Update

After I put this post up the Bureau of Economic Analysis released its first estimate for GDP growth in the third quarter: 2.6%

Real gross domestic product (GDP) increased at an annual rate of 2.6 percent in the third quarter of 2022 (table 1), according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP decreased 0.6 percent.

For all the reasons already stated, I am extremely skeptical about this number. Contractionary signals generally do not end in an expansionary result.

As a general rule, the most reliable way to navigate anything in this world is to follow the data. There is, however, a caveat: the data has to make sense. When the data does not make sense, the result is not more answers, but more questions.

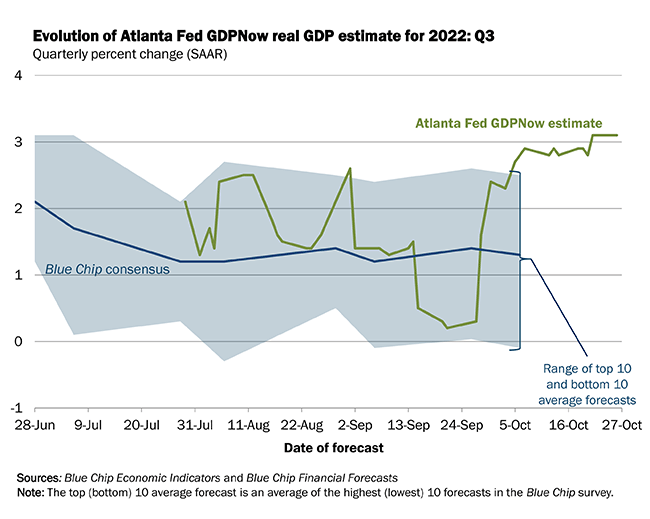

This is the situation presented by the Atlanta Federal Reserve’s GDPNow Nowcast, a near realtime forecasting tool on the expansion or contraction of the US economy.

According to the latest GDPNow nowcast, the US economy grew during the third quarter by a respectable 3.1%

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2022 is 3.1 percent on October 26, up from 2.9 percent on October 19. After recent releases from the US Census Bureau, the US Department of the Treasury's Bureau of the Fiscal Service, and the National Association of Realtors, the nowcast of third-quarter real government spending growth increased from 2.4 percent to 3.8 percent, while the nowcast of the contribution of the change in real net exports to third-quarter real GDP growth decreased from 2.23 percentage points to 2.19 percentage points.

However, there are a few problems with that figure:

