There are lies, damned lies, and then there are statistics.

And then there are reports from the Bureau of Economic Analysis, which rival the Bureau of Labor Statistics for the sheer artlessness of their communications.

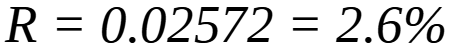

Last week’s third and final fourth quarter GDP estimate for 2022 was that GDP grew at an annual rate of 2.6%, a downward revision from the second estimate which pegged GDP growth at 2.7%.

Real gross domestic product (GDP) increased at an annual rate of 2.6 percent in the fourth quarter of 2022 (table 1), according to the "third" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.2 percent.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 2.7 percent. The revision primarily reflected downward revisions to exports and consumer spending (refer to "Updates to GDP"). Imports, which are a subtraction in the calculation of GDP, were revised down.

There is, however, one small point that needs to be emphasized here: at no time during 2022 did the national Gross Domestic Product increase by 2.6%. Growing at “annual rate” of 2.6% means that, had the percentage increase in calculated increase in GDP for just the fourth quarter were compounded across four quarters, the resulting increase would be 2.6%.

In other words, the reported increase is mostly wishful thinking, not articulated reality.

A quick overview of compounding is in order. The typical compounding scenario is the interest that is applied to a loan or to a savings account. The idea is to recognize the interest gain in each interval going forward until a set number of periods (i.e., the 12 months of a year) is reached.

This compounded rate is the “annual rate” when the total number of periods equals one year. This is slightly different from a year on year presentation, which merely works on the difference between a value today and a value one year ago.

The formula for calculating compound interest1 is as follows:

Compound interest = total amount of principal and interest in future (or future value) minus principal amount at present (or present value)

Where CI is the total amount of compound interest, P is the principal of the loan or deposit, i is the periodic interest rate, and n is the number of periods.

From this compound interest formula we can extract the formula for converting a quarterly growth rate into the equivalent compounded annual rate, which is simply the compound interest calculation without the principal:

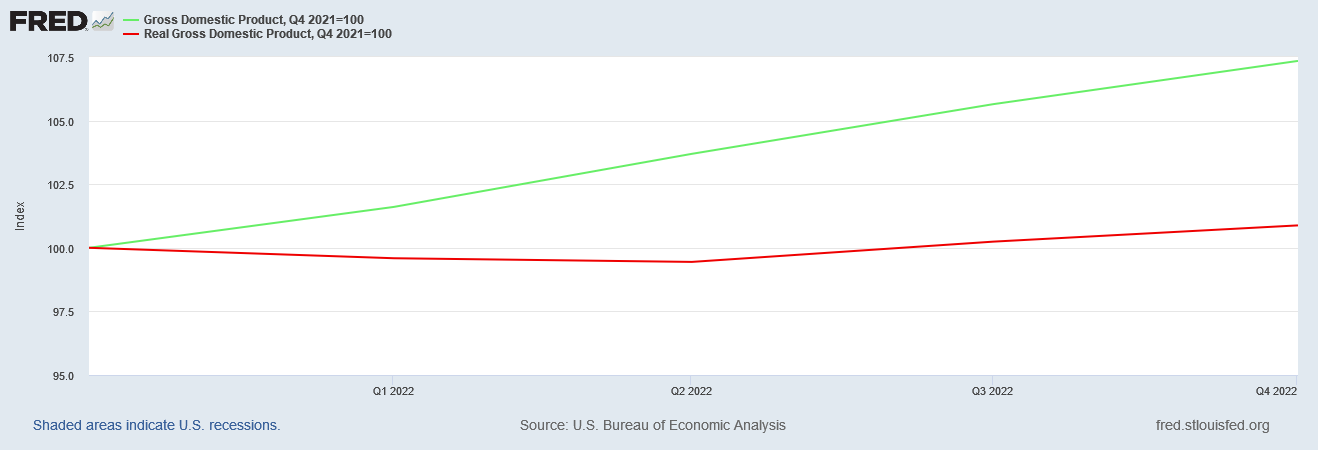

Where R is the compounded growth rate, i is the periodic growth rate, and n is the number of periods.

