.

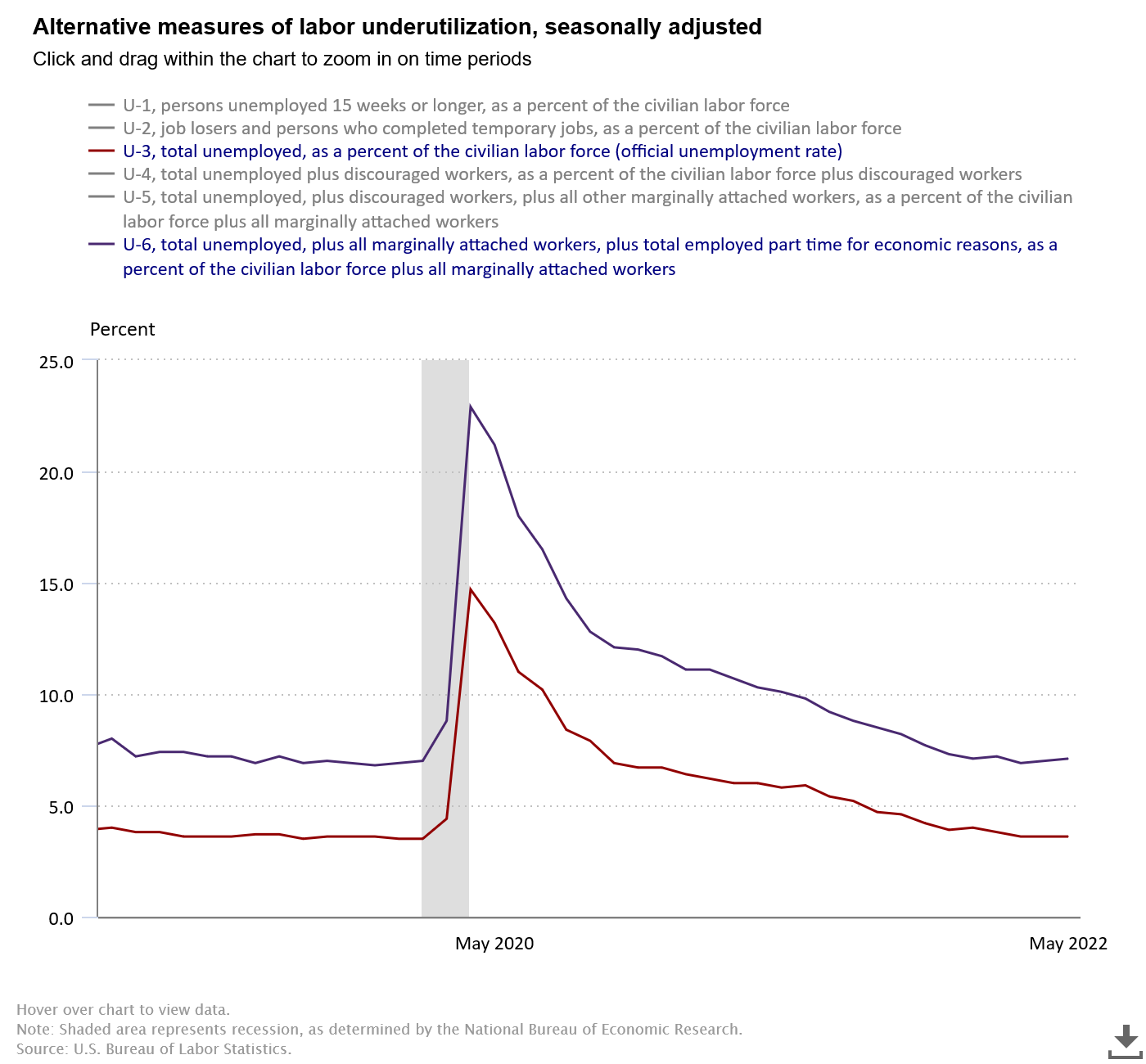

Despite these figures not changing—some not appreciably changing at all for the year—the Bureau of Labor Statistics claims 390,000 jobs were added to US payrolls during the month of May. Moreover, the jobs gains occurred while labor underutilization rose and unemployment held steady:

