If there is one thing the “experts” in Washington DC demonstrate on a daily basis it is that there is a finite amount of clue in the world. That the corporate media plays along with their foolishness merely confirms that.

The latest bit of economic nonsense comes from President Asterisk, who, responding to the Bureau of Economic Analysis’ release of November Personal Consumption Expenditures data yesterday, decided to take a much undeserved victory lap.

Once again, we are seeing signs of our economy recovering and remaining resilient. Today’s report shows that incomes are up and inflation is coming down – while our job market remains strong. Christmas arrives with gas prices down and grocery store prices showing the lowest increase in a year. Coming the day after we saw unemployment claims remain low and estimates of economic growth revised upward, it is a winning streak for America’s families, businesses, and farmers. There will be more ups and downs in the year ahead, but we are making progress building an economy from the bottom up and the middle out and I’m optimistic for the year ahead.

On what planet does he spend most of his time? Better question: on what planet do his handlers spend most of their time?

To be fair, the BEA is just as bad, given the lead paragraphs in their news release:

Personal income increased $80.1 billion (0.4 percent) in November, according to estimates released today by the Bureau of Economic Analysis (tables 3 and 5). Disposable personal income (DPI) increased $68.6 billion (0.4 percent) and personal consumption expenditures (PCE) increased $19.8 billion (0.1 percent).

The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.2 percent (table 9). Real DPI increased 0.3 percent in November and real PCE increased less than 0.1 percent; goods decreased 0.6 percent and services increased 0.3 percent (tables 5 and 7).

Once again, the data tells a rather different tale.

It is true that the PCE price index shows consumer price inflation trending down, and yes, that is good news.

Both headline and core consumer price inflation have declined significantly over the past few months.

With the highs reached during the summer months by both the PCE and CPI indices, any decline is good news.

That being said, the PCE price index shows headline consumer price inflation to be three times what it was in February, 2020. Core consumer price inflation is 2.6 times the February, 2020, level, per the PCE price index.

Inflation at three times historical norms is the antithesis of “good news”. News like that has a pretty high suckage factor attached to it.

That energy price inflation is still more than double headline consumer price inflation is also bad news.

With the holiday season in full swing, food price inflation still being higher than headline price inflation does not help in making merry. Higher food prices mean smaller servings come Christmas dinner time.

Those were the highlights and bright spots of the PCE data for November. The income numbers are not nearly as nice.

While it is true that real disposable personal income did rise month on month in November, that rise was aided and abetted by several months of declines month on month earlier in the year.

No matter how one calculates Real DPI, for the first part of the year it was shrinking, and ever since it has barely stayed above water.

That’s not news deserving of optimism.

Even worse, however, is the reality that Real DPI has declined year on year every month since March of 2021.

That means incomes are not rising, incomes are not growing, but rather that incomes are shrinking. Inflation is taking big bites out of workers paychecks each and every month, and has been for over a year.

The last calendar year Real DPI actually grew, Donald Trump was President.

Given that it’s almost 2023, not only is that not good news, but for the White House it’s really bad news—it means their economic tomfoolery has completely failed to benefit ordinary Americans (shocking, I know).

As for the economy being “strong” and “resilient”….

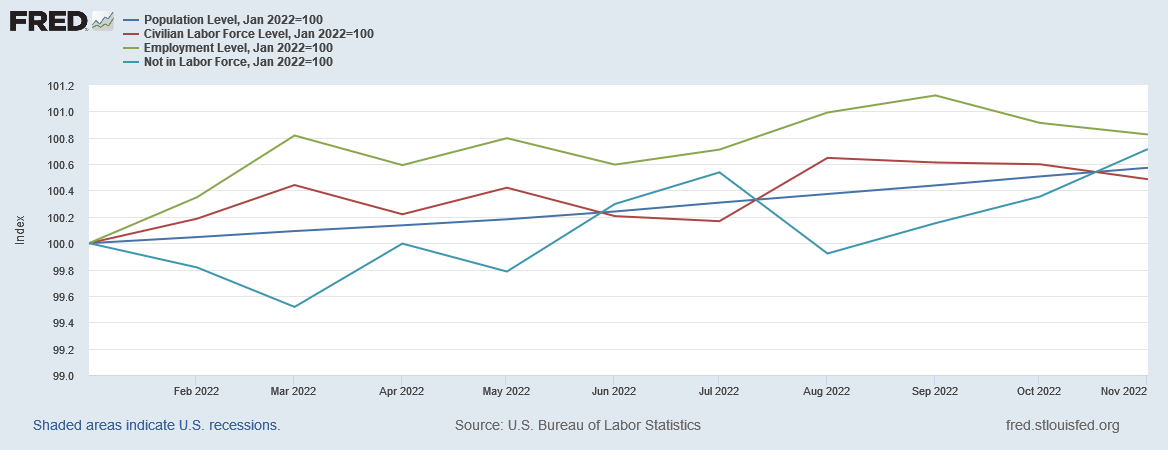

As I have previously discussed, the United States has seen almost no job growth of note since March.

How does 12,000 jobs over six months constitute good news for any economy?

While the employment level in this country plateaued in March, the population fraction not in the labor force did not.

Lack of labor force participation and declining employment is the sort of news that signals “recession”—the antithesis of a “strong” and “resilient” economy.

Additionally, the reality of jobs in the US is that employment growth year on year has been declining since April of 2021, as has the growth of the civilian labor force.

Declining job growth is never good news.

Viewed month on month, employment growth has been taking a back seat to the growth of people not in the labor force for most of the year.

A growing lack of labor force participation is also not good news. A healthy economy needs people going to work, not sitting on the sidelines. Right now the US economy is trending in the exact wrong direction to be considered healthy (or “strong” or “resilient”).

The simple reality of economic data, or of any data set at all, is that one cannot get a full understanding from a single number. To say that consumer price inflation is 5.5% means nothing on its own. To speak of November’s Real Disposable Personal Income figure is useless unless one examines also the historical trend—what matters most is whether or not Real DPI is shrinking (bad), holding steady (okay), or growing (good to very good).

It is not enough for economic “experts” and elected officials to look simply at one headline number and pretend that it tells the state of the US economy. It does not. The reason I include so many charts in these articles is because there are a lot of numbers needed to convey the state of the economy. Even a modest grasp of the reality of this or any economy requires attending to all of the data, all of the numbers.

The White House thinks the economy is in good shape and that all the economic news is good. The data says the White House is utterly clueless about the economy.

I trust the data.