Ending Zero COVID Merely Reveals The Extent Of China's Ongoing Collapse

What To Do When The Economy Only Exists On Life Support?

Yesterday, I detailed how Xi Jinping’s decision to abruptly end Zero COVID was exposing China’s brittle and inadequate healthcare system to an accelerating wave of COVID infections.

Yet as chaotic as China’s healthcare situation is becoming as Beijing surrenders to the virus, that is far from the only challenge the end of Zero COVID presents. It may not even be the worst one.

With Beijing no longer imposing draconian lockdowns and other COVID restrictions on the population, China is also having to confront the economy’s state of utter collapse.

China's economy lost more steam in November as factory output slowed and retail sales extended declines, both missing forecasts and clocking their worst readings in six months, hobbled by surging COVID-19 cases and widespread virus curbs.

The data suggested a further deterioration in economic conditions as lockdowns in many cities, a property-sector crunch and weakening global demand pointed to a bumpy road ahead even as Beijing ditched some of the world's toughest anti-virus restrictions following widespread and rare public protests.

China’s economy is faltering and failing in nearly every regard.

China’s November growth in industrial production of only 2.2% year on year is the second worse performance for that sector of the economy in five years.

While the decline in industrial output is largely attributable to Zero COVID draconian restrictions on people’s activity and movement, which were still in effect during November, the ongoing wave of COVID infections coupled with people’s fear of COVID itself (courtesy of government propaganda over the disease) means people’s activity and movement will still be curtailed for the immediate future. People who are in hospital because of COVID symptoms, and people who are fearful to go outside lest they get sick with COVID, are not people who are going to be terribly productive.

This reality is being driven home by the fact that China’s industrial production even month on month fell to just 0.33%, the third worst month over the past year, and one of the worst month’s over the past five years.

China’s factories, long the heart of China’s economic growth over the past several decades, are not doing at all well.

