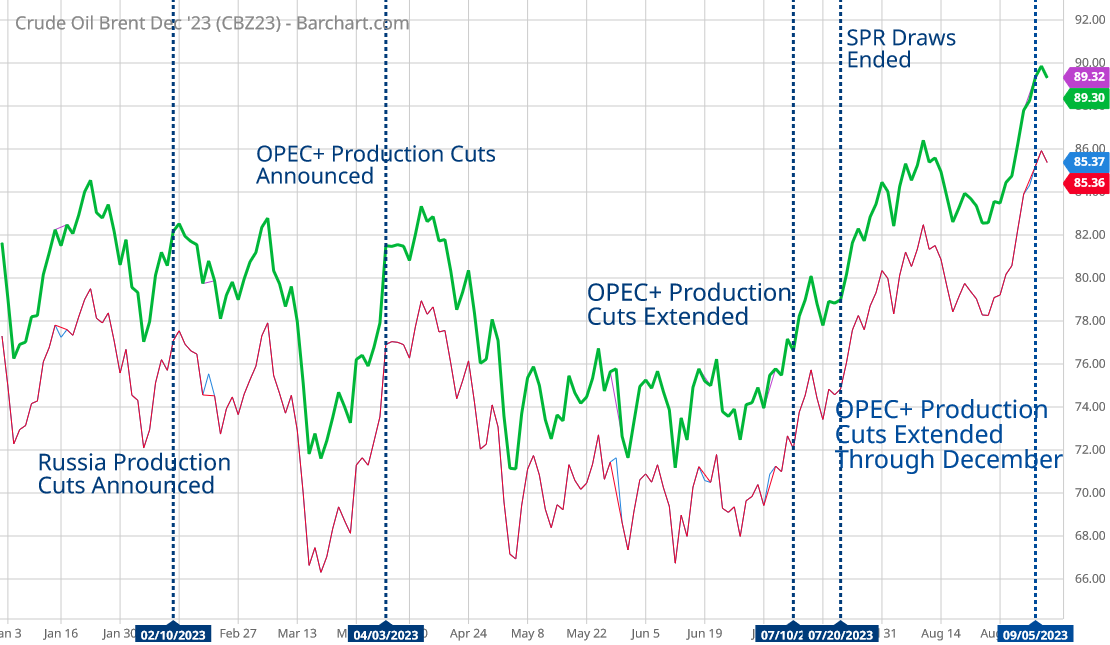

After receding from its previous ceiling price, the price of Brent Crude has been climbing once again, even pushing past that ceiling price.

The immediate driving force behind the price rises has been the expectation and then the confirmation that OPEC and Russia would extend their production cuts, first into October and then until the end of the year.

Saudi Arabia and Russia agreed Tuesday to extend their voluntary oil production cuts through the end of this year, trimming 1.3 million barrels of crude out of the global market and boosting energy prices.

The dual announcements from Riyadh and Moscow pushed benchmark Brent crude above $90 a barrel in trading Tuesday afternoon, a price unseen in the market since November.

However, there is another factor that must also be assessed: the impact of China’s demand for oil on the broader market.

China has been the focus of attention for oil traders and industry insiders for years now, and with a good reason. The world’s largest importer of crude is as important for prices as is the world’s largest consumer, the United States.

A persistent assumption within oil markets this year has been that China’s demand for oil would play a significant role in pushing prices up.

Yet when we look closer at China’s economy, there are signs that are not nearly as bullish as some oil traders are wont to believe. How much more upward pressure oil demand from China is going to be problematic at best.

Oil Is Up On Tighter Supply

As I have observed more than once, OPEC’s production cuts have finally succeeded in tightening oil markets sufficiently to have an impact on prices, and this most recent decision to extend those cuts have pushed Brent Crude up to briefly above $90/bbl.

The prior slump in oil prices has been a primary contributor to overall disinflation, particularly in the United States.

Unsurprisingly, oil’s renewed upward climb is raising fears of renewed inflation.

Higher oil and higher energy prices could stoke inflation again at a time when Wall Street has raised the odds of the Fed pausing the interest rate hikes at their meeting at the end of September.