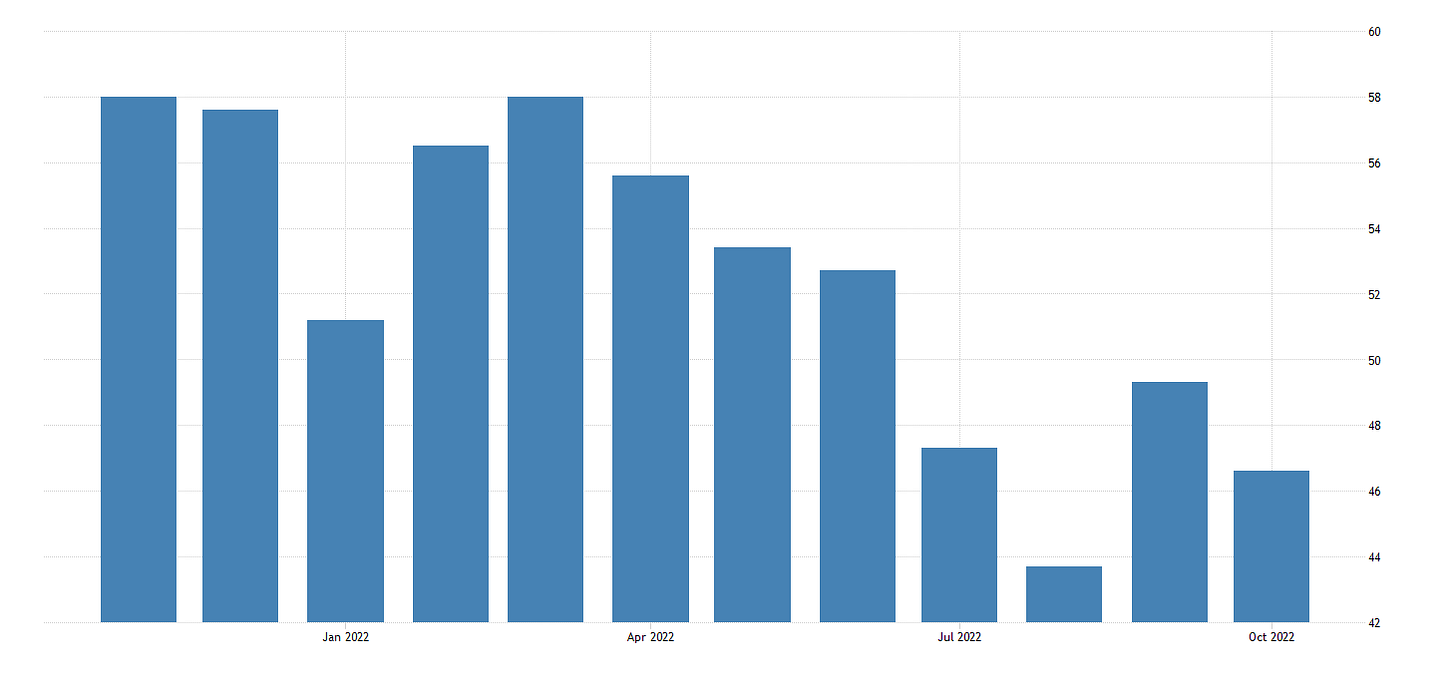

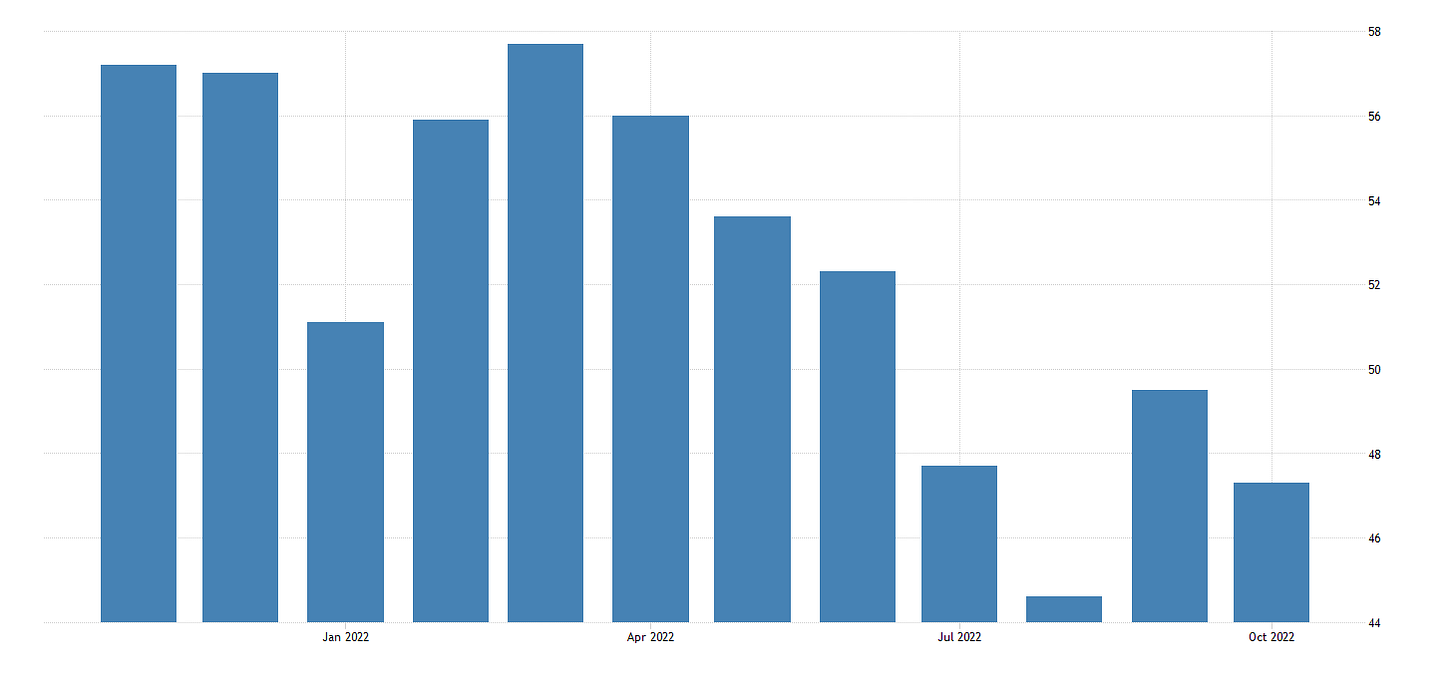

The S&P Global Manufacturing PMI dropped to 49.9 in September (any reading below 50 indicates contraction).

Services PMI moved farther into contraction territory at 46.6.

Naturally, the Composite PMI also moved deeper into contraction at 47.3.