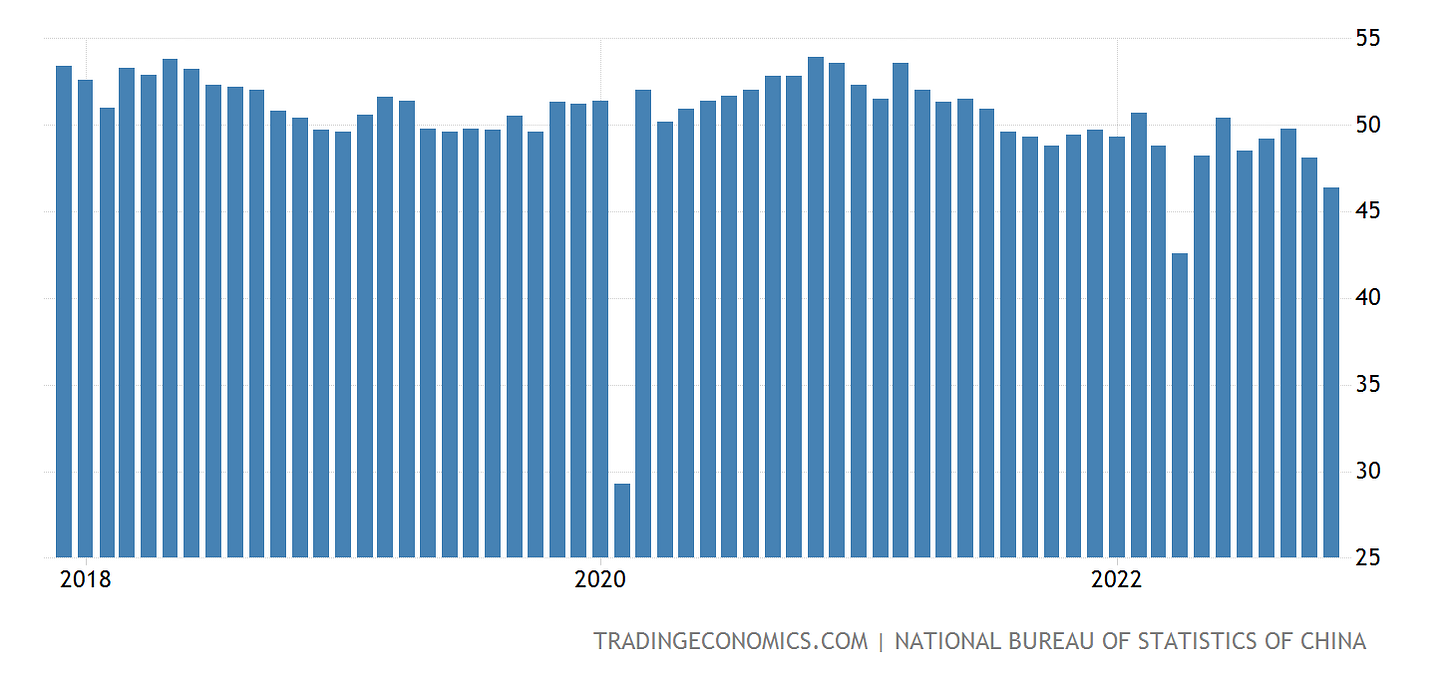

Nor are the factories likely to be doing much better any time soon. New orders for November declined yet again, coming in at the third worst level over the past five years.

Even more ominous for China is that new factory orders have been trending down since late 2020, after an initial post-COVID recovery following China’s initial lockdown over the disease. Without fresh orders for output industrial production will not be enjoying much if any growth. WIthout new orders China’s factories do not have the luxury of pent-up demand to fulfill as the country emerges from Zero COVID.

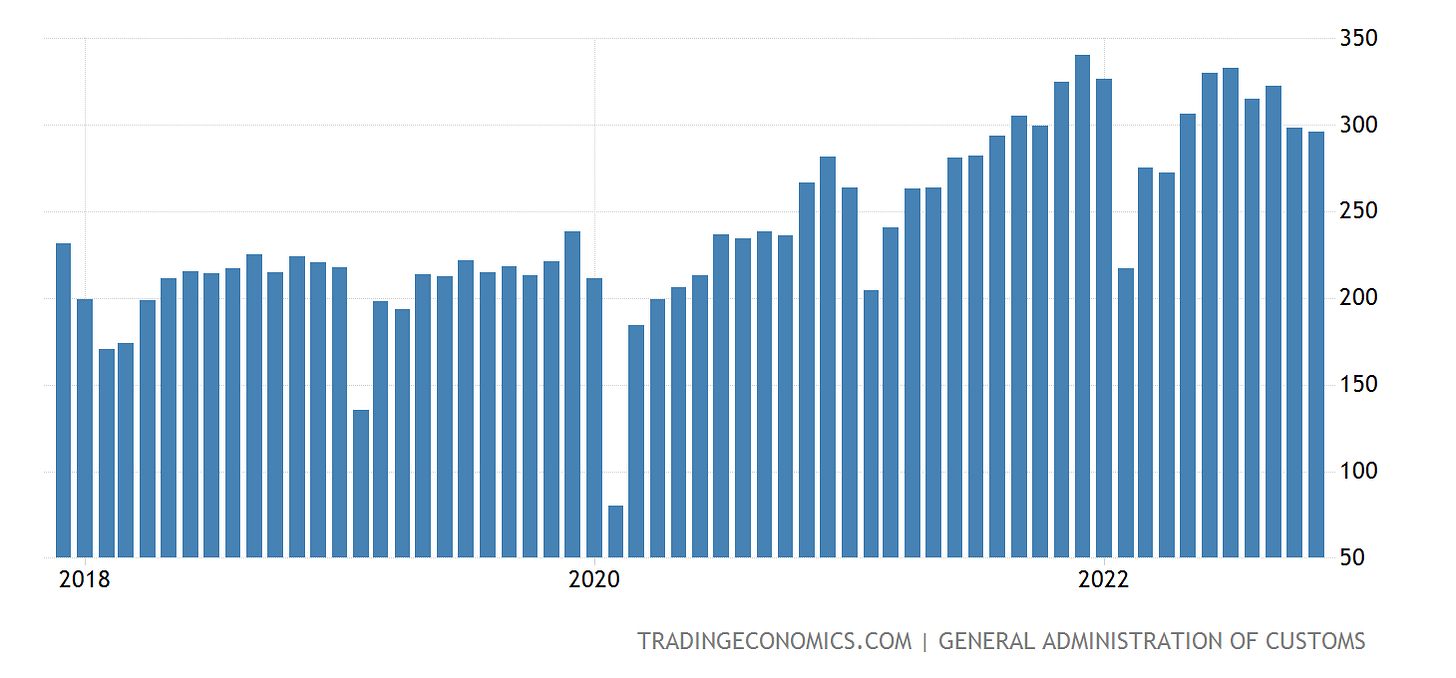

Lack of demand for China’s output is confirmed by an 8.7% year on year drop in exports from China.

Nor is the services sector doing any better. In November China’s Services PMI declined for the sixth month in a row, and was in contraction territory for the second month in a row.

