The problem with today’s economists is they ignore (or perhaps are ignorant of) the most basic principle of economics—and thus they cannot recognize a contracting and dysfunctional economy even when they are living in it.

Thus it is we have economists prattling on about the risk of a recession (i.e., a contracting and dysfunctional economy) months after the data demonstrated unambiguously that the US economy is in said recession (i.e., it’s contracting and dysfunctional).

Recession concerns in the US are widespread these days. Yet, some economists argue that the strength of the labor market — as well as household balance sheets — will keep the economy strong enough to avoid a recession.

We disagree. Despite the relatively robust job growth we’ve been seeing, the Economic Cycle Research Institute (ECRI), which we co-founded, has been predicting recession since last spring, and it remains our expectation that the US economy will enter a recession this year.

There are three fundamental flaws with the thesis stated by economists Lakshman Achuthan and Anirvan Banerji of the Economic Cycle Research Institute (ECRI), whose stated business it is to declare recessions for some 22 countries—excuse me, “economies”:

Flaw #1 — Job growth is anemic to nonexistent, not robust.

Flaw #2 — Household balance sheets are not relevant to whether the economy is expanding or contracting, except as an indicator of lagging wages.

Flaw #3 — Recession is happening now. It’s a present problem, not a future challenge.

The lunacy of these three flaws is immediate apparent when one pauses to remember that Adam Smith—long feted as the intellectual father of free-market capitalism—identified jobs (and the income generated by jobs) as the source of a nation’s wealth at the very beginning of his seminal work Wealth of Nations1.

The annual labour of every nation is the fund which originally supplies it with all the necessaries and conveniencies of life which it annually consumes, and which consist always either in the immediate produce of that labour, or in what is purchased with that produce from other nations.

If ordinary people are prospering earning ordinary paychecks, the economy is in rude health. If they are not, the economy is in poor health. Slice and dice the econometrics however you want, the fundamental characteristic of a recession is when the economy is in poor health—as it is now and as it has been for quite some time (at least since last spring).

Regular readers of this Substack are by now well familiar with my derisions the data manipulations by the Bureau of Labor Statistics that I term “Lou Costello Labor Math”, as it takes a vaudevillian sense of the absurd to appreciate the strange maths that produce their delusional jobs numbers. One only has to look at the most recent Employment Situation Summary to apprehend my meaning:

From August onward, the “All Employees” metric is substantially lower than during the first half of the year, as is the “Employment Level” metric until December. At the same time, “Unemployment” and “Not in Labor Force” both show stronger numbers during the second half as compared to the first.

This is not a “strong” labor market signal.

Yet it is not merely that job growth is either anemic or nonexistent. Real Wage growth is entirely nonexistent and has been for months.

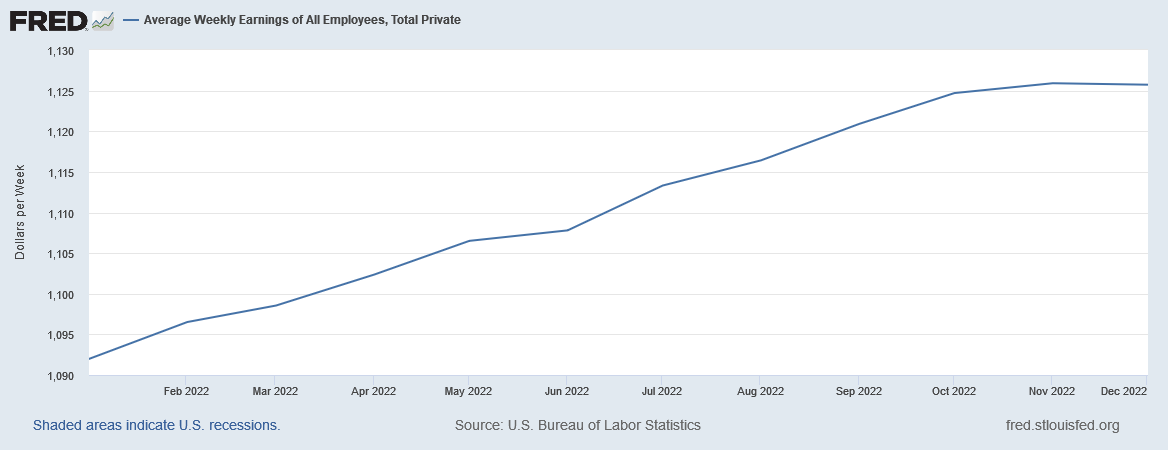

On the surface nominal wages appear to have grown throughout 2022.

