China Avoids Deflation...Or Not

Will China Still Manage To Kick The Economic Can Down The Road Yet Again?

The corporate financial media managed to breathe a sigh of relief when China’s latest inflation numbers came out, indicating an incremental increase in the Consumer Price Index for China, rather than the deflation recorded in July.

China’s economy edged out of deflation in August, as Beijing struggles to promote growth and revive investor confidence following a slide in the country’s property market and a plunge in exports.

The consumer prices index was 0.1 per cent higher year on year in August, below a Reuters poll of analysts for a 0.2 per cent increase, but emerging from the negative territory of minus 0.3 per cent recorded in July.

Deflation has been avoided in the Middle Kingdom, at least for now.

Or has it?

Looking more closely at the overall trends in the Consumer Price Index suggests such celebration might be premature. Deflation has in fact been happening even before July. Deflation, and its cousin, stagflation, have been signature features of the Chinese economy for far longer than the corporate media is willing to admit.

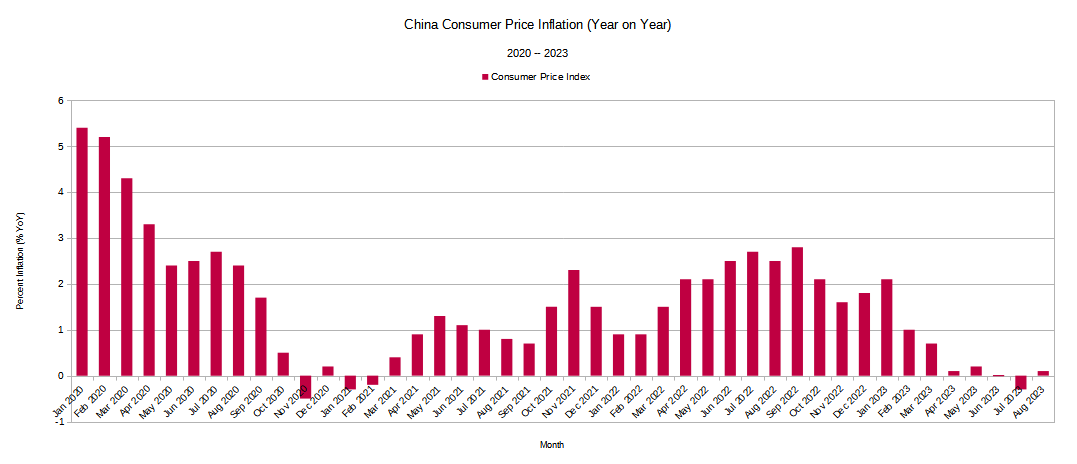

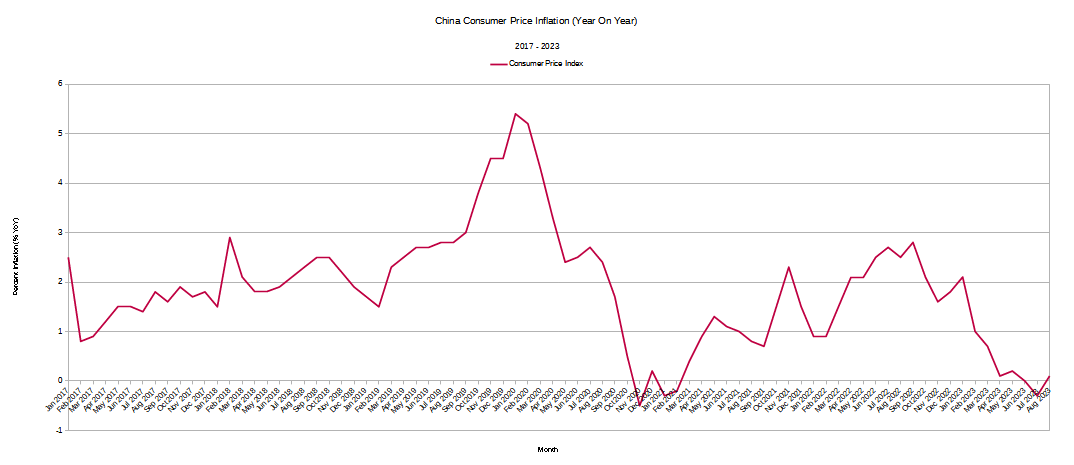

July was not China’s first deflationary month in recent memory. China also experienced a brief deflationary episode in late 2020, during the early days of “Zero COVID”. Between November, 2020, and February, 2021, only December saw any consumer price inflation, according to China’s own statistics.