Despite these concerns, major oil trading concerns have been bullish on China’s future oil demand, and on the upward price pressures presented by that demand.

Doom-laden stories about China’s economy aren’t portraying an accurate picture of energy demand in the top crude importer, according to oil luminaries at a major conference in Asia.

“There’s a lot that’s good about what’s going on in China,” Ben Luckock, co-head of oil trading at Trafigura Group, told hundreds of attendees at the APPEC by S&P Global Commodity Insights in Singapore on Monday. “In terms of China demand, the property market is bad, but the other parts of the economy aren’t.”

Even though China’s economy overall has been tipping into outright deflation, the oil bulls still see a China thirsty for oil.

China has been recovering from the pandemic lockdowns a lot more unevenly than expected. Economic indicators, such as the purchasing managers’ index, have read below the growth threshold for months. And because China is such a focal point for oil price analysis, most market players in that field have assumed that China has a problem with oil demand. Only it doesn’t.

The assumption that kept oil prices depressed for much of this year was that China’s economy was not bursting at the seams as expected. The PMI reading has been below 50 for five months in a row. However, several subindices have moved above the growth threshold. Then, there are the direct oil demand indicators.

The case for China pushing up oil prices towards $100/bbl centers on China’s resurgent travel sector—in particular, the rise in air travel.

Oil prices still have upside from here because of booming travel in China and restricted supply from OPEC+, according to Gary Ross, a veteran oil consultant turned hedge fund manager at Black Gold Investors LLC.

Domestic flights in China are already back to 110% of their pre-pandemic levels and long-distance road travel is still dominated by gasoline-powered cars, he said he said in an interview at APPEC by S&P Global Commodity Insights in Singapore on Monday.

The argument, of course, is that China’s demand for travel will translate into demand for fuel, which will drive demand for crude.

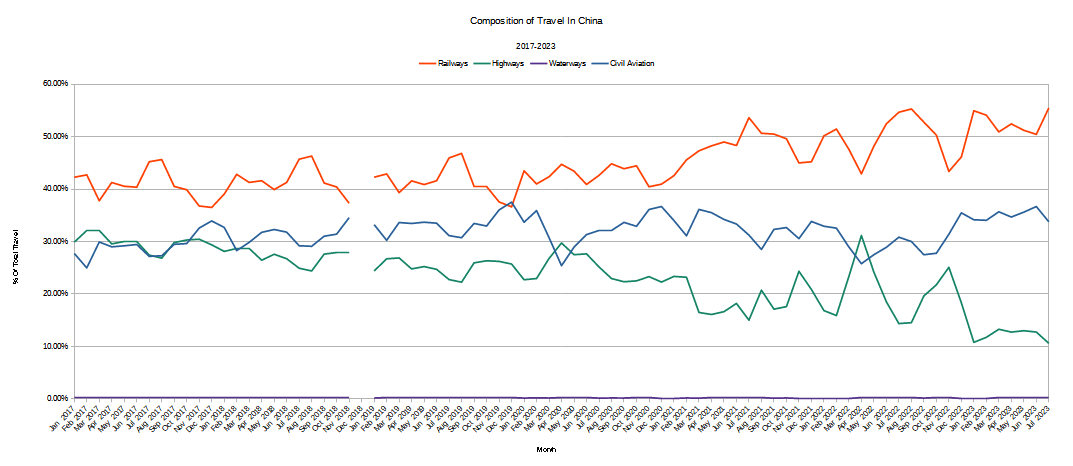

Yet what is China’s travel picture? How robust is this “recovery”?

The answer is somewhat less bullish than the oil bulls present.