However, when one takes into account the significant inflation we have had throughout 2022, inflation-adjusted wages2 have steadily decreased throughout 2021 and 2022.

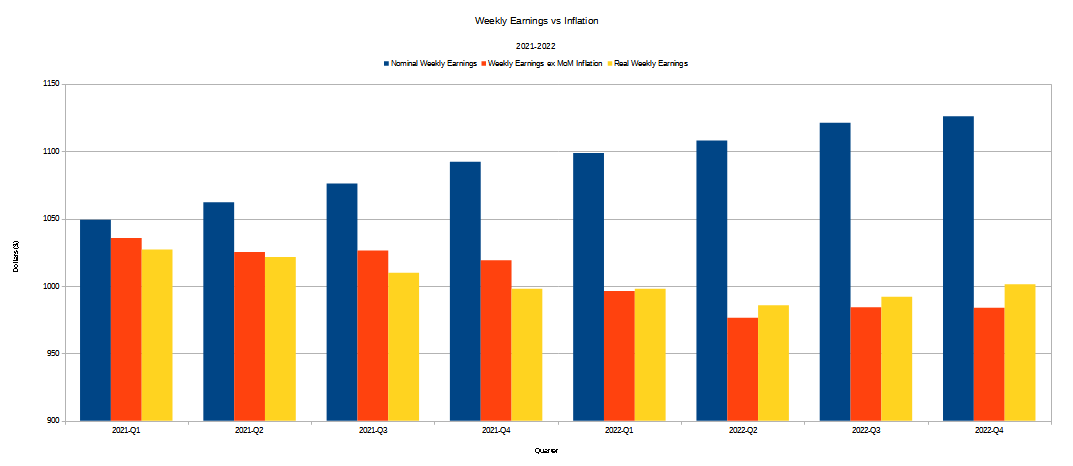

If we compare by quarter nominal wages vs those same wages ex Month on Month inflation vs Real Wages, we see just how much inflation has eaten out of the typical weekly paycheck.

Inflation is not the working man’s friend. Where there is high inflation there is greatly reduced real earnings and therefore reduced actual consumption of physical goods and services. Where there is high inflation there is recession.

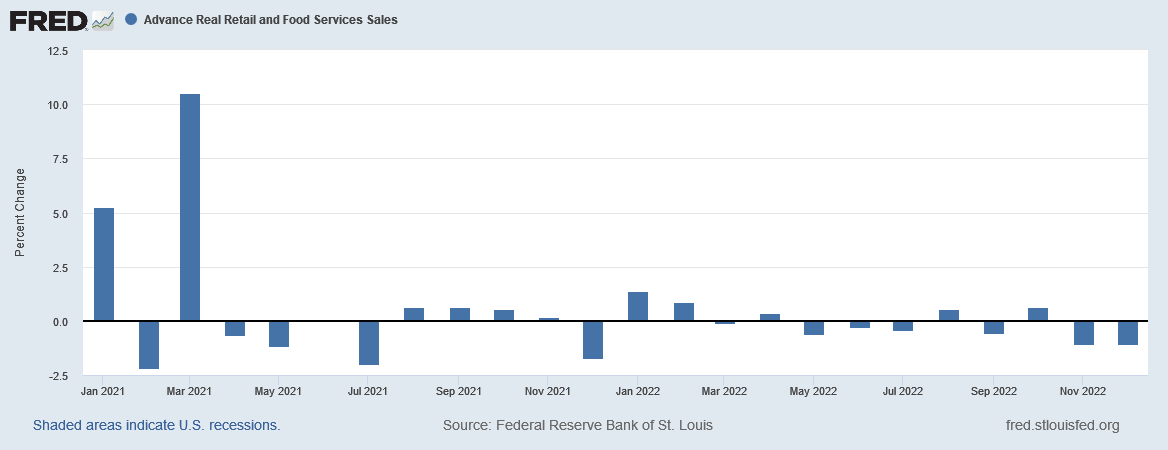

We can see that there is in fact a decline in said consumption, as real sales figures have been declining more often than not over the past two years.