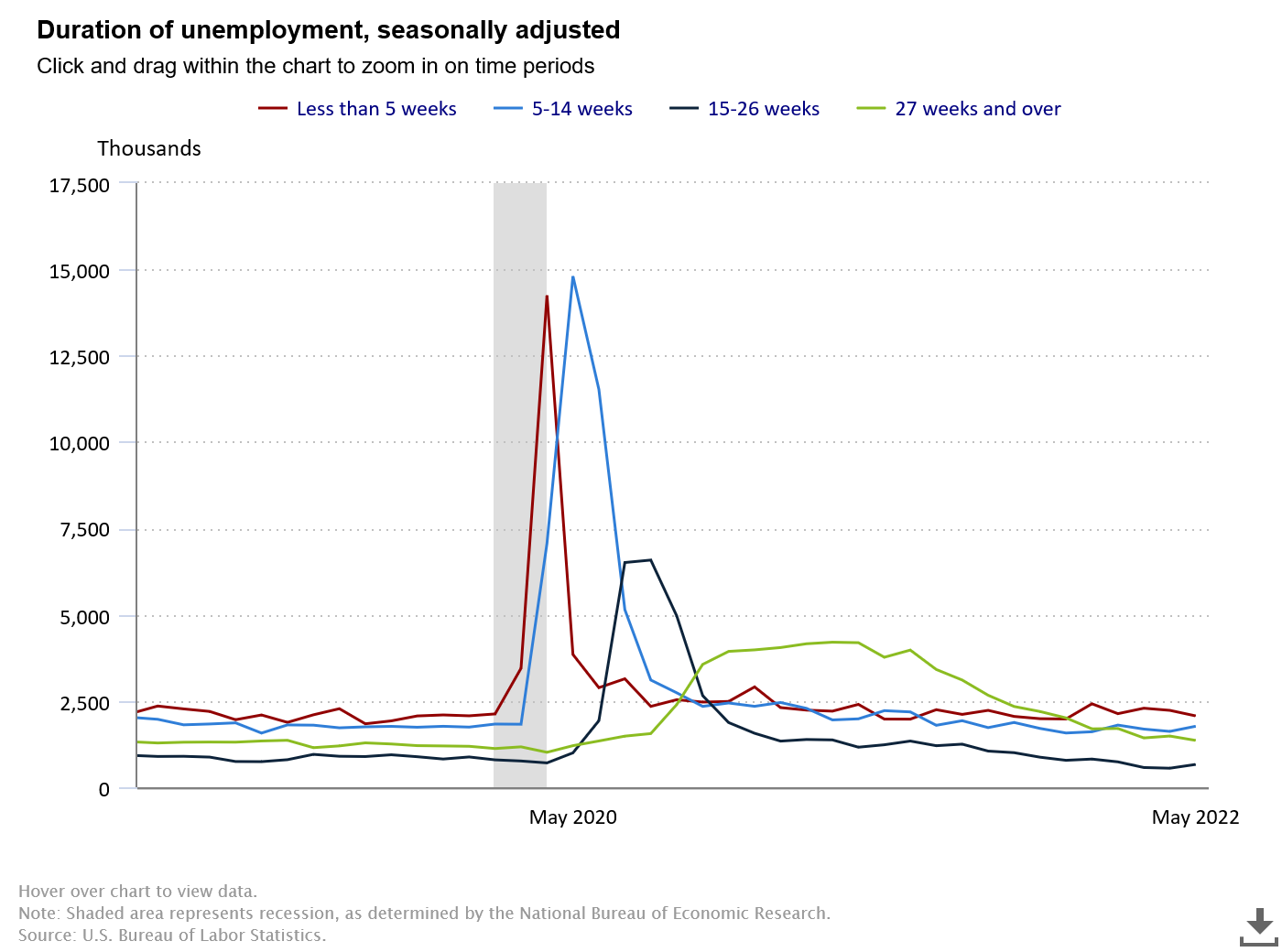

Interestingly, very short term unemployment declined in May, as did very long term unemployment, but unemployment lasting 5-26 weeks actually rose.