However, it’s also important to acknowledge the significant level of disinflation that occurred during 2020, which saw a relatively steep decline in consumer price inflation from a peak of 5.4% year on year in January, 2020, at the very outset of the COVID-19 pandemic. In the space of ten months, China went from that level of inflation to 0.5% year on year deflation.

Thus, even before July of this year, consumer price inflation had been dramatically muted in China, with the pandemic lockdowns of what would become the Zero COVID policy standing as the primary contributors to the decline.

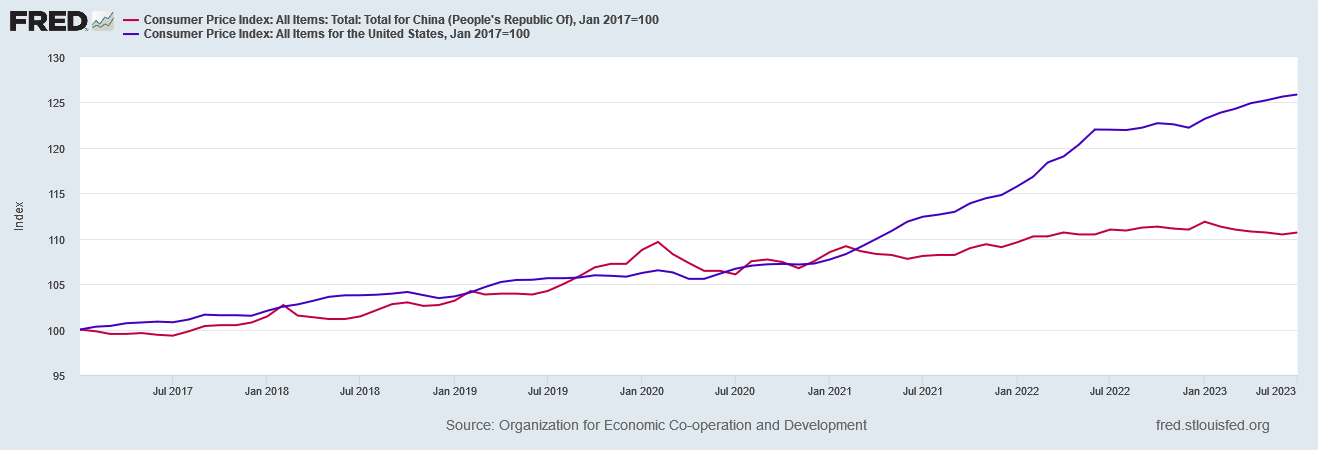

To appreciate the full impact of the drop in inflation during 2020, it is perhaps instructive to view China’s Consumer Price Index and charting it with respect to the United States’ Consumer Price Index (both indices generated per the OECD). When we do, we see a significant flattening in China’s CPI curve.

At a time when ruptured supply chains were triggering inflationary surges in prices both in the US and around the world, China’s price increases all but stopped. From January of 2020 through July of 2023, consumer prices in China rose per the OECD a total of 1.8%.

In the United States, according to the OECD metrics, consumer prices rose more than ten times that much, at 18.5%.

By comparison, if we look at the OECD data for the US and China from January of 2017 onward, we see much similar inflation trajectories in the US and China, with prices rising by January 2020 8.8% for China, and 6.2% for the United States.

Post 2020, however, China’s consumer prices dropped, and did not recover their February 2020 peak until January of 2022.

While Beijing’s radical response to the emergence of SARS-CoV-2 and the attendant COVID disease is without a doubt the primary catalyst for China’s drop in consumer prices during 2020, it is also important to recognize that China’s economy has, to some degree, been exhibiting signs of stagflation—where inflationary and deflationary forces exist concurrently within an economy—well before January of 2020.