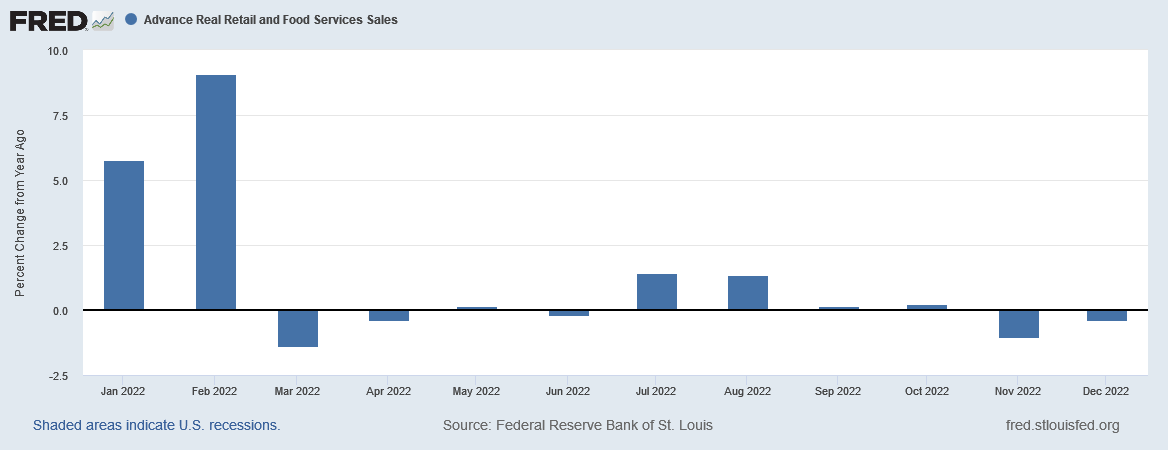

Even when viewed as a change year on year, the retail sales numbers are still abysmal.

When inflation eats up a working man’s paycheck, he ends up paying more and buying less. As the retail sales data shows, people have been buying less more often than not.

That’s a recession.

Nor can household balance sheets (savings) rescue the situation—in fact, the household balance sheets are themselves showing signs of weakness and dysfunction, not the abundance of wealth claimed by the Wall Street investment “experts” at Goldman Sachs.

Households are in better shape financially than they have been at the onset of most recessions. The ratio of household-net-worth to disposable income is at a record high, the personal savings rate is elevated, pent-up savings are ample and Americans overall have a healthy financial surplus. This means a slowdown in labor income growth is less likely to cause households to sharply cut back on spending than in some past cycles.

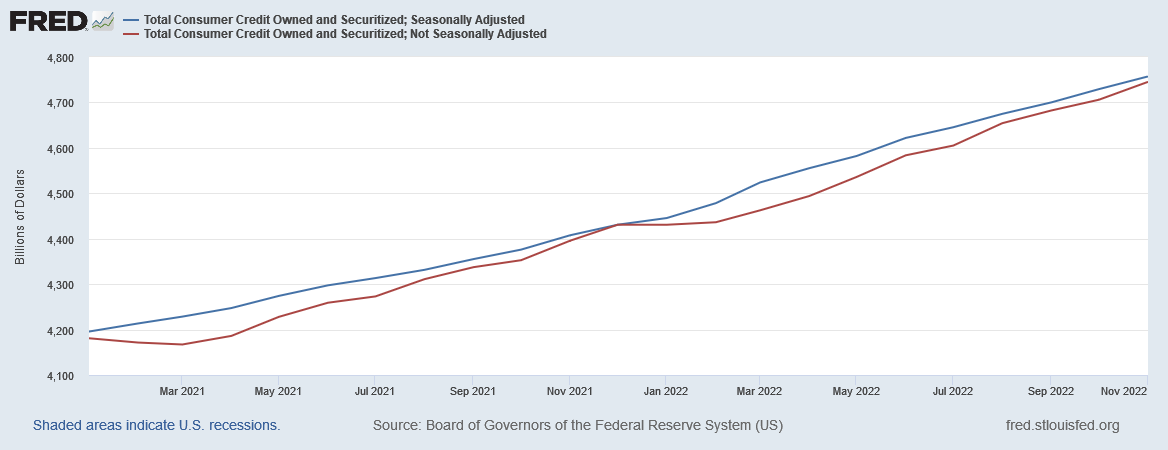

It is impossible for households to be in good shape when they are taking on increasing amounts of debt—which they are. Total consumer credit has been rising steadily throughout the past two years.