In the fourth quarter of 2022, the growth rate was 0.637%, or 0.00637. Plugging that in for i gives us this:

Completing the math yields the annual rate of growth based on the growth achieved during the fourth quarter:

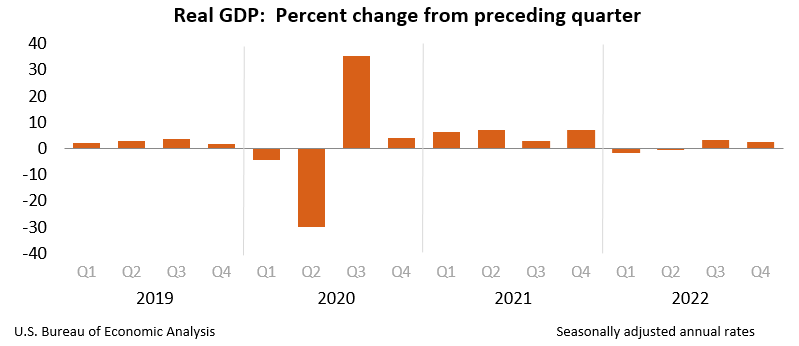

Thus, the annual rate being reported for GDP growth during the fourth quarter is the rate that would have been achieved if the quarterly growth rate were compounded across four quarters. Of course, we didn’t actually get that growth across four quarters. Readers will no doubt recall that in the first and second quarter GDP growth was actually negative—i.e., the economy contracted (but don’t you dare call it a recession, or Janet Yellen will stare blankly at you not understanding).

For the fourth quarter, real GDP growth was just 0.637%. That was all the growth that occurred during that fourth quarter.

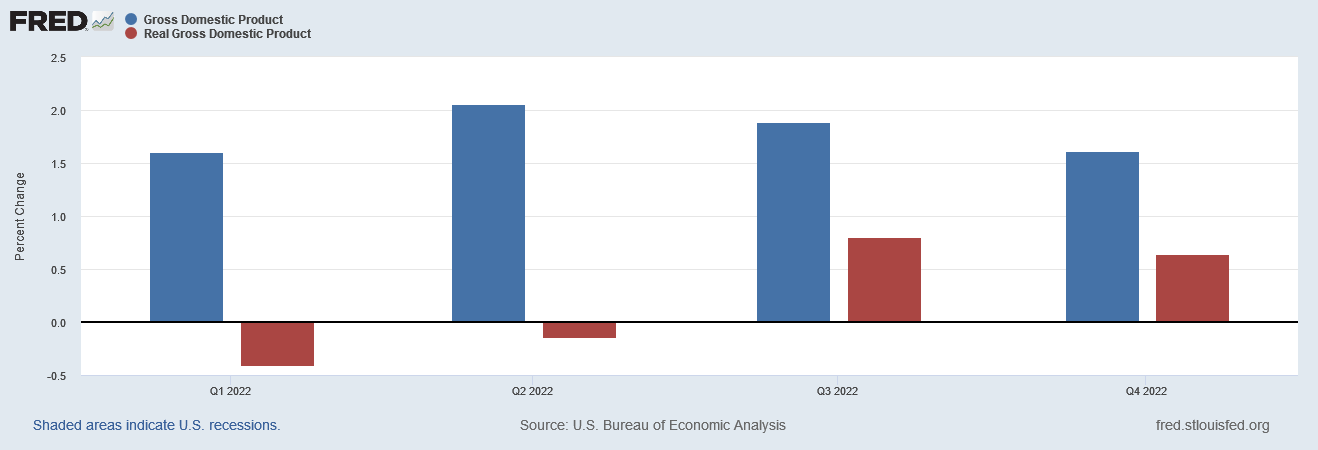

The third quarter was slightly better, at 0.8% growth. However, because of the contraction in the first two quarters, cumulative GDP growth for all of 2022 amounts to barely 0.9%. We can see this clearly if we index real GDP to the fourth quarter of 2021.

The economy did not grow by even 1% for all of 2022. There is no 2.6% growth to be seen anywhere during 2022. “Annual rate” does not mean “actual rate”.