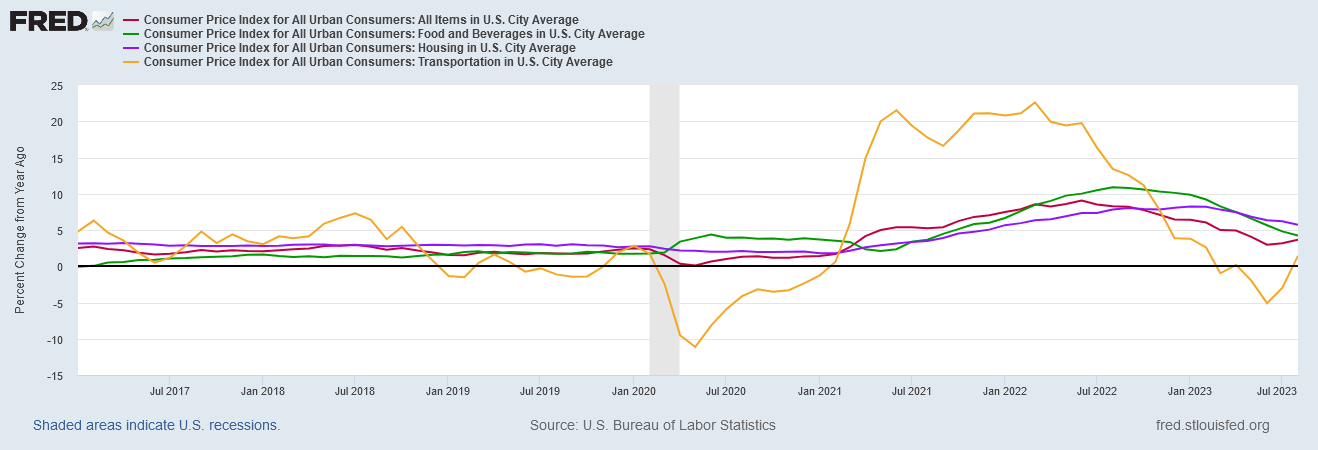

Between January of 2019 and March of 2021, prices within China’s Transportation and Communication sector underwent a sustained period of deflation, and entered another period of deflation in March of this year.

At largely the same time, from March of 2019 through November of 2020, food prices went through a period of near hyperinflation, rising as high as 16% in February of 2020.

Housing costs have undergone two extended periods of deflation recently. The first ran from March of 2020 through February of 2021. The second ran from October, 2022 through May, 2023.

That these different sectors undergo deflation and inflation at different times is what results in a more muted overall inflation metric for China’s economy.

What is distinctive about the Chinese economy is that these various sectors experience outright deflation far more frequently than their American counterparts.

Overall, the variations in inflation rates among multiple sectors still provides a leveling effect on overall headline inflation, but the less frequent periods of deflation suggests a healthier and more resilient capacity for domestic consumption. There simply is a greater built-in capacity for consumer demand within the US economy that we do not see in the Chinese economy.

This is not to suggest that rising prices are an inherent economic good or that falling prices are an inherent economic problem. Ultimately, persistent trends of either inflation or deflation signify a reduction in overall economic health. As I have commented on more than one occasion, inflation and deflation represent economic distortions which are themselves exemplars of economic harm.

Within the media, there is a general presumption that a small amount of inflation is better than a small amount of deflation, the theory being that a little (<2% YoY) inflation shows enough demand pressure for goods and services as to quickly draw in additional supply, whereas the same amount of deflation tends to discourage not just consumption but the entry of new suppliers, thereby exacerabting overall economic stagnation.

Be that as it may, when the trend is either inflation or deflation for any extended period of time, that itself signifies economic disequilibrium. When an economy experiences disequilibrium, until equilibrium is restored, that economy will be functioning below its fullest potential.

A close look at China’s own econometrics shows that China’s economy has been lurching from one disequilbrium to another for quite some time. For all that has been said of its economic “miracles”, the patterns of economic rot have been building throughout multiple sectors for years. Even before COVID, before the lockdowns, even before the psychopathy of Zero COVID, the warning signs were accumulating.

Contrary to the media narrative, China has not avoided deflation. China has not avoided it in 2023, for it had not avoided it multiple times even before 2020.

What China has avoided is the inevitable reckoning for its economic intemperances. Through a variety of government policy changes and diktats, China has succeeded in repeatedly kicking its economic can further and further down the road.

2023 may prove to be the year China runs out of road.

"As I have commented on more than one occasion, inflation and deflation represent economic distortions which are themselves exemplars of economic harm."

Why? Seems to me that mild deflation over long term should be the natural order of things as technology increases productivity and reduces the cost to produce all manner of goods.

You state 2023 may prove to be the year China runs out of road. Don't know if you have seen this video. but several substacks have linked it today: Don't Be Surprised by China's Collapse || Peter Zeihanhttps://www.youtube.com/watch?v=mqA5NODRnQI&feature=youtu.be

Was wondering what your take might be on this. Linking your article today @https://nothingnewunderthesun2016.com/