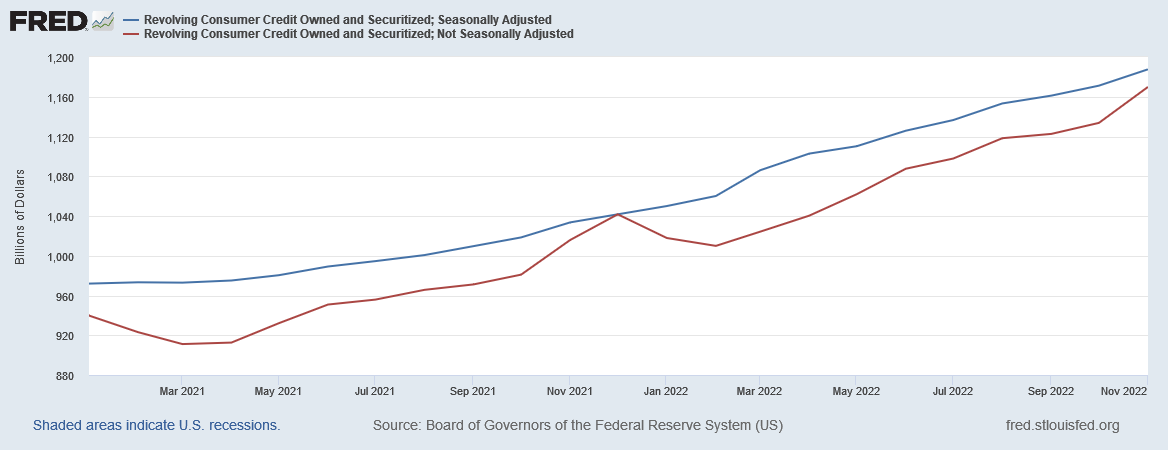

Revolving consumer credit—i.e., credit card balances—are also rising, suggesting that people are using credit, not income, to fund their lifestyles.

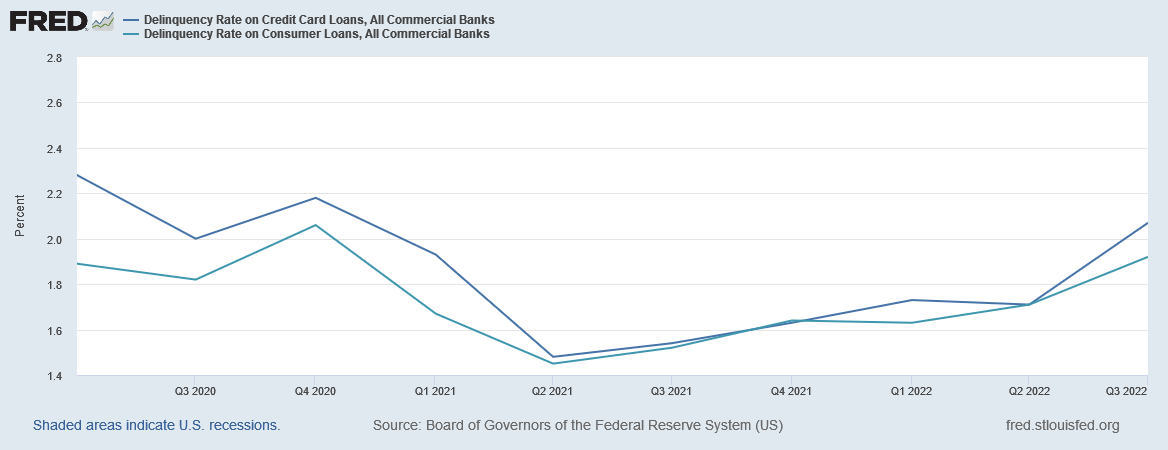

We can see that these rising debt loads are becoming a problem, because the delinquency rate on that debt has been rising as well.

