The White House wants you to believe yesterday’s jobs report heralds a strong US economy that will be an engine of growth into the future.

Quite frankly, I would like to believe that myself. I want to live in a robust economy with plenty of prosperity for all.

That’s what I want to believe. Unfortunately, the data says something starkly different.

Jobs Report Is Not All That Great

We do well to remember that, as I detailed yesterday, the Employment Situation Report from the Bureau of Labor Statistics is not the untrammeled success the White House claims it is.

Despite a seemingly strong top-level net gain of 390,000 jobs, the report is filled with data that sends its own red flags about the state of the economy:

The overall unemployment rate did not change from April’s 3.6%

The number of unemployed individuals remained at 6 million.

There were 1.4 million permanent job losers in May, roughly the same as in April.

Temporary layoffs in May was 810,000—”little change” from April.

The number of people in part-time employment for economic reasons rose 295,000 in May.

The number of people not in the labor force who want a job was 5.7 million—roughly the same number as in January.

The net gain in jobs may have exceeded expectations, but it cannot change the reality that, because of these factors, labor force underutilization actually rose in May. That's never a good thing.

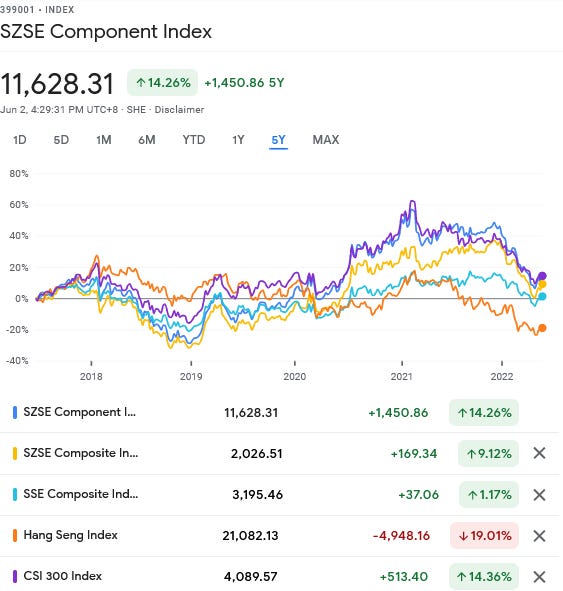

Global Markets Peaked Last Year And Have Been Declining Ever Since

Moreover, the data says that not just the US economy, but the global economy reached a peak last year, and is trending towards recession and contraction—those parts that are not already there. The decline has already begun, and is happening worldwide.

When we look at the five year trend for the world’s top stock market indices from the US, China, Europe, Japan, and India, the crest of investment activity last year is plainly visible.

Nor are these indices a one-off phenomenon. If we focus on any one part of the globe, while the exact timing of the peak might differ, every region shows a peak at some point last year.

The United States peaked in mid-November.

China peaked early last year.

Even Russia began heading towards a recession in October of last year, long before anyone even thought war in Ukraine was a possibility.

Not Just Markets. Let Us Not Forget Inflation

In an unusual display of economic synchronicity, inflation is simultaneously stalking the economies of the world. In each of the countries mentioned above, prices have risen sharply in the past 12 months.

The Consumer Price Index jumped significantly in the US earlier this year.

While China’s CPI metric is lower overall than in the US’, it has still seen a sharp rise over the past 12 months.

Inflation is a growing problem in Europe, Japan, and India as well.

Given that inflation eventually chokes off consumer demand, a global phenomenon of rising prices is yet another clear signal that the world economy is tipping into a contractionary phase.

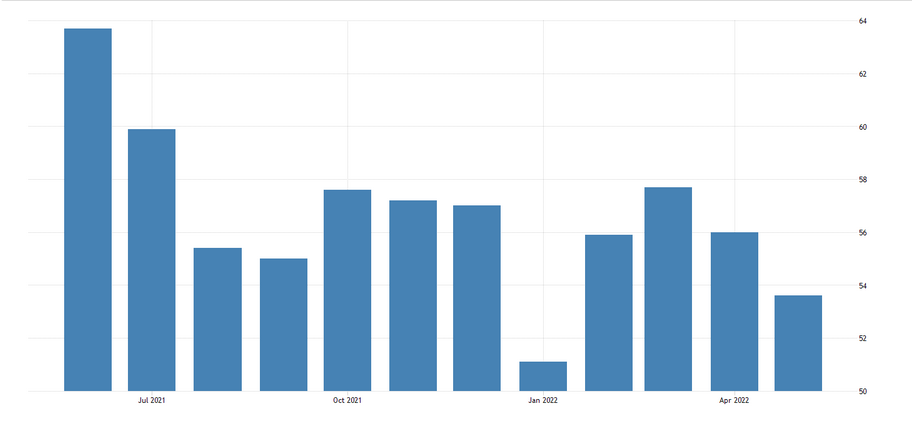

Composite PMI Data Shows Contractionary Headwinds

While inflation numbers threaten to choke off economic growth from the consumer side, for most parts of the world economy the Composite Purchasing Managers Index is concurrently pointing either towards slower growth or outright contraction on the business side of things as well (a PMI number below 50 signals contraction).

In the US, Composite PMI has been showing slower economic growth for the past 12 months.

In China, due in no small measure to its Zero Covid lockdowns, Composit PMI reveals outright contraction is already happening.

With Europe and Japan also posting anemic PMI data, only India is indicating strong growth within its business sector.

Global Signals Point To Global Contraction

For any one country, the state of these economic indicators would be a series of red flags indicating its economy was slowing down and about to contract.

That these indicators are showing the same signals across the world’s major economic areas can only mean the global economy as a whole is slowing down and contracting.

A global recession on par with the economic turbulence following the 2008 Great Financial Crisis is either about to happen or has already begun, and the synchronicity of the signals strongly suggests a contagion phenomenon, where contraction in one country triggers contraction elsewhere, is underway.

The contagion effect also is an amplification—it means the contraction everywhere will be worse than it would be otherwise.

As I have noted previously, the “everything bubble” in the world’s financial markets has finally burst. That puts asset prices on a downard trend for some time to come.

As the markets recede and contract, however, there is a growing signal that they will take the rest of the world economy down with them. The wealth destruction will be ubiquitous.

We already live in “interesting times”, to borrow from the apocryphal pseudo-Chinese “curse”. Unfortunately, they are about to get even more “interesting”.

Employment numbers are definitely not a leading indicator when it comes to economic downturns.

We're in the 'just go up there and make shit up' stage of the collapse.