A rise in mid-term unemployment suggests that people either transition to a job quickly or they are facing a lengthy job search. That phenomenon seems rather difficult to reconcile to an above-forecast jobs number.

While we do not have the glaring evidence of manipulation that we did in Janaury, we are still advised to take the jobs numbers with a grain of salt.

Jobs Growth Amid Business Weakness?

Adding to the skepticism on the jobs numbers, the Institute for Supply Management’s monthly business report for May manufacturing reports declining employment—according to the BLS report, the only sector with declining jobs were retail trade businesses. Manufacturing employment can either rise or fall, but it cannot rise and fall; one of these reports must be wrong.

Also, while the ISM report shows service-sector employment to be rising, the service sector itself is reporting a slowing growth rate.

If the business climate in this country continues to weaken, it is difficult to see how job growth can be sustained. Even if the BLS numbers are more or less accurate for May, it seems unlikely to expect they can continue into or past June.

As regards the business climate, the ADP numbers are far more reflective of what one would expect: slowing job growth, while the BLS trend shows less tapering of job growth.

A Strong Foundation?

The question marks surrounding May’s jobs numbers are a rather sharp rebuke to the puffed up claims the President made earlier about the jobs numbers, when in his public address he claimed an “historically strong” foundation for the economy going forward:

To be blunt, the foundation is not strong.

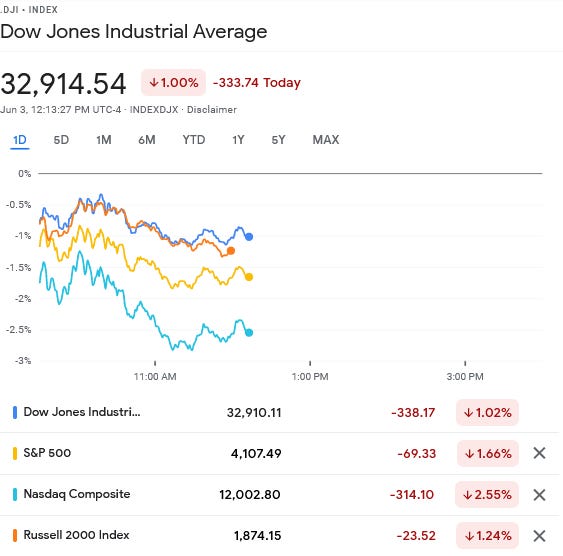

A strong foundation would not trigger a market decline, which is what happened this morning.

Rather, the markets seemed to view the jobs report as strengthening the Federal Reserve’s hand on upcoming interest rate hikes in their ongoing effort to corral inflation, something apparently confirmed by the rise in the 10 year treasury yields.

The market’s take on the economic future is that the US is heading not into a period of strong growth, but of uncertainty, weakness, and even contraction. The markets certainly do not view the jobs report as the “strong foundation” the Biden regime wants it to be.

Top Level Numbers Conceal More Than They Communicate

While a charge of “Lou Costello math” would be a bit overblown this time, the fine details of the May jobs report is yet another cautionary against leaning too heavily on the top level numbers in any broad report of economic data. As the May report shows (yet again), a net result may appear strong and positive while obscuring fundamental weakness and question marks.

Whether one is looking at jobs, inflation, or even the ISM business survey reports, the top level numbers invariably conceal more than they communicate.

For the 1.4 million job losers in May, it was not good month.

For the 5.7 million not in the labor force but who want a job, it was again not a good month.

For the 295,000 compelled to accept part-time rather than full time work, it was not a good month.

390,000 new jobs unquestionably sounds like a good number. Yet the proper perspective on any such good number includes acknowledging the fine details which are not good. There are more than a few such details within the May jobs report.

Like the ADP numbers, the BLS report uses a little good to conceal a whole lot of bad.

Musk put a hiring freeze on Tesla. He doesn't like the outlook at all.

My husband told me last week the company where he works was getting ready for layoffs. Today he said around 60 or 70 people.. gone.