An economy where people are increasingly unable to manage their debts is not an healthy economy. An unhealthy economy is an economy in recession.

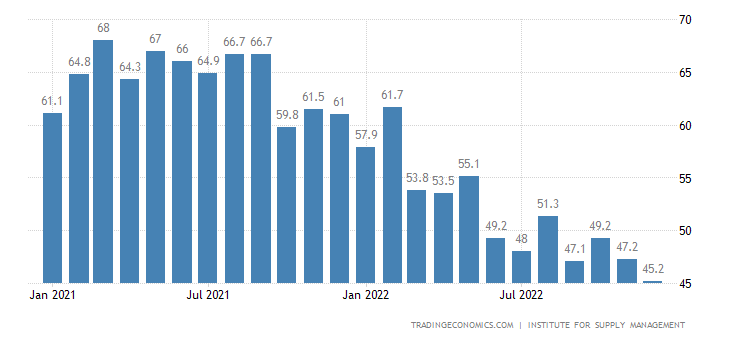

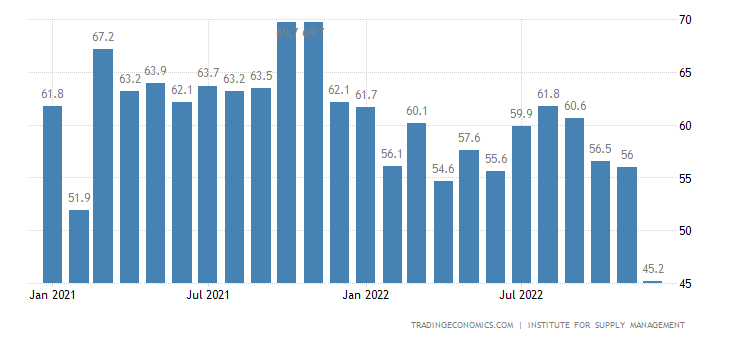

When people cannot manage their debts, their ability to continue to purchase and thus conume deteriorates—and that means businesses get fewer new orders for physical goods, which is exactly what we have been seeing in recent months.

Even non-manufacturing orders fell off a cliff in December.

Of the Institute for Supply Management’s December “Report On Business”, 7 out of the 10 indices used by ISM to compute their Manufacturing PMI Index show contraction rather than expansion.

When the majority of indicators show contraction, it’s a fair bet the economy is contracting!

That “something” has occurred within the US economy is a near certainty, given the many indicators of an economic inflection during the spring and/or summer of last year.

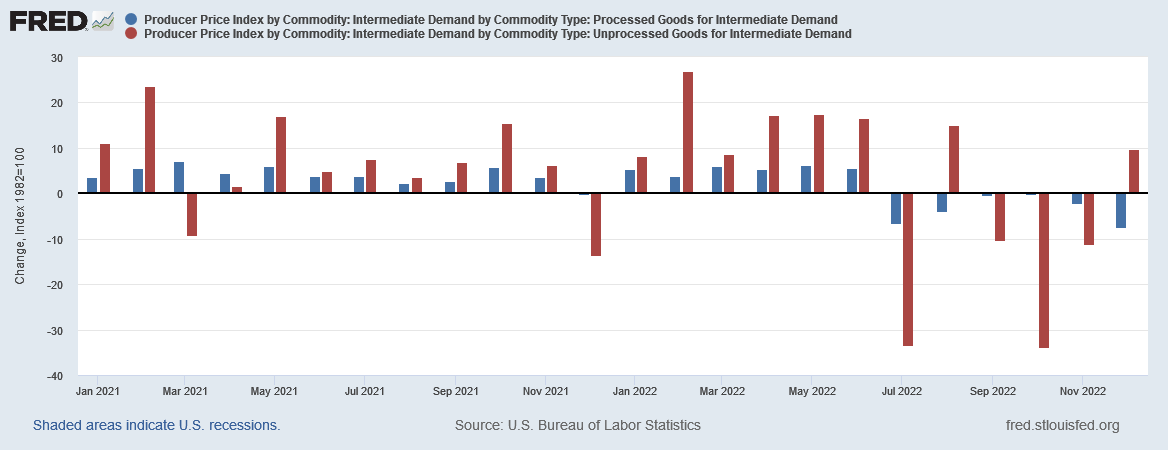

Producer prices for intermediate goods (things used to make other things) dropped significantly beginning in July.

