Yesterday, having assessed both the November Job Openings and Labor Turnover Summary (JOLTS) and the ADP National Employment Report (NER), I reached the following conclusion:

With both the underlying JOLTS and ADP data signalling employment stagnation, in order for the upcoming December Employment Situation Summary to produce any “strong” numbers, another application of the lunacy of Lou Costello Labor Math will be required.

The government and the corporate media have a choice to make: analyze the data honestly and report the data accurately, or massage a nice headline number using vaudevillian mathematics to continue the fiction of a strong jobs market.

I doubt either will choose the path of honesty.

When the BLS released its December Employment Situation Summary, it did not choose the path of honesty.

Total nonfarm payroll employment increased by 223,000 in December, and the unemployment rateedged down to 3.5 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in leisure and hospitality, health care, construction, and social assistance.

That’s a nice summary—if only it were true. It isn’t.

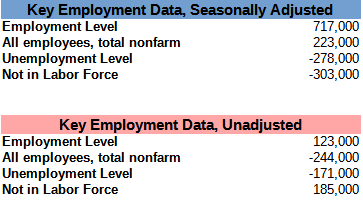

First off, the 223,000 figure comes from the seasonally adjusted “All Employees” figure from the Establishment Survey portion of the summary. As the chart above shows, the raw unadjusted data shows a slightly different set of numbers. To summarize the seasonally adjusted and raw data sets from the December Summary:

The BLS seasonal adjustments made 594,000 jobs appear in the Household Survey’s Employment Level, made 467,000 jobs appear on the Establishment Survey’s “All Employees” metric, made 107,000 unemployed individiuals disappear from the “Unemployment Level” metric, and made 408,000 individuals disappear from the “Not In Labor Force” metric.

That’s quite the adjustment!

Yet even that seasonal massaging of the numbers—which in effect merely redistributes numbers from or to prior months—fails to obscure the substantial weakening within the labor market over the last half of 2022.

From August onward, the “All Employees” metric is substantially lower than during the first half of the year, as is the “Employment Level” metric until December. At the same time, “Unemployment” and “Not in Labor Force” both show stronger numbers during the second half as compared to the first.

This is not a “strong” labor market signal.

Further demonstrating the BLS’ unwillingness to look at the reality of the data, once again the Summary failed to note the stagnation within the Household Survey’s “Employment Level”, or that the Establishment Survey has yet to catch on to that stagnation, both of which can be plainly seen when we index their changes to January of this year.

December is the first time since March the Household Survey registered appreciable employment gains.

Normally, those gains would be heralded as good news, but, once again, the details tell a different story. When we break down employment among full time and part time workers, multiple job holders, and self-employed individuals, that Employment Level gain acquires some significant caveats:

Full-time employment actually declined in this country by 1,000 jobs, while part time employment increased by 679,000 jobs. (Yes, somehow the net of -1,000 plus 679,000 equals 223,000—such are the glories of Lou Costello Labor Math!)

Additionally, the number of multiple job holders rose by 370,000. Apparently 370,000 people taking on a second job equates to 223,000 jobs.

Ain’t Lou Costello Labor Math amazing? Note: these number games only mean there will be substantial downward revisions to these jobs numbers in the coming months, and the January correction to the raw “All Employees” data just got that much larger. The data is not showing any sort of actual job growth taking place.

Nor is this a recent trend. When we index these same metrics to April of 2020 (as the US was coming out of the 2020 COVID recession), we see immediately that full time employment has shown the worst relative gains, while part time work and holding down a second job has shown the best.

When we amalgamate the employment changes by year, we immediately see that the jobs “recovery” from the 2020 recession was significantly different than the recovery from each of the prior two recessions.

Not only is the jobs recovery front-loaded to 2021 after the 2020 recession, while the 2001 and 2008-2009 recessions showed a much slower jobs recovery, but part time jobs and multiple jobholders increased much less, and in most years did not increase but rather decreased. Post-2020 we have two years of significant increases in part-time employment and people holding more than one job.

You will not see any of this discussed in the BLS employment summaries.

Also left out of the BLS Employment Summary is what appears to be a significant shift in how part-time work is apprehended.

Throughout 2022, there have been significant increases in the level of individuals working part-time for non-economic reasons.

This is not an aberration, either, but is shaping up as a longer-term trend, as the full year comparisons to prior years shows:

A significant element of the perceived “tightness” in the labor markets is driven by a significant increase in the number of individuals who are either choosing to work part time or are unable to work full time.

Also falling by the wayside is the argument that rising labor prices are fueling further inflation. The data makes it quite clear that argument is pure horse hockey.

When the year on year change in weekly earnings is outpaced by the year on year change in consumer price inflation, it is difficult to argue persuasively that a wage-price spiral is taking place. When the year on year change in weekly earnings starts to decline ahead of the year on year change in the consumer price index, it is impossible to argue for a wage-price spiral.

Even the monthly changes in wages and consumer price inflation do not support the notion of a wage-price spiral.

Workers are still getting squeezed by consumer price inflation. It was against this backdrop of declining real wages that Congress voted to strip rail workers of their rights to strike and negotiate a fair contract last fall.

Despite the multiple patent defects in American labor markets, President Asterisk’s handlers still took the predictable victory lap over the jobs report, with the President’s Tweeter-in-Chief demonstrating just how far removed from reality the current regime really is.

To be clear: job growth is practically nonexistent, and it sure as Hell isn’t strong. Jobs are not being created, and costs are not being lowered (that would be “deflation”, which we don’t have, not “inflation”, which we do have).

Naturally, the corporate media is fully on board with the “strong jobs report” narrative as well.

Nearly 165 million people were either in jobs or looking for them last month, a record high that showed a long-hoped-for improvement in labor supply. U.S. firms added 223,000 payroll jobs to cap a year in which 4.5 million people were hired, a total exceeded in the post-World War Two era only by 2021's 6.7 million.

Again, to be clear: Given the totality of the data, it is mathematically impossible for there to have been 223,000 payroll jobs created during December. Further, the job creation which did occur was entirely among part time workers, with full time workers decreasing during December.

That’s job loss, not job growth.

However, don’t tell that to Wall Street, as they are still wedded to the idiocy of the Fed engineering a “soft landing” for the economy as it battles inflation.

The jobs report is "the embodiment of the soft landing narrative - this idea that can you have a strong labor market with slowing wage growth," said Simona Mocuta, chief economist at State Street Global Advisors.

"You can kind of, in this case, have your cake and eat it too," she added, with earnings growth coming off the boil but no collapse in labor demand or widespread layoffs.

Ideally, she said, that should allow the Fed to slow and soon pause its interest rate hikes.

Perhaps the ultimate demonstration of how surreal the jobs situation in this country has become is that Wall Street is not at all concerned with how the economy is doing overall, or whether businesses are genuinely on track to prosper. Rather, the only thing that matters on Wall Street is whether the Federal Reserve will continue to raise interest rates or whether it will “pivot” back to a looser monetary policy and monetary “stimulus” to boost the economy.

Perversely, the seemingly “strong” headline jobs number in the Employment Summary only means the Fed has 223,000 new fictitious reasons to persist in its largely ineffectual battle against consumer price inflation by raising the Federal Funds rate. There will be no “pivot”—and there will be no “soft landing” either—and the BLS’ vaudevillian math antics are proving to be a major reason why not.

Methinks they want a higher unemployment rate around 6-8% as a target set by the fed.

Half the actual inflation rate too? Just sayin’...