China Travel Is Rebounding And Then Some

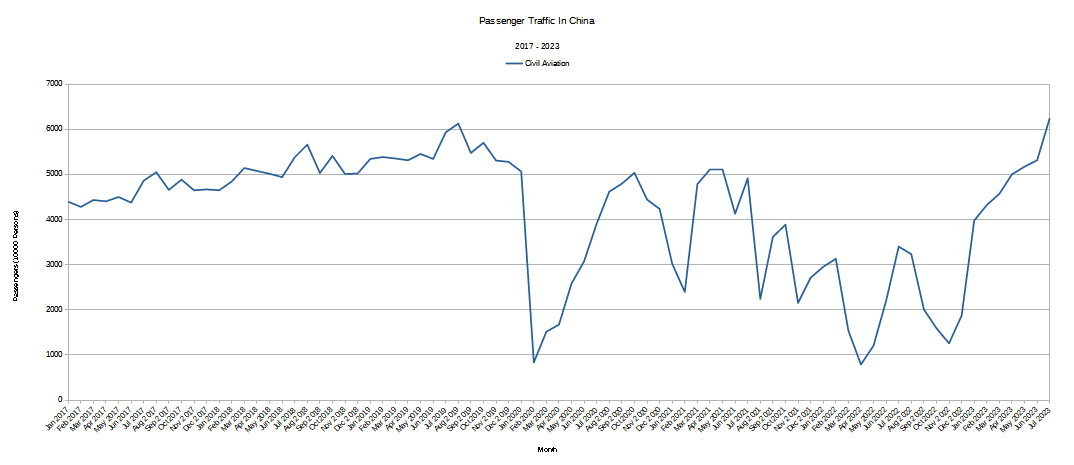

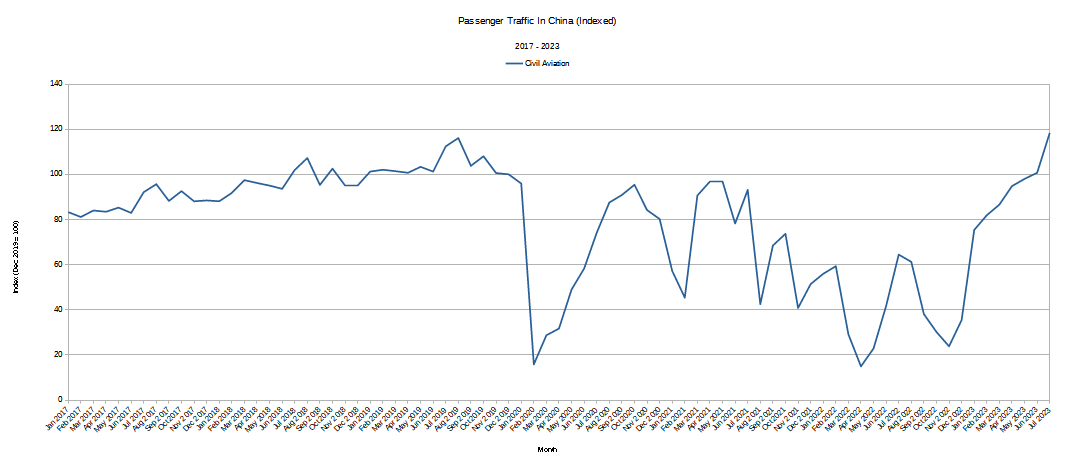

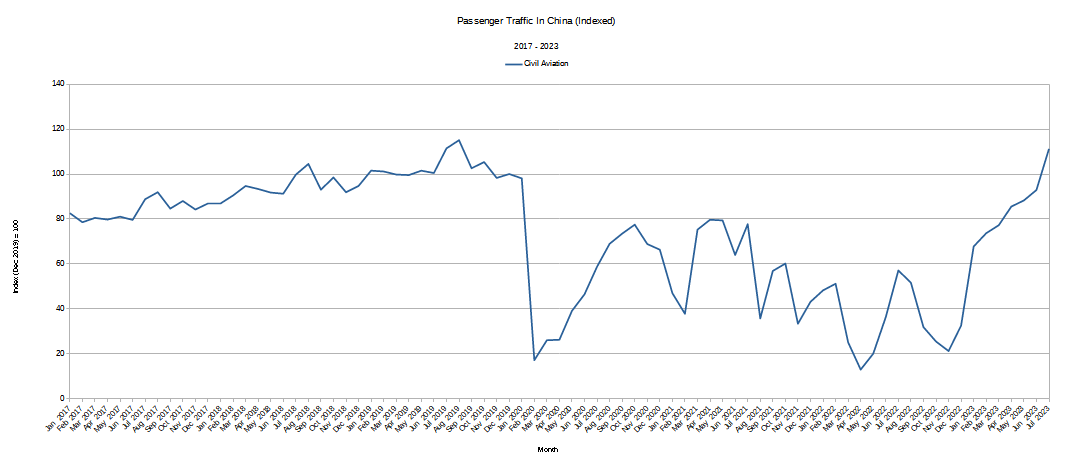

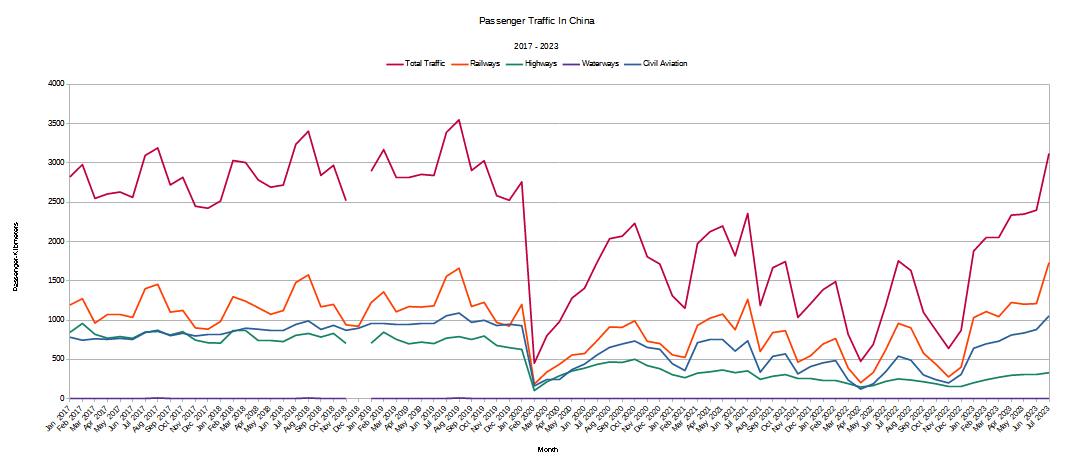

There is no doubt that China’s air travel industry has been on the rebound this year, and by July had exceeded pre-pandemic levels in terms of passengers.

On a percentage basis, China’s civil aviation industry in July handled 118% of the passenger volume of December, 2019.

However, that demand is somewhat softer than it might first appear, for while the number of passengers is at 118% of pre-pandemic levels, using the broader metric of passenger-kilometers traveled, travel volumes are only at 111% of pre-pandemic levels.

Moreover, while air travel and even rail travel are recovering in China, and powering an overall recovery in travel, travel by car has yet to even get close to pre-pandemic levels.

Without resurgent highway travel, China’s demand for gasoline is going to be muted, leaving demand for aviation fuel. Moreover, the travel sector with the best improvement has been rail traffic—and China’s extensive high-speed rail network is powered by electricity, and China’s principal fossil fuel for power generation is coal, not oil.

China may see greater demand for aviation fuel, but at the present time that is the only demand leading to increased crude demand.