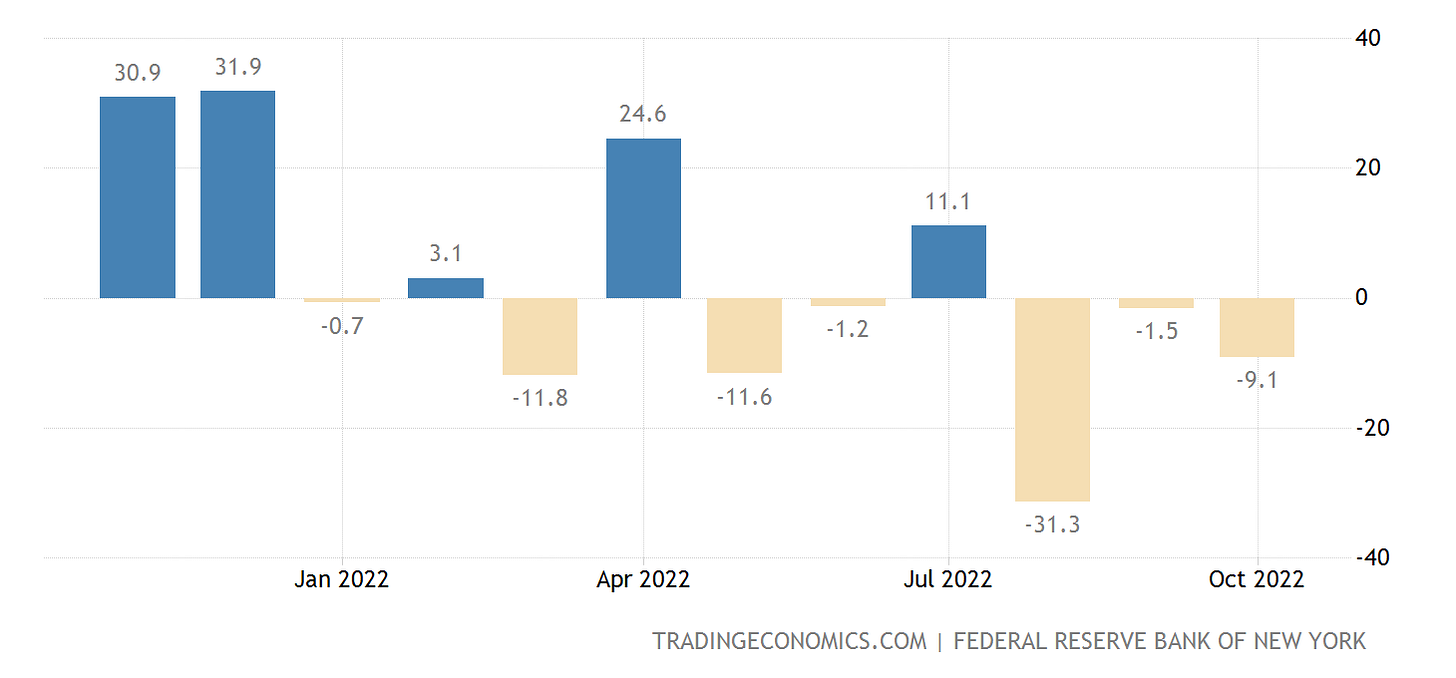

Separately, the NY Empire State Manufacturing Index of the New York Federal Reserve has shown declining manufacturing activity since August.