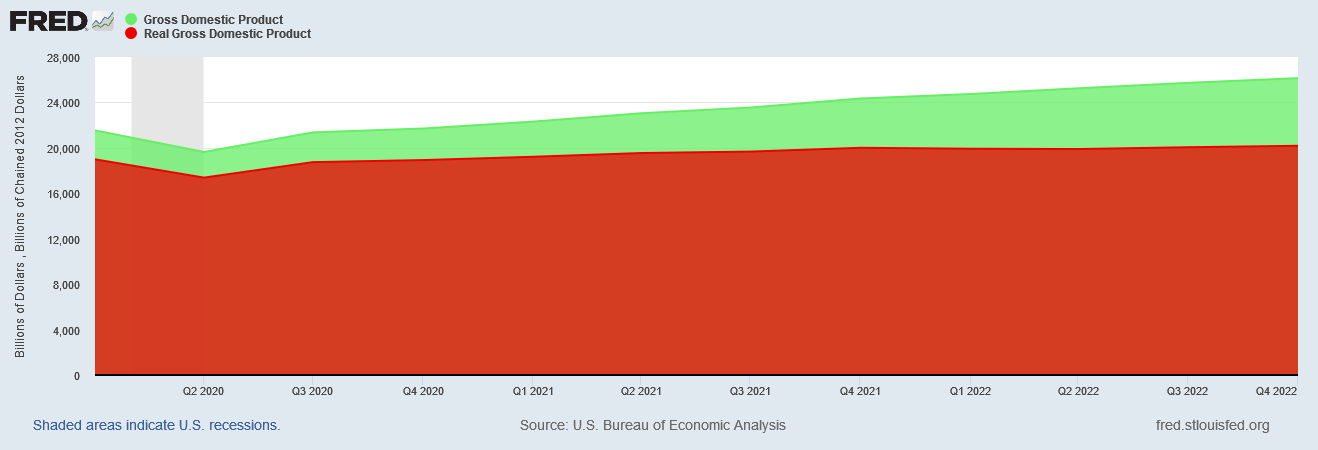

More importantly, however, is that 0.9% growth is barely any growth at all. Which is plainly visible if we look at growth of real GDP over the past couple of years.

That flatness that is real GDP is telling us that there was little GDP growth. The growing expanse above real GDP is nominal GDP being progressively more and more distorted by consumer price inflation.

In other words, there was no substantial real GDP growth at all during 2022—less than 1%. Nominal GDP growth was almost entirely due to rampant consumer price inflation.

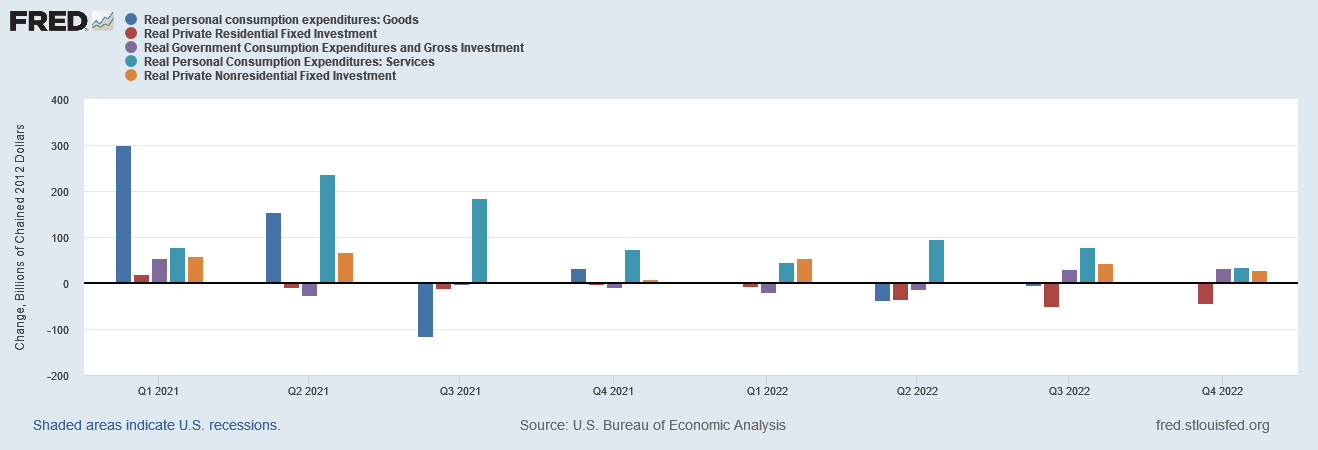

Moreover, when we look at various breakdowns of GDP growth and personal expenditures for 2022, we begin to see several areas where there not only was no growth but outright contraction.