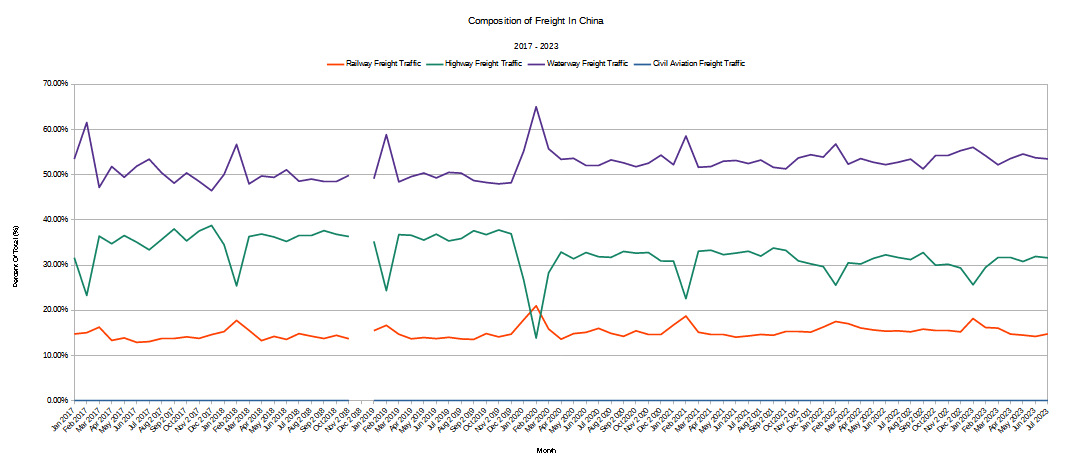

China Freight Traffic Is A Different Picture Entirely

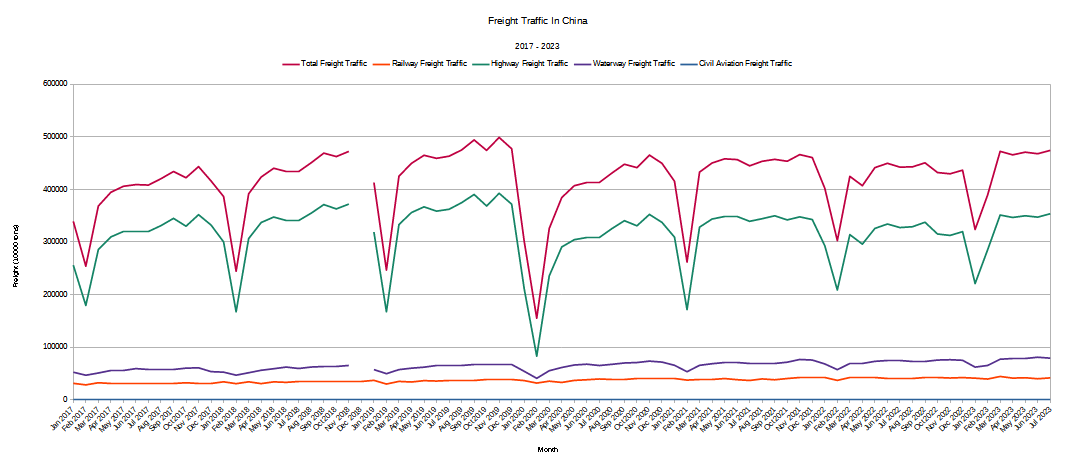

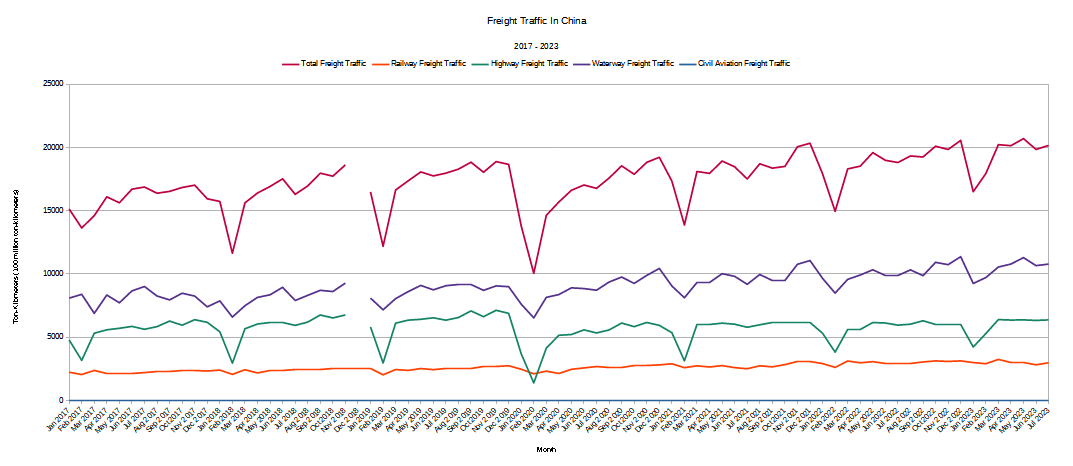

Yet we should also remember that travel involves more than just passengers. Freight has to move around the country as well, and the freight picture for China is not nearly as optimistic.

Overall, China’s freight volumes are have yet to reach their pre-pandemic peaks. Even more disconcerting, overall freight volumes plateaued earlier this year and have yet to show any serious sign of rising above that plateau.