November was the second worst month for China’s Service PMI since the start of the COVID pandemic, and the third worst over the past five years.

As a result of China’s across the board economic duress, unemployment rose in November to 5.7%, rising up from China’s official unemployment target of 5.5%.

While China’s youth unemployment did improve slightly in November, it remains extremely high at 17.1%. Zero COVID has cost many Chinese their jobs, and it is by no means certain where they will find new employment in the near future.

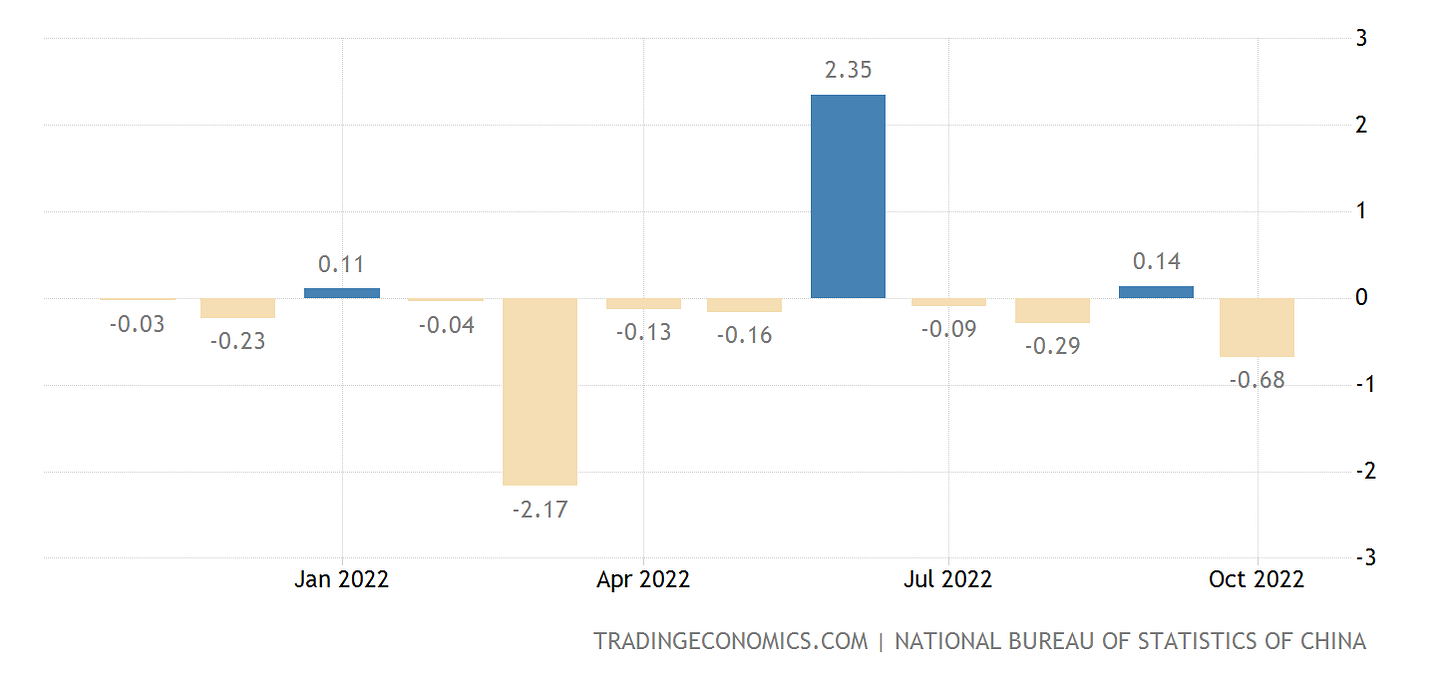

Lack of employment coupled with Zero COVID restrictions served to drive down China’s retail sales figures during November. A 0.68% decline month on month was the steepest decline since March, during the infamous Shanghai lockdown.

Month on month, China has managed only three months of retail sales growth during the past year. Domestic consumption is decreasing in China, not increasing.

On a yearly basis, China’s retail trade dropped 5.9%, far above expectations of a 3.7% decline.