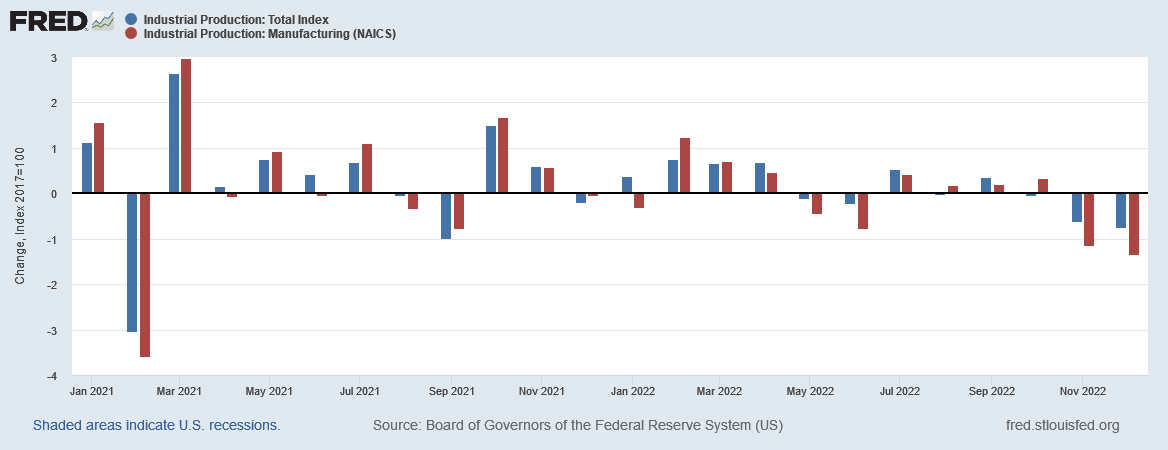

Industrial production began to show mostly contraction last May:

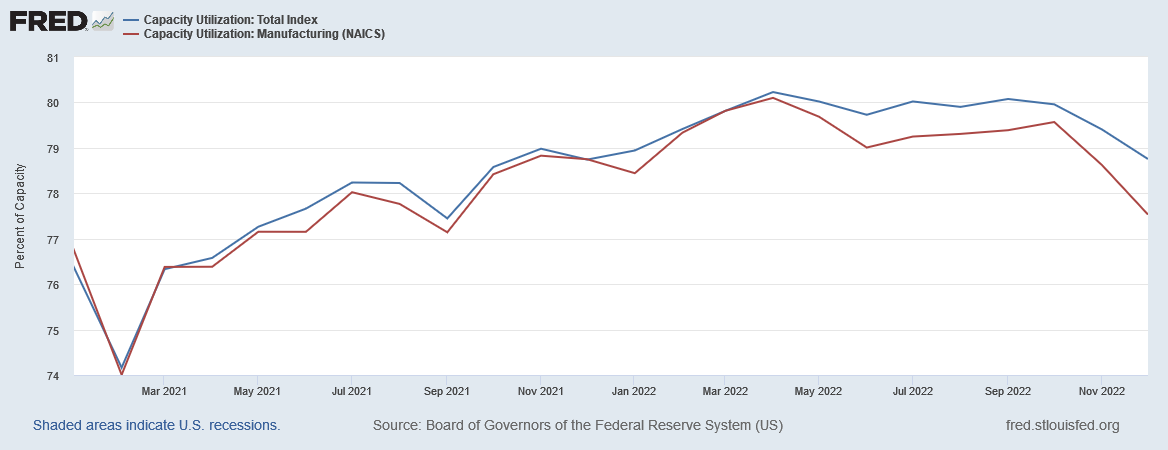

Capacity utilization peaked in April of last year and has trended down ever since:

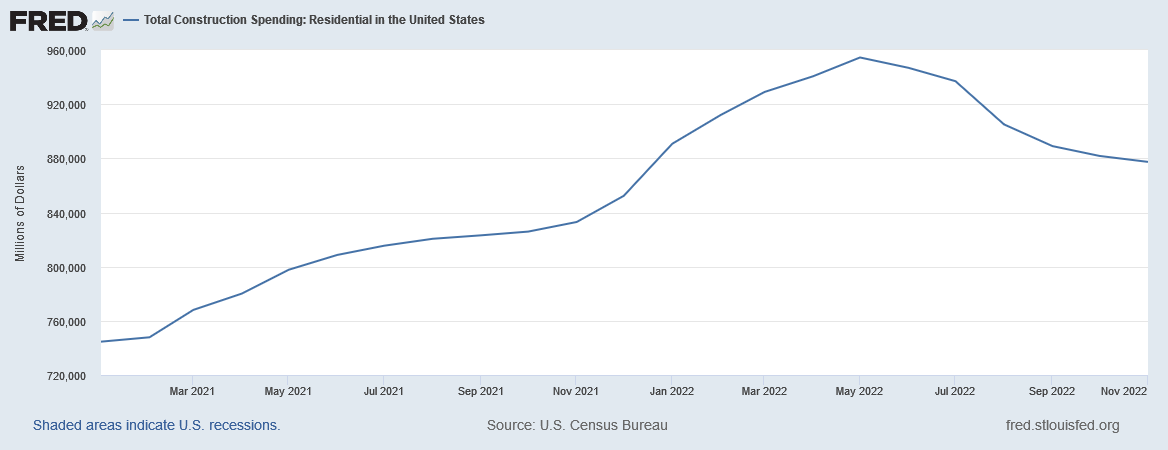

Spending on residential construction peaked in May:

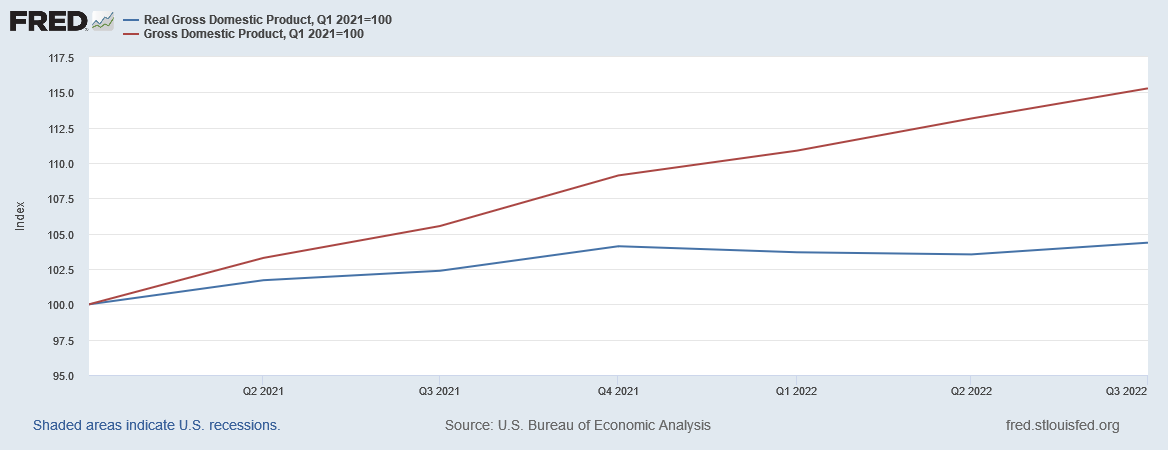

Given all of the above, it comes as no surprise that Real GDP growth has been stalled since the fourth quarter of 2021.

It boggles the mind, therefore, when presumptive economic “experts” such as Fed Vice Chair Lael Brainard speaks of even “moderate growth” when taking an undeserved victory lap on the Fed’s interest rate jihad against that growth.

Inflation has been declining over the past several months against a backdrop of moderate growth. Yesterday's industrial production index points to a significant weakening in the manufacturing sector, and the retail sales report points to a further moderation in consumer spending. Looking forward, weaker readings on real income, wealth, and sentiment, along with indicators of spending on services, such as the ISM services index, point to subdued growth in 2023. Real disposable personal income declined, on net, at an annual rate of 4.1 percent in the first three quarters of 2022, suggesting that recent consumption has been supported by running down pandemic savings and greater reliance on credit. In particular, savings among low-income households appear to be lower and to have declined more rapidly than was previously appreciated.