There was no actual growth in personal expenditures for goods in 2022. The change in each quarter was negative.

Even more negative for 2022 was spending on fixed residential investment—i.e., housing. People were not spending money building homes or fixing up homes during 2022. In almost every advanced economy, expenditures on residential investment are a significant component of GDP growth. It’s hard to achieve GDP growth when residential investment is declining.

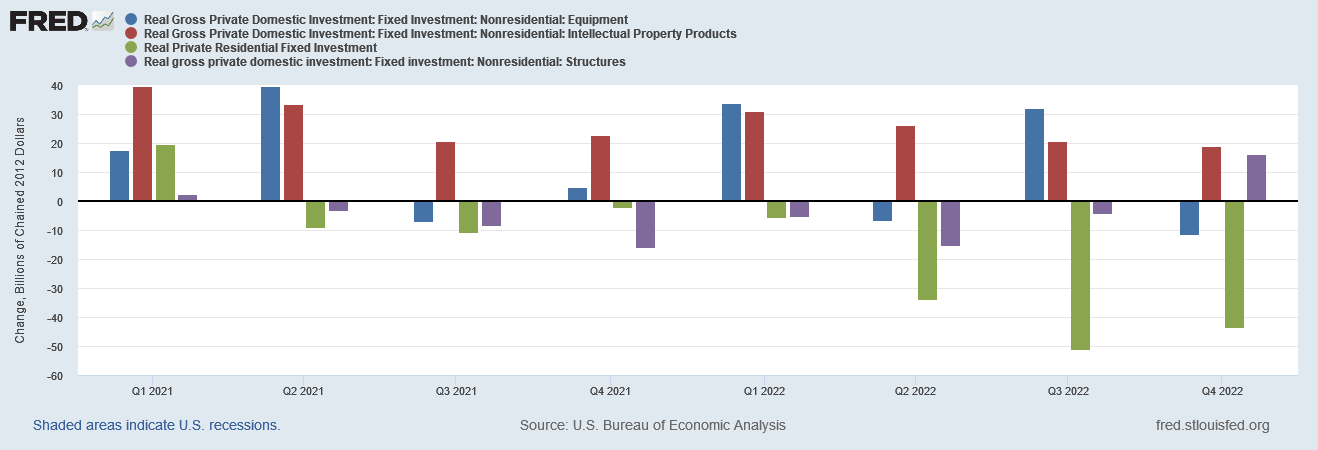

Yet even within non-residential investment, construction spending on actual structures declined throughout 2022. In fact, spending on structures decline from the second quarter of 2021 through to the third quarter of 2022, with growth only happening in the fourth quarter of 2022.