Air freight has shown considerable growth during the first few months of 2023, but it appears to have peaked, and the only other freight sector that has shown significant growth in 2023 is waterway traffic, and both air freight and water freight carry only a fraction of China’s overall freight tonnage. Trucking is the prime mover of freight volumes in China, and trucking has shown no growth since early spring.

Air freight peaked in May. Rail freight peaked in March.Trucking plateaued also in March.

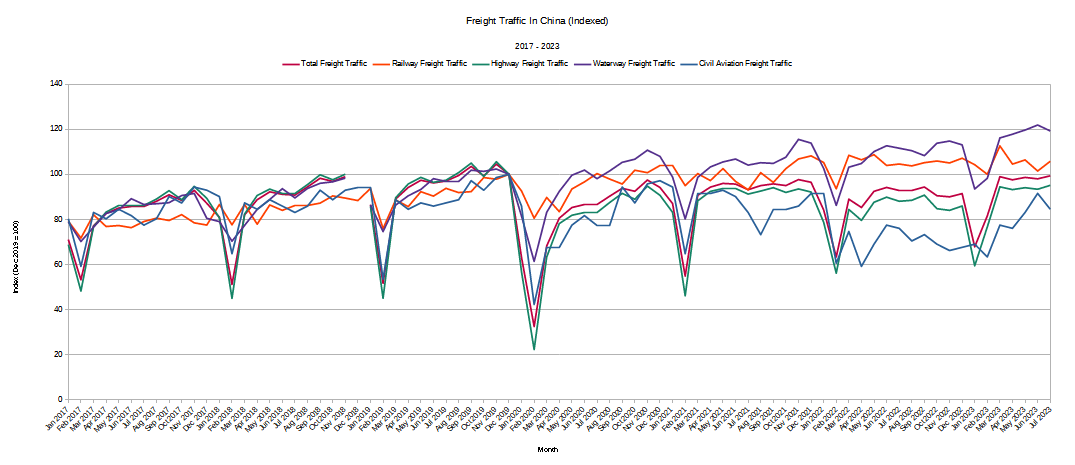

However, when we look at the broader metric of ton-kilometers, accounting not just for freight tonnage but distance transported, there has been no real growth in total freight activity since the end of 2021.

Notably, air freight is a negligible fraction of total freight volume measured by ton-kilometers.

For China’s travel sector to contribute significantly to China’s oil demand, there needs to be more growth than in just civilian air travel.

Air Travel Just Not Enough

While as a percentage of overall travel, air travel has been rising in recent years, the travel sector that has risen the most is rail traffic. Highway traffic has been steadily declining as a percentage of overall travel.

In terms of freight volumes, aviation is not even a significant factor, and, for the most part, there have not been any appreciable shifts in freight mode composition.

While there is growth in China’s civil passenger aviation, that is the only area of travel and freight which is poised to contribute to fuel and thus oil demand.

With freight volumes largely stagnant, with highway passenger traffic very much on the decline, and with the transition going mainly not to aviation but to rail, the forward prognosis for travel-related demand for oil in China is simply not all that great. The trends simply are not there.

If we look at freight tonnage rather than people, there is no trend which leads to increased demand for oil.

China is looking at increased power demand from the growth in passenger rail, but as power generation most likely means more coal burning rather than more oil, that incremental power demand is not likely to produce much incremental oil demand.

The oil bulls are looking for a sharp increase in China’s oil demand to push oil prices even higher now that the OPEC+ production cuts have finally established a floor price for oil, and given OPEC the leverage to ratched the price per barrel up. Where that increased demand will appear within China’s economy is at this point something of a mystery. Contrary to the oil bulls’ expectations, China’s resurgent travel sector is not yet poised to put much upward pressure on oil prices

In order for there to be a sustained increase in the price of oil, there has to be a sustained increase in relative demand. Without progress on the demand side OPEC can only push prices up by pulling oil stocks off the market—which can only be done to a certain extent without harming overall oil revenues.

The oil bulls are hoping China is going to provide that rise in oil demand to keep up the price pressure. China’s travel surge has been the latest hopium sustaining the bulls’ narrative. However, the internal composition of that travel surge is not one that favors oil. The oil bulls will likely have to look elsewhere to find support for further increases in oil prices.