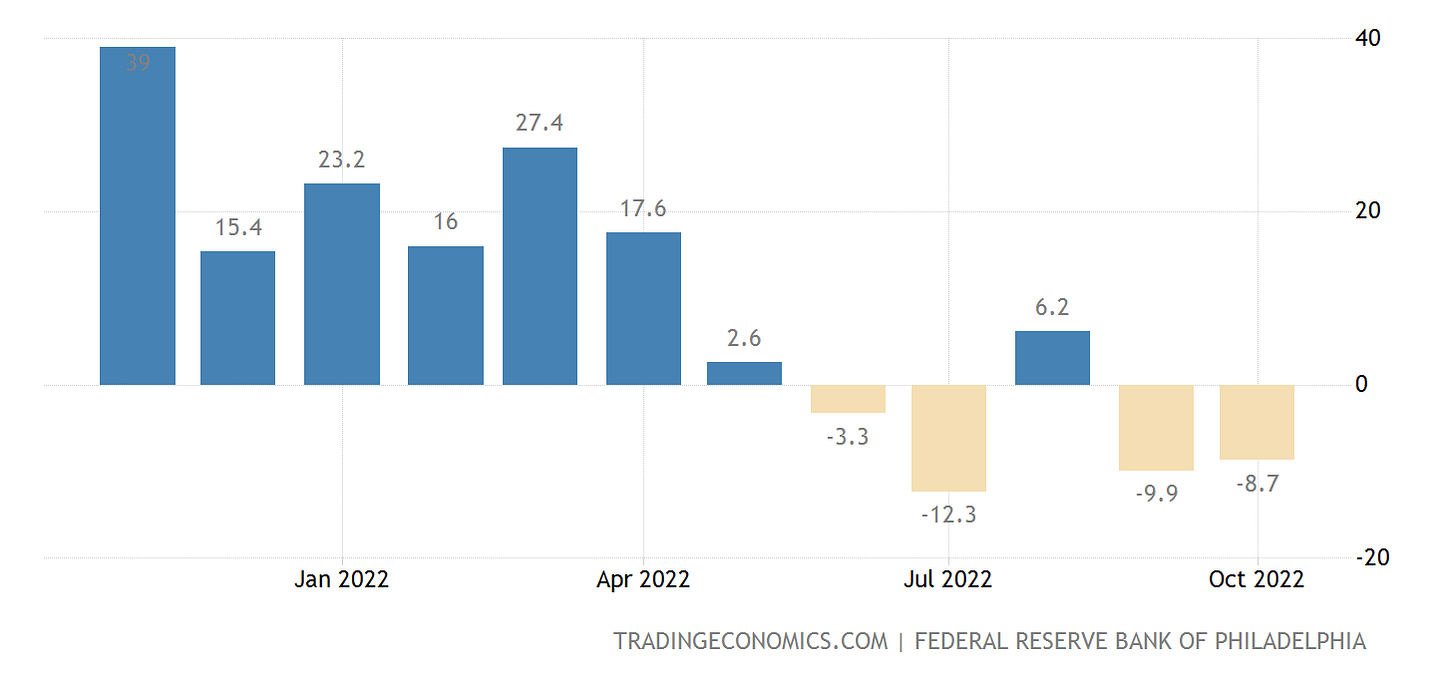

The Philadelphia Fed Manufacturing Index has shown declining activity in four of the past five months.

Even some of the data sets specifically referenced by the GDPNow nowcast itself are not good. According to the National Association of Realtors, existing home sales fell by 1.5% in the month of September.

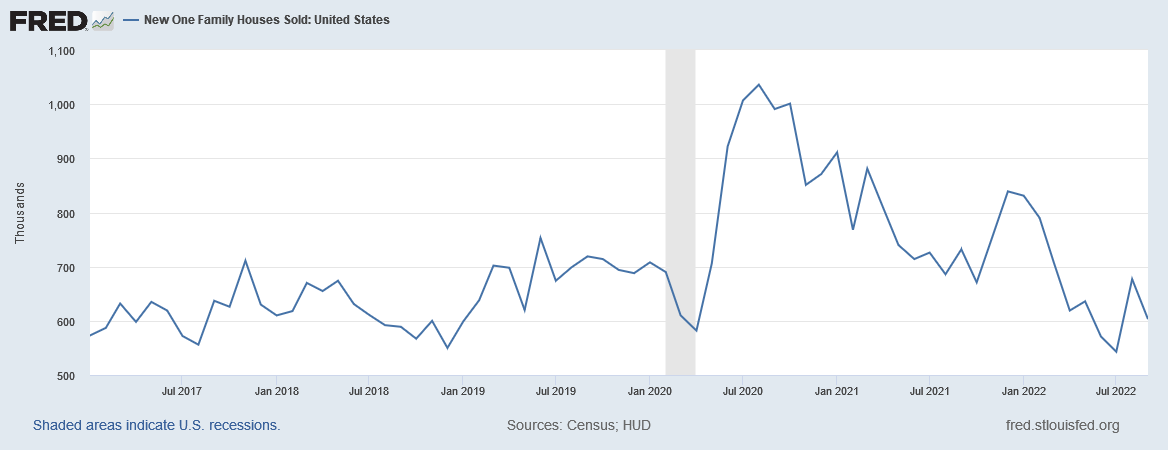

Similarly, according to the Department of Housing and Urban Development, new home sales also fell, continuing a broad downward trend begun in 2020.

With so many indicators of actual economic activity showing economic contraction, how can the Atlanta Fed be showing economic expansion?

To say that the data and the nowcast are contradicting each other is an understatement.

This GDPNow nowcast simply does not make sense. Given the indicators above, the expectation for the nowcast should be another quarter of contraction.

Yet here we are.

Makes me wonder what comes up in November that could benefit from bs data???

I know my business is just an anecdote, not data, but we're definitely running somewhat slower than we had been. FWIW, about half my revenue comes from exports (mostly to Europe) and those customers a whining about the exchange rate because my prices are in Dollars. They'd like me to cut prices or give them discounts. I so wanna ask them, "Hey, did you offer to pay more back when one Euro bought $1.50?"