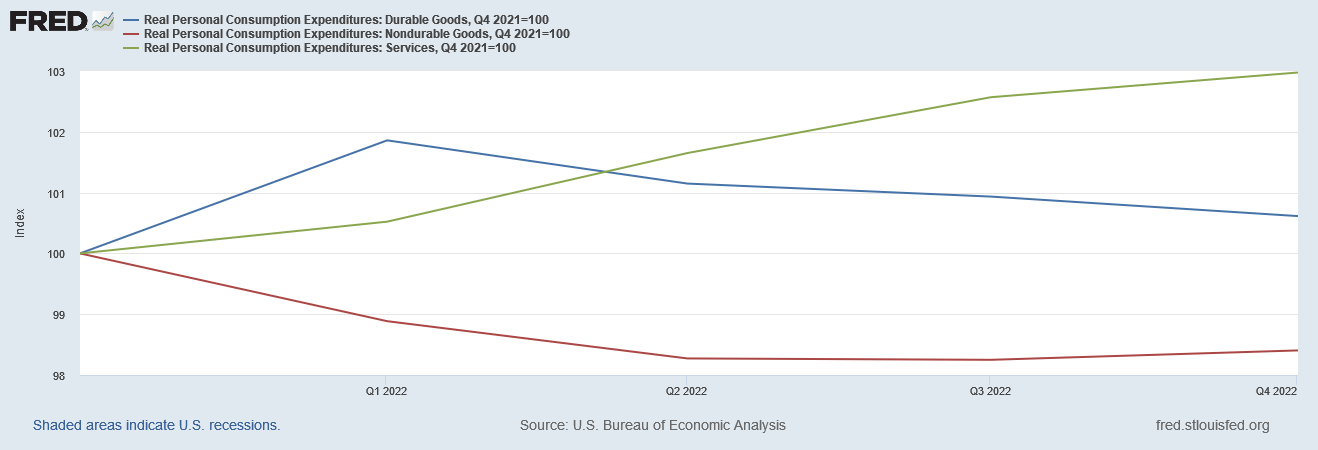

Drilling into the data on personal consumption expenditures does not yield any more comforting data. As we can see if we index the data to Q4 in 2021, from the first quarter of 2022 onward, expenditures on both durable and non-durable goods declined, with only expenditures on services increasing through the year.

It’s hard to have a growing economy when people are not buying enough “things”.

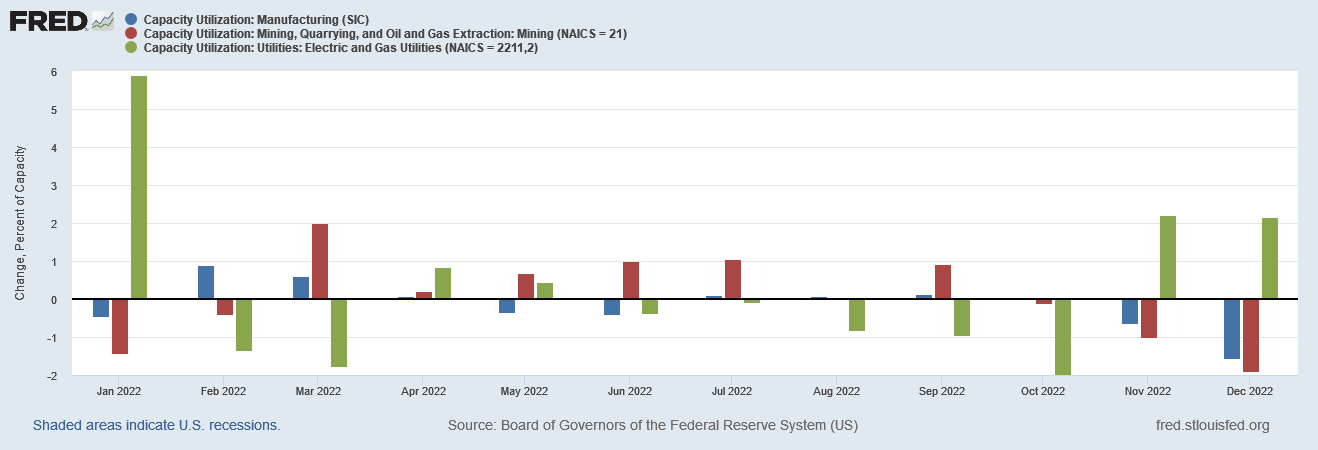

We begin to see the ramifications of a decline in consumer spending on goods when we look at the capacity utilization within the economy. Utilization of manufacturing capacity also declined in the US from April onward.

The last month where capacity utilization increased was March. When people are not buying “things”, businesses generally stop making “things”, and that sector of the overall economy naturally contracts.