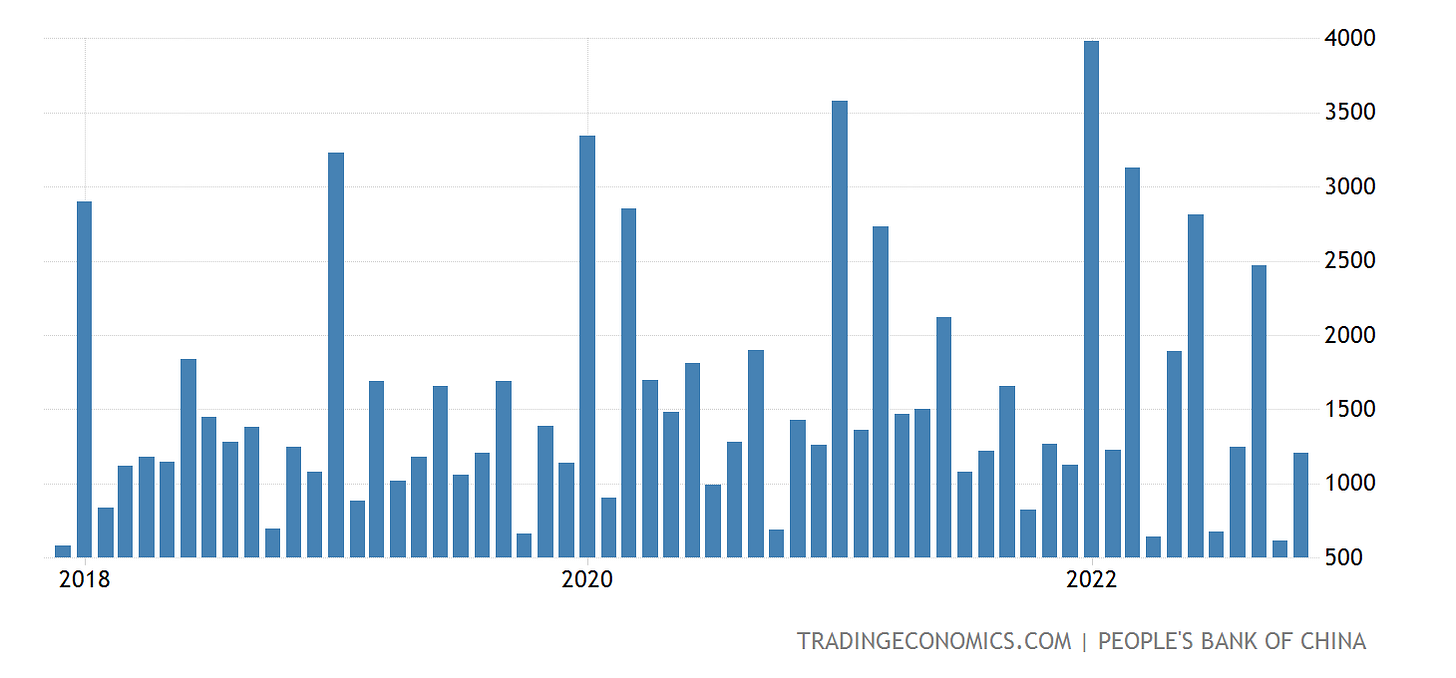

Beijing’s efforts at stimulus have not produced stellar results. New loan growth in November amounted to 1.21 trillion yuan, an increase from the prior month but below the 1.27 trillion yuan from November, 2021, and well below expectations.

Indeed, stimulus is the only thing sustaining the Chinese economy at present, making it the main topic of discussion at the upcoming Central Economic Work Conference, where the economic agenda for 2023 will be laid out.

When China's leaders gather this month to set next year's economic agenda, they will likely map out more stimulus steps, eager to underpin growth and to ease disruptions caused by a sudden end to COVID-19 curbs, policy insiders and analysts said.

In three days of closed-door sessions at the annual Central Economic Work Conference, President Xi Jinping and other top officials are expected to discuss keenly anticipated growth targets, expanded fiscal spending on infrastructure and other programs, and the potential for more monetary easing.

In housing, in lending, and throughout China’s economy in general, stimulus measures are what are propping up the economic numbers, and 2023 promises to be a year of even more stimulus. Virtually all of China’s economic “growth” at the moment is the consequence of stimulus measures out of Beijing, and Beijing is likely to double down on that for next year.

Can it even be called economic growth when the economy is completely on government life support?

While the easing of Zero COVID removes many of the government obstacles to a return to economic expansion, the COVID wave itself moving through China means it will be a few months yet at least before China is in a position to even begin thinking about renewed economic growth.

Chinese society may be reopening at long last, but for the next few months at least much of China’s economy will remain closed for business.

China's hurting. As is Russia, Europe, Iran. And the US is not doing so well either. If the Fed had more credibility, it would not need to be so "macho" with rate hikes.

Patience on Jay Powell's part is called for.