Since when do declining capacity utilization, declining residential construction spending, and declining industrial production amount to growth? When these metrics decline, fewer goods are being produced. When coupled with declining retail sales, it is yet another sign that people are buying less (even as inflation means they pay more).

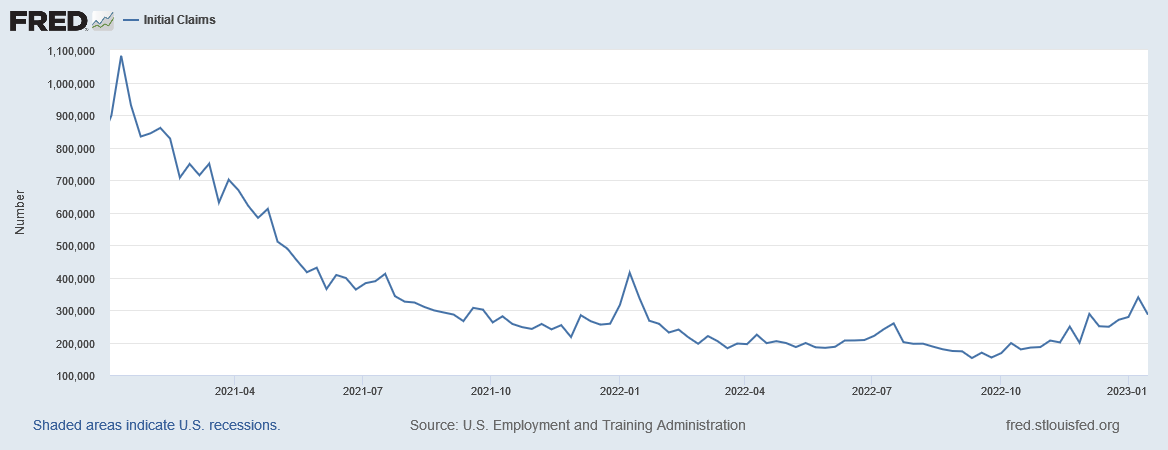

Almost certainly, one reason people are buying less is because fewer people appear to be working. How else to explain recent rises in both initial unemployment claims and continuing unemployment claims?

Whatever is happening within the US economy, it is starting to throw people out of work. That’s a recession by definition, not growth, making Vice Chair Brainard’s gobbledygook about economic growth in the US simply delusional.

All economic analysis fundamentally reduces to assessing the state of the individual worker. If more people are working, if their real wages are increasing, if their household debts are decreasing, invidivual workers are prospering to varying degrees.

It is ludicrous to speak of economic growth when there is scant evidence of job growth.

It is ludicrous to speak of economic growth when there is negative wage growth.

It is ludicrous to speak of economic growth when there is negative retail sales growth.

It is ludicrous to speak of economic growth when there is negative growth in industrial production.

It is ludicrous to speak of economic growth when there is negative growth in capacity utilization.

When it becomes this ludicrous to speak of economic growth, all that is left to discuss is the magnitude of the ongoing economic contraction.

This much has not changed since the days of Adam Smith and Wealth of Nations: the national economy prospers when the individual worker and businessman prospers. When the individual worker is not prospering, neither is the national economy.

The individual worker has not been prospering for many months (arguably for many years). That means we are in a recession. That means we have been in a recession. That means unless workers start prospering soon, that recession will only get worse and not better.

Smith, A. “Introduction And Plan Of The Work.” An Inquiry Into the Nature and Causes of the Wealth of Nations, 1775, p. 2. Project Gutenberg e-Text https://www.gutenberg.org/files/38194/38194-h/38194-h.htm#Page_1

Real Wages = Prior Period Real Wage + (% Nominal Wage Growth From Prior Period - Month On Monrth Consumer Price Inflation) * Prior Period Nominal Wage

Thanks for saying it out loud. The people already know, what governments around the world have tried to gas light them into NOT thinking, because they see it every time they go to the shops or service stations.

#wearememory #wearemany #theyarefools

Excellent coverage