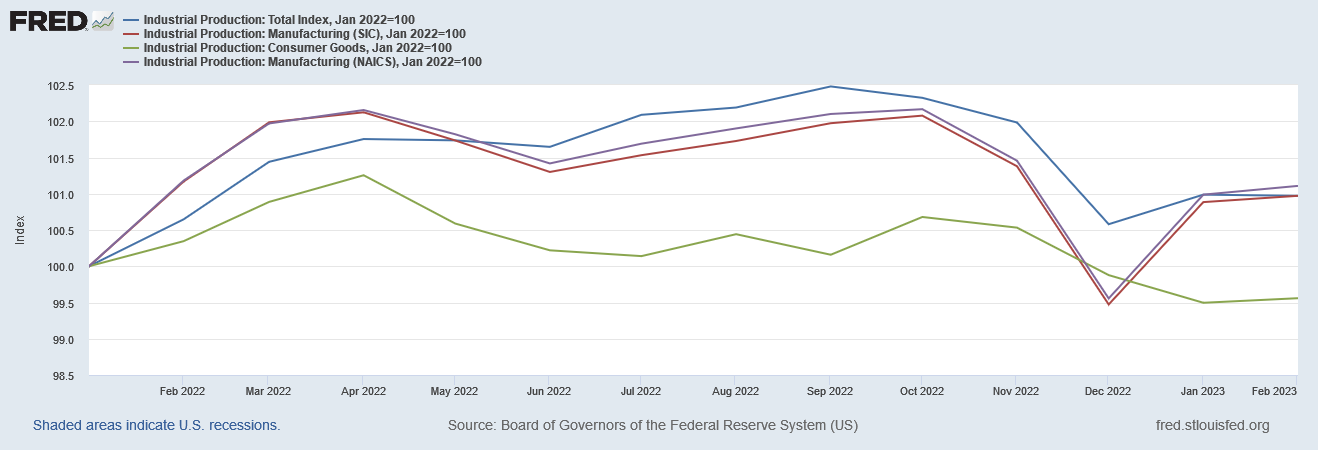

What “things” were being made were not consumer goods. Indexing to January of 2022, we can see that, while industrial production did increase (barely), production for consumer goods declined.

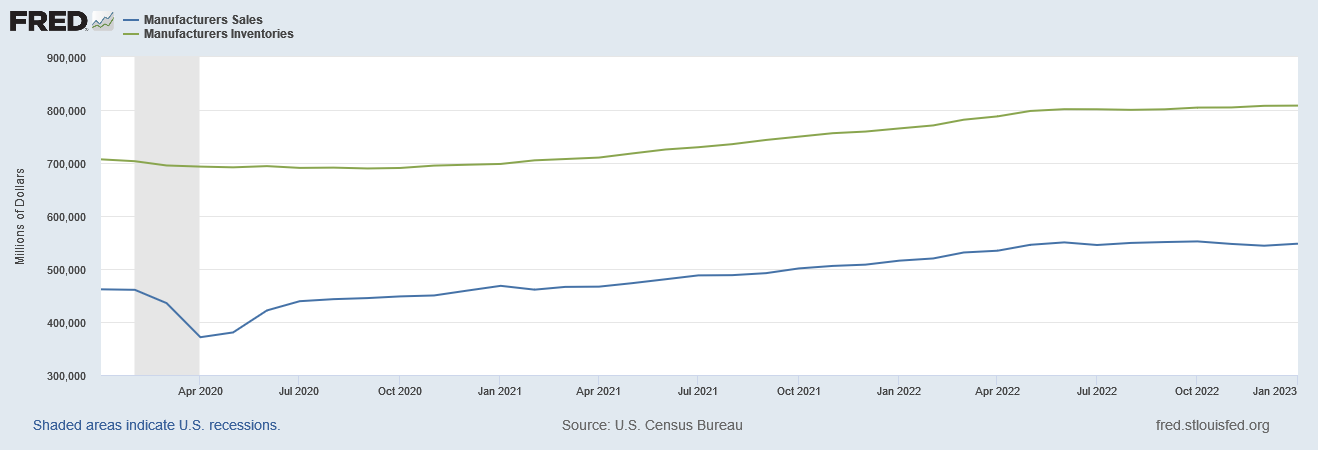

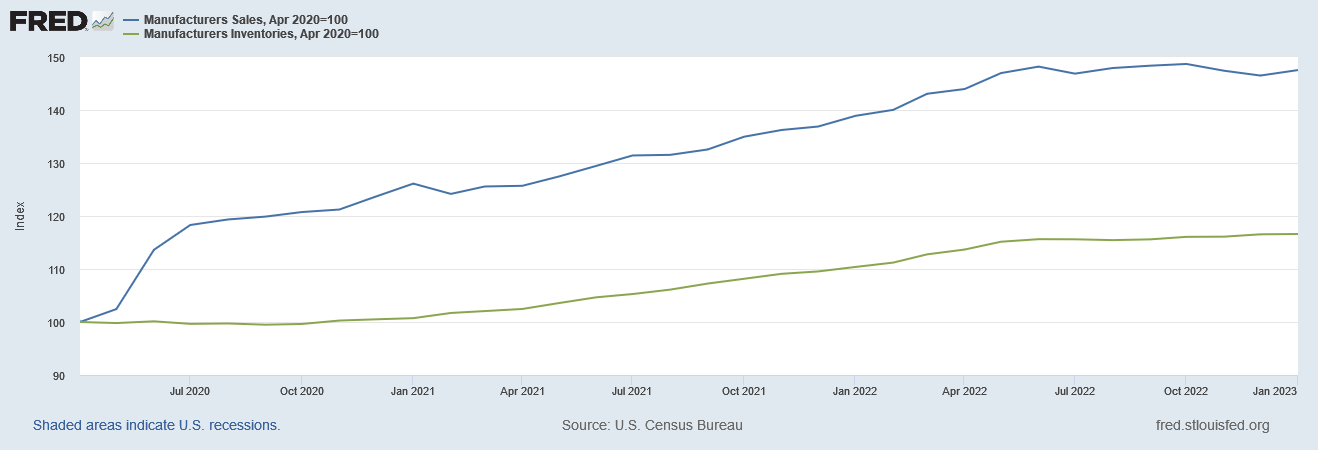

One genuine bright spot in the economy has been the growth of real manufacturing sales.

While the gains there have not been extraordinary, there have been at least gains.

The most gains in manufacturing sales since the government-ordered recession of 2020 came in 2020 and to a lesser degree in 2021, with sales tapering off to a large degree in 2022. For the year there were still positive gains, but just barely.

It is not hard to understand why the economy has shown little or no growth. By and large, there has been little growth in our production of “things”. Almost all of the GDP growth recorded by the US economy has been in the realm of services.

Without growth in the productive portion of the economy, without growth in manufacturing, it becomes that much more difficult to generate lasting wealth and prosperity. Goods as well as services are necessary to achieve lasting prosperity.

While the economy overall did not shrink in 2022, it only just avoided that fate by the slimmest of margins. Far from the 2.6% annual rate touted for the fourth quarter, or the 3.2% touted for the third quarter, across the entire twelve months of 2022, total growth in real GDP did not even amount to 1%, and would have contracted significantly but for the growth in services.

The difference between the reported annual rate of GDP growth and reality is the difference between the wishful thinking among “experts” that recession might yet be avoided and the practical reality that recession is already upon us, and has been for much if not all of 2022.

Fernando, J. “The Power of Compound Interest: Calculations and Examples”, Investopedia. 28 Mar. 2023, https://www.investopedia.com/terms/c/compoundinterest.asp.

My guess is that the employees of the Bureau of Economic Analysis are lazy weasels.

2022 is the year that we started to ‘come out of’ the pandemic shutdown. Whole downtowns began to revive, people shut in their homes warily began to venture out to do things again. Because of the historic uniqueness of the multi-year shutdown, a huge percentage of the statistics gathered and generated by these government employees would need to be ‘corrected’ for historic abnormalities. But how, exactly? An excellent mind such as yours, Mr. Kust, would have figured out fairly accurate statistical corrections, but the bureaucrats- faced with a task they’ve never encountered- probably could not agree on the particulars of how and what to correct, so they didn’t, at least not in meaningful ways. An employee of a government bureaucracy is not likely to rock the boat by proposing daring new corrections. The result is that their statistics are probably off even more than usual.

Coming out of a huge economic shutdown, there should have been such pent-up demand that we would have had robust growth. We didn’t, and your analysis shows that growth was even weaker than officially indicated. I agree, we’re in a recession, not two-plus percentage annual growth. Thank you again, Mr. Kust, for giving us meaningful analysis!

Mr. Kust - thank you for another substantive work of original thought. Yours is a daily must read - have you thought out the fate of the dollar as the reserve currency to the world and whether it is net net good for us regular USA cutizens? The "hype media" seems to claim sky is falling is that true?

Know this is a complicated topic but I'm guessing you have serious thoughts on it already?

Thanks in advance.

DT